Is paper money worth collecting?

Contents

- 1 Is paper money worth collecting?

- 2 What is a note in real estate?

- 3 Can I get a $500 bill from the bank?

- 4 Are bank notes a good investment?

- 5 How do I get my mortgage note?

While today’s paper bills are only worth the amount printed on them, older, collectible bills can be worth much more. For example, the $ 1,000 Alexander Hamilton ticket of 1918 can be sold for up to $ 8,000, as there are only about 150 in circulation today.

Is picking up tickets a good investment? Investing in banknotes may seem strange, but it can be a very lucrative business. Our ticket expert, Hans Seems, is here to help. He advises that if you have a rare ticket in perfect condition, it will always increase in value every year.

Is Obsolete money worth anything?

Although not valid as currency, obsolete money printed by entities other than the federal government can be valuable. … Interrupted banknotes, which are no longer printed or widely distributed, still retain their face value, while obsolete money has no face value.

Are old foreign banknotes worth anything?

According to a recent study, households in the UK are accumulating millions in overdue foreign currency. But if you still have old notes and foreign currency, the good news is that they are useless, you can still exchange them.

Why is paper money worth anything?

For the most part, inflation occurs when the money supply increases faster than the supply of other goods and services. In short, money is valuable because people believe that they will be able to exchange that money for goods and services in the future.

Does money maintain its value?

Currency Value Unlike early coins made of precious metals, most of what is minted today does not have much intrinsic value. However, it retains its value for one of two reasons. First, in the case of “representative money,” each coin or note can be exchanged for a fixed amount of a commodity.

Which value is high for paper money?

Num. 1: United States: $ 100 ($ 100) This leaves the $ 100 Federal Reserve bill as the highest-denominated rolling stock in the country. The $ 100 bill, with a portrait of founding father Benjamin Franklin, is one of the most popular and marketed forms of paper money in the world.

What is the value of paper money?

Paper notes, or â € œfiatâ € money, have no intrinsic value either; their value is determined solely by supply and demand, and they are declared legal tender by government decree. The most important element that separates one national currency from another is its value.

What makes pieces of paper money so valuable?

Governments around the world issue paper money and people use it to store value and buy goods they need for their daily lives. Currency paper has value because a large number of people agree with its value, so it becomes useful as a tool for exchange.

What is the lowest paper money?

The smallest national banknote ever issued was the 10 bani banknote of the Romanian Ministry of Finance in 1917. Measured (printed area) 27.5 x 38 mm (1.08 x 1.49 inches).

What is a collector of paper money called?

Notafilia is the study and collection of paper money and banknotes. A notafilista is a collector of banknotes or paper money, especially as a hobby.

What is paper money also called?

A banknote, also called a banknote (American English), paper money, or simply a banknote, is a type of negotiable promissory note, made by a bank or other authorized authority, payable to the bearer on demand.

What is a person who collects money called?

Numismatics. The term numismatic applies to coin collectors and traders, as well as to scholars who use coins as a source or who study.

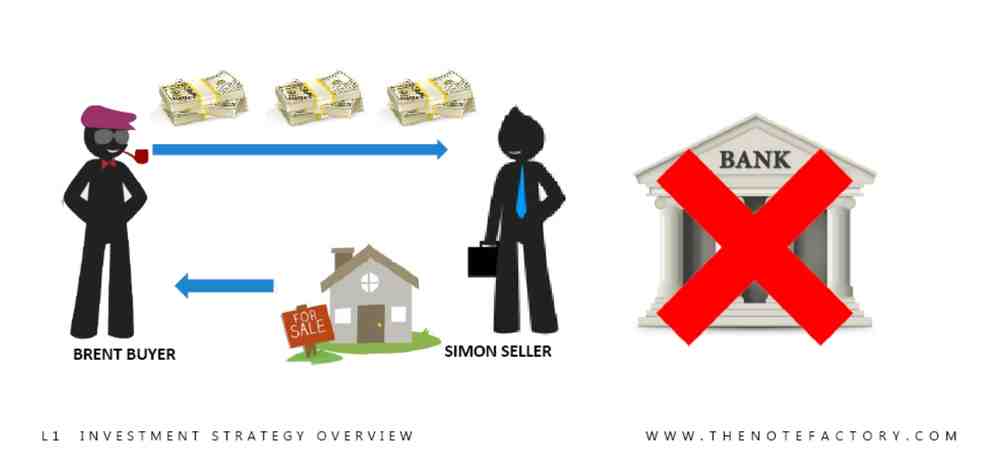

What is a note in real estate?

A mortgage is a type of contract. What makes it special is that it is a loan secured by real estate. A mortgage note is the document that you sign at the end of the closing of the home. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it does not.

What does a note on real estate contain? A real estate note is a legally binding agreement between a buyer and the lender. It is a promise to repay a loan with specific conditions. Terms include the amount of debt, the period of payment of the debt, which may be a series of payments or at sight, and the interest rate.

What is the role of the note in real estate?

In short, a note is simply an IOU: an agreement between a borrower and a lender where the borrower agrees to pay the lender on the terms set out in the note. Real estate notes, in particular, are IOUs that use a piece of real estate as collateral for the loan.

What is a repack SPV?

In their most basic format, SPV repackages involve an SPV acquiring an underlying asset and profiling cash flows by conducting a derivative transaction with an exchange counterparty. The combined transaction is financed by issuing a note, which is then sold to an investor.

What is a repack security?

A repackaging is a security that is supported by, and generally structured to modify the terms of, an existing security (an underlying security). Repacks are also often backed by additional financial instruments, such as a derivative contract.

What is a note when buying property?

A real estate note is created when two parties reach an agreement on a transaction that gives one of the parties the capital to buy a house or other form of ownership. Whoever owns the mortgage is the one who receives the loan from the borrower, regardless of who originally financed it.

What is the difference between a note and a mortgage?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage loan, while a mortgage is a secured loan for real estate.

What is a note and a mortgage?

A promissory note provides the financial details of the loan repayment, such as the interest rate and the form of payment. A mortgage specifies the procedure to be followed if the borrower does not repay the loan. If you live in a state of trust writing, you will not receive any mortgage notes.

Does a mortgage note commit you to paying your loan?

Mortgage notes give lenders security during the loan process, as without the note, borrowers would not be legally required to repay the loan. Once the note has been signed by both parties, it is legally binding and gives the lender the opportunity to take legal action if the borrower fails to repay the loan.

Can you be on the mortgage but not the note?

In the event of non-payment of the bill, the lender may foreclose on the property and sell it. The mortgage or deed of trust must be signed by all the owners of the property. … But if you have not signed the mortgage, it is because you are not the co-owner of the home.

Can I get a $500 bill from the bank?

Can I still get a five hundred dollar bill from the bank? Although the $ 500 bill is still considered legal tender, you will not receive it from the bank. Since 1969, the $ 500 bill has been officially discontinued according to Federal Reserve high-denomination notes.

Can you get a thousand dollar bill? Although the $ 1,000 bill has been suspended for more than 50 years, it is still considered legal tender. This means that any $ 1,000 bill you find is worth at least face value, or $ 1,000. … Tickets from Federal Reserve branches that printed fewer tickets are also rarer.

Is there a bill larger than $100?

The U.S. Treasury circulated large denominations of U.S. currency in excess of $ 100 until 1969. Since then, U.S. dollar bills have only been issued in seven denominations: $ 1, $ 2, $ 5. $ 10, $ 20, $ 50 and $ 100.

How much is a stack of 100s?

A stack of 100 US $ 2 banknotes, secured with a green banknote strap indicating the denomination and total amount of the stack.

How many bills are in a stack of $100 bills?

The 1-inch stack of $ 100 notes contains 250 notes.

How many $100 bills are in a bank bundle?

The packages are used to deposit money in the US Federal Reserve Bank. There are 1,000 tickets of the same denomination in any package, all tickets are placed face up, looking in the same direction. A package consists of 10 straps of 100 tickets each.

How much money is in a stack of 100s?

The American Bankers Association puts $ 100 bills in $ 100 runs, but offers you a $ 10,000 package. Sure the standard batteries are $ 10,000.

Is there a 1000 dollar note?

Like his younger cousin, the $ 500 bill, the $ 1,000 bill was suspended in 1969. … Only 165,372 of these Cleveland-faced banknotes still exist.

What is the highest dollar bill?

Since 1969, the highest denomination note issued in the United States has been the $ 100 note.

How much is a $1000 bill worth today?

Bills in good condition can range from $ 5,000 to $ 12,000. Uncirculated or almost uncirculated tickets can be worth $ 10 thousand. Tickets in good condition are worth about $ 1,800. Tickets circulating in excellent condition can reach $ 3,000.

Can I get a 1000 dollar bill from the bank?

The highest value of the denomination currently in production is the $ 100 note, but in recent decades, the Federal Reserve has issued $ 1,000, $ 5,000, $ 10,000 and even $ 100,000 notes.

Are bank notes a good investment?

To the average investor, structured notes seem to make a lot of sense. Investment banks advertise structured notes as the ideal vehicle to help you benefit from excellent stock market performance while protecting you from poor market performance.

What is a banknote investment? Banknotes are effectively a “loan” made by the investor to the bank for a certain period. … In the case of income notes, which pay regular interest monthly or quarterly, at the end of the term if the underlying shares have lost value, they may not recover 100% of their original investment.

What happens when you buy a bank note?

When you buy a ticket, you become the bank. Buy a note of good performance and you can expect timely payment from a borrower with credit. You’ll get some of your money plus some interest, and everything is secured by these real estate, making it an attractive way to invest in making notes.

How much does a mortgage note cost?

How much do people usually invest in mortgage notes? Most mortgage investments range from $ 20,000 to $ 50,000 per ticket. The cost will vary depending on various factors, such as the seniority of the note, the payment history, the loan / value ratio, and more.

Should I invest in bank notes?

One of the biggest benefits of buying banknotes is that you can buy them in or out of a retirement account, such as a traditional IRA, Roth IRA, or 401 (k). This allows you to quickly accumulate money in your account on a deferred tax basis or, in the case of a Roth IRA, tax-free.

How do you buy notes?

You can purchase Treasury bills directly from the U.S. Treasury or through a bank, broker, or dealer.

- Buy directly from the United States Treasury. …

- Submit a bid to TreasuryDirect. …

- Payments and receipts to TreasuryDirect. …

- Purchase through a bank, broker or distributor.

Should I invest in bank notes?

One of the biggest benefits of buying banknotes is that you can buy them in or out of a retirement account, such as a traditional IRA, Roth IRA, or 401 (k). This allows you to quickly accumulate money in your account on a deferred tax basis or, in the case of a Roth IRA, tax-free.

Are old bank notes a good investment?

In general, the old coin in the form of coins or banknotes is not a good investment. It is best to pick up these items as a hobby. Most old coins and coins have not kept up with inflation. Since 1900, the following are some assets that have increased in value adjusted for inflation.

Is paper money a good investment?

Rare paper money demonstrates the best return on investment Over the past 30 years, paper money collections have produced substantial long-term benefits for their owners, often as good or better than currency investments.

Can you make money investing in notes?

Investing in mortgage notes is a good way to generate passive income with minimal management. Finding the right company, buying the ticket, or buying and shipping the ticket is an easy way to earn a monthly income without having to deal with property or tenants.

Are bank capital notes a good investment?

Because debt is unsecured, capital bonds tend to pay investors a higher interest rate. This also means that the debt is lower than the guaranteed notes. … Capital notes cannot normally be recovered, which makes them attractive to investors because they can expect to receive interest payments until the note matures.

What asset class are capital notes?

Equity notes are debt securities with similar characteristics to shares. Examples include: Perpetual debt securities – no fixed maturity date. They are generally considered hybrid securities because they are a debt value with equity-like characteristics (as a stock, they do not mature).

Is Westpac capital notes 8 a good investment?

Westpac Capital Notes 8 may be suitable for investors looking for fully paid regular income (3) through variable rate distributions. Westpac Capital Notes 8 can offer investors the opportunity to further diversify their income portfolio.

Is it good to invest in capital notes?

One last term worth thinking about is that capital notes absorb losses; this means that investors, not the bank, are at risk of loss. This protects bank depositors, at the expense of hybrid investors.

How do I get my mortgage note?

The mortgage note is part of your closing documents and you will receive a copy at closing. If you lose your foreclosure documents or are destroyed, you can obtain a copy of your mortgage by searching the county records or contacting the deed record.

How Much Does a Mortgage Note Cost? How much do people usually invest in mortgage notes? Most mortgage investments range from $ 20,000 to $ 50,000 per ticket. The cost will vary depending on various factors, such as the seniority of the note, the payment history, the loan / value ratio, and more.

Do banks sell mortgage notes?

Banks create and sell mortgage bonds as part of their business model. They earn their money by borrowing and receiving interest. The more they lend, the more they earn.

Can you buy a note from a bank?

To buy a ticket from a bank, you need to contact the person who handles the transactions, also known as the decision maker.

What is selling mortgage notes?

Selling a Mortgage Note Normally, a mortgage note is sold to a buyer when the seller no longer wants to wait for payments and needs a lump sum of cash immediately. In this case, the current owner of the mortgage title would sell the title, waiving his right to the obligations of the borrower.

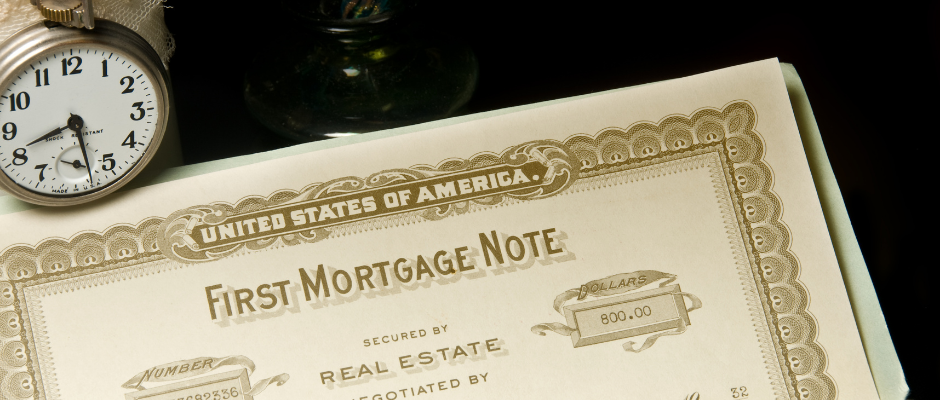

What is a real estate mortgage note?

A mortgage promissory note is simply a promissory note used exclusively in real estate transactions. As its name suggests, it represents the borrower’s promise to the note holder (lender) to pay the obligation.

What are real estate mortgage notes?

A real estate mortgage promissory note is a promissory note secured by a mortgage loan. It is a way of saying that a promissory note is secured by a property. This security instrument can be a mortgage or a deed of trust.

What is a real estate note?

A real estate note is simply an IOU secured by property. … In a private real estate transaction, a buyer makes an initial payment, does not get a loan, but signs a note promising to pay a certain amount each month to the seller until the price of the property, plus interest, is paid.

How do mortgage notes work?

A mortgage promissory note is simply a promissory note used exclusively in real estate transactions. … Once the borrower signs the required documentation and provides the note, the lender holds the paper until the borrower makes the final repayment of the loan.

What is a mortgage note example?

The mortgage note is the document that describes the key terms of the mortgage and indicates the borrower’s promise to pay off the debt. … For example, if your lender is trying to change the terms of your loan or charge you additional fees, check your mortgage to see what is allowed.

What is in the mortgage note?

It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage. That is, when you buy a home, the mortgage note is the document that indicates how you will pay off your loan and uses your home as collateral.

How many pages is a mortgage note?

Mortgage Note: Your commitment on loan I is another long document, 7 to 12 pages long. In addition to listing all the borrowers, it covers the following: The amount you owe, the principal. The interest rate on the loan.

What is the difference between a note and mortgage?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage loan, while a mortgage is a secured loan for real estate.