Does SARS check your bank account?

Contents

- 1 Does SARS check your bank account?

- 2 How do the rich pay off loans?

- 3 Do I have to pay taxes on money loaned to me?

- 4 Is interest on a promissory note reported to the IRS?

- 5 What happens if you loan someone money and they don’t pay back?

SARS now has access to all bank details, including all payments made or amounts received in your accounts. … A wide variety of information must be disclosed, including monthly totals of all credits and debits on an account.

What information do banks send to SARS? The specific information that banks will at this point be required to report to SARS under the notice, for both individual and corporate taxpayers, includes: Names, surnames, date of birth/Registered name if legal person. Address, identification number/registration number if legal person, taxpayer number.

Can SARS block your bank account?

A: In order to “freeze” the bank account, SARS would have to obtain an arrest warrant pursuant to art. not be terminated or void (section 163(4)).

Can SARS take money from your bank account?

We are in the midst of tax season in South Africa, with taxpayers filing their tax returns and some facing challenges with the revenue collector. One such challenge involves the South African Revenue Service (SARS) withdrawing money from taxpayers’ bank accounts through a process called Third Party Appointment (TPA).

Can tax department freeze bank accounts?

The department cannot freeze the taxpayer’s bank account if the appeal has been filed with mandatory pre-deposit. (ii) A copy of the memorandum of appeal submitted to the appellate body.

Why would my bank account be blocked?

Banks can freeze bank accounts if they suspect illegal activities, such as money laundering, terrorist financing, or issuing bad checks. Creditors may seek judgment against you, which could lead to a bank freezing your account. The government may request an account freeze for any unpaid taxes or student loans.

How does SARS investigate?

SARS is statutorily mandated by its legislation to conduct criminal investigations into tax offences. Once the criminal investigation of the alleged tax offense is completed, a formal complaint is filed with the South African Police Service to initiate the criminal justice process.

What is common reason to file a suspicious activity report SAR?

In the United States, financial institutions must file a SAR if they suspect that an employee or customer has engaged in insider trading activities. A SAR is also required if a financial institution detects evidence of computer hacking or a consumer operating an unlicensed money services business.

In what types of accounts can suspicious activity occur?

An illustrative list of instruments or mechanisms that may be used in suspicious activities includes, but is not limited to, wire transfers, letters of credit and other commercial instruments, correspondent accounts, casinos, structuring, shell companies, bonds/notes, stocks, funds, insurance policies, travelers checks…

What amount triggers a suspicious activity report?

Under federal rules, banks and financial institutions are required to file a SAR whenever they flag a transaction of at least $5,000 as suspicious.

Can the government check your bank account?

The short answer: Yes. The IRS probably already knows many of your financial accounts, and the IRS can get information about how much is there. But in reality, the IRS rarely delve into your bank and financial accounts unless you are being audited or the IRS is collecting back taxes from you.

Can the government find your bank accounts?

Yes, the government can look at the individual personal bank account. Government agencies such as the Internal Revenue Service can access your personal bank account. If you owe taxes to a government agency, the agency may place a lien or freeze a bank account in your name.

Do banks report deposits to HMRC?

Not normally. Banks sometimes (actually quite often) report large deposits to the NCA which is responsible for investigating financial crimes. But HMRC is responsible for taxes, and they generally don’t care whether people make large deposits or not – as long as they pay the tax owed.

How much money are you allowed to have in the bank?

The bank you work with manages the accounts on your behalf, ensuring that no account has more than the $250,000 limit.

How do the rich pay off loans?

Rich people use credit cards often so they can earn rewards – but pay the balance in full so they don’t pay interest. By living on a budget and avoiding getting into debt for assets that don’t increase in value, you too can borrow like a wealthy person.

How do rich people use debt to their advantage?

How do billionaires take out loans?

The simple answer: they don’t need loans. They need tax breaks, and they can get them by borrowing – at extremely low interest rates – from their mountains of assets.

How do billionaires pay themselves?

Billionaires avoided taxation by paying themselves very low wages while amassing fortunes in stocks and other assets. They then borrow these assets to finance their lifestyles, rather than selling the assets and paying capital gains taxes.

How do billionaires borrow money?

When the richest man in the world wants money, he can simply borrow money by placing — or pledging — some of his Tesla shares as collateral for lines of credit, rather than selling stock and paying capital gains taxes.

Do billionaires live off loans?

In fact, an estimated 90% of millionaires own real estate. … As a result, wealthy individuals with investment opportunities can use existing real estate as collateral for long-term, low-interest loans.

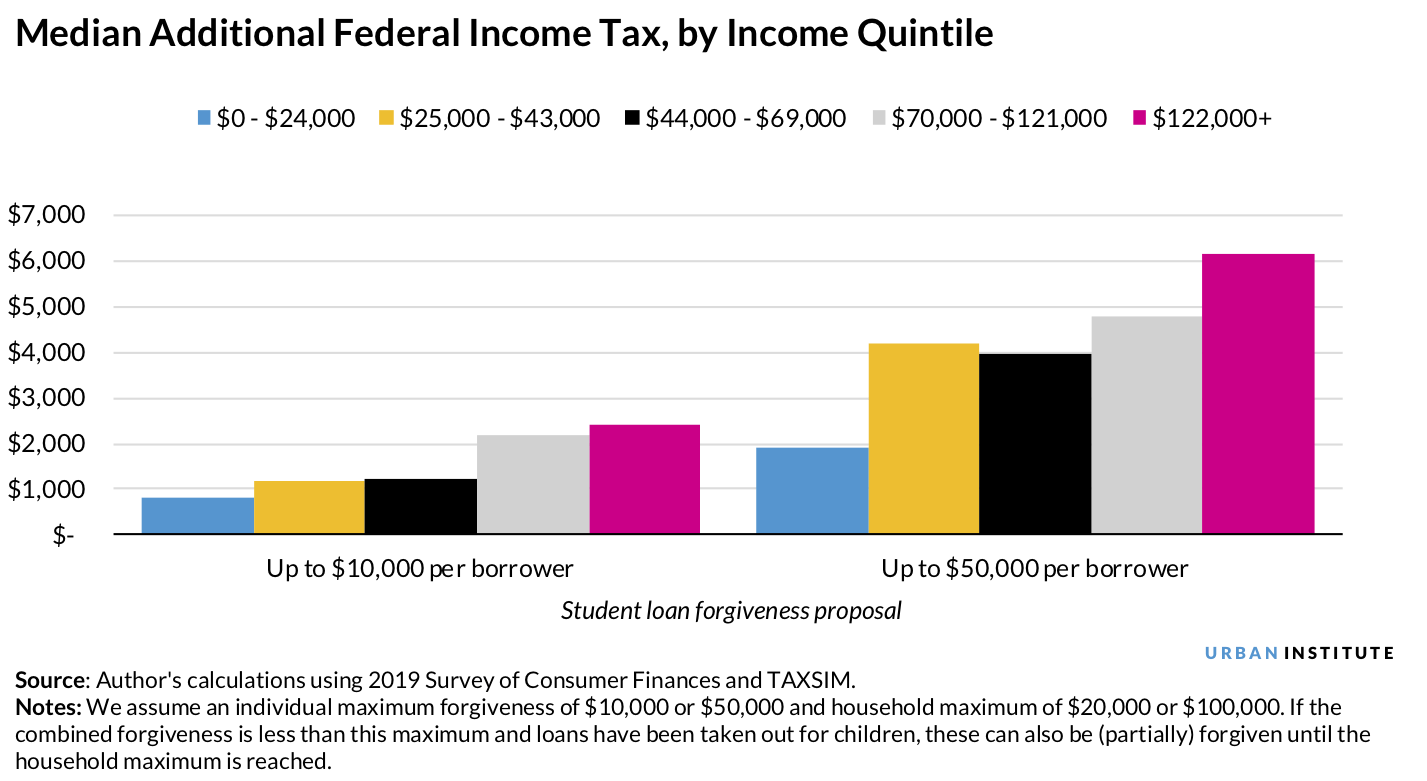

How do billionaires use loans to avoid taxes?

Rich people can use their stock portfolios to get cheap loans and avoid capital gains tax. A rally in the stock market and low interest rates have boosted borrowing among America’s wealthy. Real estate cash deals are a popular use of this strategy.

Do I have to pay taxes on money loaned to me?

As personal loans are loans and not income, they are not considered taxable income and therefore you do not need to report them on income tax.

How much money can you lend to a family member without paying taxes? If you have the financial means, consider giving money to family members with no strings attached. For 2019, family members can donate up to $15,000 per individual gift recipient without triggering gift tax laws.

Do you have to pay tax on a loan from family?

There are unlikely to be any immediate tax consequences if parents or other family members lend you a loan. But if you agree to pay interest, the creditor may have to pay tax on the interest you receive, depending on your individual tax position.

Do you have to pay tax on a loan from family UK?

Typically, when you get a loan, you have to pay it back, often with interest added. … And, they don’t pay any tax on that money, even if it’s clearly income. It is highly unusual to receive your salary in loans and is clearly a method used to avoid paying taxes.

Do you have to declare a loan from family?

It is a common belief that since family loans are a personal arrangement, there will be no tax implications involved. However, if there is interest involved, you will need to inform HMRC and complete a self-assessment as it could be considered taxable income. For interest-free loans, you will not need to inform HMRC.

Do you have to pay taxes if someone loans you money?

Personal loans are generally not taxable because the money you receive is not income. … If you get a personal loan from a friend or family member, there may be other tax implications, but the money still won’t be taxable income for you.

Does the IRS require interest on family loans?

The IRS requires that any loan between family members be made with a signed written agreement, a fixed payment schedule, and a minimum interest rate. … On the other hand, if the lender wants to forgive the loan, the unpaid amount will be treated as a gift for tax purposes.

What is the minimum interest rate for a family loan IRS?

AFRs are published monthly and represent the minimum interest rates that must be charged for family loans to avoid tax complications. The Section 7520 interest rate for January 2021 is 0.6%.

Do you have to pay taxes on money borrowed from family?

Filing a Gift Tax Return for a Loan In most cases, you will not have to pay taxes for a “loan” that the IRS has deemed a gift. You only owe gift tax when your lifetime gifts to all individuals exceed the Lifetime Gift Tax Exclusion. For fiscal 2017, that threshold is $5.49 million. For most people this means they are safe.

Does the IRS require interest on loans?

Lend money to someone at zero interest and you will not profit from the business. The tax code expects you to charge a certain amount of interest for a loan – and even if you don’t, you could be taxed as if you did. … The IRS refers to this as “imputed interest”.

What is the minimum interest rate for a family loan IRS 2021?

The IRS has released the Applicable Federal Rates (AFRs) for January 2021. The AFRs are published monthly and represent the minimum interest rates that must be charged for family loans to avoid tax complications. The Section 7520 interest rate for January 2021 is 0.6%.

What is applicable federal rate for family loan?

AFRs for December 2019: 1.59% for “short-term” loans of three years or less. 1.67% for “medium-term” loans of more than three years, but not more than nine years. 2.07% for “long-term” loans over nine years.

What is the minimum IRS interest rate?

You may face tax implications if you charge no interest rate or an interest rate of less than 1.00%.

What is the lowest interest rate you can charge a family member?

0.66% for “short-term” loans of three years or less. 1.29% for “medium term” loans of more than three years, but not more than nine years. 1.93% for “long-term” loans over nine years.

Is interest on a promissory note reported to the IRS?

Interest income on a promissory note should normally be included as taxable income for the year it was received. While there is a reporting requirement, not all promissory note income is reported to the IRS.

What interests must be reported to the IRS? If you earn more than $10 in interest from any person or entity, you must receive a Form 1099-INT that specifies the exact amount you received in bank interest for your tax return. Technically, there is no declared minimum income: any interest you earn must be declared on your income tax return.

Is interest income from a promissory note taxable?

Generally, any income you generate from a promissory note is taxable income and must be reported. The income generated is simply the interest you earned on the note for the tax year in question. If you loaned the money personally and not through your company, report the income on your personal income tax return.

Do I need to issue a 1099 for interest paid on a loan?

Companies that pay an individual interest of $10 or more on a loan must file a Form 1099 INT. For example, if a company pays interest to a shareholder, the company must file a Form 1099 for the interest. Principal repayments are not reportable.

Who pays taxes on a promissory note?

When a lender forgives a loan, the forgiven amount is treated as taxable income, which must now be reported by the borrower on their tax returns. At the time of reporting to the IRS, creditors must issue Form 1099-C, Cancellation of Debt, to borrowers.

How do I report a promissory note on my taxes?

If you are receiving promissory interest, enter it as if you had received form 1099-INT. In the Received from box, you can enter Interest Promissory Note and the name and any CPF, if any.

Do I need to issue a 1099 for interest paid on a loan?

Companies that pay an individual interest of $10 or more on a loan must file a Form 1099 INT. For example, if a company pays interest to a shareholder, the company must file a Form 1099 for the interest. Principal repayments are not reportable.

Who is required to send a 1099 INT?

If a company earns at least $600 in interest during the year from an interest-bearing private account, a Form 1099-INT must be issued. This is taxable money and the IRS requires liability on all parties, which is the purpose of Form 1099-INT.

Do I need to issue a 1099 INT for a personal loan?

Do I have to submit a 1099 int form to someone to report interest received on a personal loan to my daughter to pay off her second home mortgage? No, you do not need to send a 1099 to your daughter. You are not in the lending business or trade. Interest on 1099 INT.

Do I need to send a 1099 to a loan company?

When you have a loan, there is a note, with an amortization schedule. Both must have a copy of this amortization schedule. Your obligation is to file a Form 1099-INT to report the interest you paid her – not the total monthly payments. … You only deduct interest expense as a business expense.

How do you report interest on a promissory note?

If you are receiving promissory interest, enter it as if you had received form 1099-INT. In the Received from box, you can enter Interest Promissory Note and the name and any CPF, if any. However, only the amount is needed.

How do I report interest paid on a loan?

Reporting Requirements for Loan Interest Income To report this income, the borrower who pays the interest fills out a 1099-INT form and sends one copy to the lender and another to the IRS. The form specifies the total amount of interest paid to the creditor during the tax year.

Can you deduct interest on a promissory note?

If you are paying the promissory interest and this is a personal loan, you cannot deduct the interest. According to the IRS, only a few categories of interest payments are tax deductible: Interest on home loans (including mortgages and real estate loans) … Interest on money borrowed to buy investment properties.

Do you have to charge interest on promissory note?

With Few Exceptions, You Need to Charge Interest Unfortunately, the IRS can “impute” the interest received from the seller, even if the parties agree to zero interest or a rate below the rates published by the IRS.

What happens if you loan someone money and they don’t pay back?

If you receive interest on the loan, that is income and must be declared on your taxes. If you are not refunded, the money could be considered a gift to the other person, and both you and they may have to count it on your taxes if it is over a certain dollar amount threshold.

How can I legally get my money back from a friend? Procedure to recover money from a friend legally

- 105 votes. Hi.. …

- It’s very simple sir. Send him a legal notice for the recovery of the money. …

- You can file a case under section 138 of the Marketable Instruments Act if the payment you are given is not cash. You must file it within the statute of limitations.

Can you sue someone for not paying back borrowed money?

Yes, you can sue someone who owes you money. When someone keeps “forgetting” to pay you or refuses to pay, the situation can quickly become frustrating. You can take the matter to a small claims court and file legal action if you meet the minimum and maximum money limits.

How do I sue someone for unpaid loans?

Contact the small claims court in your county or the county where the loan was made. A lawsuit can be filed up to four years after a loan has not been paid, and you may have moved since then. Filing in the wrong place will likely cause your case to be filed.

What can I do if someone owes me money and refuses to pay?

Take someone to small claims court. Someone owes you money but won’t pay it? You can take them to small claims court to get your money back (and your temper).

Can you sue someone for not returning borrowed money?

If you’ve loaned someone money and they refuse to pay it back, it’s natural to think, “Can I sue someone who owes me money?” The answer is yes, you can. That’s why the small claims court exists. It is a specific type of court that adjudicates cases between two parties without the need for expensive and lengthy proceedings.

What can you do legally if someone owes you money?

If you think someone owes you money or has violated the rules of a contract, you can sue them in court. This includes some employment issues such as wrongful termination and unpaid wages. If you are asking for $35,000 or less, you can file a claim in Small Claims Court.

Can you sue someone who owes you money without a contract?

If you rushed into a business transaction or loaned money to a friend in need and it was not repaid, you may have questions about suing for money owed without a contract. Just watch an episode of People’s Court or Judge Judy and you’ll see that, yes, you can sue for a verbal agreement.

Can I take a friend to court for owing me money?

To win a case, you need to have some evidence that your friend owes you money. This does not have to be a written legal contract, with witnesses, etc. Suing someone for money is a civil case and the judge will decide who wins “on the balance of odds” by looking at which story seems most likely.