Can I get my mortgage note online?

Contents

- 1 Can I get my mortgage note online?

- 2 What are the pros and cons of structured notes?

- 3 How do you make money with mortgage notes?

- 4 How do real estate notes make money?

- 5 What is the difference between a mortgage and a mortgage note?

Mortgage notes can be purchased through mortgage note brokers (you can find hundreds of them online).

What if the bank loses my mortgage note? Even in the event of a loss of a bill, the legal obligation remains to repay the loan. The lender has the right to “re-establish” the note legally as long as he has not sold or transferred the note to another party.

Where can I find my promissory note?

You can get a copy of your master promissory notes by going to studentloans.gov and entering your FSA ID. Click “Completed Master Promissory Notes” under the menu bar header that says “My Loan Documents”. The completed main promissory notes will appear and you can download them directly.

Who keeps the original promissory note?

The buyer of the note becomes what is called the “holder” because he holds your note as the owner of the note. A cardholder has a special right to collect from you immediately if you don’t pay. But only the holder of an original bill of exchange can collect from you. A bill of exchange can change many hands when it is bought and sold.

Are promissory notes recorded?

Unlike a mortgage or trust deed, the promissory note is not registered in the county land records. The lender holds the bill while the loan is pending. When the loan is paid off, the note is marked as “paid in full” and returned to the borrower.

What happens if a promissory note is lost?

A bill of exchange, in simpler terms, is the recognition of a debt. … Even in the event of a loss of a bill, the legal obligation remains to repay the loan. The lender has the right to “re-establish” the note legally as long as he has not sold or transferred the note to another party.

Are mortgage notes recorded?

Note: this is the “IOU” between a lender and a borrower. So anyone who is a borrower on the note is personally responsible for repaying the debt to the lender. The note is not filed in court, so the original note is returned to the lender upon closing.

Does a mortgage note need to be recorded?

Mortgages are proprietary interests and therefore can and should be registered as soon as possible after closing. Most states have registration statutes that impose restrictions on when and how a document conveying property rights can be legally created. Registration statutes are important for several purposes.

How do you get a copy of your mortgage note?

If you lose your closing papers or are destroyed, you can obtain a copy of your mortgage note by searching county records or by contacting the deeds register. You can also obtain a copy from the loan company (the company you receive your statements from).

Does a note need to be recorded?

Bills of exchange are usually not posted. They are executive even if not registered. Hiring a lawyer is an important decision that shouldn’t be based solely on advertising. The…

How do I get a copy of my mortgage note?

If you lose your closing papers or are destroyed, you can obtain a copy of your mortgage note by searching county records or by contacting the deeds register. You can also obtain a copy from the loan company (the company you receive your statements from).

How do I get a copy of a note?

You can contact your lender and request a copy of the note. You can get the security tool like your mortgage or trust deed from the county clerk’s office in your county, however, it won’t normally contain the terms of the note. If your lender is unable to provide a copy of the note, the note is likely to be lost.

What is a mortgage note document?

As stated earlier, the mortgage note is a legal document that establishes all the terms of the mortgage between a borrower and his lender. Includes terms such as: The mortgage loan amount. The amount of the down payment. Whether monthly or bi-monthly payments are required.

What are the pros and cons of structured notes?

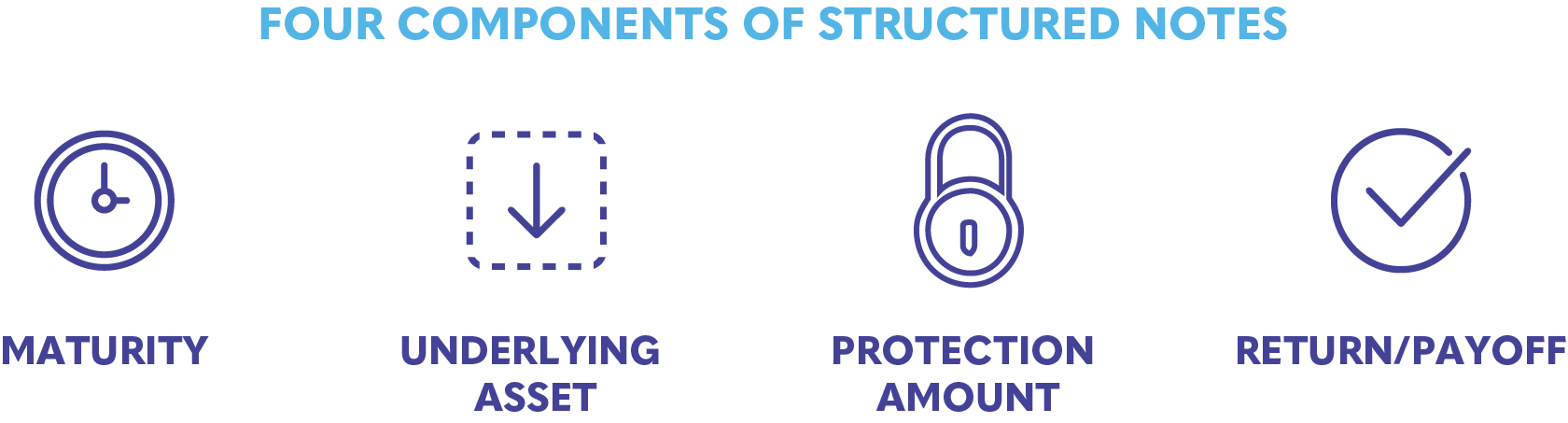

The benefits of a structured note include higher potential returns than CDs, participation in the upside of the market while limiting downside exposure, and customized parameters of the note based on the level of risk. Some structured notes may have a “buffer”, which describes the downside protection.

What are the benefits of taking structured notes? The flexibility of structured notes allows them to provide a wide variety of potential earnings that are hard to find elsewhere. Structured securities may offer greater or lesser upside potential, downside risk and overall volatility.

Do structured notes pay interest?

A bank issues a structured note with no interest rate. Instead, the return on the note is based on the performance of the S&P 500. By linking the return to the S&P 500 the bank created a derivative. It did not invest directly in related shares.

Why are structured notes not right for you?

Investment banks issue structured notes, which are debt obligations with an embedded derivative component. The value of the derivative is derived from an underlying asset or group of assets, also known as a benchmark. … Call risk, lack of liquidity and inaccurate pricing are other disadvantages of structured notes.

Are structured notes fixed income?

What are structured fixed income securities? Fixed income securities are a type of fixed income investment for investors looking to increase yield, express a particular view on interest rates or hedge existing investment portfolios.

What are the pros and cons of structured notes?

The benefits of a structured security include higher potential returns than CDs, participation in the upside of the market while limiting downside exposure, and customized parameters of the stock based on your level of risk. Some structured notes may have a “buffer” describing downside protection.

Why are structured notes not right for you?

Credit risk If you invest in a structured security, you intend to hold it until maturity. … As with any IOU, loan or other type of debt, there is a risk that the issuing investment bank could get into trouble and lose its obligation.

Are structured notes guaranteed?

These products can accept traditional securities such as an investment grade bond and replace normal payment characteristics with non-traditional payments. Structured products can in principle be guaranteed that the issue will return to maturity.

What are the pros and cons of structured notes?

The benefits of a structured security include higher potential returns than CDs, participation in the upside of the market while limiting downside exposure, and customized parameters of the stock based on your level of risk. Some structured notes may have a “buffer” describing downside protection.

Are structured products high risk?

A structured product is a hybrid investment consisting of a bond and an option. They offer the potential for higher returns on your investment than a standard deposit. Structured products are low-risk investments and can receive up to 100% capital protection.

Are structured notes fixed income?

What are structured fixed income securities? Fixed income securities are a type of fixed income investment for investors looking to increase yield, express a particular view on interest rates or hedge existing investment portfolios.

What type of investment is a structured note?

A structured note is a debt obligation, basically like an issuing investment bank IOU, with an embedded derivative component. In other words, it invests in assets via derivative instruments. A five-year bond with an option contract is an example of a type of structured note.

What is a structured income note?

A structured note is a debt security issued by financial institutions. Its performance is based on stock indices, a single stock, a basket of stocks, interest rates, commodities or foreign currencies. The performance of a structured note is linked to the performance of an underlying asset, group of assets or index.

Are structured notes an alternative investment?

Structured products typically have two components: a note and a derivative, which is often an option. … Structured products are usually created to meet specific needs that cannot be met by standardized financial instruments available in the markets. They can be used as: alternative to direct investment.

How do you make money with mortgage notes?

Note buyers can profit from purchasing the loans as they will receive interest from these loans and can buy them at a discount from the lenders. Note takers can work with lenders who provide them with loans and receive monthly checks without having to check with the borrower.

Is investing the notes profitable? Fewer still know the secret that makes investing in banknotes so profitable: they are sold at a discount from your balance. This discount offers the investor a higher return than the note’s interest rate. … If you bought it for $ 50,000, your return would be six percent. Not bad.

How do real estate notes make money?

Real estate investors make money on notes by investing through the purchase of mortgages from lenders who no longer want them. In essence, they buy the debt. As a result, the investor is able to collect mortgage payments and interest just like banks do.

How do notes work in real estate?

A real estate note is simply a property-backed IOU. In a conventional real estate transaction, a buyer makes a down payment, obtains a loan, and signs a note promising to pay the lender a certain amount each month until the loan is paid, plus interest.

How do mortgage notes make money?

Banks create and sell mortgage bills as part of their business model. They make money by lending and receiving interest. The more they lend, the more they earn. There are guidelines on how much money a bank must hold in reserve in order to lend – this amount is called the reserve ratio.

How does a note investment work?

Investors typically buy distressed securities from other lenders at a discount on face value. Lenders and investors sell their impaired notes to cash out quickly and avoid time-consuming and costly foreclosure procedures.

How does a note investment work?

Investors typically buy distressed securities from other lenders at a discount on face value. Lenders and investors sell their impaired notes to cash out quickly and avoid time-consuming and costly foreclosure procedures.

How do real estate notes make money?

How to make money with real estate notes

- Using P2P. Over the past decade, peer to peer (P2P) groups have sprung up online that grant mortgage loans or down payments to home buyers. …

- Finding private lenders. …

- Purchase of existing notes. …

- Investing in mortgage REITs.

How does an investment note work?

A note is a legal document that serves as an IOU from a borrower to a lender or investor. Securities have bond-like characteristics in which investors receive interest payments to hold the security and the amount originally invested, called principal, is repaid at a future date.

Is buying notes a good investment?

If you are looking for passive income without buying physical property, mortgage notes can be an ideal real estate investment. You will receive monthly income in the form of principal and interest repayments on the underlying mortgage.

How does a mortgage note work?

In essence, a mortgage note is an agreement that promises that money borrowed from a lender will be repaid by the borrower. The mortgage note also explains how to repay the loan, including details on the monthly payment amount and repayment duration.

What does a mortgage note do?

A mortgage note is the document you sign when your home is closed. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if not.

What is the difference between a mortgage and a mortgage note?

The difference between a bill of exchange and a mortgage. The main difference between promissory note and mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

Does the mortgage note commit you to paying your loan?

Mortgage notes provide security for lenders during the lending process, as without the note, borrowers would not be legally obligated to repay the loan. Once the note has been signed by both parties, it is legally binding and gives the lender the ability to take legal action if the borrower defaults on the loan.

How do real estate notes make money?

Real estate investors make money on notes by investing through the purchase of mortgages from lenders who no longer want them. In essence, they buy the debt. As a result, the investor is able to collect mortgage payments and interest just like banks do.

How Do Mortgage Notes Make Money? Banks create and sell mortgage bills as part of their business model. They make money by lending and receiving interest. The more they lend, the more they earn. There are guidelines on how much money a bank must hold in reserve in order to lend – this amount is called the reserve ratio.

How do notes work in real estate?

A real estate note is simply a property-backed IOU. In a conventional real estate transaction, a buyer makes a down payment, obtains a loan, and signs a note promising to pay the lender a certain amount each month until the loan is paid, plus interest.

What is a note in real estate?

A mortgage is a type of contract. What makes it special is that it is a loan secured by real estate. A mortgage note is the document you sign when your home is closed. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if not.

What does it mean to buy a note on a house?

When you buy a note and a mortgage, you are buying the outstanding debt on the note, backed by the asset outlined in the mortgage. You are not buying the property, you are buying the debt and securing the interest on the property. In essence, a banknote buyer steps into the bank’s shoes.

How does a note investment work?

Investors typically buy distressed securities from other lenders at a discount on face value. Lenders and investors sell their impaired notes to cash out quickly and avoid time-consuming and costly foreclosure procedures.

What is investing in real estate notes?

Mortgage note investment is the ownership of real estate without property management or without becoming a landowner where the homeowner pays the investor rather than the bank. It is an inexpensive way to invest in real estate.

What does it mean to buy notes?

When investing in banknotes, you buy the debt secured by a piece of property, the promise of repayment and (generally) the right to foreclose and recover the investment if the borrower fails to meet obligations or make payments. You simply don’t own the physical property.

How does a note investment work?

Investors typically buy distressed securities from other lenders at a discount on face value. Lenders and investors sell their impaired notes to cash out quickly and avoid time-consuming and costly foreclosure procedures.

How does an investment note work?

A note is a legal document that serves as an IOU from a borrower to a lender or investor. Securities have bond-like characteristics in which investors receive interest payments to hold the security and the amount originally invested, called principal, is repaid at a future date.

Is buying notes a good investment?

If you are looking for passive income without buying physical property, mortgage notes can be an ideal real estate investment. You will receive monthly income in the form of principal and interest repayments on the underlying mortgage.

Can you make money investing in notes?

Investing in banknotes can be profitable in most scenarios, but in almost all cases the greater the discount negotiated at the time of purchase, the greater the chances of earning more from the investment.

What is the difference between a mortgage and a mortgage note?

The difference between a promissory note and AMP; a mortgage. The main difference between promissory note and mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

What does a mortgage note include? The note will provide you with details regarding your loan, including the amount owed, the mortgage loan interest rate, the dates payments are due, the repayment term, and where payments are to be made. sent.

Does a mortgage note commit you to paying your loan?

Mortgage notes provide security for lenders during the lending process, as without the note, borrowers would not be legally obligated to repay the loan. Once the note has been signed by both parties, it is legally binding and gives the lender the ability to take legal action if the borrower defaults on the loan.

What does a mortgage note do?

A mortgage note is the document you sign when your home is closed. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if not.

What is the difference between a note and a loan?

A promissory note is a simple document that isn’t as complex as a loan agreement and can be shorter and less detailed. … Unlike a bill of exchange, a loan agreement imposes obligations on both parties, which is why both the borrower and the lender have to sign the agreement.

Can you be on the note and not the mortgage?

Lenders require co-signatories to sign the note, but not the deed, upon closing. Borrowers can remove themselves from the deed, giving up their property rights, but they remain on the note and are responsible for repaying the loan. In both cases, your credit is implicated in the event of a default.

Is a mortgage the same as a mortgage note?

The mortgage note is a legal document that establishes all the terms of the mortgage between a borrower and his lender. Includes terms such as: The mortgage loan amount.

What is the difference between a mortgage and a mortgage note?

The difference between a bill of exchange and a mortgage. The main difference between promissory note and mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

How do I find my mortgage note?

The mortgage note is part of your closing documents and you will receive a copy upon closing. If you lose your closing papers or are destroyed, you can obtain a copy of your mortgage note by searching county records or by contacting the deeds register.

Can you be on the note but not the mortgage?

In the event of non-payment of the note, the lender can foreclose the home and sell it. The mortgage or trust deed must be signed by all the owners of the property. … But if you have not signed the mortgage it is because you are not co-owner of the house.

Can you be on the note but not the mortgage?

In the event of non-payment of the note, the lender can foreclose the home and sell it. The mortgage or trust deed must be signed by all the owners of the property. … But if you have not signed the mortgage it is because you are not co-owner of the house.

What is the difference between the mortgage and the note?

The difference between a bill of exchange and a mortgage. The main difference between promissory note and mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

Can a borrower be on the note but not on title?

The entire definition of “mortgage” requires a borrower to be the nominee because a mortgage refers to a debt or promissory note linked to real estate as collateral. If the borrower is not the owner, the property cannot be tied to the bill of exchange. Buyers can own the property without being on loan.

Does the note follow the mortgage?

Law in the United States has long followed the Mary’s Little Lamb rule: wherever the mortgage note goes, the related mortgage will surely follow. Restatement (Third) of Property (Mortgage) § 5.4.