Is the closing disclosure more accurate than the loan estimate?

Contents

- 1 Is the closing disclosure more accurate than the loan estimate?

- 2 Does closing disclosure mean final approval?

- 3 Is a closing disclosure a commitment to lend?

- 4 What comes first close or closed disclosure?

- 5 What is a closing disclosure for buyer?

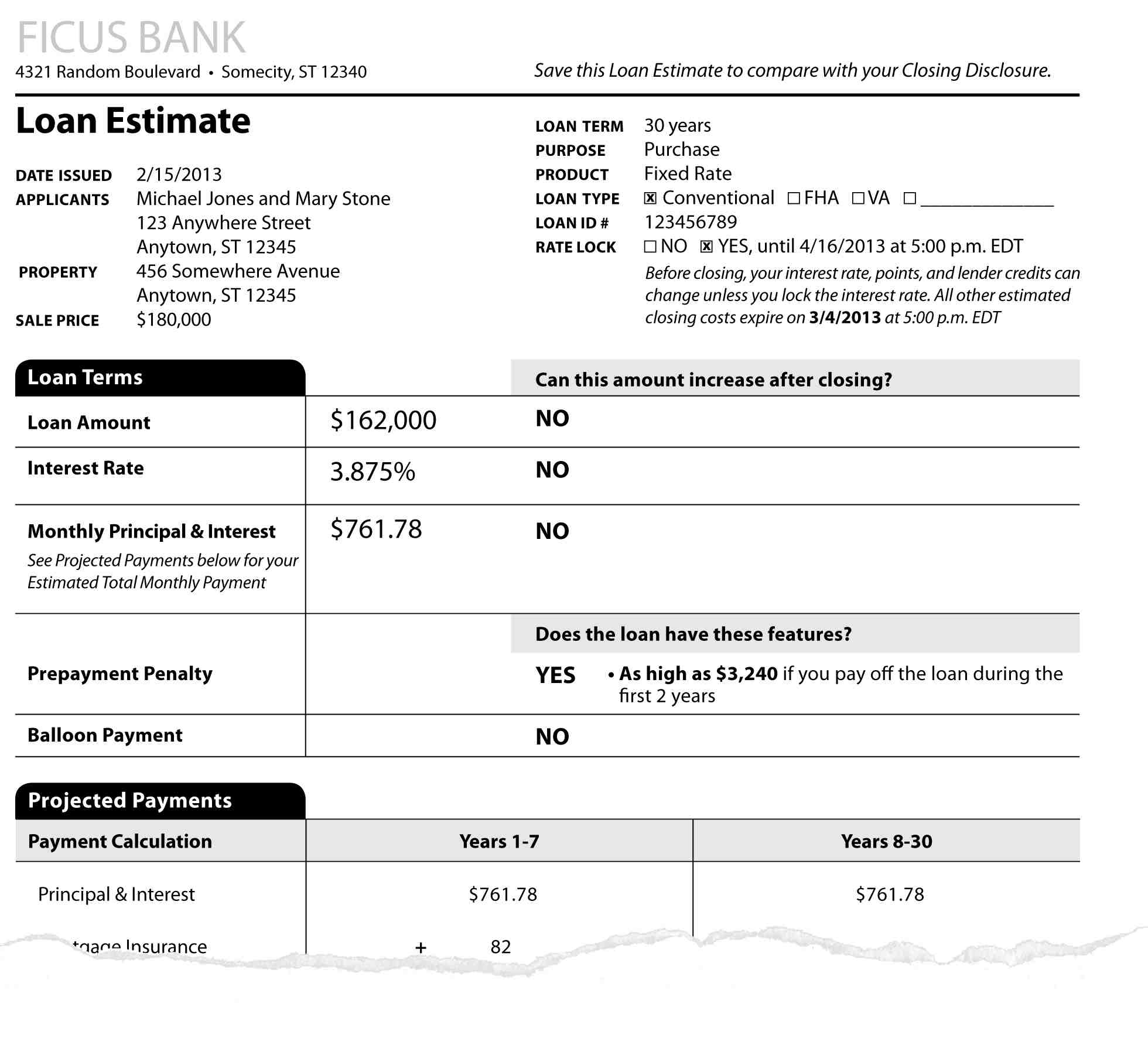

In the meantime, the Closing Disclosure is given to you three days prior to your closing date and includes information similar to the Loan Estimate. However, the numbers and details on the Disclosure Closing are much more accurate.

Can the loan estimate be different from the closing disclosure? Loan estimation and closing disclosure are two forms you will receive during the home buying process. The Loan Estimate comes at the beginning, after you have applied, while the Closing Disclosure comes at the end, before you sign the final documentation for your mortgage.

Should the loan estimate match the closing disclosure?

In general, the closing terms and costs listed on your Closing Disclosure should correspond very closely to those listed on the Loan Estimate you received after you applied. In fact, there are some articles that cannot be changed on the CD by the law. But some closing costs may increase before closing.

Are estimated closing costs accurate?

How accurate is a loan estimate? Even if it’s just an estimate, the loan estimate is very often a reasonable approximation of what your loan will cost. This is because, by law, the final costs of the loan must be within 10 percent of the costs indicated on the original LE.

Can a loan estimate be issued after a closing disclosure?

The loan estimate must be provided to consumers no later than three business days after the submission of a loan application. … A Closing Disclosure must be provided to consumers three business days before the loan is closed.

Is closing disclosure accurate?

The Closing Disclosure shows you exactly how much, assuming you make all your payments on time, in scheduled amounts. That’s a sober number. The good news is that you can save a huge amount of interest if you make extra payments on the principal, especially in your early years of home ownership.

What happens if the closing disclosure is incorrect?

If an event occurs within 30 days of the expiration date, and that event causes the Closing Disclosure to become inaccurate in a manner that results in a change in an amount paid by the consumer, the credit union may send a correct Closing Disclosure to Commerce. lender.

Does a closing disclosure mean I’m approved?

The 3-day Closing Disclosure rule now gives you plenty of time to go through the final terms of your loan before signing your closing documents. … This means that the approval, evaluation, assurance and calculation of all third party fees will be completed before the Disclosure Closing is issued to you.

Is the closing disclosure final?

A Closing Disclosure is a five page form that provides the final details on the mortgage loan you have chosen. It includes the terms of the loan, your expected monthly payments, and how much you will pay in fees and other costs to obtain your mortgage (closing cost).

Are estimated closing costs accurate?

How accurate is a loan estimate? Even if it’s just an estimate, the loan estimate is very often a reasonable approximation of what your loan will cost. This is because, by law, the final costs of the loan must be within 10 percent of the costs indicated on the original LE.

Is the estimated cash to close accurate?

Sometimes referred to as “closing funds,” cash to close is the amount of money needed to complete a home purchase transaction. This term does not refer to real cash – and in fact, it is not a good idea to bring real money because it will often not be accepted.

Why are my closing costs higher than estimated?

You have decided to get another type of loan or change the amount of your deposit. The rating of the home you want to buy has been higher or lower than expected. You have taken out a new loan or you have missed a payment and that has changed your credit. Your lender could not document your overtime, bonus, or other income.

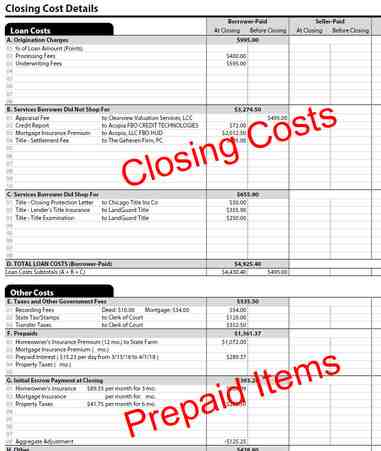

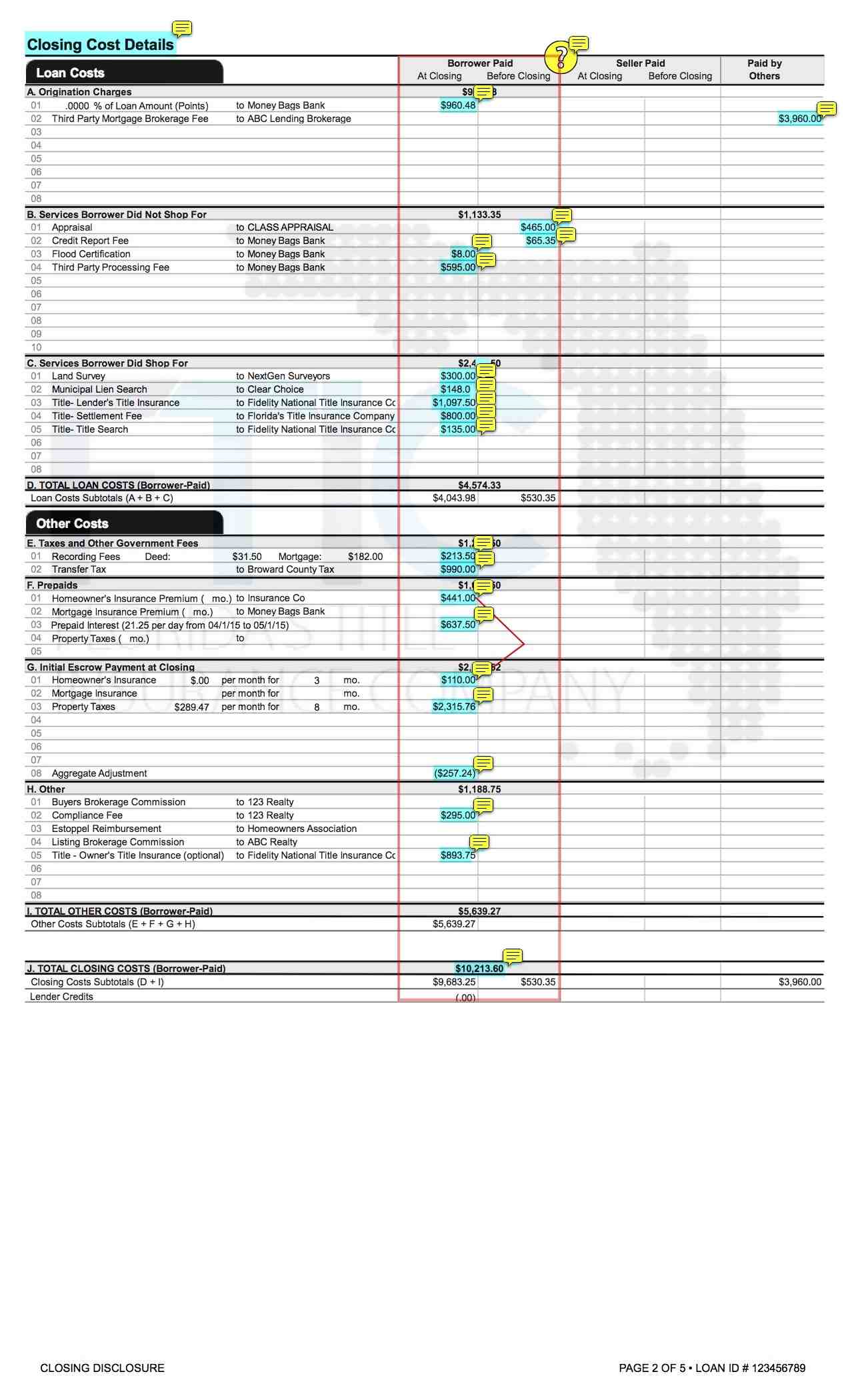

What is a good estimate for closing costs?

Closing costs are generally between 3% and 6% of the purchase price of the home. 1 So, if you buy a $ 200,000 home, your closing costs can range from $ 6,000 to $ 12,000. Closing rates vary depending on your status, type of loan, and mortgage lender, so it’s important to pay close attention to these rates.

Does closing disclosure mean final approval?

Closing Disclosure is a final accounting of the interest rate and rates of your loan, the closing costs of your mortgage, your monthly mortgage payment and the grand total of all payments and installments. financial burdens. The form is issued at least three days before signing the mortgage documents.

Does key disclosure clearly mean closure? Receiving a key disclosure means that you are clear of a key, but the terms are not just synonymous. Technically speaking, you are clear about closing the moment the lender signs the loan, and it can take between 24-72 hours from then to receive your closing disclosure.

Does closing disclosure mean loan is approved?

The 3-day Closing Disclosure rule now gives you plenty of time to go through the final terms of your loan before signing your closing documents. … This means that the approval, evaluation, assurance and calculation of all third party fees will be completed before the Disclosure Closing is issued to you.

What comes after closing disclosure?

What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

Does closing disclosure mean underwriting is complete?

Once you have selected a lender and executed the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that you include the closing costs of your loan and the specific amount that you will have to pay in the end.

Can loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

Does closing disclosure mean underwriting is complete?

Once you have selected a lender and executed the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that you include the closing costs of your loan and the specific amount that you will have to pay in the end.

Can a loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

What comes after closing disclosure?

What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

How do I know when underwriting is complete?

The Underwriting Approval Process has been removed

- Loan Application and Preapproval: A few days.

- Rating: one week or menu.

- Collection of documentation and subscriptions: from a few days to a few weeks.

- Conditional Approval: One Week Or So.

- Clear To Close: At least 3 days.

Can loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

Can you be denied after closing disclosure?

Although rare, a mortgage can be denied after the loan has signed the closing documents. For example, in some states, the bank may finance the loan after the loan closes. … During this time frame, lenders have the right to withdraw from the loan, so the bank can keep out of wiring the money right away.

Can a lender cancel a loan after closing?

Yes. For certain types of mortgages, after signing your mortgage lock documents, you may be able to change your mind. You have the right to cancel, also known as the right of rescission, for most unsecured cash mortgages.

Is a closing disclosure a commitment to lend?

Once you have selected a lender and executed the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that you include the closing costs of your loan and the specific amount that you will have to pay in the end.

Can you be denied after the lock disclosure? Although rare, a mortgage can be denied after the loan has signed the closing documents. For example, in some states, the bank may finance the loan after the loan closes. … During this time frame, lenders have the right to withdraw from the loan, so the bank can keep out of wiring the money right away.

What happens after loan disclosures are signed?

Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures. Also sign the documents to close your loan.

Can a loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

Does a loan disclosure mean loan is approved?

The 3-day Closing Disclosure rule now gives you plenty of time to go through the final terms of your loan before signing your closing documents. … This means that the approval, evaluation, assurance and calculation of all third party fees will be completed before the Disclosure Closing is issued to you.

What happens after initial disclosures are signed?

Once you have signed the Closing Disclosure, you are not allowed to change the lender’s or broker’s fees, transfer fees or other fees that you are not allowed to purchase. Don’t let anyone rush you through the Closing Disclosure. You have every right to take a breather and read and reread the documents.

At what point am I committed to a lender?

You know that you are free to change providers at any time during the process; you are not committed to a lender until you have actually signed the closing documents. But if you decide to change, restarting the documentation and underwriting could cause delays in your home purchase or refinancing process.

Can I change lenders while under contract?

No – unless you have signed a contract with the lender stating that you cannot change providers. But such a stipulation is uncommon, say real estate experts. … “Most contracts specify that buyers have a specific period of time in which they must obtain financing and execute.”

How long does a mortgage commitment take?

How Long Does It Take To Get A Mortgage Commitment Letter? Exactly when you receive the letter varies, but usually lasts between 20 and 45 days. The letter of commitment is issued after you have submitted your application with all the required documents such as payment stubs, bank statements, etc.

What should you not tell your lender?

1) Anything of a False Mind to a mortgage lender can ruin your chances of approval. In addition to this, providing misleading information about a loan application is a crime. Welcome to Mortgage Fraud! You can try to hide certain information, but lenders are required to verify key financial documents.

Does a closing disclosure mean loan is approved?

The 3-day Closing Disclosure rule now gives you plenty of time to go through the final terms of your loan before signing your closing documents. … This means that the approval, evaluation, assurance and calculation of all third party fees will be completed before the Disclosure Closing is issued to you.

What happens after loan closing disclosure?

What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

Can loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

What comes first close or closed disclosure?

Once you are free to close, you will receive a Closing Disclosure to sign from your provider. You will receive this letter three days before your scheduled closing date. As a buyer, it is important to acknowledge this disclosure immediately, or your closing date may be delayed.

How many days before closing do you have to disclose locks? By law, you must receive your Closing Disclosure at least three business days prior to your closing. Please read your Disclosure Closing carefully. It tells you how much you will pay for your loan. Our interactive Closing Disclosure sample helps you double-check the details and get definitions for the terms used in the form.

What comes after closing disclosure?

What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

How long does it take to close after closing disclosure?

How long does it take to close after they are unlocked? Most buyers don’t have to wait very long to meet at the closing table once they are clear of closing. With this in mind, you should expect at least a 3-day buffer between the time you receive your Closing Disclosure and the closing date.

Can loan be denied after closing disclosure?

Can a loan be refused after it has been closed? Usually a loan will not be denied after you have cleared the loan. However, if you have major changes to your credit report (such as a new car or a credit card), you can cancel your entire loan.

Do you have to wait 3 days after closing disclosure?

According to the final rule of the Office of Consumer Financial Protection, the creditor must send the Closing Disclosure to the consumer at least three days before the date of completion of the transaction.

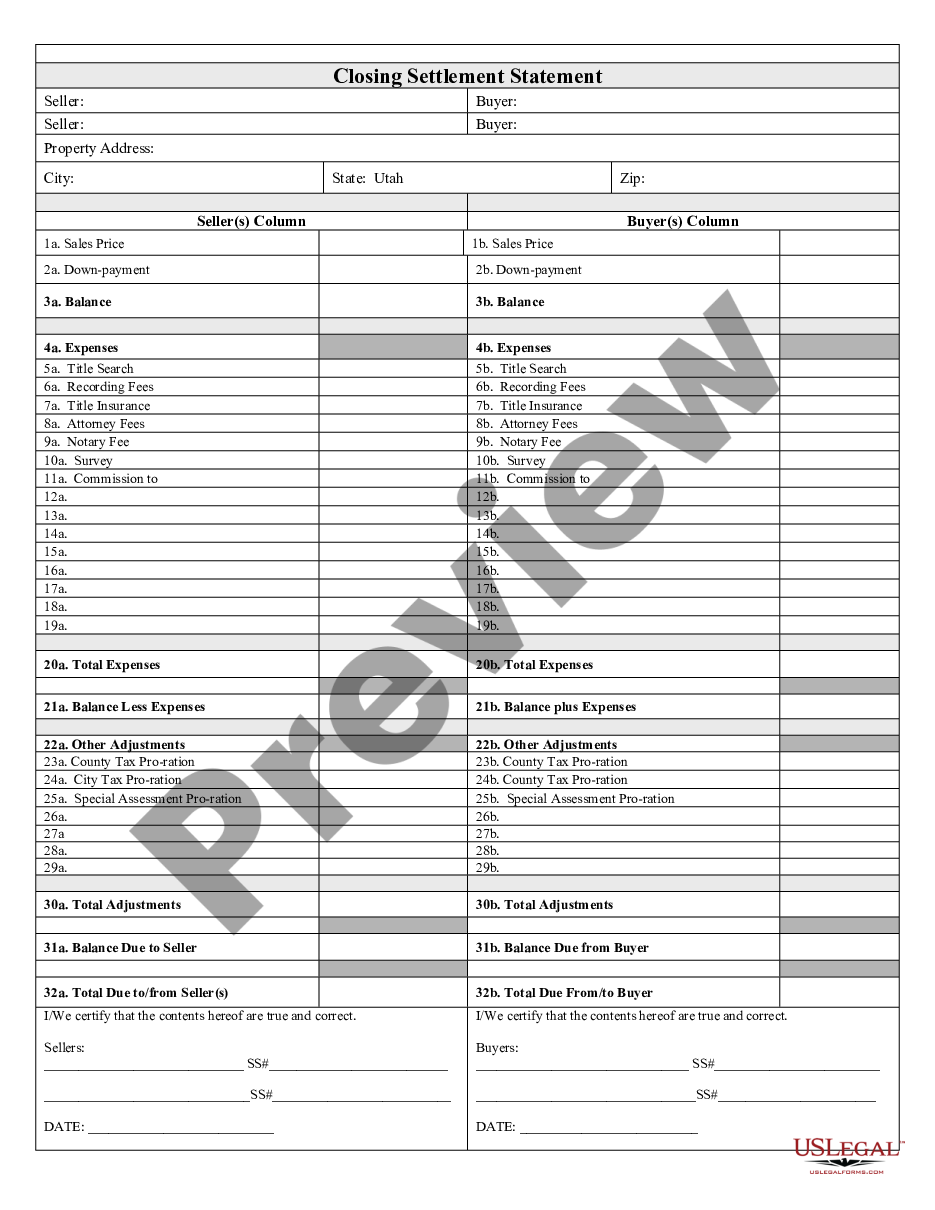

Is closing disclosure same as closing statement?

A mortgage closing statement lists all the costs and fees associated with the loan, as well as the total amount and payment schedule. … The Seller’s Closing Disclosure is prepared by a liquidation agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a statement of liquidation. Arrive three days before closing from your lender. This document is commonly known as “key disclosure.” Essentially, this is for buyers to review in advance before closing.

What is the closing disclosure statement?

A Closing Disclosure is a five page form that provides the final details on the mortgage loan you have chosen. It includes the terms of the loan, your expected monthly payments, and how much you will pay in fees and other costs to obtain your mortgage (closing cost).

What is another name for closing disclosure?

1, 2015, the CD was known by another name: the HUD-1 statement.

What is a closing disclosure for buyer?

Closing Disclosure is a five-page form that describes in detail the critical aspects of your mortgage loan, including the purchase price, loan rates, interest rate, estimated property taxes, and insurance. , closing costs and other expenses.

What comes after the closing disclosure? What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

When Should buyer Receive closing Disclosure?

By law, you must receive your Closing Disclosure at least three business days prior to your closing. Please read your Disclosure Closing carefully. It tells you how much you will pay for your loan.

Do you have to wait 3 days after closing disclosure?

According to the final rule of the Office of Consumer Financial Protection, the creditor must send the Closing Disclosure to the consumer at least three days before the date of completion of the transaction.

Does a closing disclosure mean I’m approved?

The 3-day Closing Disclosure rule now gives you plenty of time to go through the final terms of your loan before signing your closing documents. … This means that the approval, evaluation, assurance and calculation of all third party fees will be completed before the Disclosure Closing is issued to you.

Is the closing disclosure final?

A Closing Disclosure is a five page form that provides the final details on the mortgage loan you have chosen. It includes the terms of the loan, your expected monthly payments, and how much you will pay in fees and other costs to obtain your mortgage (closing cost).