Who would most likely obtain a blanket mortgage?

Contents

- 1 Who would most likely obtain a blanket mortgage?

- 2 Is a 3.25 interest rate good?

- 3 What kind of loan can I get with a 700 credit score?

- 4 How much is 2 points on a loan?

- 5 Are points tax deductible?

Lenders prefer borrowers with a higher down payment ($75,000 or more), a higher credit score, and a lower debt-to-income ratio. The term for a general loan can be from 2 to 30 years.

How does a collective loan work? A general mortgage allows you to buy or refinance multiple homes under one loan so that each property can receive the same financing terms. Instead of paying all at once, you can be released from liability for individual properties as they are sold or refinanced on different terms.

What is a blanket mortgage?

A general mortgage, often called a general loan, is a type of mortgage that finances multiple real estate properties at the same time. Popular with real estate investors, developers and commercial property owners, general loans can make the lending process more efficient and profitable.

What does a blanket mortgage contain?

The term general mortgage refers to a single mortgage that covers two or more properties. The property is held together as collateral for the mortgage, but the individual parts of the property can be sold without taking out the mortgage in full.

How does a blanket mortgage work?

A general mortgage is a single mortgage that covers multiple properties, with the group of assets serving as collateral for the loan. Real estate contractors and larger investors often buy more than one property at a time, so a general mortgage allows them to streamline these transactions with a loan.

What is an example of a blanket mortgage?

A builder, for example, might use a general mortgage to pay for the construction of several houses in a neighborhood. When a home is sold, the portion of the mortgage that was used to finance that home is paid back to the lender and then retired.

Is a blanket loan a good idea?

The main advantage of general mortgages over conventional loans is that they can help preserve your cash flow as an investor. In that case, you only have to worry about paying a set of closing costs, where you would have to pay the closing costs at a time with individual mortgages.

Are blanket loans good?

One of the main benefits of a general mortgage is that it allows the borrower to have more cash on hand – for example, a homeowner can save on the costs associated with applying for and closing multiple mortgages. Pitfalls for general mortgages include higher average costs than a traditional mortgage.

Is it hard to get a blanket mortgage?

Not all lenders offer them, but it can be much more difficult to find a good deal on a general mortgage. For starters, many lenders don’t offer them. … You should explore your options with portfolio lenders (who typically view mortgages as their own long-term investments) as well as traditional and commercial banks.

What is an example of a blanket mortgage?

A builder, for example, might use a general mortgage to pay for the construction of several houses in a neighborhood. When a home is sold, the portion of the mortgage that was used to finance that home is paid back to the lender and then retired.

What does a blanket mortgage contain?

The term general mortgage refers to a single mortgage that covers two or more properties. The property is held together as collateral for the mortgage, but the individual parts of the property can be sold without taking out the mortgage in full.

How does blanket mortgage works?

A general mortgage is a single mortgage that covers multiple properties, with the group of assets serving as collateral for the loan. Real estate contractors and larger investors often buy more than one property at a time, so a general mortgage allows them to streamline these transactions with a loan.

Is a 3.25 interest rate good?

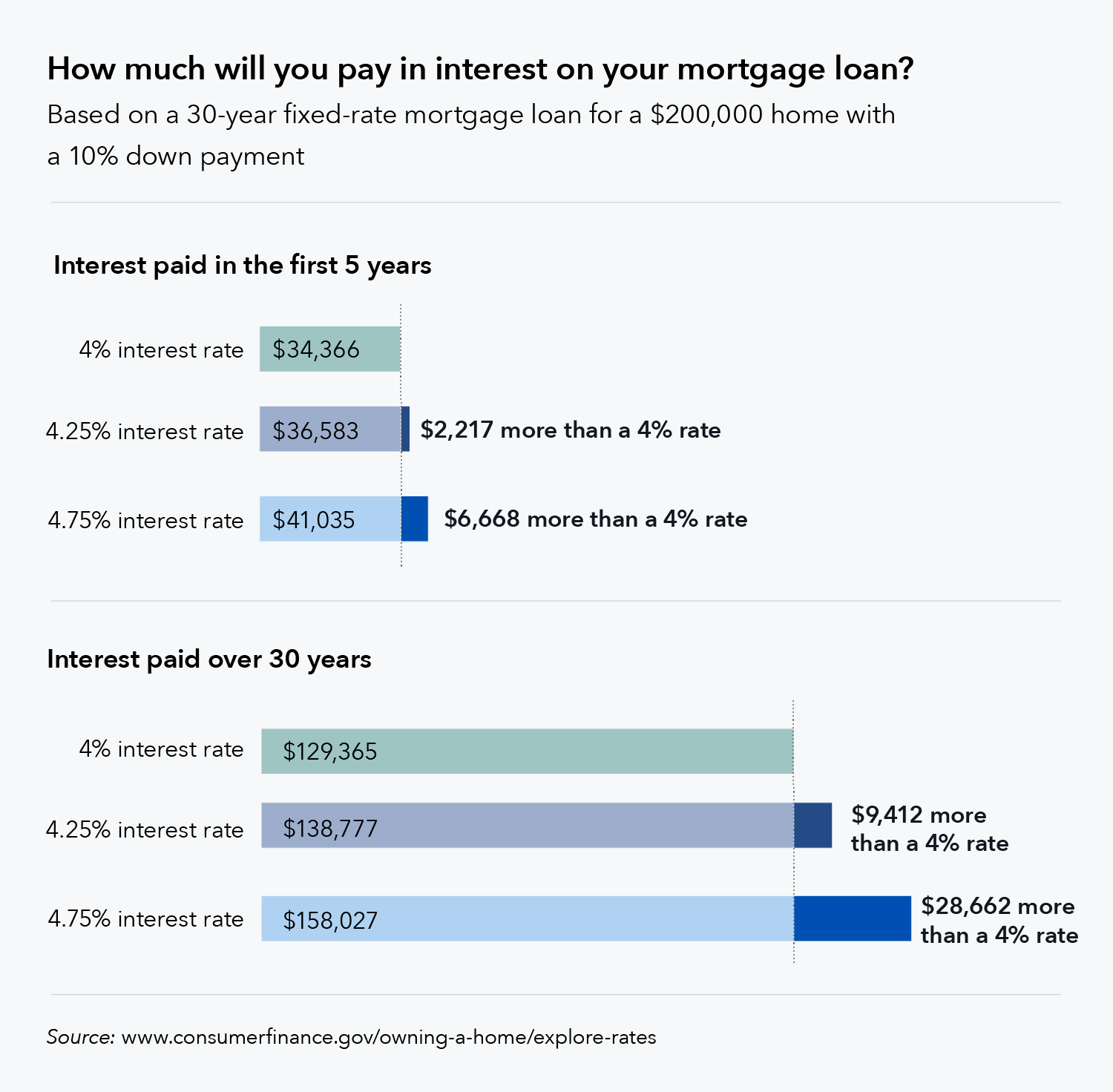

However, rates are rising and homeowners who can guarantee between 3 and 3.25% are still in a great position. In a historical context, 3.25% is an ultra-low mortgage rate. It’s a fraction of the rate homebuyers have paid throughout modern history.

What is considered a good interest rate? Generally, a good interest rate for a personal loan is one that is lower than the national average, which is 9.41%, according to the latest data from Experian. Your credit score, debt-to-income ratio and other factors determine what interest rates you can expect to receive.

What is a good APR on a 30 year mortgage?

What are today’s 30-year fixed mortgage rates? As of Tuesday, February 15, 2022, according to Bankrate’s latest survey of the nation’s largest mortgage lenders, the average 30-year fixed mortgage rate is 4,200% with an APR of 4,190%. The average 30-year fixed mortgage refinancing rate is 4,220% with an APR of 4,200%.

What is considered a good APR for a mortgage?

A low credit card APR for someone with excellent credit might be 12%, while a good APR for someone with more or less credit might be in their teens. If “good” means best available, it will be about 12% for credit card debt and about 3.5% for a 30-year mortgage.

Is a 2.75 interest rate good?

Is 2.875 a good mortgage rate? Yes, 2.875 percent is an excellent mortgage rate. It’s just a fraction of a percentage point higher than the lowest mortgage rate ever recorded on a 30-year fixed-rate loan.

Is 3.8 a good interest rate?

Anything at or below 3% is an excellent mortgage rate. … If you get the same mortgage, but at a rate of 3.8%, you will be paying a total of $169,362 in interest over a 30-year payment term. As you can see, just one percentage point can save you nearly $50,000 in interest payments for your mortgage.

Is 3.75 a good home interest rate?

Yes, he is. Good is subjective though. In a market where rates are 3% on average, 3.75% is a bit high. In a market where rates are 5% on average, it’s a phenomenal rate.

What mortgage rate is too high?

If your loan-to-value ratio is greater than 80%, it is considered high and puts the lender at greater risk. This can result in a higher mortgage rate, especially when combined with a lower credit score. The loan will usually require mortgage insurance as well.

Is 3.75 A good 30 year mortgage rate?

Right now, a good mortgage rate for a 15-year fixed loan can be in the high 2% or low 3% range, while a good rate for a 30-year mortgage can be anywhere from 3-3.5% or above. . … Also, looking ahead to 2022, interest rates seem to rise.

What is a good house interest rate?

Anything at or below 3% is an excellent mortgage rate. And the lower the mortgage rate, the more money you can save over the life of the loan. … If you get the same mortgage, but at a rate of 3.8%, you will be paying a total of $169,362 in interest over a 30-year payment term.

Is 3% a good interest rate?

Anything at or below 3% is an excellent mortgage rate. And the lower the mortgage rate, the more money you can save over the life of the loan. … As you can see, just one percentage point can save you about $50,000 in interest payments for your mortgage.

Is 3 a high interest rate?

Right now, a good mortgage rate for a 15-year fixed loan can be in the high 2% or low 3% range, while a good rate for a 30-year mortgage can be anywhere from 3-3.5% or above. . You would have to be lucky (and a very strong borrower) to find a 30-year fixed rate below 3% at this point.

Is 3 interest rate good for a car?

19.85%. The average auto loan interest rate is 3.64% for new cars and 5.35% for used cars, according to Experian’s State of the Automotive Finance Market report for Q3 2021. credit rating above 780, you will have the best chance to get a rate below 3% for new cars.

What does a 3 interest rate mean?

For example, if you borrow $5,000 at a simple interest rate of 3% for five years, you will pay a total of $750 in interest. … r is the interest rate per year. In this case, it would be written as 0.03. This is how 3% is written as a decimal. t is the total time in years that you will use to repay the loan.

What kind of loan can I get with a 700 credit score?

With a score of 700, you are likely to qualify for a conventional loan with cheaper mortgage insurance and an even smaller down payment. There are only a few exceptions to this rule: if you have higher debt, an FHA loan may be better. The FHA may be more tolerant of a high debt-to-income ratio.

What credit score do I need for a $50,000 loan? In most cases, you must have a credit score of 650 or higher if you are applying for a $50,000 personal loan. If your credit score is 650 or lower, you may still qualify if your income is high enough.

How much can I borrow with a 750 credit score?

A credit score of 750 can qualify you for a $200,000 mortgage for 30 years at a rate of 3.625%. That translates to a monthly payment of $912. With a credit score of 625, however, your rate would be 4.125% for a mortgage of the same size and term. This would result in a monthly payment of $969.

How big of a loan can I get with a 800 credit score?

The average mortgage loan amount for consumers with exceptional credit scores is $208,977. People with FICO® Scores of 800 have an average auto loan debt of $18,764.

What kind of loan can you get with a 700 credit score?

With a score of 700, you are likely to qualify for a conventional loan with cheaper mortgage insurance and an even smaller down payment. There are only a few exceptions to this rule: if you have higher debt, an FHA loan may be better. The FHA may be more tolerant of a high debt-to-income ratio.

What can you get approved for with a 750 credit score?

A credit score of 750 can help you:

- Qualify for a mortgage.

- Negotiate the terms of the loan, as the lender may be willing to compete for your business.

- Get low mortgage rates, which makes borrowing cheaper.

What kind of home loan can I get with a 720 credit score?

With conventional fixed rate loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need cash reserves and your DTI ratio can be as high as 45%; but if your credit score is 620 to 639 and you have a 5% to 25% down payment then you need to have at least two months of…

What kind of loans can you get with a 700 credit score?

What a 700 Credit Score Can Give You

- Car loans. According to a 2021 report released by credit bureau Experian, nearly 65% of financed cars went to borrowers with a score of 661 or higher. …

- Housing loans. …

- Credit cards. …

- Personal loans. …

- Payment history. …

- Credit usage. …

- Length of credit history. …

- Credit applications.

What can I get with a 720 credit score?

A credit score of 720 is a good credit score. The good credit range includes scores from 700 to 749, while an excellent credit score is from 750 to 850, and people with scores that high are in a good position to qualify for the best possible mortgages, auto loans and credit cards. credit, among other things.

Can you get a home loan with a 720 credit score?

If your credit score is above 580, you are in the realm of mortgage eligibility. With a score above 620, you should have no problems getting credit approved to buy a home.

Can I get a personal loan with a 700 credit score?

Having a credit score of 700 should give you a chance to qualify for a personal loan from almost all major lenders as it is uncommon for a lender to have a minimum credit score requirement of more than 700. With a score of 700 , you are also likely to qualify for personal loans that do not have origination fees.

What kind of loan can you get with a 700 credit score?

With a score of 700, you are likely to qualify for a conventional loan with cheaper mortgage insurance and an even smaller down payment. There are only a few exceptions to this rule: if you have higher debt, an FHA loan may be better. The FHA may be more tolerant of a high debt-to-income ratio.

What credit score do I need to borrow $20000?

You must have a credit score of 640 or higher to qualify for a $20,000 personal loan. If you have bad or fair credit, you may not qualify for the lower rates. However, to rebuild your credit, you may have to pay higher interest rates and make payments on time.

What is the minimum credit score for a personal loan?

The minimum credit score to qualify for a personal loan is typically 610 to 640, according to an anonymized dataset of NerdWallet users who have qualified for personal loans. A high credit score does not guarantee that you will qualify or get a low rate.

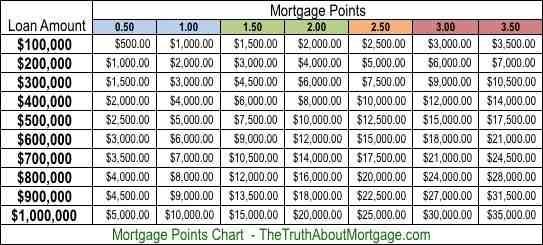

How much is 2 points on a loan?

Each point equals one percent of the loan amount. For example, one point on a $100,000 loan would be one percent of the loan amount, or $1,000. Two points would be two percent of the loan amount, or $2,000.

How to calculate loan points? One mortgage point is equal to 1% of the total loan amount. For example, on a loan of $100,000, one point would be $1,000. Learn more about mortgage points and determine if “buying points” is a good option for you.

How much is 3 points on a mortgage?

Points are an initial charge from the lender that is part of the price of a mortgage. Points are expressed as a percentage of the loan amount, with 3 points being 3%. On a loan of $100,000, 3 points means a cash payment of $3,000.

How much does 2 points cost on a mortgage?

How much do points cost? A mortgage point typically costs 1% of the total loan (for example, $2,000 on a $200,000 mortgage). So if you buy two points — at $4,000 — you’ll need to write a check for $4,000 when your mortgage closes.

What does 3 points mean in real estate?

Are there different types of points? Typically, points are cited as something plus one. For example, a 10% interest rate with three points plus one: One point is a loan origination fee that pays the cost of processing the mortgage; the three points are discount points.

How do I calculate my mortgage points?

One point is 1% of the loan amount or $1,000. To calculate this amount, multiply 1% by $100,000. For this payment to make sense, you need to benefit more than $1,000. Points are not always in round numbers, and your lender may offer several options.

How much does 2 points save on mortgage?

By purchasing two points for $4,000 upfront, the borrower’s interest rate dropped to 3.5%, reducing their monthly payment by $56 and saving $20,680 in interest over the life of the loan. (However, to save the full $20,680, the borrower would have to live in the house for the full term of the loan, 30 years.)

Is it worth refinancing for 2 percentage points?

The traditional rule of thumb is that it makes financial sense to refinance if the new rate is 2% or more below the existing interest rate. The new refinance rate must provide enough savings on the monthly mortgage payment to justify the cost of the refinance.

Is it worth it to refinance for 2 points?

The old rule of thumb was that you should refinance if you could get a rate 1-2 points lower than you are now. Well, the rules have changed, because rates in recent years have been at all-time lows, so a half-point drop represents a larger percentage of your existing rate.

How much is 2 discount points on a mortgage?

Each point equals 1 percent of the loan amount, for example, 2 points on a $100,000 loan would cost you $2,000. You can buy up to 5 points. Enter the annual interest rate for this mortgage with discount points as a percentage.

How much does 1 point cost on a mortgage?

A mortgage point – sometimes called a discount point – is a fee you pay to lower your interest rate on purchasing or refinancing your home. A discount point costs 1% of the value of your home loan. For example, if you take out a mortgage for $100,000, one point will cost you $1,000.

How much does 1 point lower your interest rate?

Each point typically reduces the rate by 0.25%, so one point would reduce a mortgage rate from 4% to 3.75% over the life of the loan.

How much is 1 point on a mortgage?

One mortgage point equals 1% of the total loan amount – for example, on a $100,000 loan, one point would be $1,000.

Are points tax deductible?

Points are prepaid interest and may be deductible as home mortgage interest if you detail the deductions in Exhibit A (Form 1040), Detailed Deductions. … Points can be deducted proportionately over the life of the loan or the year in which they were paid.