Do banks accept promissory notes?

Contents

- 1 Do banks accept promissory notes?

- 2 Do promissory notes need to be registered?

- 3 What if someone defaults on a promissory note?

- 4 Can a promissory note be handwritten?

- 5 Is a promissory note a loan?

Banks often accept private receipts, one of the most obvious examples being a receipt signed by a new homeowner when taking out a mortgage.

Can the bill be legally accepted? The legal windows are binding if the ticket is backed by a guarantee or based solely on a promise to return it. If you lend money to someone who does not fulfill a letter of debt and does not return it, you can legally hold any property legally ordered by that individual as collateral.

Can you use a promissory note to buy a house?

Receipts are suitable for people who do not have a regular mortgage, as they allow them to buy a home, using the seller as a source of the loan and as a source of collateral for the home purchased.

Is a promissory note the same as a mortgage?

The main difference between an insurance letter and a mortgage is that it is a written agreement that includes the details of the mortgage loan, the mortgage is a secured loan with real estate.

Can a buyer use a promissory note for consideration on the purchase of a property?

A buyer wanted to use a receipt to consider the purchase of a property. Can he do this? Yes, this is acceptable if supported by the seller.

Can I get a mortgage with a promissory note?

Paid payments are just one part of the complex financial and legal process of buying a home. … A home mortgage effectively secures a letter of debt with the title to the property in question, if the lender has to seize and sell the property if it is not paid.

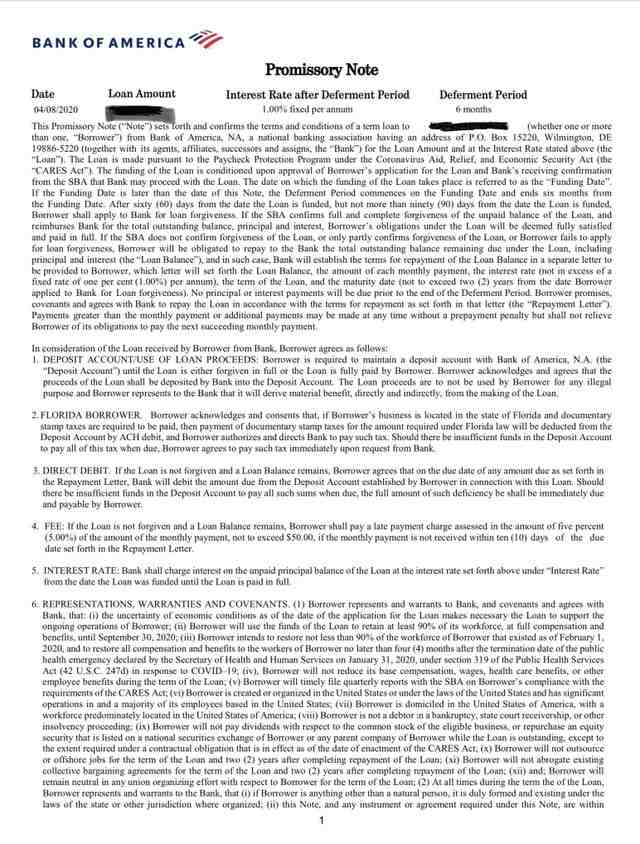

What do banks do with promissory notes?

The legal window legally binds the borrower and the lender in an agreement responsible for repaying the loan or debt. They determine the terms of the loan and determine the repayment period of the loan, as well as any interest that may arise during the life of the loan.

Who keeps the promissory note?

The lender saves it in the place of debt while repaying the loan. When the loan is repaid, the note is marked as “paid in full” and returned to the borrower.

Do banks legally have to accept promissory notes?

Think of the I.O.U. on steroids. If done correctly, however, the legal receipts are enforceable, that is, if you borrow $ 10,000 from your friend and sign a legal debit card, you can take action if you do not return the money within the specified timeframe.

Do banks cash promissory notes?

The lender can then take the receipt to a financial institution (usually a bank, even if it may be a private individual, or another company), which will pay the payment; Normally, the receipt is paid for the amount stated on the receipt, minus a small discount.

Do promissory notes need to be registered?

SHOULD NOTES BE RECORDED? Most bills of exchange must be registered as securities with the SEC and in the states in which they are sold. But remember that some debt letters, such as those that are nine months or shorter, may be “exempt.” This means that they do not have to be registered.

What invalidates a debt letter? Even if you have the original note, it may be invalid if it is not spelled correctly. If the person you are trying to collect has not signed up – and yes, this is the case – the notice is invalid. If another law fails, for example, even if you are charging a high illegal interest rate, it will be invalid.

Can promissory note be legally accepted?

Only legal money will be accepted as a debtor. Rare coins or coins would not be considered a valid bill of exchange. The amount to be paid should also be known. It is not payable to the carrier – it is illegal to pay the carrier in accordance with the provisions of the RBI Act.

Will a promissory note hold up in court?

In general, interest rates that are legally acceptable on the receipt, the signatures of both contractors and the applicable limitation period may be confirmed in a court of law.

What is required for a valid promissory note?

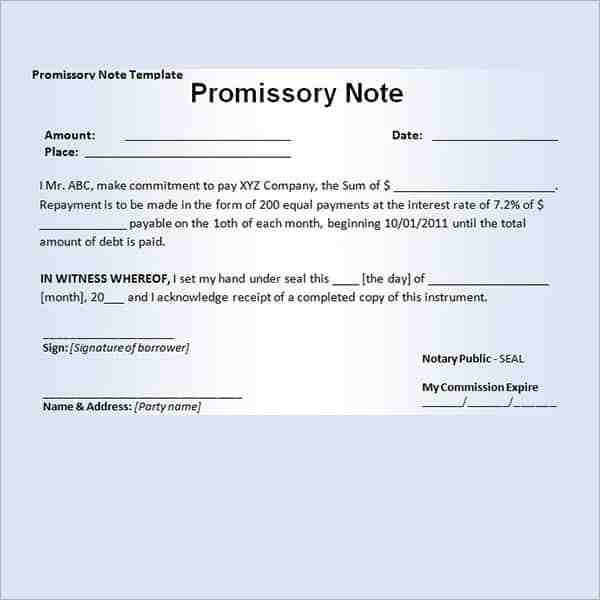

In order for an insurance letter to be valid and legally binding, it must include specific information. “An order letter should include the number of loans, the repayment schedule, and details of whether it is secured,” says Wheeler.

How do you register a promissory note?

They must be registered with the SEC, a state securities regulator, or be exempt from registration. Most legal tender can be easily verified by checking the SEC’s EDGAR database or by calling your state securities regulator. The seller must have a proper license to sell the securities.

What are the requirements for a promissory note to be valid?

A letter of payment must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment period. When this document is signed by both parties, it becomes a legally binding contract.

What are the rules of promissory note?

Unconditional promise to pay a certain amount of money to a designated party or to the holder of the note, or to deposit such money in the manner directed by such persons. A letter of payment must be in writing and signed by the author of the pledge.

What are the formal requirements to create a promissory note?

A letter of payment basically includes the name of both parties (lender and borrower), the date of the loan, the amount, the date the loan will be repaid in full, the frequency of loan payments, the interest rate charged on loan payments, and any other. security agreement.

What makes a promissory note legally binding?

Is the receipt legally binding? A letter of payment must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment period. When this document is signed by both parties, it becomes a legally binding contract.

What if someone defaults on a promissory note?

Legal laws are binding documents. Anyone who fails to repay the loan specified in a letter of payment may lose an asset that secures the loan, such as a home, or other actions. You have a few options if someone who borrowed money from you doesn’t return it to you.

How Much Money Does the Enforcement Pay? To be legally enforceable, a debit card must meet a number of legal requirements. It must also include the offer of the agreement and the acceptance of the agreement. … Once the parties have dealt with and signed the terms of the debt letter, it becomes a legally binding contract.

What happens in default on a promissory note?

A letter of payment may include non-compliance with a secured debt as part of the agreement. This means that if the borrower fails to pay on the terms agreed upon in the receipt, the lender may consider it as a means of repaying the secured debt.

Can a promissory note be enforced?

Regardless of the extent of the tax letter, the basic principle is that when it is signed by the parties involved, it becomes a legal instrument that can be enforced through a legal appeal if one of the parties does not accept the termination of the agreement.

How do I get out of a promissory note?

Circumstances for the Release of a Letter of Insurance The debt owed by a letter of insurance may be settled, or the recipient of the bill may forgive the debt, even if it has not been paid in full. In either case, the release of the subscription letter must be signed by the note-taker.

What happens if someone doesn’t pay a promissory note?

The owner of the insurance lawyer may file a civil lawsuit against the signatory letter if the signatory refuses to pay. The purpose of the lawsuit is to obtain a judgment against the signatory of the note, which will give the holder of the note the power to pursue the property of the signatory.

Can you sue someone for promissory note?

If the borrower fails to pay the personal payment owed and you want to sue, then you will have a period of time to take legal action. … As stated, if the other party does not meet the terms of the loan, then you can file a lawsuit to collect any debt.

What happens if someone doesn’t pay a promissory note?

The owner of the insurance lawyer may file a civil lawsuit against the signatory letter if the signatory refuses to pay. The purpose of the lawsuit is to obtain a judgment against the signatory of the note, which will give the holder of the note the power to pursue the property of the signatory.

Is a promissory note binding in court?

A letter of payment states that the borrower promises to return a certain amount of money to the lender within a certain period. … a letter of debt is placed between an IOU and a loan agreement. They are legally binding, but do not offer an appeal for non-payment of the loan.

Can a promissory note be handwritten?

Yes, the receipt is a legal and binding agreement, even if it is a handwritten note signed by both parties on a handkerchief. “However, it would be foolish to sign a handwritten receipt, as it is easier to add language to a handwritten note after it has been typed,” said Vincent J.

Can I write my receipt? Although it is a legal document, writing a receipt should not be difficult. There are also websites on the web that offer gap-filling templates, such as eForms or LegalZoom.

What are the requirements for a promissory note to be valid?

To be legally enforceable, a debit card must meet a number of legal requirements. It must also include the offer of the agreement and the acceptance of the agreement. All contracts indicate the types of services or goods provided and their value.

What are the formal requirements to create a promissory note?

A letter of payment basically includes the name of both parties (lender and borrower), the date of the loan, the amount, the date the loan will be repaid in full, the frequency of loan payments, the interest rate charged on loan payments, and any other. security agreement.

What are the rules of promissory note?

Unconditional promise to pay a certain amount of money to a designated party or to the holder of the note, or to deposit such money in the manner directed by such persons. A letter of payment must be in writing and signed by the author of the pledge.

What makes a promissory note legally binding?

Is the receipt legally binding? A letter of payment must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment period. When this document is signed by both parties, it becomes a legally binding contract.

Does promissory note need to be stamped?

A payment must always be handwritten. … Once issued, the competition for authority shall be sealed in accordance with the regulations of the Seal Act of India. It is customary to use the income stamp on the banknote and then the payee and / or cross signed by the borrower.

Is a promissory note valid if it is not notarized?

Does an insurance letter have to be a notary? A valid letter of payment only requires the signatures of the participants in the agreement, it does not require a declaration or notarized testimony to be legitimate.

How do I mark a promissory note paid?

Put the signature “paid in full” next to the text. The lender must sign and date the front of the letter of debt next to the letter “paid in full”. The date on which the lender enters the debt letter must be the date on which the borrower made the final payment on the loan.

What are the requirements for a promissory note to be valid?

A letter of payment must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment period. When this document is signed by both parties, it becomes a legally binding contract.

Is a promissory note a loan?

A repayment order is essentially an unconditional written promise to repay a loan or other debt at a fixed or decisive date in the future. Although legally enforceable, a letter of debt is more formal than a loan agreement and is appropriate when the amount of money is lower.

Is a letter of debt borrowed? Letters of payment can also be referred to as IOUs, loan agreements, or notes. It is a legal loan document that states that the lender promises to repay a certain amount of money to the lender within a certain period of time.

What is the difference between a promissory note and a contract?

Payment competition is a written promise to pay within a specified period. … the receipt is not the same as the contract. A contract sets out all the terms of a legal agreement.

What is the difference between a promissory note and loan agreement?

It is a simple document that is not as complex as a loan agreement, and can be shorter and more accurate. … Unlike a letter of assurance, the loan agreement imposes obligations on both parties, which is why both the borrower and the lender must sign the agreement.

Is a promissory note a contract?

Is the receipt legally binding? A letter of payment must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment period. When this document is signed by both parties, it becomes a legally binding contract.

Can you have a promissory note without a loan agreement?

2. Both cover the consequences of non-payment. Neither the receipt nor the loan agreement would be completed if it is not returned to the lender without certain information being provided. Without this critical information, both documents would not be worth much!

What is the difference between a loan and a promissory note?

Receipts are generally used for more informal relationships than loan agreements. A banknote can be used for family and family loans, or for small short-term loans. Loan agreements, on the other hand, range from vehicles to mortgages to new businesses.

Which is better promissory note or loan agreement?

As a general rule, if a small amount of money is involved and there is a high level of trust between the lender and the borrower (or borrower), a guarantee notice will suffice. However, if there is a large debt and the two sides are not well known, a loan agreement is highly recommended.

Will a promissory note hold up in court?

In general, interest rates that are legally acceptable on the receipt, the signatures of both contractors and the applicable limitation period may be confirmed in a court of law.