Who is primary liable on a promissory note?

Contents

- 1 Who is primary liable on a promissory note?

- 2 What happen to mortgage when owner dies?

- 3 What happens to a promissory note when the lender dies?

- 4 Who is not a party to a cheque?

- 5 Who is the grantor?

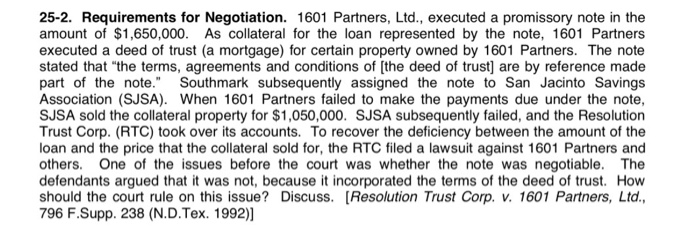

The promissory note issuer is primarily responsible, because that person is the person who originally promised to pay. He must fulfill this obligation when payment becomes due, unless he has a valid defense or has been discharged of debt.

Who is primarily responsible for the project? There are two types of responsibility: primary and secondary. The main holders are the authors of the banknotes and the check routers (your bank is the drawee of your check) and their liability is unconditional. The secondary pages are drawers and inserts.

Who is primarily liable on a bill of exchange?

If the drawee accepts the bill by writing and signing on it, he becomes the merchant, and therefore, first of all, is obliged to pay the bill when it is due. If the merchant fails to pay, the issuer or endorser must compensate the holder.

Who is liable in bill of exchange?

A promissory note often covers three pages – the drawee is the party that pays the sum, the recipient receives the sum, and the issuer is the one who obliges the drawee to pay the recipient.

Which of the following parties is primarily liable?

Two parties are primarily responsible: the creator of the note and the acceptor of the promissory note. They are obligated to pay according to the terms of the instrument itself and their liability is unconditional.

Who is primarily liable on a negotiable instrument?

Only the makers and merchants (extractors who promise to pay when the instrument is presented) are under primary responsibility. The promissory note issuer undertakes to pay the promissory note. A merchant is a drawee who promises to pay the instrument when it is later presented for payment.

Who is primarily liable on a note quizlet?

The trasat bank is primarily responsible after accepting the check. Investors of all instruments bear primary responsibility for the instrument. The discharge is for the person and not for the instrument, and the person’s liability may be released against one party but not against the other.

Who is primarily liable on a note?

Only the makers and merchants (extractors who promise to pay when the instrument is presented) are under primary responsibility. The promissory note issuer undertakes to pay the promissory note. A merchant is a drawee who promises to pay the instrument when it is later presented for payment.

Who is primarily liable on a negotiable instrument quizlet?

– Liability for negotiable instruments. Someone who has primary responsibility for a negotiable instrument must pay, unless he has a legitimate defense. Persons with secondary liability only pay if the person with primary liability does not.

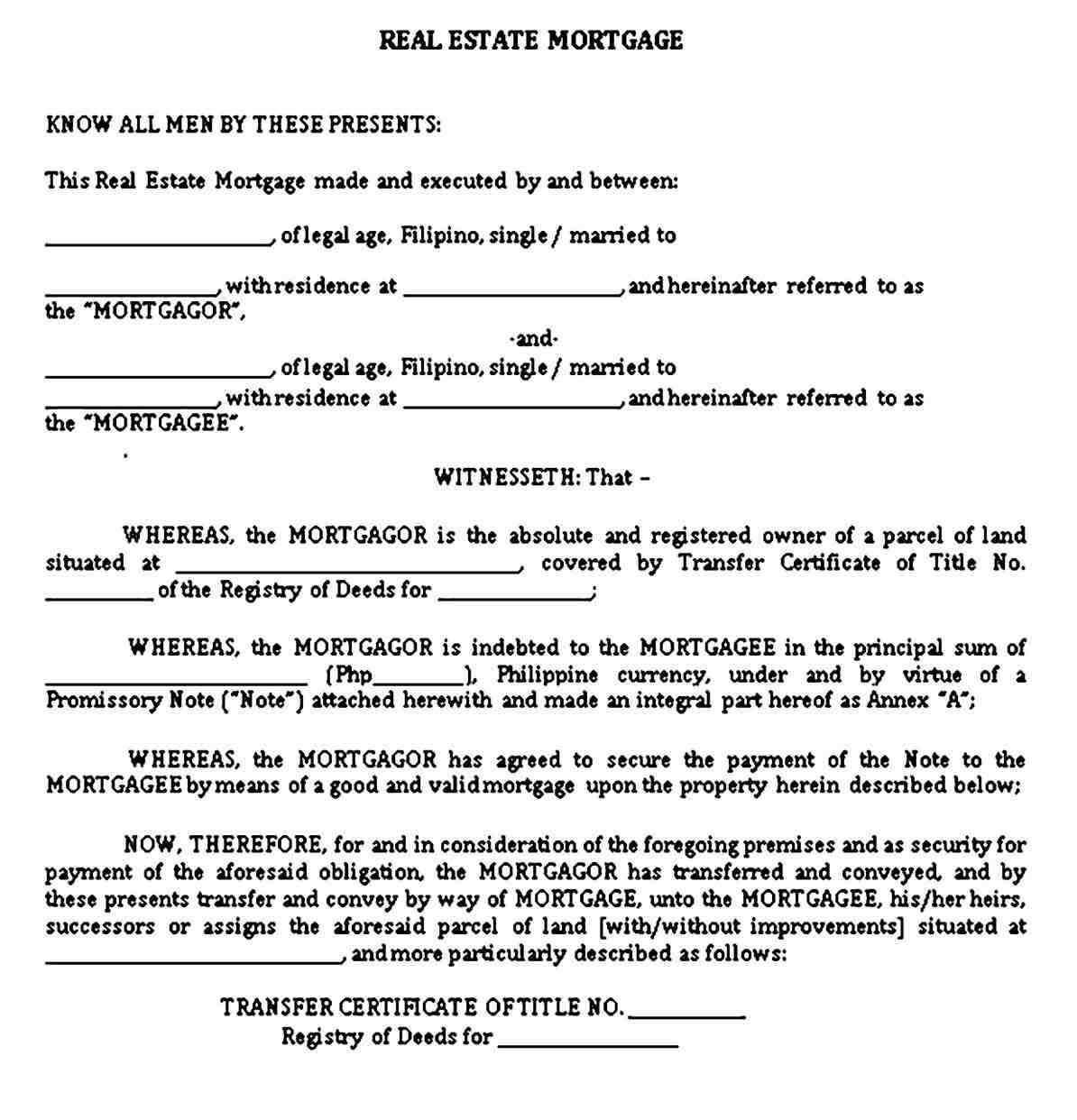

What happen to mortgage when owner dies?

When a person dies before paying off their home mortgage, the lender is still entitled to their money. In general, the property pays off the mortgage, the beneficiary inherits the house and pays off the mortgage, or the house is sold to pay off the mortgage.

What happens to the mortgage if the owner dies? Typically, the debt is paid off your property upon death. This means that before any assets can be transferred to heirs, the executor of your estate will first use those assets to pay off your creditors. … Or the surviving family can make their mortgage payments while they prepare to sell the home.

Can a mortgage stay in a deceased person’s name?

Where a home encumbered with a mortgage is inherited from a relative, the beneficiary may either keep or seize the mortgage in the relative’s name. However, relatives inheriting a mortgage home must live there if they intend to keep the mortgage in the deceased relative’s name.

How do you assume a mortgage after death?

Simply notify the deceased parent’s mortgage lender that you are inheriting your parents’ home, will live in, and will be paying off the mortgage payments. After inheriting your parents’ home, you may need to obtain a new title deed in your own name.

Can a house remain in a dead person’s name?

Can a house remain on behalf of a deceased person? The home cannot remain in the deceased’s name, and instead property must be transferred under their will or state inheritance law. … This will enable the executor or the probate court to officially close those accounts on behalf of the deceased.

Can you take over a deceased family members mortgage?

Mortgage: Federal law requires lenders to allow family members to take out a mortgage if they inherit the property. … They can pay off the debt, refinance or sell the property. Likewise, co-borrowers (i.e. spouses) can take out a loan, refinance it, or pay it off in full.

Who is responsible for mortgage of deceased?

Your surviving spouse, who will now be the sole owner of the house, will also be responsible for the entire mortgage. However, under federal law, a lender cannot force a surviving spouse to pay off all of the outstanding mortgage immediately after your death.

Who is responsible for paying a deceased person’s mortgage?

If the deceased is the owner of the house jointly with his spouse or anyone else, the co-owner takes over the property interest of the deceased by operation of law. They will also take over the mortgage payment.

Am I responsible for my parents mortgage when they die?

Mortgage: Federal law requires lenders to allow family members to take out a mortgage if they inherit the property. However, there is no requirement for the heir to retain the mortgage. They can pay off the debt, refinance or sell the property.

What happens to a mortgage if the mortgagee dies?

If the heirs of the interests have a strong desire to keep the property in question in their family, they have the right to obtain the balance of the mortgage from the deceased. … In the event of the death of the mortgagee, the heirs of the estate cannot legally be compelled to pay off the balance of the mortgage immediately.

How do you assume a mortgage after death?

Simply notify the deceased parent’s mortgage lender that you are inheriting your parents’ home, will live in, and will be paying off the mortgage payments. After inheriting your parents’ home, you may need to obtain a new title deed in your own name.

How do you transfer mortgage after death?

One option is to simply sell the home to pay off the mortgage and distribute any remaining proceeds from the sale to your heirs under the will or law in your state. If you want to keep the home, you will need to work with your provider to transfer the mortgage over to you.

What happens when mortgage holder dies?

If you inherit a mortgage-backed property, you will be responsible for paying off that loan. If you are the sole heir, you can contact your mortgage servicer and ask them to take out a mortgage or sell the property. You can also let the lender take over.

How do you assume a deceased relatives mortgage?

How to take over a mortgage on an inherited house or real estate?

- Use other assets to pay off your existing mortgage.

- Take the loan (take it) and take responsibility for making future mortgage payments with a house deed and a loan in your name.

What happens to a promissory note when the lender dies?

Overall US / California Answer: Establishing Individuals, not Corporations: Generally, if the lender dies, the loan is an asset that will pass under probate terms and the executor / trustee will act under the loan originator’s rights, including right to collect payments , declaring arrears, takeovers, etc.

What causes a bill of exchange to be invalid? Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to receive the data from didn’t sign it – and it does – the note is invalid. It can also become invalid if he broke some other law, for example if he was charging a high interest rate illegally.

Is a promissory note valid after death?

If a person dies before the unsecured loan is paid off, the lender cannot claim the unpaid debts from the surviving partner or legal heirs of the deceased. The statutory heirs are liable to the lender only in terms of value / property, if he inherited from the deceased.

What debt is Cancelled upon death?

Usually, the estate of the deceased pays the credit card debt from the estate. Usually, children do not inherit credit card debt – unless they own the account. The surviving spouses are liable for the deceased spouse’s debt if he is the co-borrower.

Can an estate collect on a promissory note?

Nevertheless, not all is lost and you may be able to pick up on the promissory note even after the death of the borrower through the borrower’s estate.

Can a promissory note be inherited?

A promissory note is a kind of IOU under which one person promises to pay the other a certain amount of money. Bill of exchange inheritance puts you in the position of receiving a string of bill of exchange payments over a period of months or years. … The value of the banknote will also be inherited and will be subject to property tax.

What happens if a lender dies?

If, after your departure, no one has been designated to inherit the loan and no one is paying, the lender will still have to collect the debt. Therefore, the lender usually sells the house to pay off the debt. This means that if someone is going to keep the house, they have to keep paying off the mortgage.

Do I have to repay a loan to someone who has died?

If you owe money to someone who has died, that debt is considered the estate of the deceased. In the first place, these assets will be used to pay off inheritance debts. … If you do not return the money, a personal attorney can make a claim to you and sue you on behalf of the estate to recover the debt.

What happens to personal loans when the lender dies?

Your property is responsible for any personal loans that you acquire solely on your behalf, while any loans you borrowed from someone else will become that person’s responsibility. Personal loans are unsecured, which means your assets will only pay them back after you have settled any secured debts.

Is debt transferable after death Philippines?

In general, debts do not die with a person. … This means that debts will survive death; however, this does not mean that creditors can follow the heirs of the deceased on their own behalf. Creditors can only subscribe to the deceased’s estate, effectively reducing the heirs’ shares, if any, in the estate.

Does a promissory note go through probate?

“This is. Your mother’s will is known as “transfer will,” which means she will become part of the trust after the end of the estate administration. One option is to divide the banknote into four parts and deal 1/4 to each of you.

What happens to a promissory note upon death?

Promissory Notes: A promissory note is a written promise or loan repayment agreement – these are often used for loans between family members. These loans must be repaid through the estate unless the deceased has made arrangements for a debt forgiveness in the event of death.

What happens to promissory note when borrower dies?

Assuming you didn’t pay him back before you die, unforeseen circumstances come in and his due responsibility passes to his wife (from what you described). In other words, you will owe her every part of the promo that remains after his death.

Can an estate collect on a promissory note?

Nevertheless, not all is lost and you may be able to pick up on the promissory note even after the death of the borrower through the borrower’s estate.

Who is not a party to a cheque?

The merchant is not a checking page.

Who are the pages to the check? There are three parties involved in the check transaction. The issuer is the one issuing the check, the drawee is a financial institution, and the recipient is the person / institution that receives the check. What’s the difference between a payee and a consignee?

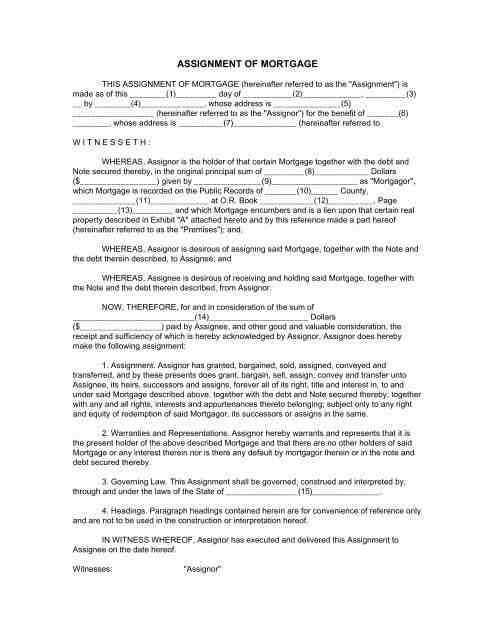

Who is the grantor?

The grantor is any transferor or offender to whom any Lis Pendens, judgments, seizure orders or claims relating to separate or communal property are to be recorded. The grantor is the seller (on file) or the borrower (on the mortgage). The originator is usually the one who signed the document.

Who is the founder and grantee in the trusteeship? The Beneficiary differs from the Beneficiary in that although the Beneficiary is the person who creates and owns the trust fund, the Beneficiary is the recipient of the item.

What is a grantor and grantee?

In real estate, the beneficiary of the real estate is the beneficiary, and the grantor is the person who transfers the ownership of the real estate to another person. However, the specifics of their transactions may differ depending on the situation. The official documents they use, such as a piece of legislation, detail their obligations.

Is the owner the grantor?

The donor is the owner and the beneficiary is the buyer who acquires a fair interest (but not an unfounded legal interest) in the property.

What is the grantee on a deed?

The beneficiary is the buyer, recipient, new owner or lien holder. When “vs.” appears on legal documents, Grantor is at the bottom, Beneficiary is at the top. The petitioner is a scholarship holder; The Grantor is the defendant. Definitions of the grantor and scholarship holder.

Can the grantor and grantee be the same person?

It is important to understand the difference between a grantor and a grantee. The grantor is the person who transfers ownership to another person. The beneficiary of the real estate is therefore the beneficiary.

Is the lender the grantor or grantee?

The beneficiary is the person receiving the property. With a deed of trust, it’s not the lender; Rather, the beneficiary is a trustee with legal title, while the borrower discharges its repayment obligation to the mortgage lender.

Is the grantor the mortgagor?

A real estate loan from a lender is often secured by a mortgage. If you take out a home loan and give the lender a mortgage in return, you are called a mortgage. … When you transfer title to real estate through deed, you also become a donor. The party receiving the file is the beneficiary.

Is a bank a grantor or grantee?

In such a situation, the grantee is often the bank to which the borrower owes the loan. The property owner returns the ownership deed to the beneficiary. This is to relieve yourself of mortgage debt and avoid the takeover process.

Is the grantor the owner?

Generally, the grantor is the person who transfers the ownership title to the grantee. In a real estate transaction, the grantor is the present owner of the property right, i.e. the seller. The act that transfers property is a subsidy.

Is the grantor the buyer or seller?

The grantor is the seller (on file) or the borrower (on the mortgage). The originator is usually the one who signed the document.