Secured and unsecured promissory notes Promissory notes can be unsecured or backed by collateral, which is normally the asset purchased with the borrowed money.

Is flipping real estate ordinary income?

Contents

- 1 Is flipping real estate ordinary income?

- 2 Does promissory note need to be notarized Philippines?

- 3 Is promissory note a valuable security?

- 4 Can an estate collect on a promissory note?

- 5 Does a promissory note require collateral?

In most cases, home flip gains are considered regular income, especially if you repeatedly refurbish and flip homes for profit, or have multiple projects running at the same time. Ordinary income is subject to tax in the tax brackets in effect for the tax year in which the sale is completed.

Is Flipping a Home Passive Income? Passive vs. active income is money you earn in exchange for the work you do. That includes your salary from work, as well as the profit you make. Flipping is considered active income whether or not you do the physical labor of stripping floors.

How do I avoid paying taxes on a house flip?

Other Ways to Avoid Real Estate Capital Gains Taxes

- Live in the property for 2 years. †

- Check if you qualify for other homeowner exemptions. †

- Increase your cost base by documenting expenses. †

- Do a 1031 Exchange. †

- Sell in a year in which you have incurred other losses. †

- crop losses. †

- Turn your house into a rental property.

What kind of income is flipping houses?

Flipping house profits are generally treated as ordinary income, not capital gains, so profits are subject to normal income tax and self-employment tax.

How do I report income flipping a house?

Record income and expenses as a taxpayer on a cash basis on Schedule C of Form 1040 if you turn over real estate in the normal course of business. You are considered a cash-based entity, which means that you report income and expenses in the actual year received or paid.

What kind of job is flipping houses?

Property flipping, or house flipping as some people call it, can be a lucrative way to make money from real estate – if done right. Since it requires a significant investment of your own money, becoming a real estate flipper can also be a risk that doesn’t always pay off.

How much does a house flipper make a year?

Earnings: About $30,000 per Flip House flipper Mark Ferguson admits that gains and losses can vary wildly from home to home. He has flipped over 155 houses and makes an average of $30,000 in profit on each. “You can make a lot of money once you have developed a system and learned the trade,†he says.

How are real estate flips taxed?

Typically, house flipping is not considered passive investing by the IRS, and as active income, the investor must pay normal income taxes on their net income within the fiscal year. … However, all gains made on properties held for more than one year are subject to capital gains tax which can be as high as 20%.

Does promissory note need to be notarized Philippines?

In any case, a promissory note does not have to be legalized by a notary to be binding. The private respondents admitted to signing the two notes and failed to prove that they did so “under coercion, fear and undue influence”.

Is promissory note a valuable security?

A promissory note can be secured or unsecured. In the case of a secured receipt, the borrower will have to provide collateral such as property, goods, services, etc., in the event that he cannot repay the loan amount. … In the case of an unsecured promissory note, no collateral is required.

What is the limit for a promissory note? All promissory notes are only valid for a period of 3 years from the date of execution, thereafter they are invalid. There is no limit to the amount that can be borrowed or borrowed.

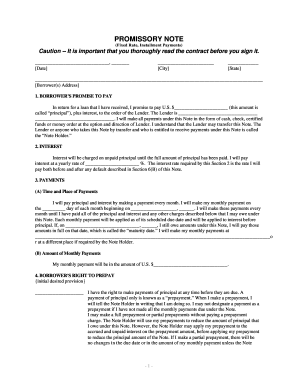

What are the requirements of a promissory note?

Requirements for a promissory note:

- The promise to pay must be unconditional. †

- The promise should be to pay just the money. †

- The amount to be paid must be certain. †

- The money must be paid to the beneficiary, or on his order or to the holder of the note.

- The beneficiary must be a specific person.

What is needed for a promissory note to be valid?

For a promissory note to be valid and legally binding, it must contain specific information. “A promissory note should contain details including the amount borrowed, the repayment schedule, and whether or not it is secured,” Wheeler says.

What are the rules of promissory note?

An unconditional promise to pay a specified amount to a named party or the holder of the note, or to deposit that money directly as such. A promissory note must be in writing and signed by the maker of the promise.

What makes a promissory note invalid?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

What makes a promissory note void?

A promissory note is a contract, a binding agreement that someone will pay your company a sum of money. But under certain circumstances – if the note is changed, not written correctly, or if you do not have the right to claim the debt – the contract becomes void.

What is promissory note India?

A promissory note in India, sometimes referred to as a bill of lading, is a legal instrument in which one party (the issuer) guarantees or promises in writing to pay a specified amount of cash to the other (the payee), either at a fixed or definable amount. future tense or at the request of the beneficiary, under certain conditions.

How long is a promissory note good for?

Depending on the state you live in, the statute of limitations on promissory notes can range from three to 15 years. Once the statute of limitations has expired, a creditor can no longer file a lawsuit regarding the unpaid promissory note.

Is a handwritten promissory note legal?

Whether a promissory note is handwritten or typed and signed, it is a legally binding contract. LendingTree quoted Vincent Averaimo as saying, “However, it would be foolish to sign a handwritten promissory note, as it is easier to add language afterwards to a handwritten note than to a typed note.”

Is a handwritten promissory note legal?

Whether a promissory note is handwritten or typed and signed, it is a legally binding contract. LendingTree quoted Vincent Averaimo as saying, “However, it would be foolish to sign a handwritten promissory note, as it is easier to add language afterwards to a handwritten note than to a typed note.”

What are the requirements for a promissory note to be valid?

To be legally enforceable, a promissory note must meet several legal conditions. In addition, it must contain both an offer of agreement and an acceptance of the agreement. All contracts state the type of services or goods provided and how much they cost.

Does a promissory note need to be recorded?

Unlike a mortgage or trust deed, the promissory note is not registered in the county land records. The lender keeps the promissory note while the loan is outstanding. When the loan is paid off, the bill is marked “paid in full” and returned to the borrower.

What makes a promissory note invalid?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

Can an estate collect on a promissory note?

Nevertheless, all is not lost and you may still be able to collect on the promissory note even after your borrower dies through the borrower’s estate.

What happens if someone does not pay a promissory note? What happens if a promissory note is not paid? Promise notes are legally binding documents. A person who fails to repay a loan described in a promissory note could lose an asset that guarantees the loan, such as a house, or take other actions.

What are the rules of promissory note?

An unconditional promise to pay a specified amount to a named party or the holder of the note, or to deposit that money directly as such. A promissory note must be in writing and signed by the maker of the promise.

What are the requirements for a promissory note to be valid?

To be legally enforceable, a promissory note must meet several legal conditions. In addition, it must contain both an offer of agreement and an acceptance of the agreement. All contracts state the type of services or goods provided and how much they cost.

What makes a promissory note illegal?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

Is a promissory note valid in court?

Whether the lender’s signature is a mandatory requirement varies from state to state. However, the signatures of the borrower and witness are of the utmost importance because without them the banknote is invalid and has no jurisdiction in a court of law.

Who can enforce a promissory note?

The first step in enforcing an unsecured promissory note is to petition the courts and obtain a judgment in your favor. While this is a strong legal enforcement of your rights under the promissory note, it does not in itself guarantee a refund of the receipt.

Who executes a promissory note?

Usually, the party that executes the note is the party that borrows the money. He is also known as the “maker” of the note. The lending entity is known as the beneficiary. To create a promissory note, you must note the date, the amount borrowed, and the terms of the repayment.

What makes a promissory note enforceable?

To be legally enforceable, a promissory note must meet several legal conditions. In addition, it must contain both an offer of agreement and an acceptance of the agreement. … Once the parties discuss and sign the terms of the promissory note, it becomes a legally binding contract.

Is promissory note legally enforceable?

Unlike a IOU, which is usually flexible and informal, a promissory note creates a legal document of the loan and creates a legal obligation to repay it. … A promissory note falls somewhere between an IOU and a loan agreement. They are legally binding but do not provide recourse for non-payment of the loan.

What voids a promissory note?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

Can a promissory note be revoked?

Before a promissory note can be canceled, the lender must agree to the terms of its cancellation. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings and confusion. When canceling the promissory note, the process is called a release of the note.

How do you break a promissory note?

Circumstances for release of a promissory note The debt on a promissory note can either be paid off, or the bondholder can waive the debt even if it has not been paid in full. In either case, a release of the promissory note must be signed by the holder of the bond.

What makes a loan agreement void?

A consumer credit agreement can only be terminated if it is signed after or after all statements made by the lender in the presence of the borrower and not signed at the lender’s premises.

Does a promissory note require collateral?

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral needs a second document. If the collateral is real estate, there is a mortgage or trust deed.

What does a promissory note need? For a promissory note to be valid and legally binding, it must contain specific information. “A promissory note should contain details including the amount borrowed, the repayment schedule, and whether or not it is secured,” Wheeler says.

How do you secure a promissory note?

A promissory note can be secured with collateral of collateral, something of value that can be seized if a borrower defaults.

- Security. A secured promissory note must clearly identify the collateral backing the loan. †

- Conditions. †

- Link deposits. †

- state law.

What makes a promissory note invalid?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

Can a promissory note be secured by real property?

A secured promissory note is a payment obligation secured by some type of property. This means that if the payer does not pay, the payee can seize the designated goods to obtain repayment of the loan. … If the collateral is real estate, there is a mortgage or a trust deed.

How legally binding is a promissory note?

Promissory notes are legally binding whether the note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay it, you can legally own all the property that person has pledged as collateral.

What makes a promissory note invalid?

Even if you have the original note, it may be invalid if not written correctly. If the person you’re trying to retrieve from hasn’t signed it — and yes, it does — the note is invalid. It can also become invalid if it violates another law, for example if it charges an illegally high interest rate.

What makes a promissory note void?

A promissory note is a contract, a binding agreement that someone will pay your company a sum of money. But under certain circumstances – if the note is changed, not written correctly, or if you do not have the right to claim the debt – the contract becomes void.

Is a handwritten promissory note legal?

Whether a promissory note is handwritten or typed and signed, it is a legally binding contract. LendingTree quoted Vincent Averaimo as saying, “However, it would be foolish to sign a handwritten promissory note, as it is easier to add language afterwards to a handwritten note than to a typed note.”

What connects promissory note to collateral?

Complete a financing statement to attach the collateral to the promissory note. To attach the loan to personal property, you must have the borrower complete a financing statement, also known as a “UCC” or “UCC-1” statement.

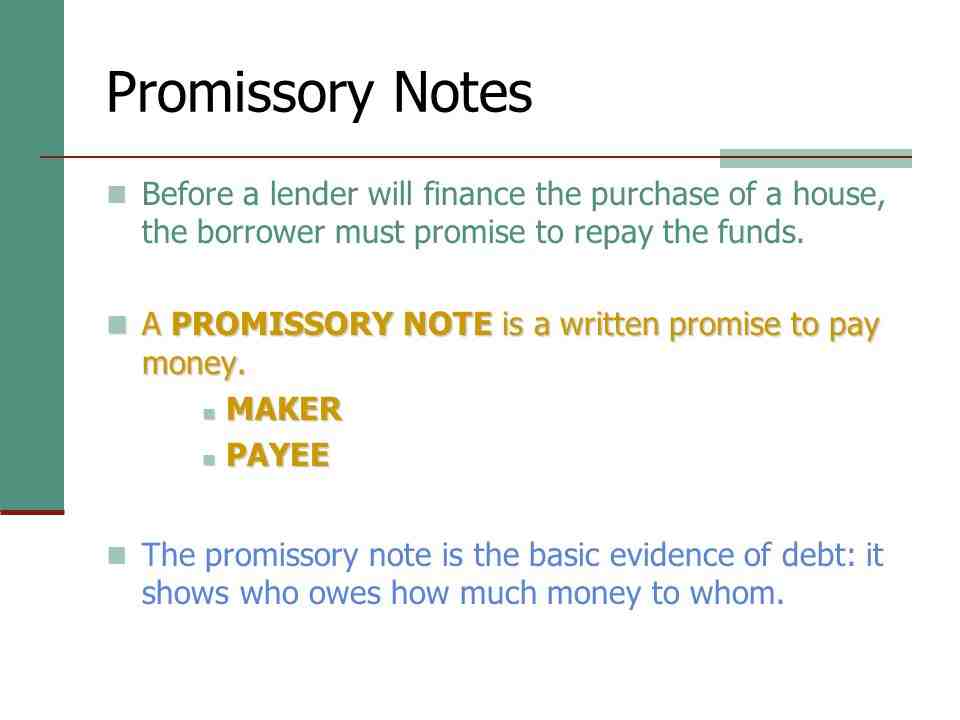

What does promissory note include?

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to repay another party. A promissory note contains the terms agreed upon between the two parties, such as the maturity date, principal, interest, and the signature of the issuer.

What is a promissory note also called?

A promissory note, also known as a bill to pay, is a legal instrument (more specifically, a financing instrument and a debt instrument), in which one party (the maker or issuer) promises in writing to pay a specified sum of money to the other (the beneficiary ), either at a fixed or determinable future time or …

What is the holder of a promissory note?

A written promise to pay money that is often used as a means of borrowing money or taking out a loan. The person who promises to pay is the maker, and the person to whom the payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.