Once the loan documents are signed, the escrow officer returns them to the lender for review. Once the lender is satisfied that all required documents have been signed and that all outstanding loan terms have been met, the lender will notify escrow that it is ready to disburse the escrow loan funds.

Can you be denied after closing disclosure?

Contents

- 1 Can you be denied after closing disclosure?

- 2 How long does signing closing documents take?

- 3 Can loan be denied after closing disclosure?

- 4 Is closing Disclosure final?

- 5 How long after signing closing do you get money?

Yes, you can still be denied once you get approval to close. While a clear closure means a closing date is coming, it doesn’t mean the lender can’t give up on the deal. They can re-check your creditworthiness and employment status as it has been a long time since you applied for the loan.

Does the final post mean I am approved? The three-day final disclosure policy now gives you plenty of time to review the final terms of your loan before signing your closing documents. … This means that the approval, assessment, insurance and calculation of all third party fees will be completed before the Final Disclosure is issued to you.

Is the closing disclosure final?

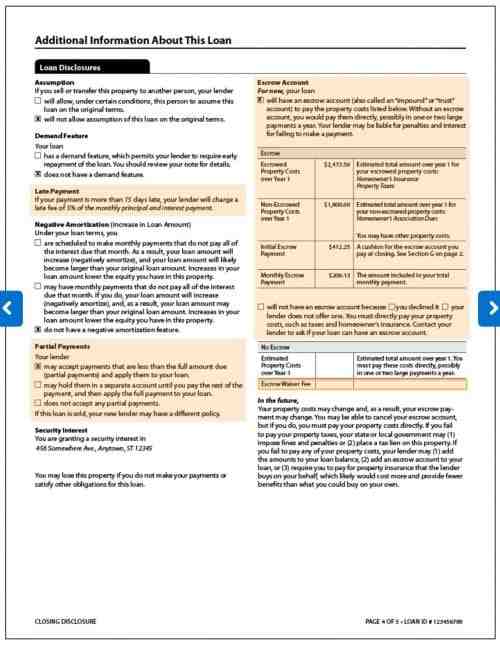

The final post is a five-page form that provides the final details of the mortgage you have chosen. It includes the terms of the loan, your projected monthly payments and how much you will pay fees and other costs to get a mortgage (closing costs).

Does closing disclosure mean underwriting is complete?

Once you have selected a lender and started the mortgage takeover process, you will receive a Final Disclosure. It provides the same information as the loan estimate, but in its final form. This means that it contains the locked costs of your loan and a certain amount that you will have to pay at closing.

What happens after a closing disclosure?

What happens after the final release? Three business days after you receive your closing notice, you will use a cashier’s check or bank transfer to send all the money you need to bring to the closing table, such as payment and closing costs, to the settlement company.

Is closing Disclosure final approval?

Final disclosure is the final calculation of the interest rate and fees of your loan, the cost of closing the mortgage, your monthly mortgage payments and the total amount of all payments and financial costs. The form is issued at least three days before you sign the mortgage.

Can loan be denied after closing disclosure?

Can a loan be refused after closing? Usually the loan will not be rejected once you are ready to close. However, if you have major changes to your credit report (such as a new car or credit card), you can decline the entire loan.

Does closing disclosure mean clear to close?

Receiving a concluding announcement means that it is clear that you are closing, but the terms are not completely synonymous. Technically, it is clear that you close at the time the insurer signs the loan, and it may take between 24-72 hours from then to receive your final notice.

Can a lender cancel a loan after closing?

Yes. For certain types of mortgages, you may be able to change your mind after signing the mortgage closing documents. You have the right to cancel, also known as the right to cancel, for most cash mortgages without a purchase.

Can you be denied after closing disclosure?

Although this is rare, a mortgage can be refused after the borrower signs the final papers. For example, in some states, a bank may finance a loan after the borrower closes. … During this time period, borrowers have the right to cancel the loan, so the bank can immediately cancel the sending of money.

How long does signing closing documents take?

The signing process can take place in person, where everyone signs the documents, which can take from 5 minutes to 2 hours. In general, the seller needs less time to sign the final documents than the buyer.

How long does it take to process the final documents? In fact, most real estate transactions take between 30 and 60 days to close, and the average is 47 days. Each state, county, and lender is different, with unique procedures and schedules.

What happens after signing closing papers?

After signing the documents and paying the closing costs, you get ownership of the property. The seller must publicly transfer the property to you. The final attorney or property agent will then record the offense. You get your keys and officially become the owner of the house.

What are initial closing documents?

The final disclosure (aka “CD”) is a mortgage document that describes all the details of the financing. The lender creates the initial CD after the initial approval of the download. The following pages list the closing costs. …

What are real estate closing documents?

Documents used to exchange money and real estate rights are called final documents. Final documents are signed at closing, which are also called settlement, which is the process of bringing the transaction to an end.

What are the closing documents?

A guide to closing real estate documents for buyers

- Closing the house is a stressful endeavor. …

- Proof of homeowner insurance. …

- Closing Disclosure. …

- Loan application. …

- Credit assessment. …

- Mortgage Note. …

- Deed Of Trust. …

- Initial escrow statement.

How long does closing take after signing?

Although the process of closing a house usually takes 30 to 45 days, you should be prepared to close as soon as possible. While some delays are inevitable, you can do your part to ensure a smooth closure by meeting all outstanding debts, preparing all the necessary documents to sign, and paying the down payment on time.

How long does it take to close after signing?

Typically, you can expect the house to close in 30 to 45 days. As of June 2021, the average time to close a home purchase is 51 days, according to the Ellie Mae Origination Insight Report.

How long after signing closing documents do you close?

This is the date when the seller will be completely evicted from the house, and you will be able to move into the house. Please note that the end date is usually at least one month after the purchase offer is accepted.

Can loan be denied after closing disclosure?

Can a loan be refused after closing? Usually the loan will not be rejected once you are ready to close. However, if you have major changes to your credit report (such as a new car or credit card), you can decline the entire loan.

Does closing detection mean clearly closing? Receiving a concluding announcement means that it is clear that you are closing, but the terms are not completely synonymous. Technically, it is clear that you close at the time the insurer signs the loan, and it may take between 24-72 hours from then to receive your final notice.

Can a lender cancel a loan after closing?

Yes. For certain types of mortgages, you may be able to change your mind after signing the mortgage closing documents. You have the right to cancel, also known as the right to cancel, for most cash mortgages without a purchase.

Can a lender take back a loan after closing?

Grace period for closing the mortgage It is not there to give the lender the opportunity to take over the transaction. The lender has no right of termination. After you have signed the loan documents, you have entered into a binding agreement, and the lender is legally obliged to respect those signed documents.

Can lender back out after closing documents are signed?

If you have signed the final documents, then you have essentially already bought a house. You have also signed any mortgage paper. So, if you try to give up now, the seller may force you to fulfill all the requirements to complete the sale.

Can you be denied after closing disclosure?

Although this is rare, a mortgage can be refused after the borrower signs the final papers. For example, in some states, a bank may finance a loan after the borrower closes. … During this time period, borrowers have the right to cancel the loan, so the bank can immediately cancel the sending of money.

Is the closing disclosure final?

The final post is a five-page form that provides the final details of the mortgage you have chosen. It includes the terms of the loan, your projected monthly payments and how much you will pay fees and other costs to get a mortgage (closing costs).

Is closing Disclosure final?

The final post is a five-page form that provides the final details of the mortgage you have chosen. It includes the terms of the loan, your projected monthly payments and how much you will pay fees and other costs to get a mortgage (closing costs).

Is the final document the final document? The final document is the last document you will receive before you close your home loan. Carefully review this detailed five-page sheet to make sure all numbers look correct before closing day.

Is closing Disclosure final approval?

Final disclosure is the final calculation of the interest rate and fees of your loan, the cost of closing the mortgage, your monthly mortgage payments and the total amount of all payments and financial costs. The form is issued at least three days before you sign the mortgage.

What is the next step after closing disclosure?

What happens after the final release? Three business days after you receive your closing notice, you will use a cashier’s check or bank transfer to send all the money you need to bring to the closing table, such as payment and closing costs, to the settlement company.

Is closing disclosure the final numbers?

You can consider the Final Disclosure from the final version of the loan appraisal â € “formerly called Good Faith Estimate â €“ that you received when you first applied for your loan.

How do you read a final closing disclosure?

What comes after closing disclosure?

What happens after the final release? Three business days after you receive your closing notice, you will use a cashier’s check or bank transfer to send all the money you need to bring to the closing table, such as payment and closing costs, to the settlement company.

Does closing disclosure mean underwriting is complete?

Once you have selected a lender and started the mortgage takeover process, you will receive a Final Disclosure. It provides the same information as the loan estimate, but in its final form. This means that it contains the locked costs of your loan and a certain amount that you will have to pay at closing.

What comes after closing disclosure?

What happens after the final release? Three business days after you receive your closing notice, you will use a cashier’s check or bank transfer to send all the money you need to bring to the closing table, such as payment and closing costs, to the settlement company.

How do I know when underwriting is complete?

The insurance approval process has been interrupted

- Loan application and prior approval: a few days.

- Estimate: a week or less.

- Collection of documentation and insurance: a few days to a few weeks.

- Conditional approval: approximately one week.

- Clear to close: At least 3 days.

How long after signing closing do you get money?

When did the seller get the money after closing? Most sellers live in countries with wet funding, which means you will get paid on the closing day. In dry-finance states, it can take up to four days before the seller receives the money after closing.

How long does it take to disburse funds after closing? Wet financing Once confirmed, your lender will order a bank transfer in advance, ensuring that the money is paid out on the closing date or up to two days later. In this way, the funds can be immediately paid to the seller and other persons.

How long after closing do I get my cash out?

The sellers receive their money, ie the income from the sale, soon after the closing of the property. It usually takes a working day or two for the deposit holder to generate a check or transfer funds. However, the exact turnaround time may depend on the escrow company and your method of reception.

When you close on a house do you get the money that day?

Closing day is the payout day, and in most cases you will be able to collect your profit from the sale of the house as soon as the ink dries on the final documents. Choose a closing date Monday through Thursday during local bank opening hours for the fastest payment. It closes on Friday, and you may have to wait until Monday to receive your payment.

How long does it take to get money after House Settlement?

Banks can also hold large amounts for several days to ensure that the deposit is legal. In most cases, compensation from the settlement is received within six weeks after the end of the negotiations.

How long does funding take after closing?

| The loan was approved for closing | |

|---|---|

| Day 7 | |

| Day 8 | |

| Day 9 | Disbursement (Cash-out clients receive cash 3-5 days after the lender has confirmed that the funds have been received) Usually 3 days after the loan is financed you receive cash and the funds are disbursed, but this can be faster. |

Does funding happen the same day as closing?

Funding and closing usually take place on the same day. But the funding date may come one or more days after the closing date. What is the funding date? Your financing date is the date when your lender deposits the proceeds of your home loan into the account of your escrow or parent company, allowing you to purchase your home.

What happens after closing papers are signed?

After signing the documents and paying the closing costs, you get ownership of the property. The seller must publicly transfer the property to you. The final attorney or property agent will then record the offense. You get your keys and officially become the owner of the house.

How long after signing closing documents do you close?

This is the date when the seller will be completely evicted from the house, and you will be able to move into the house. Please note that the end date is usually at least one month after the purchase offer is accepted.

What happens between signing and closing?

While signing refers to negotiating terms, closing is the actual act of selling shares or assets. Between signing and closing, the so-called closing conditions mature in order to successfully complete the job.

Can a buyer back out after signing closing papers?

Federal law gives borrowers what is known as the “right to cancel.” This means that the borrowers have three days to give up the job after signing the final documentation for the loan or refinancing.