Does a mortgage note commit you to paying your loan?

Contents

- 1 Does a mortgage note commit you to paying your loan?

- 2 Can you be on the mortgage but not the note?

- 3 How do you secure a promissory note with real estate?

- 4 What happens if my spouse dies and my name is not on the mortgage?

- 5 Can someone be on the note and not the mortgage?

Mortgage bills give lenders security during the lending process, because without borrowers, borrowers would not be legally obligated to repay the loan. After both parties sign the note, it is legally binding and gives the lender the opportunity to take legal action if the borrower fails to pay the loan.

What is the difference between a bill and a mortgage? The difference between a promissory note and a mortgage. The main difference between a bill of exchange and a mortgage is that a promissory note is a written contract that contains the details of a mortgage loan, while a mortgage is a loan secured by real estate.

What does a mortgage note do?

A mortgage is a document that you sign at the end of the closing of the house. It should accurately reflect all the terms of the contract between the borrower and the lender or be corrected immediately if not.

What does a mortgage note show?

The note will provide you with details regarding your loan, including the amount you owe, the mortgage interest rate, the dates when payments need to be made, the length of the repayment time, and the place of payment to be sent.

How do I get my mortgage note?

The mortgage is part of your final paperwork and you will receive a copy at closing. If you lose your final papers or they are destroyed, you can get a copy of your mortgage by searching the district records or contacting the Deed Registry.

What is the difference between a note and a loan?

A promissory note is a simple document that is not as complex as a loan agreement, and can be shorter and less detailed. … Unlike a bill of exchange, a loan agreement imposes obligations on both parties, which is why both the borrower and the lender must sign the agreement.

What is the difference between a note and a term loan?

The interest rate can be fixed or variable; interest rates on payable bonds are generally fixed. Term loans are usually repaid over a period of one to five years.

Why is a loan called a note?

A promissory note is a type of promissory note agreement that outlines the legal obligations of the lender and the borrower. A loan record is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, maturity date, principal amount, interest rate, and any pre-repayment penalty.

Is a loan a note?

A loan is a type of financial instrument; it is the loan agreement that determines when the loan must be repaid, and usually the interest to be paid.

Can you be on the note and not the mortgage?

Lenders require co-signatories to sign a note, but not a deed, upon closure. Borrowers may be excluded from the contract, waiving property rights, but remain on note and responsible for repaying the loan. In both cases, your credit is included in the event of default.

What happens when someone is on the deed but not the mortgage?

Remember this: no matter whose name it is or is not on the mortgage, if someone does not pay the mortgage, the mortgagee (bank, savings bank and lender or other lender) can enforce and take ownership of the property no matter whose name they are in action. So much for what you can always count on.

Can a borrower be on the note but not on title?

The full definition of “mortgage” requires that the borrower has a right of ownership because the mortgage refers to a debt instrument or debenture that is tied to the property as collateral. If the borrower is not owned, the property cannot be tied to the debenture. Customers can be owned without being on loan.

Can you put someone on a deed and not the mortgage?

The person’s name may be on the document, but not on the mortgage. In such circumstances, the person owns the property but is not financially responsible for paying the mortgage.

Can you be on the mortgage but not the note?

In case of delay in payment of the banknote, the lender can foreclose on the house and sell it. A mortgage or trust agreement must be signed by all property owners. … But if you did not sign the mortgage, it is because you are not a co-owner of the house.

Can a borrower be on a mortgage but not on a property? Legally, at least one borrower must be on the title deed to qualify for a mortgage loan. However, most mortgage lenders prefer that all borrowers appear on the title. … But mortgage borrowers who are not on the title deed become guarantors, not co-debtors.

Can you be on the mortgage but not the loan?

If your name is on the mortgage, but not in the document, it means that you are not the owner of the house. Instead, you are simply a co-signer of the mortgage. Since your name is on the mortgage, you are required to pay the loan repayments as well as the individual who owns the home.

Can someone be on the title and not the mortgage?

It is possible to be named in the title deed of the house, without being mortgaged. However, this implies risks of ownership because the right of ownership is not free from liens and possible other encumbrances. Free and clear means that no one else has the right to a title above the owner.

Can someone be on the title but not the loan?

The full definition of “mortgage” requires that the borrower has a right of ownership because the mortgage refers to a debt instrument or debenture that is tied to the property as collateral. If the borrower is not owned, the property cannot be tied to the debenture. Customers can be owned without being on loan.

How do you secure a promissory note with real estate?

In general, the secured debenture will be secured by an additional document. If the property used as collateral is personal property, the Note will be secured by the Security Agreement. If the property used as collateral is real estate, the Minutes will be secured by a Trust Agreement.

How do I protect my bill? Types of Bills of Exchange – Secured or Unsecured Debentures may be secured or unsecured. In the case of a secured debenture, the borrower will have to provide collateral such as property, goods, services, etc., in the event that he does not repay the borrowed amount.

How do you secure a promissory note with real property?

Secured promissory notes The property that secures a bill of exchange is called collateral, and it can be real estate or personal property. A promissory note secured by collateral will need another document. If the collateral is real estate, there will be either a mortgage or a trust agreement.

What connects promissory note to collateral?

Fill out the financing report to attach the collateral to the debenture. To attach a loan to any personal property, you will need to compel the borrower to complete a financing statement, sometimes referred to as a “UCC” or “UCC-1” statement.

Is a promissory note real property?

The main difference between a bill of exchange and a mortgage is that a promissory note is a written contract that contains the details of a mortgage loan, while a mortgage is a loan secured by real estate.

What is a note secured by real property?

A mortgage loan is a loan secured by real estate using a mortgage that serves as proof that the loan exists. During the period in which the owners of mortgage bills pay the mortgage on a monthly basis, the lender retains interest in that property.

What connects promissory note to collateral?

Fill out the financing report to attach the collateral to the debenture. To attach a loan to any personal property, you will need to compel the borrower to complete a financing statement, sometimes referred to as a “UCC” or “UCC-1” statement.

Is a promissory note a lien?

A promissory note is a contract, a mortgage (in California a trust agreement) is a lien. The certificate of trust would relate to the debenture.

What document connects the promissory note to the collateral?

Which of the following documents links a bill of exchange to collateral? The mortgage links the debenture (the borrower’s promise to pay) to the collateral.

Can a promissory note be used as collateral?

Secured and unsecured bills of exchange Debentures can be unsecured or secured by collateral, which is usually an asset purchased with borrowed money.

Can you use a promissory note for real estate?

Anyone who borrows money can issue a debenture (such as real estate sellers, credit unions, FinTech solutions and non-mortgage-related banks, for example), but specific to the real estate and mortgage process, debentures serve as a contract that the borrower will repay his mortgage loan by maturity.

How do promissory notes work in real estate?

The promissory note is a written and signed promise to return the borrowed money. The document identifies the terms of the loan and the parties to the loan, but does not provide details of what will happen if the borrower fails to pay. The promissory note may be secured or unsecured, depending on the terms of the loan.

Can a buyer use a promissory note for consideration on the purchase of a property?

The buyer wanted to use the debenture for a fee to purchase the property. Can he do that? Yes, this is acceptable as long as the seller agrees.

Can you use a promissory note to buy a house?

Debentures are ideal for individuals who do not qualify for traditional mortgages because they allow them to buy a home using a seller as a source of loan and a purchased home as a source of collateral.

What happens if my spouse dies and my name is not on the mortgage?

If there is no co-owner on your mortgage, the assets in your deposit can be used to pay the outstanding amount of your mortgage. If there are not enough assets in your property to cover the remaining amount, your surviving spouse can take over the mortgage payment.

How much money do you need for a non-lucrative visa to Spain? What is the minimum income to stay in Spain in 2022? To be eligible for a non-lucrative visa in Spain, the Spanish government dictates that you must prove that you have a minimum monthly income of € 2,316.08 / month and an additional monthly income of € 579.02 for each family member in your care.

How long can an Embassy hold your passport?

Please note that CITIC will only keep your passport for 15 days, after which it will be returned to the embassy / consulate. You must pick up your passport within 15 days.

How long does it take for Embassy to return passport?

Although passports are often available within one week, the exact time can vary significantly depending on the office used and the workload the consulate is facing at the time.

How long does it take to get passport back after visa interview?

After the visa interview, the consular officer will often keep your passport and documents to complete the processing of your application. If your immigrant visa application is approved by the consulate, it takes 7 to 10 days to get your passport back.

How long can UK Embassy hold your passport?

You will have 3 months to pick up your passport or travel document after you have been told it is ready to pick up. If you do not pick up your passport or travel document within 3 months, they will be returned to the issuing authority.

Is France accepting visa applications?

France has announced a decision to stop issuing visas in all its embassies and consulates abroad due to the situation caused by the coronavirus epidemic in the world. According to a statement issued by the French government, the issuance of visas will be suspended until further notice, including Schengen visas.

When Schengen visa will open 2021?

2 – Visa price increase and other changes explained.

How long does France visa take to process?

How long does it take to get a French visa? Your French visa application will be processed within five to 20 working days. Whereas, if you have applied for a long-stay visa in France, you will receive a reply within 15 to 20 days or up to 2 months in some special cases.

Is France issuing visas right now?

Diplomatic missions re-issue visas, with all missions processing applications based on country classification and in accordance with their ability to meet health requirements. … In the absence of a document on your certificate, your visa application may be denied.

What documents are needed for DS-260?

DS-260 supporting documents

- Proof of citizenship (passport photo page and copy of birth certificate).

- A copy of the wedding certificate.

- In the case of previous marriages, a copy of the divorce documents (ie death or divorce certificate)

What photographs are needed for DS-260?

If you are applying for an immigrant visa, using the DS-260 form, you must submit two (2) identical photos at the immigrant visa interview. Your photos must be: Printed on photo paper. Dimensions 2 x 2 inches (51 x 51 mm).

How long does it take after submitting DS-260 form?

Once you submit the supporting documents, it usually takes 1-2 months before a visa interview is scheduled. You will receive a notification from either the NVC or your local U.S. Consulate with information about the time and date of your interview.

Who fills out the DS-260 form?

Anyone applying for a U.S. immigrant visa must complete Form DS-260, online. Learn more about the requirements and submission mechanics of this form. By Tiffney Johnson, J.D. Are you in the process of applying for an immigrant visa at the U.S. Embassy or Consulate Abroad?

Can someone be on the note and not the mortgage?

But just because they’re on a mortgage, doesn’t mean they’re on bonds as well. For example, often one spouse may have poor creditworthiness so they are not on the Bond (lenders sometimes say “they are not on loan”), but both spouses have a contract, so both spouses must be mortgaged.

Can you be on a note rather than a mortgage? Lenders require co-signatories to sign a note, but not a deed, upon closure. Borrowers may be excluded from the contract, waiving property rights, but remain on note and responsible for repaying the loan. In both cases, your credit is included in the event of default.

Does the note follow the mortgage?

The law in the United States has long followed the rule of Mary’s Little Lamb – wherever a mortgage goes, a connected mortgage certainly follows. Return of (third) property (mortgage) § 5.4.

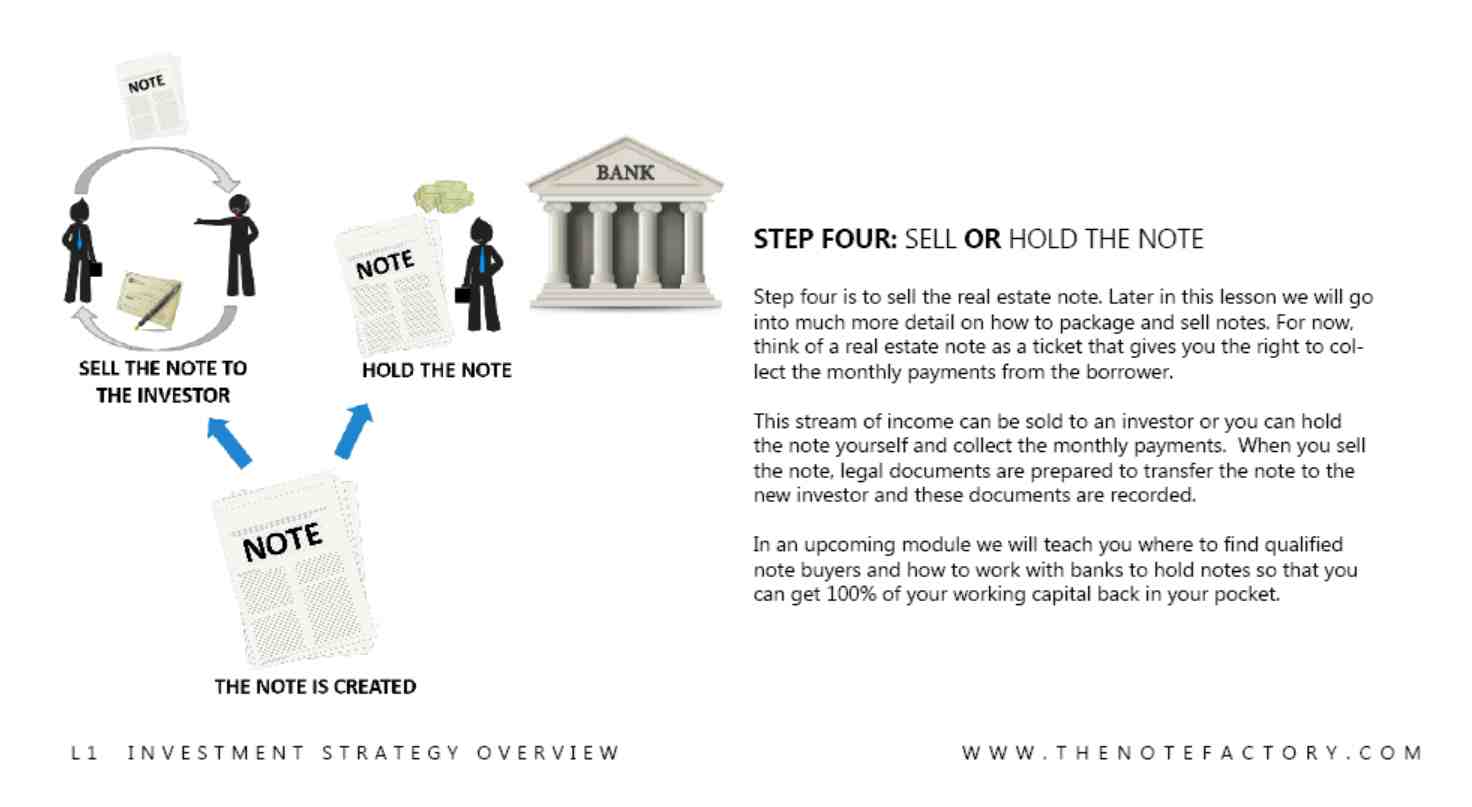

Who holds the note to my mortgage?

The owner of the mortgage, also called the owner of the mortgage or bond, is the entity that owns your loan. … The owner of the mortgage is the only party who has the right to collect the debt or foreclosure on the property if the borrower does not pay the mortgage.

Are the mortgage and the note the same thing?

The main difference between a bill of exchange and a mortgage is that a promissory note is a written contract that contains the details of a mortgage loan, while a mortgage is a loan secured by real estate.

What is the relationship between a note and a mortgage?

The debenture is the borrower’s promise to repay the loan; The mortgage puts the title on the house as collateral for the loan. When you take out a home loan, the lender will likely require you to sign both a promissory note and a mortgage.

Can I be on the mortgage but not the loan?

If your name is on the document, but not on the mortgage, it means that you are the owner of the house, but you are not responsible for the mortgage loan and payments from it. However, if you do not make the payment, the lender can still make foreclosures on the house, despite the fact that only one spouse is listed on the mortgage.

Can you put someone on a deed and not the mortgage?

The person’s name may be on the document, but not on the mortgage. In such circumstances, the person owns the property but is not financially responsible for paying the mortgage.

Can a person be on a mortgage but not the note?

A mortgage or trust agreement must be signed by all property owners. If you and your spouse own your home together, you had to sign a mortgage, even if you didn’t sign the note.

Can I put my wife on the title but not the mortgage?

The title has little to do with the mortgage. … You can put your spouse on the title without mortgaging him; this would mean that they share ownership of the house, but are not legally responsible for paying the mortgage.

Can a borrower be on the note but not on title?

The whole definition of “mortgage” requires that the borrower has a right of ownership because the mortgage refers to a debt instrument or debenture that is tied to the property as collateral. If the borrower is not owned, the property cannot be tied to a promissory note. Customers can be owned without being on loan.

Can you be on the mortgage but not the loan?

If your name is on the mortgage, but not in the document, it means that you are not the owner of the house. Instead, you are simply a co-signer of the mortgage. Since your name is on the mortgage, you are required to pay the loan repayments as well as the individual who owns the home.