Why do banks hold capital?

Contents

- 1 Why do banks hold capital?

- 2 Is Westpac capital notes 8 a good investment?

- 3 What asset class are capital notes?

- 4 Is ANZ a good stock to buy?

- 5 What is share capital notes?

Capital is a key ingredient for safe and healthy banks and here’s why. Banks take risks and may incur losses if the risks materialize. To stay safe and protect retail deposits, banks must be able to absorb these losses and continue to operate in good times and bad. This is what bank capital is for.

What is the function of bank capital? Bank capital acts as a safeguard for the bank against unforeseen risks and losses. It is the net value available to shareholders. It gives assurance to depositors and creditors that their funds are safe and indicates the bank’s ability to pay its debts.

Why do banks hold more capital than required?

Banks have an incentive to hold such a buffer because capital adjustments in response to fluctuations in their capital ratios are costly, so they want to avoid being close to the minimum regulatory constraint.

Why do banks generally prefer lower capital requirements?

It better protects the deposit insurance fund. 22. Why do banks generally prefer lower capital requirements? … To increase a bank’s return on equity.

Why do banks need capital requirements?

Capital requirements are set to ensure that the holdings of banks and depository institutions are not dominated by investments that increase the risk of default. They also ensure that banks and depository institutions have enough capital to support operating losses (OL) while honoring withdrawals.

Why do banks hold excess capital?

Excess reserves are a kind of safety buffer. Financial firms with excess reserves have an additional measure of safety in the event of a sudden loss of a loan or large cash withdrawals by customers. This buffer increases the security of the banking system, especially in times of economic uncertainty.

What do banks hold as capital?

Bank capital is the difference between a bank’s assets and liabilities, and it represents the bank’s net worth or its net worth to investors. The asset portion of a bank’s capital includes cash, government securities, and interest-bearing loans (eg, mortgages, letters of credit, and interbank loans).

What is capital for a bank?

Bank capital is the difference between a bank’s assets and liabilities, and it represents the bank’s net worth or its net worth to investors. … The liability section of a bank’s capital includes reserves for loan losses and any debt it owes.

What assets do banks hold?

A bank owns assets such as cash held in its vaults and funds it holds at the Federal Reserve (called “reserves”), loans made to customers, and bonds.

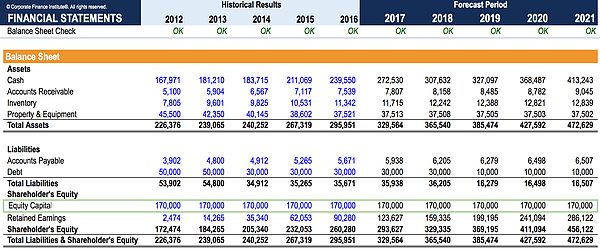

What are the types of bank capital?

Bank capital is often defined in tiers or categories that include equity, retained earnings, reserves, hybrid capital instruments, and subordinated term debt. Capital ratios are usually measured as a percentage of bank assets or risk-weighted bank assets.

Is Westpac capital notes 8 a good investment?

Westpac Capital Notes 8 may be suitable for investors seeking regular fully franked(3) income through floating rate distributions. Westpac Capital Notes 8 may offer investors the opportunity to further diversify their income portfolio.

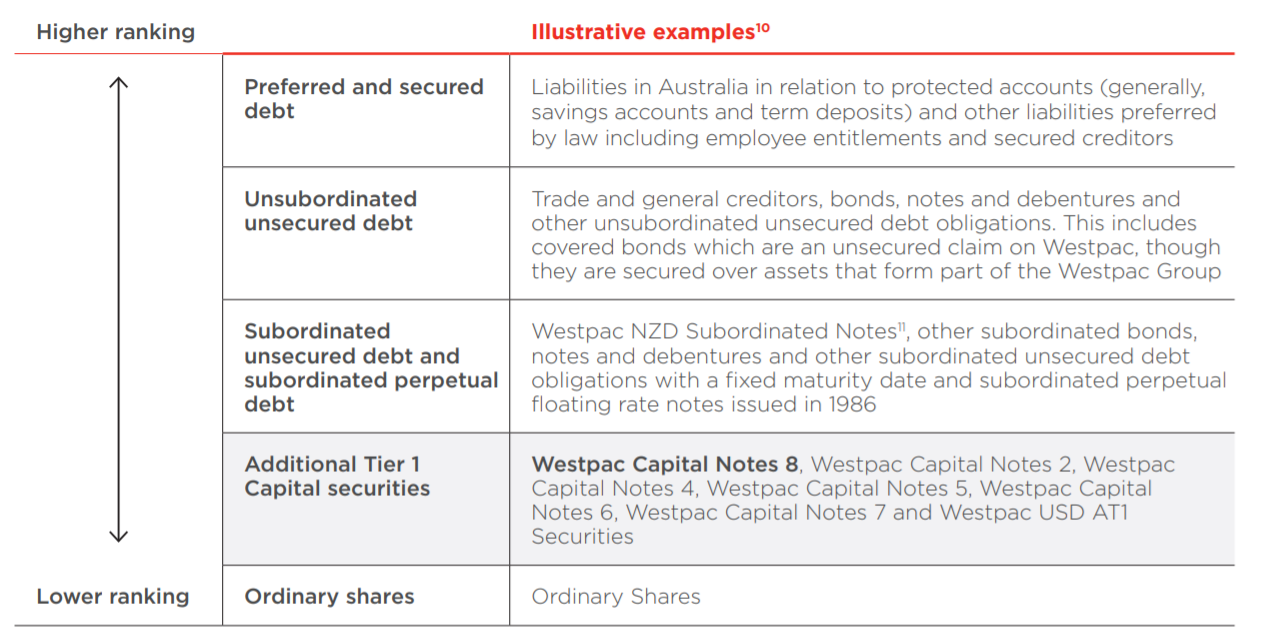

What is the Westpac 8 capital note? Westpac Capital Notes 8 Offer to Securityholders The Notes are perpetual, unsecured, subordinated notes issued by Westpac and are expected to provide investors with non-cumulative fully franked floating rate distributions paid quarterly. Details of the Notes are set out in the Prospectus dated August 17, 2021.

Are capital notes safe?

A capital note is a hybrid product and is an unsecured perpetual security that combines the characteristics of stocks and bonds – hence the term hybrid security. It is a way for banks and companies to borrow money from investors.

Are Westpac capital notes 7 a good investment?

Westpac Capital Notes 7 are riskier than bank deposits and may not be suitable for some investors. Their complexity may make them difficult to understand and the risks associated with the Notes could result in the loss of your entire investment.

Are Macquarie Bank capital notes 3 a good investment?

Macquarie Bank Capital Notes 3 may be suitable for investors seeking regular income partially franked(3) through floating rate distributions. Macquarie Bank Capital Notes 3 may offer investors the opportunity to further diversify their income portfolio.

Is ANZ capital notes a good investment?

ANZ Capital Notes 6 may be suitable for investors seeking regular fully franked(3) income through floating rate distributions. ANZ Capital Notes 6 may offer investors the opportunity to further diversify their income portfolio.

Is capital notes a good investment?

Since the debt is unsecured, capital notes generally pay investors a higher rate of interest. It also means that the debt is less than the secured notes. … Capital Notes are generally non-redeemable, which makes them attractive to investors because they can expect to receive interest payments until the note matures.

Are Westpac capital notes 7 a good investment?

Westpac Capital Notes 7 are riskier than bank deposits and may not be suitable for some investors. Their complexity may make them difficult to understand and the risks associated with the Notes could result in the loss of your entire investment.

Is it good to invest in capital notes?

A final term worth considering is that capital notes are loss absorbent – this means that the investors, not the bank, stand to suffer a loss. This protects the bank’s depositors, to the detriment of hybrid investors.

Are Macquarie Bank capital notes 3 a good investment?

Macquarie Bank Capital Notes 3 may be suitable for investors seeking regular income partially franked(3) through floating rate distributions. Macquarie Bank Capital Notes 3 may offer investors the opportunity to further diversify their income portfolio.

Are Westpac capital notes 7 a good investment?

Westpac Capital Notes 7 are riskier than bank deposits and may not be suitable for some investors. Their complexity may make them difficult to understand and the risks associated with the Notes could result in the loss of your entire investment.

Is it worth investing in capital notes?

The Australian banknote market has long been favored by income investors and is worth around $30 billion. … In fact, all banks must issue capital notes to meet APRA capital requirements and cover other debt.

What is Westpac capital notes?

What were Westpac Capital Notes? The Westpac Capital Notes were fully paid, non-cumulative, convertible, transferable, redeemable, subordinated, perpetual, unsecured notes issued by Westpac, which took priority over the common stock in the event of liquidation.

Is it good to invest in Westpac?

As we verified earlier in December, broker Morgans is currently pricing Westpac as a “buy,” with a share price target of $29. This broker believes that Westpac shares have good value at these levels, pointing to its current dividend yield (situated at 5.51% today).

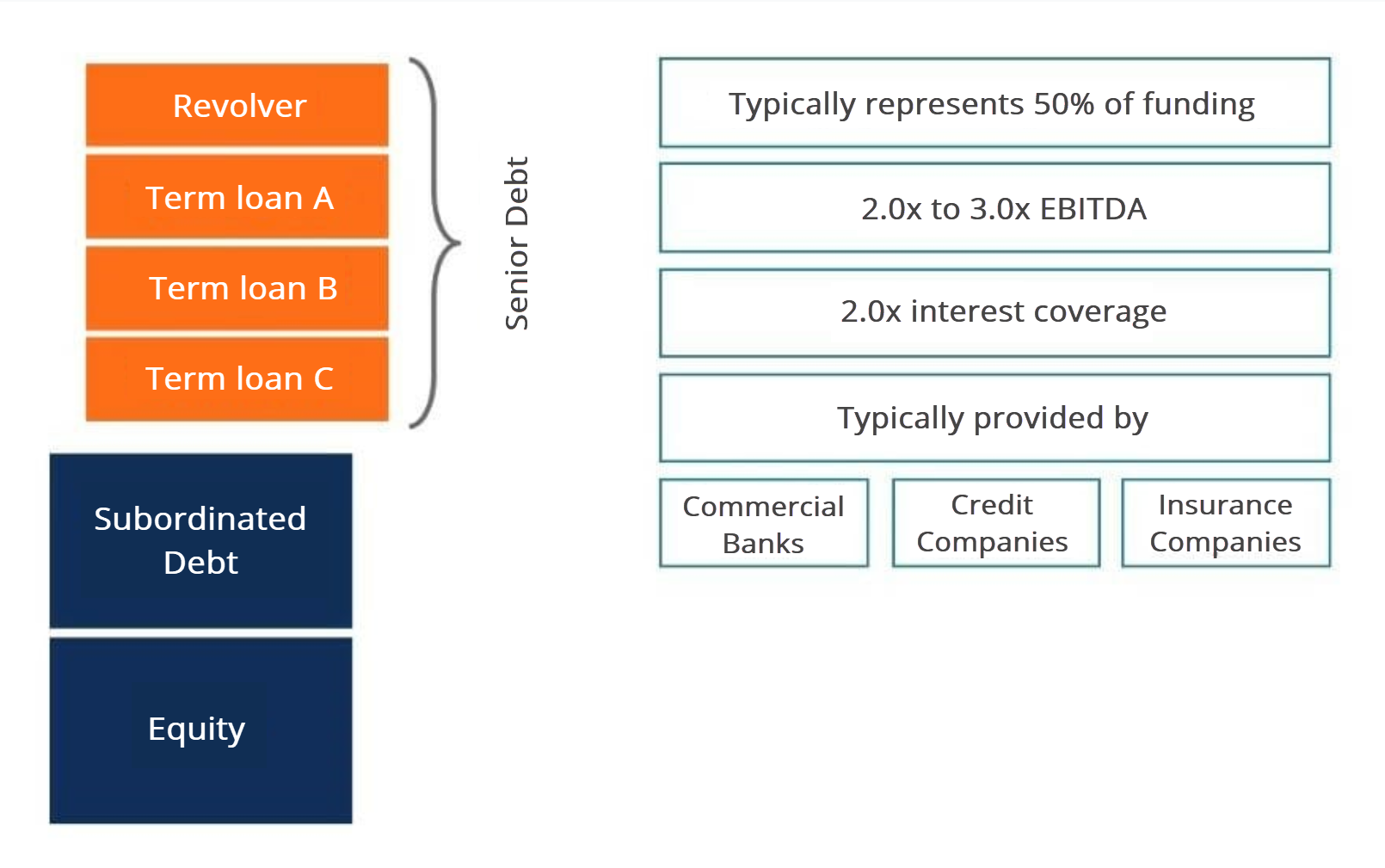

What asset class are capital notes?

Capital Notes are debt securities that have equity-like characteristics. Examples: Perpetual debt securities – no fixed maturity date. They are generally considered hybrid securities because they are a debt security with characteristics similar to stocks (like a stock, they have no maturity).

Is a capital note a bond? A capital note is a hybrid product and is an unsecured perpetual security that combines the characteristics of stocks and bonds – hence the term hybrid security. … Investors in these bank securities lend money to the issuer with no fixed maturity date.

What are capital 4 notes?

Macquarie Group Capital Notes 4 (MCN4) are unsecured subordinated notes issued by Macquarie Group Limited. They are non-cumulative and must be convertible. MCN4s are listed on the Australian Securities Exchange (ASX) under the symbol “MQGPD”. MCN4s listed on the ASX on March 27, 2019.

Is capital notes a good investment?

Since the debt is unsecured, capital notes generally pay investors a higher rate of interest. It also means that the debt is less than the secured notes. … Capital Notes are generally non-redeemable, which makes them attractive to investors because they can expect to receive interest payments until the note matures.

What is a capital note 5?

Macquarie Group Capital Notes 5 (MCN5) are unsecured subordinated notes issued by Macquarie Group Limited. They are non-cumulative and must be convertible. MCN5s are listed on the Australian Securities Exchange (ASX) under the symbol “MQGPE”.

What are capital notes 4?

A capital note is a hybrid product and is an unsecured perpetual security that combines the characteristics of stocks and bonds – hence the term hybrid security. It is a way for banks and companies to borrow money from investors. Investors in these bank securities lend money to the issuer with no fixed maturity date.

What are Class A notes?

An A rating is the highest tranche of an asset-backed security (ABS) or other structured finance product. … A ratings may be rated or labeled in the AAA, AA or A categories, depending on the credit quality of the underlying asset. They may also be referred to as “Class A note”.

What is a note and B-note?

A type of promissory note executed and delivered by the borrower in connection with a commercial real estate loan. A B-note is subordinate to one or more senior promissory notes, called A-notes. … At the time of closing the loan.

What is class A debt?

This senior status allows payment from the underlying assets of the A-note debt before others. A ratings may be rated or labeled in the AAA, AA or A categories, depending on the credit quality of the underlying asset. They may also be referred to as “Class A note”.

What is an A note in real estate?

In short, a note is simply an IOU – an agreement between a borrower and a lender in which the borrower agrees to repay the lender according to the terms set out in the note. Real estate notes in particular are IOUs that use real estate as collateral for the loan.

Are capital notes equity?

Banknotes do not have a fixed maturity date. …Finally, the bank has the discretion to convert its capital notes into shares of the bank or the bank’s parent company. In the Basel tier system, capital notes are treated as close to equity, as both forms of financing strengthen the bank’s capital.

In the Basel tier system, capital notes are treated as close to equity, as both forms of financing strengthen the bank’s capital.

Does capital go under equity?

Capital investments, such as land or vehicles that your business buys, are part of a business’s equity. They affect the balance sheet, but you include these investments with all your other assets.

Are notes debt or equity?

Understanding Notes A note is a debt obligation committing to the repayment of a loan, at a pre-determined interest rate, within a defined period of time.

Is ANZ a good stock to buy?

Why could the ANZ dividend be a good option? According to a recent note from Bell Potter, its analysts are very positive on the big four banks and expect the ANZ dividend to grow at a decent pace in the coming years. The broker has forecast a fully franked dividend of $1.30 per share in fiscal 2021.

Which ASX stocks should I buy now? Which stocks are better to buy now?

- Medical Developments (ASX: MVP) Sector: Pharmaceuticals. …

- Catapult Group (ASX: CAT) Sector: Technology. …

- Tassal (ASX: TGR) Industry: Food.

Data from the Reserve Bank of Australia and the Australian Prudential Regulation Authority (APRA) showed ANZ Bank’s market share fell another 8 basis points to 13.09% in October.

| Society | Market Cap | Dividend yield (%) |

|---|---|---|

| 2022 F | ||

| ANZ Bank (ANZ) | $78,022 million | 5.10% |

| Commonwealth Bank (ABC) | $171,970 million | 3.69% |

| National Australia. Bank (NAB) | $96,181 million | 4.49% |

How many markets does ANZ operate in?

We provide banking and financial products and services to more than 8.5 million retail and business customers and operate in 32 markets. Our expertise, our products and our services make us a bank. Our people, our purpose, our values and our culture make us ANZ.

What is ANZ market?

ANZ Markets Solutions, with proven expertise in quantitative analysis and best practice methodologies, provides world-class risk management solutions and advice. Our dedicated specialists work closely with you to develop the right advisory and risk management solution for your needs.

Is ANZ a good stock?

Quality income: ANZ has high quality income. Profit margin growth: ANZ’s current net profit margins (34.4%) are higher than last year (24.7%).

ANZ’s share registrar is Computershare Investor Services Pty Ltd.

What is the worth of ANZ bank?

| Characteristic | Assets in billions of Australian dollars |

|---|---|

| – | – |

Is ANZ the best bank in Australia?

As “Australia’s Best Big Bank”, it’s only natural that ANZ covers all banking bases with a wide range of products including bank accounts, personal loans, credit cards, home loans, savings accounts, term deposits and car loans.

These top picks are Australia and New Zealand Banking GrpLtd (ASX:ANZ) and National Australia Bank Ltd (ASX:NAB). The broker has a buy rating and price target of $30.00 on ANZ shares and a buy rating and price target of $31.00 on NAB shares.

| Rank | Securities broker |

|---|---|

| 1 | HDFC Bank |

| 2 | Kotak Mahindra Bank |

| 3 | ICICI Bank |

| 4 | SBI |

Share capital is the money a company raises by issuing common or preferred stock. The amount of a company’s share capital or equity financing may change over time with additional public offerings. … This is the total amount raised by the company when selling shares.

How does social capital work? Share capital represents the amount of money actually used to buy shares, but the market value of shares could mean that those shares would be worth much more if sold. As a limited liability company is a separate legal entity from its owners and directors, the value of someone’s stock is their total financial liability.

Share capital refers to the funds a company raises by selling shares to investors. For example, selling 1,000 shares at $15 per share raises $15,000 in share capital. … Also, if the company is dissolved, the owners of preferred stock are reimbursed before the owners of common stock.

Share capital refers to the funds a company receives from selling shares of ownership to the public. … The two types of share capital are common stock and preferred stock. Companies that issue shares of ownership in exchange for capital are called stock companies.

Simply put, a share is a percentage ownership of a business or financial asset. … For example ; if the market capitalization of a company is Rs. 10 lakh, and a single share is priced at Rs. 10, the number of shares to be issued will be 1 lakh.