Who holds the deed when there is a mortgage?

Contents

- 1 Who holds the deed when there is a mortgage?

- 2 What does a mortgage note look?

- 3 How do you transfer a house with a mortgage?

- 4 What type of security is a promissory note?

- 5 What is a note in finance?

A mortgage grants your home ownership to the lender who will transfer the title back to you after the loan has been paid off. A deed of trust gives the title to a third party trustee acting on behalf of the mortgage company who will then file a mortgage lien against your home.

Who holds the title deeds when you have a mortgage? The mortgage lender usually retains the title deeds for property with a mortgage. They will not be given to you until the mortgage has been paid off in full.

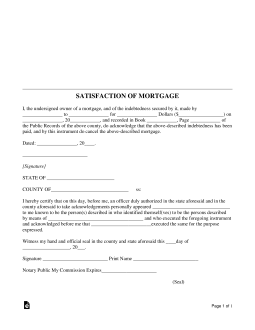

What happens to title deeds when mortgage is paid?

When you pay off your mortgage you may be asked to pay a final fee to the mortgagee (the lender) to cover administration and return your actions. At this time your actions will be sent to you for safekeeping. You can keep them safe or ask your bank or solicitors to keep them for you.

Do banks keep title deeds?

Title deeds for your home are paper documents that record the chain of ownership of your property. … The bank will give you the deeds of the house once your mortgage is finally paid off, which is when you need to find somewhere safe to store them.

What happens to deeds when mortgage paid off UK?

What happens to the title deeds when my mortgage is paid off? If you live in England and Wales, your title deeds are likely to be held electronically with the Land Registry. Your solicitor will amend them when you pay off your mortgage. Or, if the lender is holding them, they will usually send them to you.

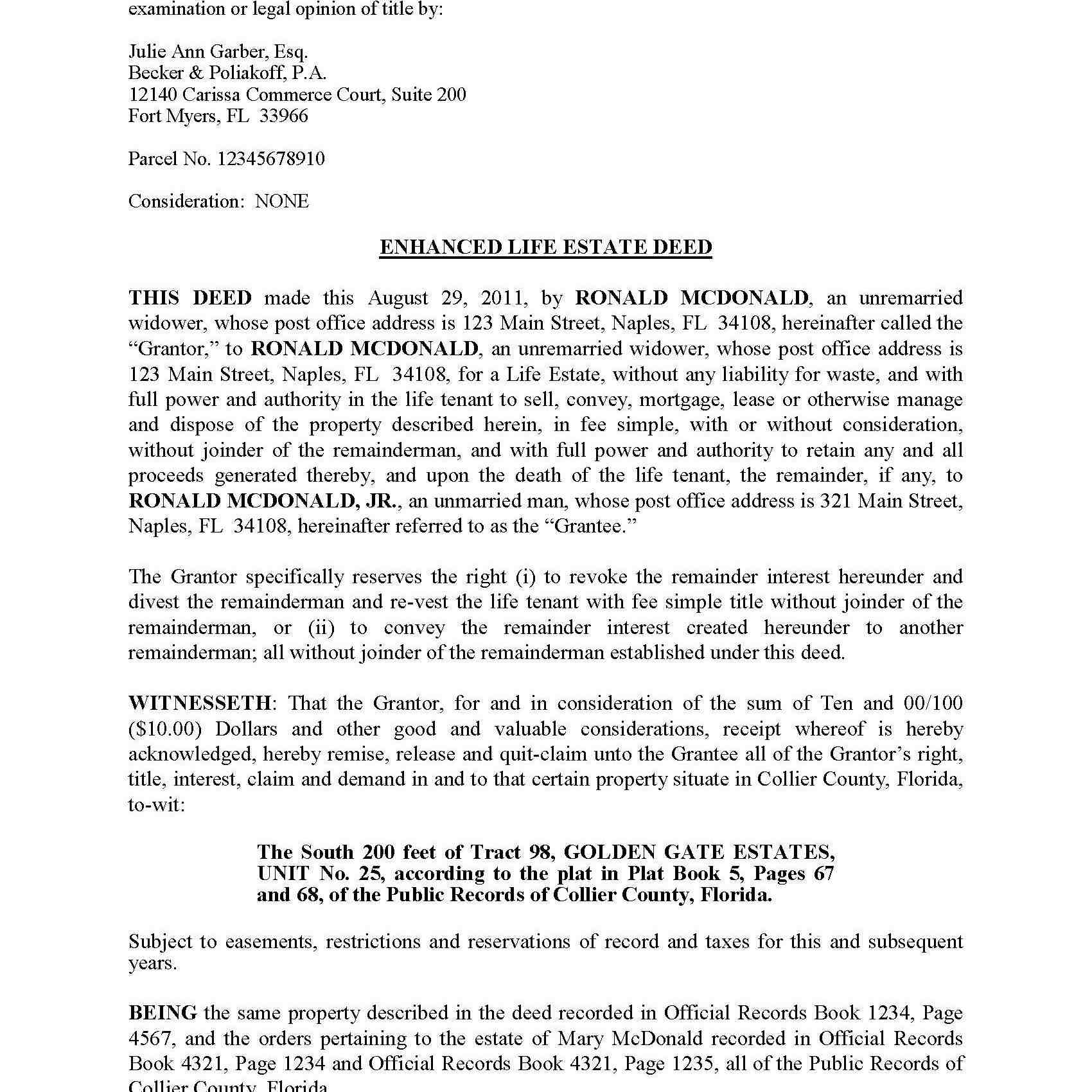

Who owns a house deed or mortgage?

If your name is on the deed but not on the mortgage, it means you are the homeowner, but you are not liable for the mortgage loan and the resulting payments. However, if you fail to make the payments, the lender can still keep the house, even though only one spouse is listed on the mortgage.

Is a mortgage title and deed the same thing?

The main difference between a deed and a title is the physical component. A deed is an official written document confirming a person’s legal ownership of property, and title refers to the concept of rights of ownership.

Can my name be on the deed and not the mortgage?

It is possible to be named on a deed of title to a house without being on the mortgage. However, ownership risks are assumed if this is done because the title is not free and clear of lien and other potential encumbrances. … If there is a mortgage, it’s best to work with the lender to make sure everyone is entitled to protection.

Does a deed mean you own the house?

A home deed is the legal document that transfers ownership of the property from the seller to the buyer. In short, the thing that ensures that the house you just bought is legally yours.

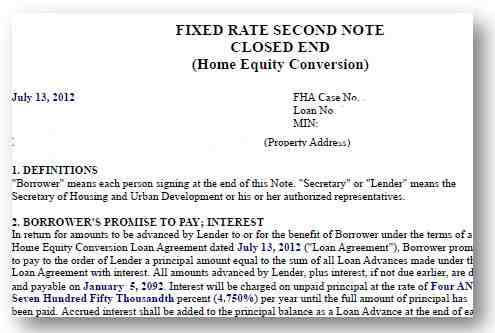

What does a mortgage note look?

According to the Bureau of Consumer Financial Protection, mortgage notes include what you have, the interest rate, the due dates for payment, the length of the repayment and where the payments are to be sent. The note also contains a section outlining any consequences, should the terms of the note be breached.

Where can I get my mortgage note? The mortgage note is part of your final papers and you will receive an approaching copy. If your final papers are lost or destroyed, you can get a copy of your mortgage note by searching the county records or contacting the registry of deeds.

What is the difference between a mortgage and a note?

The Difference Between a Promise & Mortgage Note. The main difference between a promissory note and a mortgage is that the written agreement containing the details of the mortgage loan is a promissory note, but a mortgage is a loan secured by a property.

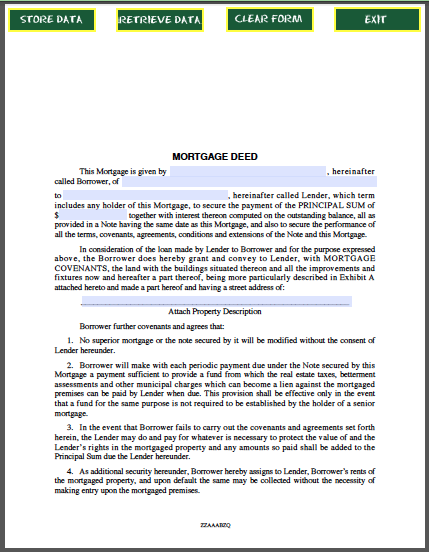

How do you transfer a house with a mortgage?

You can transfer a mortgage to someone else if the terms of your mortgage say it is “acceptable”. If you have a mortgage payable, the new borrower may pay a flat fee to take out the current mortgage and be responsible for the payment. But they usually have to qualify for a loan with your lender.

Can you transfer property to a family member? Giving property to family members by deed of gift Despite the amounts involved, it is possible to transfer ownership of your property without changing hands. This process can be called a deed of gift or a transfer of a gift, both definitions mean the same thing.

How do I gift a house to a family member?

If you want your home free and clear, you can donate it to anyone you want. The transaction must meet the IRS definition of a gift. In other words, the donor must surrender all rights to the property and must change the title to the name of the grantee.

Can you gift a house tax free?

Giving the house When you give property to anyone other than your spouse for more than $ 16,000 ($ 32,000 per couple) in one year, you must file a gift tax return. But you can donate a total of $ 12.06 million (in 2022) over your lifetime without incurring gift tax.

What are the laws for gifting a house to family?

Giving property to family members by deed of gift

- The owner should be mindful and act of his own free will.

- Independent legal advice should be sought before commencing a deed of gift.

- The outstanding property should not be secured by any outstanding debts.

How do I avoid capital gains tax on gifted property?

The only way for your children to avoid taxes is to have lived in the house for at least two years before selling it. In that case, they can exclude up to $ 250,000 ($ 500,000 for a couple) of their capital gains from taxes. Inheritance and gift property are not subject to the same taxes.

Do you need a solicitor to transfer ownership of a house?

Transferring ownership (equity) of property is a legal process. A conveyancing attorney usually completes this process. … Sometimes the process is more involved, especially when the property is mortgaged.

Can you transfer property without a solicitor?

Yes, the short answer is yes, and we provide some procedural guidance on what is involved, such as how to complete a transfer form and what to do when a property owner dies. However, if you are thinking of doing some DIY presentations, it is very important to be aware of a few things.

Do you need a solicitor to change title deeds?

Do I need a lawyer to transfer property ownership? You can change the names of the title deed yourself without the help of anyone else. All you have to do is fill in the correct forms and pay no fee.

How much does it cost to change name on house deeds UK?

A minimum fee of £ 40 must be paid from the Land Registry. This amount must be paid whether or not you complete Land Registry forms yourself. The cost can be a little higher than £ 40 depending on the exact case.

Can a house be signed over to someone else?

Property ownership can be transferred to a family member as a gift, which means that money is not exchanged. This is not the same as an Equity Transfer, where the owner stays on the title and simply adds someone else.

Can you sign a house over to someone for free?

A quitclaim deed simply states that if you own the house, you are giving your interest in it to someone else. … Such a deed ensures that the property is yours and that it is free and clear of liens so that you can transfer it to another person without burden.

How can a person transfer his property to another person?

Property rights can only be transferred upon execution and registration of a deed of sale in favor of the buyer. A deed of conveyance is executed to transfer title from one person to another. Generally, an owner can transfer his property unless there is a legal restriction that prevents such a transfer.

What type of security is a promissory note?

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes with a maturity of nine months or less are not considered securities.

What type of collateral is a promissory note? Secured Promissory Notes The property that receives a note is called collateral, and may be real estate or personal property. The second document will require a promissory note secured by collateral. If the collateral is property, there will be a mortgage or deed of trust.

Is a promissory note secured or unsecured?

Promissory notes can be secured using a financial statement, deed of trust or mortgage. If a promissory note includes these terms, it is a ratified promissory note. Therefore, the only real difference between sponsored and unsecured promissory notes is the inclusion of collateral.

Is a promissory note secured debt?

Sponsored Promissory Notes A secured promissory note is a payment obligation secured by some type of property. This means that if the payer fails to pay, the payee can seize the designated property to obtain repayment of the loan.

Is a note secured or unsecured?

Unsecured note is not supported by any collateral, so lenders are at greater risk. Due to the higher risk involved, the interest rates on these notes are higher than on sponsored notes. In contrast, a secured note is a loan that is backed by the borrower’s assets, such as a mortgage or a car loan.

Can a promissory note be used as collateral?

Secured and Unsecured Promissory Notes Promissory notes can be unsecured or secured by collateral, which is the asset typically purchased using the borrowed money.

What type of investment is a promissory note?

Promissory notes are a type of debt that companies use to raise money. Investors lend money to a company. In return, investors are promised a fixed amount of periodic income. The promised rate of return is usually very high.

Is a promissory note a capital asset?

Almost everything you own and use for personal or investment purposes is a capital asset. another debt instrument need not be a capital asset. … If you receive a note in lieu of money that would be normal income, the money you collect on the note will be ordinary income.

What type of money is a promissory note?

What is a Promissory Note? A promissory note is a debt instrument that contains a written undertaking from one party (issuer or maker of the note) to pay a definite sum of money to another party (the payee of the note), on demand or at a specified future date.

Are promissory notes considered securities?

Promissory notes are defined as securities under the Securities Act. However, notes with a maturity of nine months or less are not considered securities.

Is promissory note a security?

In general, under the Federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

Is a promissory note considered a security?

Promissory notes are defined as securities under the Securities Act. However, notes with a maturity of nine months or less are not considered securities.

Is a promissory note a security under the UCC?

UCC treats the interest of a purchaser of an account, chattel paper, payment intangibles, or promissory notes as a security interest.

What is a note in finance?

A note is a legal document that represents a loan made from an issuer to a creditor or investor. Notes represent the repayment of the principal amount borrowed, plus any prepaid interest payments. The US government issues Exchequer notes (T-notes) to raise money to pay for infrastructure.

What is the term of a note? Term Note means a promissory note of the Borrower payable to any Term Lender or its registered assignments, in the form of an accompanying Substance C-1 substantially, giving evidence of the Borrower’s aggregate indebtedness to that Term Lender as a result of the Term Borrower made with that Term. Lender.

What is a business note?

An attorney usually draws up a list of documents, including one that shows exactly what assets are being sold and another specifying the payment terms. The latter is called the business note, promissory note, or simply the note.

What is a bank or business note?

Business notes are created when a business seller decides to help finance the sale of his business. … He or she finds a buyer, who does not want to deal with the hassles, high rejection rates, or long painful underwriting process of a normal bank / SBA loan, so the buyer asks the seller to finance the sale.

How do you sell a business note?

How to Sell a Business Note

- Get a quote.

- Accept the offer (full purchase offer or partial purchase offer)

- Submit Copy of Promissory Note and Copy of Chattel Asset or Mortgage Purchase Agreement (depending on the state and nature of the business sale)

What is a note in accounting?

Home »Dictionary of Accounting» What’s a Note? Definition: A note, often called a promissory note, is a written promise that a specific amount of money will be paid in the future. In other words, a note is a loan contract between the maker and the payee. Some notes are also payable on demand from the manufacturer.

What is the difference between a loan and a note?

Promissory notes are generally used for more informal relationships than loan agreements. A promissory note can be used for loans to friends and family, or small short-term loans. On the other hand, loan agreements are used for everything from vehicles to mortgages to new business ventures.

Is a note considered a loan?

Understanding Notes A note is a debt security that requires the repayment of a loan, at a predetermined interest rate, within a specified time frame. Notes are like bonds but usually have an earlier maturity date than other debt securities, such as bonds.

Can you be on the note but not the mortgage?

In case of default in payment of the note, the lender can foreclose on the house and sell it. Everyone who is entitled to the property must sign the mortgage or deed of trust. … But if you did not sign the mortgage, it’s because you are not the co – owner of the house.