Buying a company vehicle, building, or getting a bank loan for your business are all debt obligations. Debt liabilities may be classified as either current liabilities if they are due to be settled within one year or long-term liabilities if the maturity is more than one year from the date the bond is issued.

Why is money called notes?

Contents

- 1 Why is money called notes?

- 2 Do banks accept promissory notes?

- 3 What is a note in banking?

- 4 What is the legal definition of a note?

- 5 What is the difference between a note and a term loan?

The notion of banknotes as money has evolved over time. Originally, money was based on precious metals. Some held banknotes in I.O.U. or bill of exchange: a promise to pay someone upon presentation of a precious metal (see representation).

What is a banknote? What is a note? A bond, also known as a bill of exchange, is a legal debt instrument in which one party gives a written promise to pay the other party a certain amount of money under certain conditions.

What is the difference between note and currency?

Both national banknotes and federal banknotes were commodity-backed currencies for some time. Although banknotes still exist, they are no longer considered a currency. Instead, they are bonds or negotiable instruments that are paid on demand.

What is the difference between currency and money?

Money vs. currency – The main differences The main difference between money and currency is that money is completely numerical, ie it is intangible that cannot be touched or smelled, while currency can be touched and smelled and is tangible.

Why is our currency called a note?

They are often referred to as Legal Tender Notes, but under the first legal tender law, they were called United States bonds, which allowed them to take the form of fiat currency. … The US Treasury initially circulated them directly to cover the costs incurred by the Union during the American Civil War.

Who invented money notes?

The Song Dynasty was the first to issue real paper money in 1023, and the most famous Chinese issuer was Kublai Khan, the leader of the Mongols in the 13th century.

When was currency notes invented?

The Government of India continued to issue banknotes until the establishment of the Reserve Bank of India on April 1, 1935. When one rupee banknote was re-introduced as a measure of wartime in August 1940, the Government of India issued a coin with this status.

Who actually invented money?

No one knows for sure who was the first to invent such money, but historians believe that metal objects were first used as money as early as 5000 BC. Around 700 BC, the Lydians became the first Western culture to make coins. Other countries and civilizations soon began minting coins with their own fixed values.

What are money notes called?

The banknote is called an “invoice” or a “letter”.

What are currency notes and coins called?

The Indian currency is called the Indian Rupee (INR) and the coins are absent.

What is another name for paper currency?

Find another word for banknote. On this page you will find 16 synonyms, antonyms, idiomatic expressions and related words about banknote, such as: federal reserve banknote, monetary money, money, dollar bill, currency, collapsible money; bill of exchange, legal tender, negotiable instrument, fiat money, trust currency and banknote.

What is the paper money called?

A banknote – also known as an invoice (North American English), paper money, or simply a token – is a type of negotiable note issued by a bank or other licensed institution that is paid to a bearer upon request.

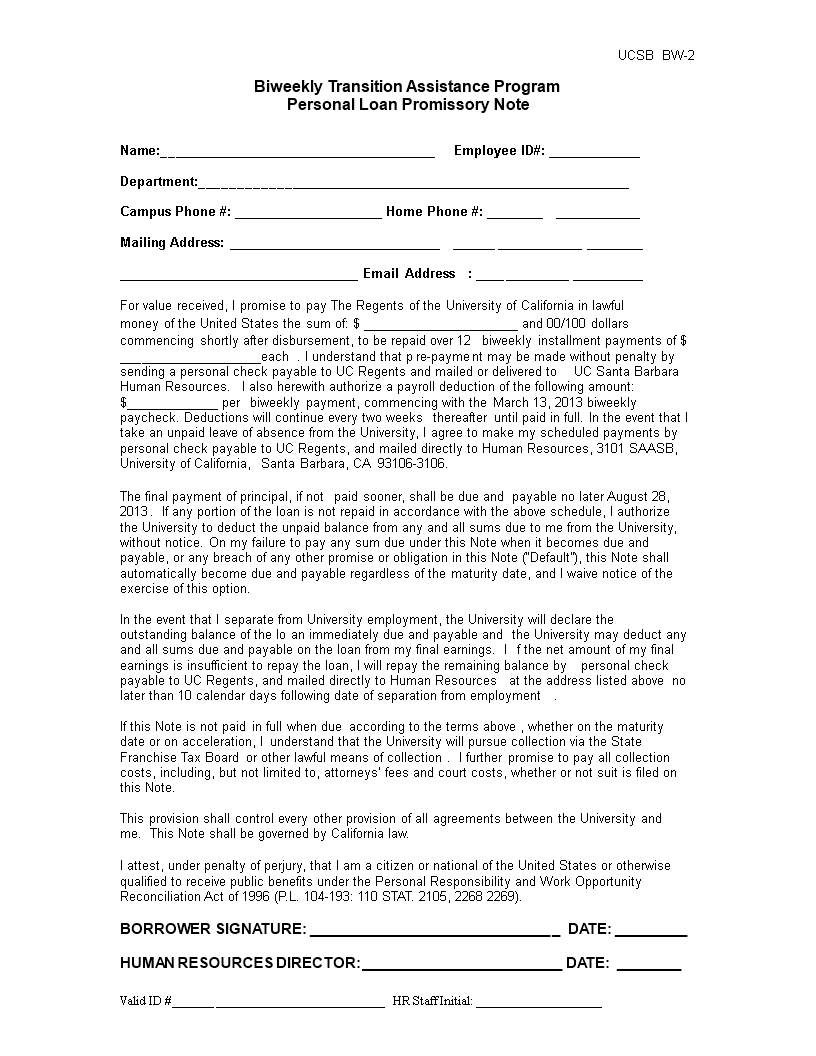

Do banks accept promissory notes?

Banks often accept promissory notes from private individuals, one of the most obvious examples being the promissory notes that a new homeowner signs when taking out a mortgage.

What do banks do with bills of exchange? Bills of exchange legally bind the borrower and the lender in a contract where the borrower is responsible for repaying the loan or debt. They describe the terms of the loan and specify the repayment schedule of the loan and the interest that may accrue during the term of the loan.

Can promissory notes be legally accepted?

Bills of exchange are legally binding, regardless of whether the bill of exchange is secured or based solely on a promise to repay. If you lend money to someone who defaults and does not repay it, you can legally own any property that the individual promised as collateral.

Will a promissory note hold up in court?

As a general rule, as long as the bill has legally acceptable interest rates, is signed by both parties and remains within the applicable statute of limitations, they can be upheld in court.

How do you make a promissory note legally binding?

In order to be legally binding, a bill of exchange must bear the signatures of both parties. As a rule, the law does not need to certify or notarize signatures. However, these two steps can add a layer of protection – especially if the two parties do not know or trust each other.

What makes a promissory note invalid?

Even if you have an original note, it may be invalid if it is not spelled correctly. If the person you’re trying to collect from hasn’t signed it – and yes, it will – the note is invalid. It can also become invalid if it does not violate another law, for example if it required an illegally high interest rate.

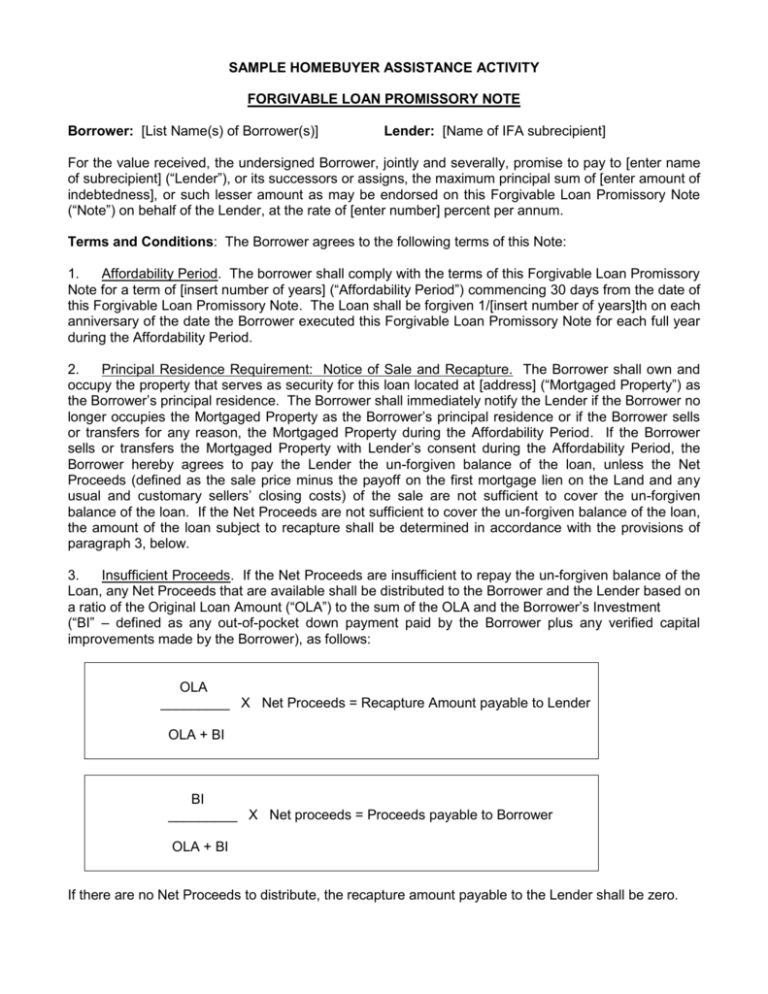

Can you use a promissory note to buy a house?

Bills are ideal for individuals who do not qualify for traditional mortgages, as they allow them to buy a home using a seller as a source of credit and a home purchased as a source of collateral.

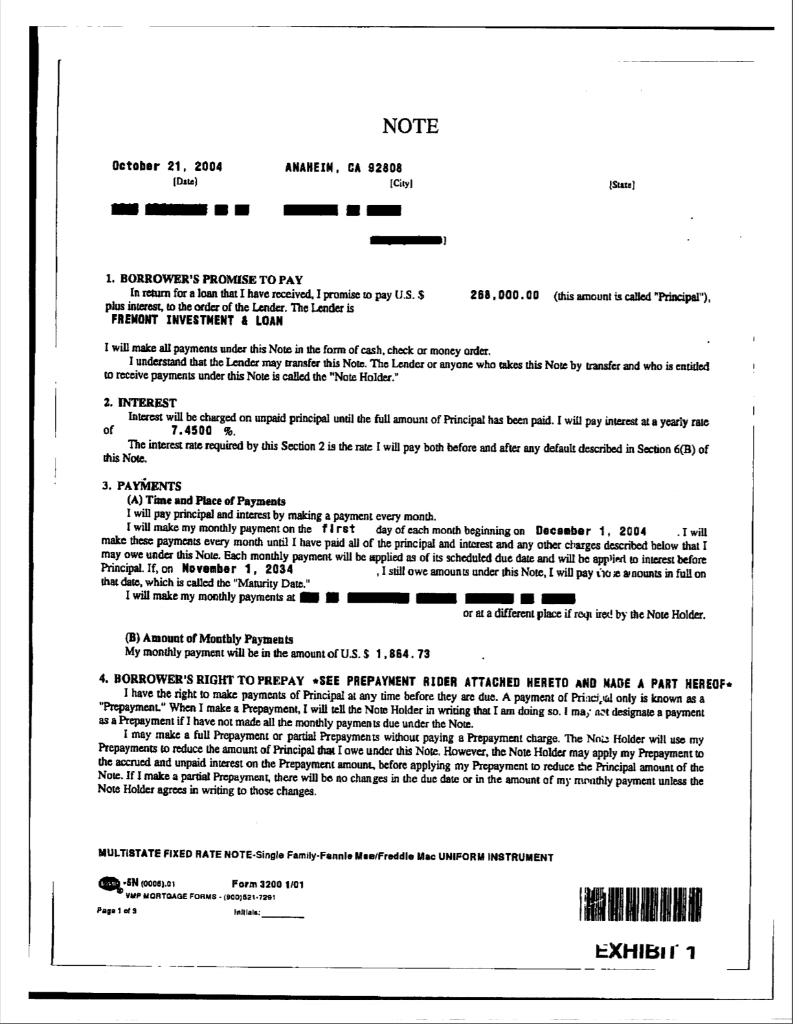

Can I get a mortgage with a promissory note?

Bills are just one part of the complicated financial and legal process of buying a home. … A home mortgage effectively secures the title deed in question in the event that the lender should seize and sell the property in the event of default.

Is a promissory note the same as a mortgage?

The main difference between a bill of exchange and a mortgage is that the bill of exchange is a written agreement that contains the details of a mortgage loan, while a mortgage is a loan secured by real estate.

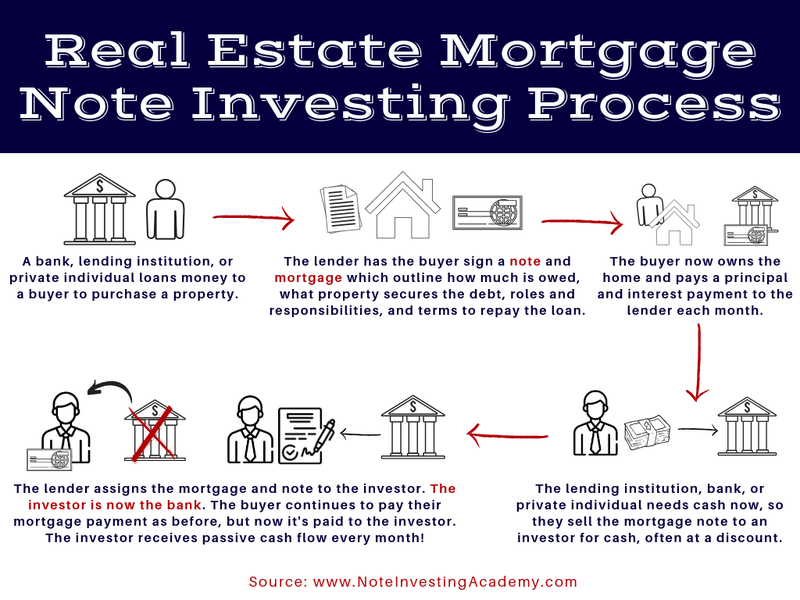

How do promissory notes work in real estate?

The bill has a written and signed promise to repay the borrowed money. The document states the terms of the loan and the parties to the loan, but does not describe in detail what happens if the borrower defaults. The bill of exchange may be secured or unsecured, depending on the terms of the loan.

What is a note in banking?

A bond, also known as a bill of exchange, is a legal debt instrument in which one party gives a written promise to pay the other party a certain amount of money under certain conditions.

How does the note work? A note is a legal document that acts as an IOU from the borrower to the creditor or investor. Bonds have similar characteristics to bonds, in which investors receive interest in holding the bond and are repaid in the future the initial amount invested, called the principal amount.

What does notes mean in money?

Definition: A bond, often called a promissory note, is a written promise to pay a certain amount of money in the future. In other words, a note is a loan agreement between a borrower and a borrower.

What are bank money notes?

There are currently six banknotes and four coins in circulation in Zambia. These are: K100, K50, K20, K10, K5, K2 banknotes K1, 50N, 10N and 5N coins. Zambian banknotes are printed with features that reflect the people’s economy, culture and history.

What does notes mean in bank?

Definition: A banknote, also known as paper money or a bill of exchange, is a form of bearer bill issued by a bank that must be paid on demand. Banknotes are legal tender and can be used to pay all debts.

Is a bank note a loan?

Short-term banknotes are bank loans with a maturity of one year or less.

Is a note considered a loan?

Understanding Bonds A bond is a debt security that obliges you to repay a loan at a pre-determined interest rate over a specified period of time. Bonds are similar to bonds, but usually have a earlier maturity than other bonds, such as bonds.

Is a bank note a promissory note?

The South African currency has evolved since the early days when barter for valuables was a common form of trading. Commercial banks kept and secured people’s valuables and issued bills of exchange in return. … Banknotes and coins are used for transactions on a daily basis.

What is considered a bank note?

A banknote is a negotiable bond that can be used by one party to pay a certain amount of money to another party. … banknotes are considered legal tender; together with coins, they form the carrier forms of all modern money. The banknote is called an “invoice” or a “letter”.

What is an example of a bank note?

Some examples are plate – proof banknotes, test banknotes, study marks, copies and hell banknotes (commonly found in Asian countries).

What are the different types of bank notes?

The Federal Reserve is currently issuing 1-, 2-, 5-, 10-, 20-, 50- and 100-dollar bills.

What is considered a bank note?

A banknote is a negotiable bond that can be used by one party to pay a certain amount of money to another party. … banknotes are considered legal tender; together with coins, they form the carrier forms of all modern money. The banknote is called an “invoice” or a “letter”.

Is a personal check a bank note?

In the US, banknotes usually enter the circulation through the Federal Reserve. Historically, banknotes contained precious metals such as gold and silver and could be exchanged. Alternatives to banknotes include credit and debit cards, checks, payment applications, and cryptocurrencies.

What is the legal definition of a note?

1. A written statement by an individual to pay a sum of money to another private individual or bond issuer within a specified period of time. It is a compromise between two people. 2.

What is the legal definition of a bill of exchange? Unconditional promise to pay a certain amount of money to a named party or the holder of a banknote or to deposit that money at the direction of such persons. The bill of exchange must be in writing and signed by the issuer of the promise.

What is in a note?

The promissory note contains all the conditions set by the issuer for the indebtedness, such as the amount, term, interest rate, date and place of issue, as well as the issuer’s signature.

What is a note saying?

the sign says. to say the least. a message that says. exact (8) In response I received a letter: “Dear Forest fan.

What is French for notes?

French translation. notes. More French words for note.

What is an example of a note?

Bonds are usually, but not always, medium-term debts. For example, government bonds (T-bonds) are medium-term bonds issued by the US Treasury. They mature in two, three, five or ten years. You may hear people use the phrase “carrying a bond”, which means taking on debt from another issuer.

What are legal notes called?

A bond, sometimes called a bond, is a legal instrument (specifically a financial instrument and a debt instrument) in which one party (the issuer or issuer) agrees to pay in writing a specified amount of money to the bond. another (payee) at a fixed or determinable future time, or …

What are the three types of promissory notes?

Types of bills of exchange

- A simple bond. …

- Student loan bill. …

- Real estate bond. …

- Personal loan bonds. …

- Car bond. …

- Commercial paper. …

- Investment bill.

Is a note a legal document?

As stated above, a mortgage loan is a legal document that sets out all the terms of the mortgage between the borrower and his lending institution.

What is promissory note in law?

“More” is a written instrument (other than a banknote or a banknote) that contains an unconditional commitment by the maker to pay a certain amount of money only or on order. , to a specific person or wearer.

What is the difference between a note and a term loan?

The interest rate can be fixed or variable; bond interest rates are generally fixed. Term loans are usually repaid within one to five years.

What are the 3 types of term loans? There are three main classifications of term loans: short-term loans, medium-term loans and long-term loans.

What’s the difference between loan and notes?

Bills of exchange are generally used for informal relationships as loan agreements. The bill can be used for a friend’s and family loan or a short-term small loan. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new businesses.

Do you pay tax on loan notes?

The taxation of loan bonds depends on whether they are structured as qualifying corporate bonds (QCB) or non-qualifying corporate bonds (non-QCB). QCBs are exempt assets from capital gains tax, which means that the proceeds from the sale are not taxable and no losses are allowed.

Is a personal loan considered a note?

A bill of exchange is a legally binding agreement that sets out all the details of the loan. … We know the best way to use bills of exchange when we take a private loan, student loan or other type of credit from a bank or lender.

Is a loan note a debt?

Loan bonds, also known as loan shares, are a type of bond called a bond. … Convertible debt securities represent the right to subscribe for or convert shares into the shares of the issuing company and are therefore generally unsecured.

Is a term loan A note?

A letter of credit is a legally binding agreement that contains all the terms of a loan, such as the payment schedule, payment term, principal, interest rate, and any prepayment penalties.

What is classified as a term loan?

What is a term loan? A term loan is a fixed amount of money, usually for a term of one to ten years, to be repaid with agreed interest.

Is a loan note a loan?

A loan letter is a type of financial instrument; it is a loan agreement that states when the loan is to be repaid and usually the interest due. It is similar to a bill of exchange, but the differences can be significant in terms of consequences, especially tax consequences.