Your new interest rate should be at least. 5 percentage points lower than your current rate. The old rule was that you would have to refinance if you could get a rate that was 1 to 2 points lower than your current one.

What does 1 point on a loan mean?

Contents

- 1 What does 1 point on a loan mean?

- 2 Is it worth refinancing to save $200 a month?

- 3 How many points does it take to lower your interest rate?

- 4 Is 3% a good interest rate?

- 5 How many points can you buy down a mortgage?

By paying points, you pay earlier, but you get a lower interest rate and therefore you pay less over time. … Each point equals one percent of the loan amount. For example, one point on a $ 100,000 loan would be one percent of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

What is 1 point on a mortgage? A mortgage point equals 1 percent of your total loan amount – for example, on a $ 100,000 loan, one point would be $ 1,000.

How much is 3 points on a mortgage?

Points are a down payment from the lender that is part of the price of a mortgage. Points are expressed as a percentage of the loan amount, where 3 points is 3%. On a $ 100,000 loan, 3 points means a cash payment of $ 3,000.

How much is a point on a mortgage worth?

Mortgage points are the fees that a borrower pays to a mortgage lender to cut the interest rate on the loan. This is sometimes called “buying down the exchange rate.” Each point the borrower buys costs 1 percent of the mortgage amount. So, one point on a $ 300,000 mortgage would cost $ 3,000.

What does 3 points mean in real estate?

Are there different types of points? Usually, points are cited as something plus one. For example, a 10% interest rate with points of three plus one: The one point is a loan fee that pays the cost of processing the mortgage; the three points are discount points.

How much does 2 points cost on a mortgage?

How much do points cost? One mortgage point usually costs 1% of your total loan (for example, $ 2,000 on a $ 200,000 mortgage). So, if you buy two points – at $ 4,000 – you have to write a check for $ 4,000 when your mortgage closes.

How much does 1 point lower your interest rate?

Each point usually lowers the rate by 0.25 percent, so one point would lower the mortgage rate from 4 percent to 3.75 percent over the life of the loan.

Is it worth it to refinance for 1% point?

Is it worth refinancing for 1 percent? Refinancing to save 1 percent is often worth it. One percentage point is a significant tax drop, and it should generate significant monthly savings in most cases. For example, dropping your rate 1 percent – from 3.75% to 2.75% – could save you $ 250 a month on a $ 250,000 loan.

How many points does it take to lower your interest rate?

Typically, one point lowers your interest rate by about a quarter of a percent.

How much does a 1% lower interest rate save?

Monthly payments on this loan would be around $ 1,347. In this example, a 1 percent interest rate difference could save you (or cost you) $ 173 a month or $ 62,252 over the life of your loan.

Are points on a loan bad?

It is important to understand that points do not constitute a larger down payment. Instead, borrowers “buy” points from a lender for the right to a lower rate over the life of their loan. Buying points doesn’t help you build equity in property — you only save money on interest.

Are points good or bad?

Buying points on a mortgage is a good idea only if you plan to pay off your loan long enough to level up – when what you paid for points equals your reduced interest rate savings. A mortgage score calculator can help guide your decision.

Are origination points bad?

When it comes to loan points, paying less is usually better. This is basically just one more commission for the original bank or mortgage lender, so be sure to discuss fees with your agent. But often a separate loan is more complicated than another, and requires more processing and / or insurance time.

Is it worth refinancing to save $200 a month?

Generally, refinancing is worth it if you stay in the home long enough to reach the “event point” – the date on which your savings exceed the closing costs you paid to refinance your loan. For example, let’s say you save $ 200 a month by refinancing, and your closing costs will come to about $ 4,000.

Is it worth refinancing to save $ 300 a month? Refinancing your mortgage, in general, should save you money over the life of the loan to make it really worth it. DiBugnara explains: â € œSay you end up saving $ 300 a month after refinancing, but your closing costs total $ 6,000. Here, you would offset your costs in 20 months.

How do you know if it’s worth refinancing?

Mortgage rates are down So how much should mortgage rates fall before you consider whether refinancing is worth it? The traditional rule is to refinance if your rate is 1% to 2% below your current rate. However, be sure to consider your current loan period when considering refinancing.

Is refinancing a waste of money?

As a refresher, when you refinance your mortgage, you get a new loan that pays off your existing debt. Doing so may result in lower monthly payments unless you withdraw a large amount of cash. In general, you should avoid refinancing your mortgage if you waste money and increase risk.

Is it worth refinancing to save $200 a month?

In general, a refinance is worth it if you stay in the home long enough to reach the â € œeving pointâ € – the date when your savings exceed the closing costs you paid to refinance your loan. For example, let’s say you save $ 200 a month by refinancing, and your closing costs will come to about $ 4,000.

Is it worth refinancing after 6 months?

Conventional loan refinancing rules Keep in mind that many lenders have a six-month “seasonal period” before a current borrower can refinance with the same company. So you will probably have to wait if you want to refinance with the lender you are already using.

How much lower interest rate is worth refinancing?

Historically, the rule is that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say that 1% savings is a sufficient incentive for refinancing.

Is it worth refinancing for .75 percent?

If you save money and have no plans to relocate soon – or if it helps you meet another financial goal – then all the signs are “yes.” Homeowners who consider a mortgage refinance. it is commonly said that it makes sense if they can shave at least 0.75% of their mortgage interest rate.

Is it worth it to refinance to drop 1%?

Is it worth refinancing for 1 percent? Refinancing to save 1 percent is often worth it. One percentage point is a significant tax drop, and it should generate significant monthly savings in most cases. For example, dropping your rate 1 percent – from 3.75% to 2.75% – could save you $ 250 a month on a $ 250,000 loan.

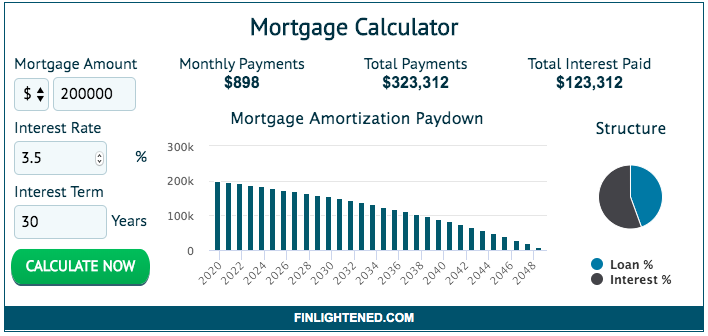

How much difference does .5 percent make on a mortgage?

If you have a $ 200,000 15-year loan at 5 percent, your monthly payment is $ 1,581.59, and at 5.25 percent, it rises to $ 1,607.76. La. A 25 percent difference adds an additional $ 26 per month. While that may not seem like a significant amount of money, it can add up to more than $ 4,000 over the life of your loan.

Is it worth refinancing to save $400 a month?

Refinancing may be worth it anyway. This homeowner would save $ 400 a month on refinancing. That extra money can make a significant dent in monthly bills and living costs. … However, refinancing into a new 30-year term also means that this person would pay an additional $ 25,000 in interest over the life of the loan.

Is it worth it to refinance to save $200 a month?

In general, a refinance is worth it if you stay in the home long enough to reach the â € œeving pointâ € – the date when your savings exceed the closing costs you paid to refinance your loan. For example, let’s say you save $ 200 a month by refinancing, and your closing costs will come to about $ 4,000.

How much can you save monthly by refinancing?

If you are able to refinance at a 3.75% interest rate on a 20-year mortgage, your monthly payment would drop to $ 1,897, saving you about $ 130 a month.

How many points does it take to lower your interest rate?

Typically, one point lowers your interest rate by about a quarter of a percent.

How much is 2 points on a loan? Each point equals one percent of the loan amount. For example, one point on a $ 100,000 loan would be one percent of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How much is 25 points on a mortgage?

A 25 percent point reduction in the interest rate and costs $ 1,000.

How much is 3 points on a mortgage?

Points are a down payment from the lender that is part of the price of a mortgage. Points are expressed as a percentage of the loan amount, where 3 points is 3%. On a $ 100,000 loan, 3 points means a cash payment of $ 3,000.

How are discount points calculated?

Points are calculated in relation to the loan amount. Each point equals one percent of the loan amount. For example, one point on a $ 100,000 loan would be one percent of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How do I calculate points on a mortgage?

A mortgage rate is equal to 1 percent of your total loan amount. For example, on a $ 100,000 loan, one point would be $ 1,000. Learn more about what mortgage rates are and determine if “purchase points” is a good choice for you.

How much do discount points reduce interest?

When you purchase one discount point, you will pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%.

How much is 2 discount points on a mortgage?

Each point is equal to 1 percent of the loan amount, for example 2 points on a $ 100,000 loan would cost $ 2000. You can buy up to 5 points. Enter the annual interest rate for this mortgage with discount points as a percentage.

How much is .25 points on a mortgage?

Here is a sample of interest savings for a 200,000 loan on a 30-year fixed-rate mortgage. Every point is worth it. A 25 percent point reduction in the interest rate and costs $ 1,000.

How do discount points affect interest rate?

When you purchase one discount point, you will pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%. … For example, you may be able to pay half a point, or 0.5% of the loan amount. This would typically reduce the interest rate by 0.125%.

How much is 1 point worth in a mortgage?

A mortgage point – sometimes called a discount point – is a fee you pay to lower your interest rate on your home purchase or refinance. One discount point costs 1% of your home loan amount. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

How are points calculated on a mortgage?

How do I calculate points on a loan? One mortgage is equal to 1% of your loan amount. So, one point on a $ 200,000 loan would cost $ 2,000 in advance. One point will usually lower your interest rate by 0.25%, so you can compare the total costs of your loan by looking at interest rates and down payments.

How much is 3 points on a mortgage?

Points are a down payment from the lender that is part of the price of a mortgage. Points are expressed as a percentage of the loan amount, where 3 points is 3%. On a $ 100,000 loan, 3 points means a cash payment of $ 3,000.

Is 3% a good interest rate?

Anything at or below 3% is a great mortgage. And the lower your mortgage, the more money you can save over the life of the loan. … As you can see, just one percentage point could save you almost $ 50,000 in interest on your mortgage.

Is 3 interest good for a car? 19.85%. The average car loan interest rate is 3.64% for new cars and 5.35% for used cars, according to the Experian State of the Automotive Finance Market report for the third quarter of 2021. With a credit score above 780, you will have the best shot. get a rate below 3% for new cars.

What does a 3 interest rate mean?

For example, if you borrow $ 5,000 with a simple interest rate of 3% for five years, you will pay a total of $ 750 in interest. … r is the interest for a year. In this case, it would be written as 0.03. Thus 3% is written as a decimal. t is all the time in years that you will use to pay off the loan.

What is a 3% interest?

When it comes to contracts, they refer annually to recurring obligations or those that occur annually during an agreement. For example, if a bank pays interest. … of 3% on a loan per year, which means that you will have to pay an additional 3% of the principal amount each year until the end of the contract.

What does a 3% interest rate on a mortgage mean?

Interest The principal balance of your loan is one factor that affects how much interest you pay each year. For example, a loan with $ 100,000 balance and 3% interest means that you will pay $ 3,000 in interest the first year you have the loan.

What does 3% AER mean?

AER means annual equivalent rate. … The higher the AER, the greater the return. For example, two accounts claim that they pay 5 percent a year, but one credits all interest at the end of the year and the other pays you 2.5 percent every six months.

Is 3 a high interest rate?

Right now, a good mortgage rate for a 15-year fixed loan could be in the high-2% or low-3% range, while a good rate for a 30-year mortgage could range from 3-3.5% or more. You should be lucky (and a very strong borrower) to find a 30-year fixed rate below 3% at present.

Is 4% a high interest?

From 2017 to 2020, the average ranged from as much as 4.42% to 5.5%. If your interest is around those averages or lower, then it’s probably a good rate.

What is considered a high interest rate?

740 and up: Under 8% (look for loans for good credit) 670 to 739: About 14% (look for loans for good credit) 580 to 669: About 18% (look for loans for fair credit)

What is considered a good interest rate?

Overall, a good interest rate for a personal loan is lower than the national average of 9.41%, according to the most recent data available from Experian. Your credit score, debt-to-income ratio and other factors all dictate what interest rates you can expect to receive.

Is a 3.25 interest rate good?

However, rates are rising, and homeowners who can lock in between 3 and 3.25 percent are still in a great position. In a historical context, 3.25 percent is an ultra-low mortgage rate. It is a fraction of the rate that homebuyers have paid throughout modern history.

What is considered a high interest rate?

740 and up: Under 8% (look for loans for good credit) 670 to 739: About 14% (look for loans for good credit) 580 to 669: About 18% (look for loans for fair credit)

Is a 12% interest rate good?

A good interest rate on a personal loan is lower than the national average — less than 12% in March 2021. That said, the real interest rate you qualify for depends on several factors, and lenders often pay other fees that can make a loan more expensive.

How many points can you buy down a mortgage?

How Many Mortgage Points Can You Buy? No one sets a limit on how many mortgage points you can buy. However, you will rarely find a lender that will allow you to buy more than about 4 mortgage points.