The three-year average return on multisectoral bond funds was 15.18%, and the three-year average return on short-term bond funds was 5.04%. U.S. Securities and Exchange Commission.

Are bonds a good investment in 2022?

Contents

- 1 Are bonds a good investment in 2022?

- 2 What is a 90 day treasury bill?

- 3 Is it a good time to buy Treasury bills?

- 4 Are bond funds safe in a market crash?

- 5 Which is better Treasury bills or bonds?

If you know that interest rates are rising, buying bonds after interest rates rise would be helpful. You avoid losing -5.2% and buy a bond that yields 2.8%. The Fed predicts a 3 to 4 increase in interest rates in 2022 by as much as 1%. … However, the Fed can directly influence these bonds through bond transactions.

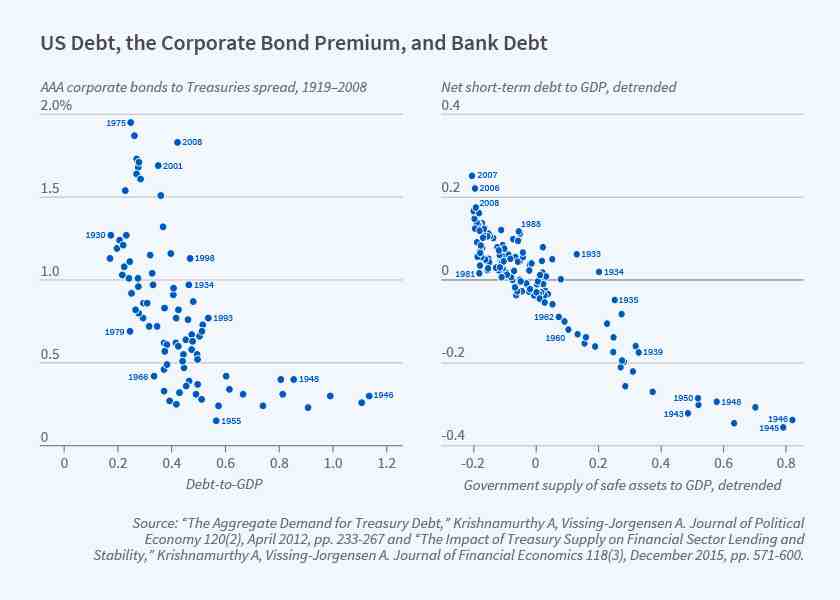

Will bonds rise in price in 2022? The meter measures the difference between interest rates on five-year government bonds and inflation-protected treasury securities, or TIPS. This figure is slightly close to the Federal Reserve’s own forecast of 2.6% for 2022 and 2.3% for next year.

Are bonds a safe investment right now?

Risk: Savings bonds are backed by the US government and are therefore considered as safe as an investment. However, keep in mind that paying interest on a bond will decrease if and when inflation subsides.

Are bonds safe if the market crashes?

Buying bonds during a market crash Government bonds are generally considered the safest investment, although they are decidedly non-sexy and usually offer modest returns compared to stocks and even other bonds.

Are bonds a good investment for 2021?

Are bonds a good investment in 2021? In 2021, interest rates paid on bonds were very low as the Federal Reserve cut interest rates in response to the 2020 economic crisis and consequent recession.

Are I bonds a good investment 2020?

Best Investment for Like other government debt, Series I bonds are attractive to risk-averse investors who are reluctant to risk default. These bonds are also a good option for investors who want to protect their investment from inflation.

Are bonds a good investment for the future?

Funds that invest in sovereign debt instruments are considered the safest investments because the bonds are backed by the full faith and credit of the U.S. government. If interest rates rise, the prices of existing bonds fall; and if interest rates fall, the prices of existing bonds rise.

Can you lose money in a bond?

Bonds are often advertised as less risky than stocks – and for the most part they are – but that doesn’t mean you can’t lose money by owning bonds. Bond prices fall when interest rates rise, when the issuer experiences a negative credit event or when market liquidity dries up.

Are bonds a good investment in 2020?

Treasury bonds can be a good investment for those looking for security and a fixed interest rate to be paid semi-annually until the bond matures. Bonds are an important part of the allocation of investment portfolio assets, as a steady return on bonds helps to offset the volatility of equity prices.

What is the future of bonds?

The Federal Reserve, which focuses on curbing inflation, is expected to raise interest rates overnight to 1% in 2022 and then above 2% by the end of next year. Strategists surveyed by Bloomberg News predict higher yields on treasury bonds by the end of 2022, with 10-year yields reaching 2.04% and 30-year bonds rising to 2.45%.

Are bonds a safe investment in 2020?

Security – One of the advantages of buying bonds is that they are a relatively safe investment. Bond values do not fluctuate as much as stock prices. Income – Another advantage of bonds is that they offer a predictable income that pays you a fixed amount of interest twice a year.

Are I bonds a good investment 2020?

Best Investment for Like other government debt, Series I bonds are attractive to risk-averse investors who are reluctant to risk default. These bonds are also a good option for investors who want to protect their investment from inflation.

Are bonds safe if the market crashes?

Buying bonds during a market crash Government bonds are generally considered the safest investment, although they are decidedly non-sexy and usually offer modest returns compared to stocks and even other bonds.

Are bonds a good investment for 2021?

Are bonds a good investment in 2021? In 2021, interest rates paid on bonds were very low as the Federal Reserve cut interest rates in response to the 2020 economic crisis and consequent recession.

What is a 90 day treasury bill?

Treasury bills are short-term securities sold by the U.S. government as a way to help repay debt. … When a treasury bill expires, the state pays the holder the nominal value of the bill. Suppose, for example, you buy a 90-day cash register worth $ 1,000 for $ 985.

What is the current interest rate for 3-month treasury bills?

What is a treasury bill and how does it work?

Treasury bills (or treasury bills) are short-term securities that fall due within one year or less of the date of issue. Treasury bills are purchased at a price less than or equal to their face value, and when they mature, the treasury pays their face value.

How do you make money from Treasury bills?

Treasury bills are also a very liquid form of investment. This means they are easy to trade. They can be sold on the secondary market and easily converted into cash. If you sell a bill on the secondary market, you sell it to someone else instead of waiting for it to mature.

How much interest can you earn from a treasury bill?

Interest rates currently range from 0.09% to 0.17% for government bills maturing from four weeks to 52 weeks. “T-bills do not pay recurring interest, instead they earn implicit interest by selling at a discount to face value,” Michelson said.

Can you lose money on Treasury bills?

Treasury bonds are considered risk-free assets, which means that there is no risk of the investor losing principal. In other words, investors who hold the bond to maturity are guaranteed their principal or initial investment.

What is a treasury bill for dummies?

For short-term investment, treasury bills (called treasury bills) are the most marketable security in the country. Treasury bills are issued with a maturity of 3, 6 or 12 months. When you buy T-bills, you pay less than the face value (or face value). … Treasury bills are not like coupon bonds that pay interest in accruals.

What are Treasury bills example?

Treasury bills are zero-coupon securities and do not pay interest. They are issued at a discount and are redeemed at face value at maturity. For example, a 91-day treasury bill of Rs. 100 / – (nominal value) can be issued for example Rs.

What is Treasury bill and how does it work?

Treasury bills are issued at a discount to the original value and the buyer receives the original value at maturity. For example, a treasury bill of 100 Rs can be redeemed at 95 Rs, but the buyer is paid 100 Rs on the due date. The profitability of treasury bills depends on the liquidity position in the economy.

What is a Treasury bill good for?

Treasury bills are one of the safest investments, but their profitability is low compared to most other investments. Opportunity costs and risk must be taken into account when deciding whether treasury bills are suitable for the retirement portfolio. In general, treasury bills may be suitable for investors approaching or retiring.

What is a 91-day treasury bill?

What this means: the U.S. government issues short-term debt at a competitive discount, usually weekly. Discount means that the banknote is sold at a discount from the face value and then redeemed at full face value at maturity. … The return on 91-day treasury bills is the average discount rate.

What is 91 day treasury bill?

Treasury bills are money market instruments issued by the Government of India as a promissory note with guaranteed subsequent repayment. … For example, a 91-day treasury bill with a face value of Rs. 120 can be purchased at a discounted price of Rs. 118.40.

Is it a good time to buy Treasury bills?

Treasury bills are one of the safest investments, but their profitability is low compared to most other investments. Opportunity costs and risk must be taken into account when deciding whether treasury bills are suitable for the retirement portfolio. In general, treasury bills may be suitable for investors approaching or retiring.

Can you lose money on treasury bills? Treasury bonds are considered risk-free assets, which means that there is no risk of the investor losing principal. In other words, investors who hold the bond to maturity are guaranteed their principal or initial investment.

Is it a good time to invest in Treasuries?

Treasuries can be a good investment for investors looking for a low-risk savings and a steady stream of income. But because of their low returns, they are unlikely to be better than other investments, such as mutual funds and exchange-traded funds.

Are long term Treasuries a good investment now?

As might be expected for a safe investment, returns on long-term treasuries are modest in today’s low-yield environment. However, they are not negligible. … Today, some popular long-term government bond funds have a yield of 2.6% or more. Moreover, interest on treasury bonds is exempt from state and local income tax.

Can you lose money on Treasuries?

Can you lose money by investing in bonds? Yes, you can lose money when selling a bond before the maturity date, as the sale price may be lower than the purchase price.

Are I bonds a good investment 2021?

Bond I is a U.S. government savings bond that has a fixed interest rate, plus an additional inflation regulator, so you get a real rate of return adjusted for inflation. In a world of worrying about inflation and some inflation-adjusted investments, Bond I is a great place to look for savers.

How much interest can you earn from a treasury bill?

Interest rates currently range from 0.09% to 0.17% for government bills maturing from four weeks to 52 weeks. “T-bills do not pay recurring interest, instead they earn implicit interest by selling at a discount to face value,” Michelson said.

Do Treasury bills earn interest?

The treasury bill does not pay coupons – interest payments – until it matures. Treasury bills can hold back cash flow for investors who need a steady income. Treasury bills have interest rate risk, so their interest rate could become less attractive in a growing environment.

How much can you make with Treasury bills?

For example, a 52-week temporary bill of $ 100,000 with an interest rate of 1.5 percent would cost $ 98,500. The current rate of treasury bills slightly underestimates the return on earnings, as the amount invested is less than the nominal one. In the case, the investor would earn $ 1,500 on an investment of $ 98,500, which is a 1.523% return.

Are bond funds safe in a market crash?

Federal Bond Funds Funds made up of U.S. government bonds are the leaders in the group, as they are considered one of the safest. … Options to consider include federal bond funds, municipal bond funds, taxable corporate funds, money market funds, dividend funds, utilities mutual funds, high-capitalization funds and hedge funds.

Can you lose money on bond funds? Bond mutual funds may lose value if the bond manager sells a significant amount of bonds in an environment of rising interest rates and open market investors demand a discount (pay a lower price) on old bonds that pay lower interest rates. Falling prices will also have a negative impact on the NAV.

Do bond funds do well in a recession?

Bonds can do well in a recession because they are becoming more in demand than stocks. There is more risk in owning a company through shares than in lending money through a bond.

Are bonds safe if the market crashes?

Buying bonds during a market crash Government bonds are generally considered the safest investment, although they are decidedly non-sexy and usually offer modest returns compared to stocks and even other bonds.

What happens to bonds in a recession?

If a recession occurs, stocks become less attractive and may enter the bear market. This increases the demand for bonds, which raises their prices and reduces yields. The Federal Reserve is also generally lowering short-term interest rates to boost the economy in times of recession.

Are bonds safe if the market crashes?

Buying bonds during a market crash Government bonds are generally considered the safest investment, although they are decidedly non-sexy and usually offer modest returns compared to stocks and even other bonds.

What is the safest investment if the stock market crashes?

Get a guarantee If you are a short-term investor, bank CDs and treasury securities are a good bet. If you invest for an extended period of time, fixed or indexed annuities or even indexed universal life insurance products can provide better returns than treasury bonds.

What happens to bonds when the stock market goes down?

Bonds affect the stock market because when bonds fall, stock prices tend to rise. The opposite also happens: when bond prices rise, stock prices tend to fall. Bonds compete with stocks for investors ’dollars because bonds are often considered safer than stocks. However, bonds tend to offer lower returns.

Are bonds a safe investment right now?

Risk: Savings bonds are backed by the US government and are therefore considered as safe as an investment. However, keep in mind that paying interest on a bond will decrease if and when inflation subsides.

What happens to bonds when stock market goes down?

Bonds affect the stock market because when bonds fall, stock prices tend to rise. … Bonds compete with stocks for investors ’dollars because bonds are often considered safer than stocks. However, bonds tend to offer lower returns. Stocks tend to be good when the economy is booming.

Are bonds safe in a stock market crash?

Buying bonds during a market crash Markets are also an opportunity for investors to consider an area that new investors might miss: investing in bonds. Government bonds are generally considered to be the safest investment, although they are markedly non-sexy and tend to offer modest returns compared to stocks and even other bonds.

Do bonds increase when stocks fall?

The sale of shares is driven by bond markets, which have fallen this year as inflation could reduce how much money investors earn from their deals. As bond prices fall, their yields increase.

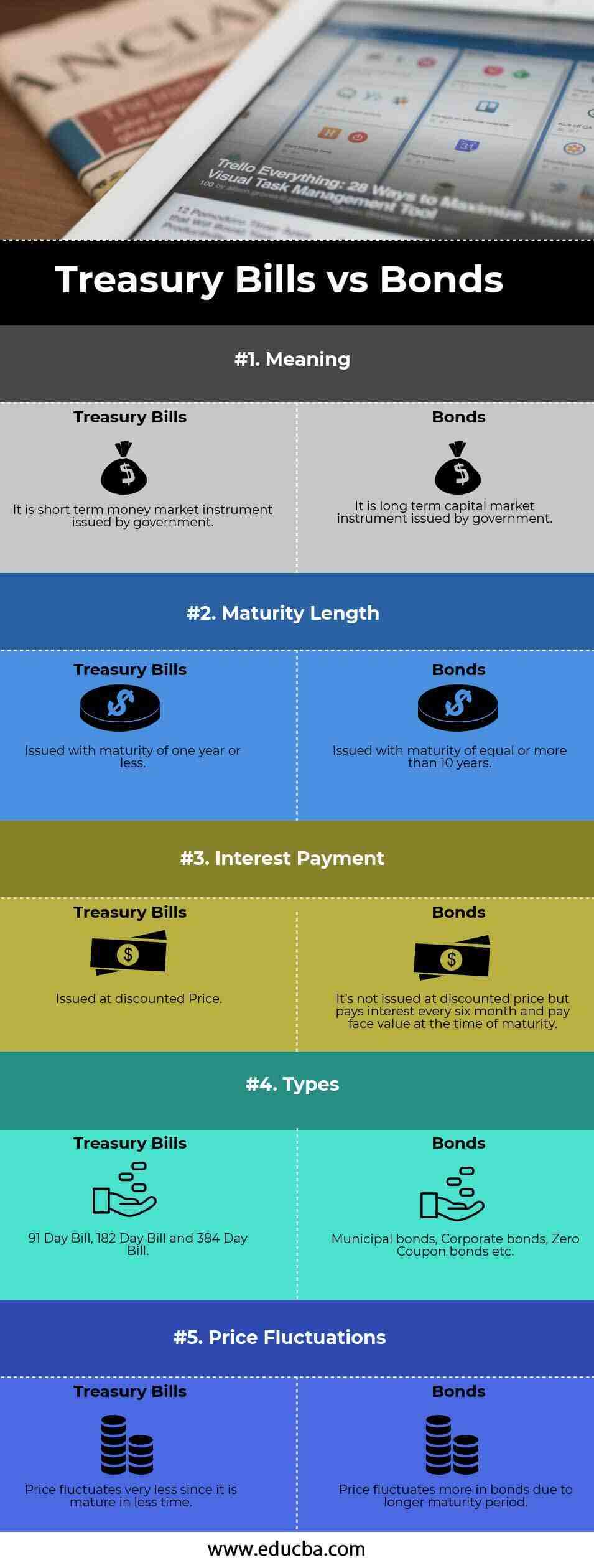

Which is better Treasury bills or bonds?

Treasury bills mature in one year or less, while treasury bonds have a maturity of more than 10 years. Return on investment for treasury bills instruments is low due to shorter maturity The return on investment is higher for treasury bonds due to longer maturities.

Are bonds better than treasury bills? T-bonds mature in 30 years and offer investors the highest interest payments each year. T-bonds mature between two and 10 years, with two-year interest payments but lower yields. Treasury bills have the shortest maturity – from four weeks to one year.

What is the difference between a Treasury bill and a bond?

The key difference between the two is the time it takes for each to mature. While treasury bonds are considered long-term debt securities maturing 30 years after sale, treasury bills are short-term securities maturing in one year and pay less interest than T-bonds.

What is a Treasury bond and how does it work?

Treasury bills and bonds are securities that pay a fixed interest rate every six months until the maturity of the security when the treasury pays the nominal value. The only difference between them is their length to maturity. Treasury bills mature for more than one year, but not more than 10 years from the date of issue.

What is Treasury bond example?

Treasury securities and programs

- Treasury bills. Treasury bills are short-term government securities with a maturity of a few days to 52 weeks. …

- Treasuries. …

- Treasury bonds. …

- Inflation-protected treasury securities (TIPS) …

- Savings bonds of series I. …

- EE series savings bonds.

What are Treasury bonds currently paying?

The compound interest rate for bonds I issued from November 2021 to April 2022 is 7.12 percent. This rate applies for the first six months when you own the bond.