Is notes payable a non current liability?

Contents

- 1 Is notes payable a non current liability?

- 2 What is notes in financial statements?

- 3 What are notes due to banks?

- 4 What is the first item in presenting the notes?

- 5 Is Notes Payable an asset?

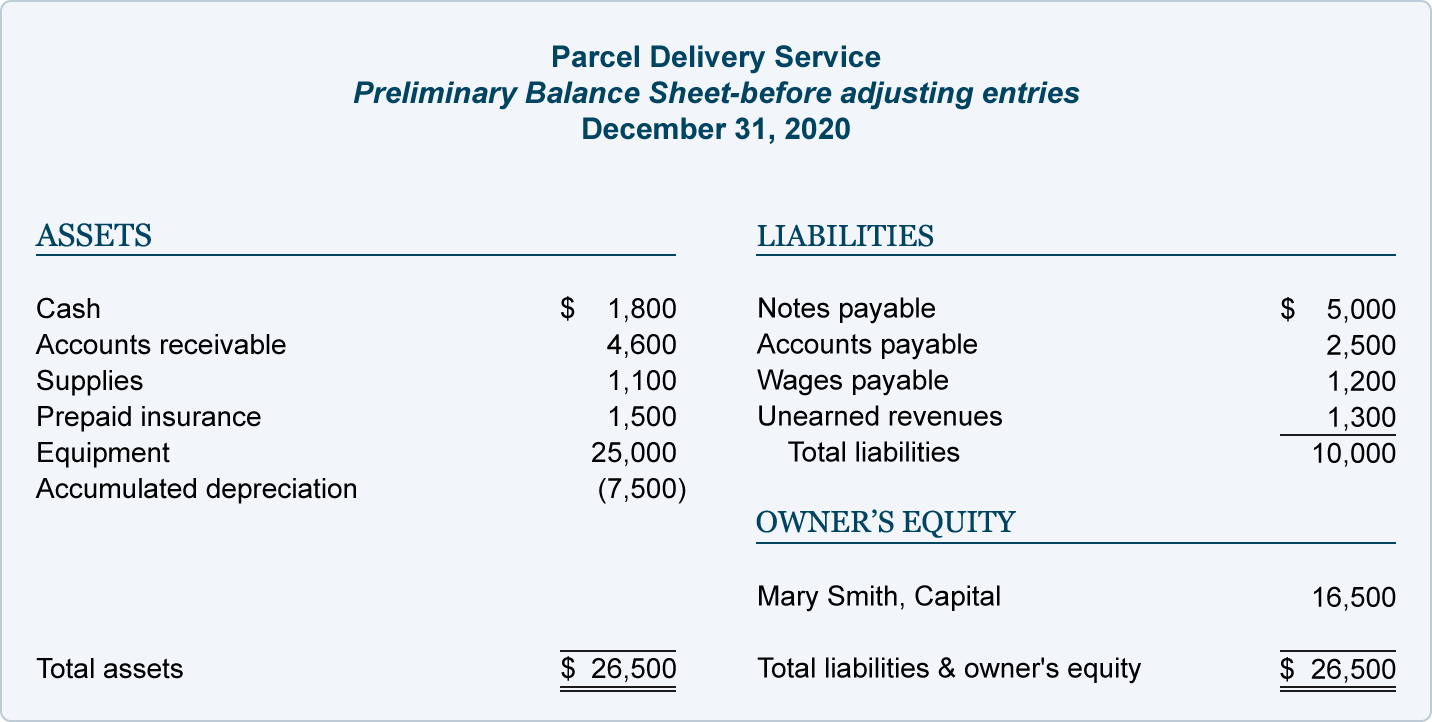

Notes to be paid are classified as current debts when the amount is due within one year of the balance sheet. … Paymentable documents always require interest payments. Interest owed over the unpaid period must be collected.

Are the documents available a current responsibility? Examples of current loans include repayment accounts, short-term loans, dividends, and disbursements as well as income tax liabilities.

Can notes payable be non-current liabilities?

Defining Payable Notes Payable Notes Payable is a general ledger account which accounts for the number of facets of promissory notes produced. … the amount not deducted within one year of the balance sheet will be a temporary or long-term liability.

Why is Notes payable a non-current liability?

The balance in Payable Notes stands for the remaining amount to be paid. Since the issuance letter requires the issuer / lender to pay interest, the issuing company will have an interest expense. … the amount not deducted within one year of the balance sheet will be a temporary or long-term liability.

Is long term notes payable a non-current liabilities?

List of non-existent loans: Depositing bonds. Long-term transcripts can be provided.

What is included in non-current liabilities?

Non-existent loans include borrowing, long-term loans, bond payable, deferred tax loans, long-term lease obligations, and pension benefit obligations.

Are accounts payable Non-current liabilities?

Accounts payable are considered current liability, not property, balance sheet.

Is accounts payable a current or noncurrent asset?

No, the accounts payable are not current assets. Current assets are any assets that will provide financial benefits for up to one year or so. Accounts payable are debts owed to third parties for goods received but not yet paid.

What accounts are non current liabilities?

Non-existent loans include borrowing, long-term loans, bond payable, deferred tax loans, long-term lease obligations, and pension benefit obligations. The part of the guarantee that will not be paid within the next year is divided into non-existent responsibilities.

Are all current liabilities accounts payable?

What are some of the Current Responsibilities listed on the balance sheet? The most popular loans currently available on balance sheet include repayment accounts, short-term loans such as bank loans or business paper issued to finance operations, disbursed dividends.

What is included in non-current liabilities?

Non-existent loans include borrowing, long-term loans, bond payable, deferred tax loans, long-term lease obligations, and pension benefit obligations.

How do you find non current liabilities?

Existing Debts = Long-Term Lease Obligations Long-Term Loans Secure / Unsecured Loans.

What is included in current liability?

Current loans are the company’s short-term financial obligations within one year or within the normal business cycle. … Examples of current debts include repayment accounts, short-term loans, dividends, and disbursements as well as income tax liabilities.

What is notes in financial statements?

The financial statements reveal the details of what accountants did when preparing the company: income statement, balance sheet, financial position change statement or available income statement. The texts are necessary to fully understand these documents.

Where are the accounting records? The first section of the financial statements describes the basis for the preparation and presentation of the relevant financial statements.

Are notes to financial statements required?

In addition to the amount reported in the financial accounting phase, US GAAP requires additional information to be provided in writing to the accounts. To alert readers to this important release, each account is required to provide a reference.

Do GAAP financial statements require footnotes?

The exact nature of the notes below varies, depending on the accounting format used to construct financial statements (such as GAAP or IFRS). The notes below are an important part of the financial statements, so you should provide them to the users along with the accounts.

Do you think it is important to have disclosures and notes to financial statements?

The disclosure statement may show negative or positive information and financial information about the company. … It also provides important facts that investors should be aware of, such as warning statements. The Securities and Exchange Commission (SEC) requires that all research reports be included in the release statement.

Why the notes that accompany the financial statements are required?

The main purpose of accounting scripts is to further clarify the accounting methods used by the company, as well as to disclose information that occurred during and immediately after the closing of the accounting period.

What is the importance of notes to the financial statements?

The main purpose of accounting scripts is to further clarify the accounting methods used by the company, as well as to disclose information that occurred during and immediately after the closing of the accounting period.

Are notes to accounts mandatory?

Accounting statements are a necessary, vital part of the company’s external financial statements. It is required as not all relevant financial information can be submitted in the amount shown (or not shown) in the accounting phase.

What is notes to accounts of a company?

Also the so-called accounting notes, subtitles, accounting notes are supporting information which are usually provided with the latest company accounts or financial accounts. The information provided depends on the accounting standards used such as IFRS or GAAP. …

What are notes due to banks?

Letters to banks are official obligations to banks that must be paid by an individual or a business. These are usually related to the loan agreement.

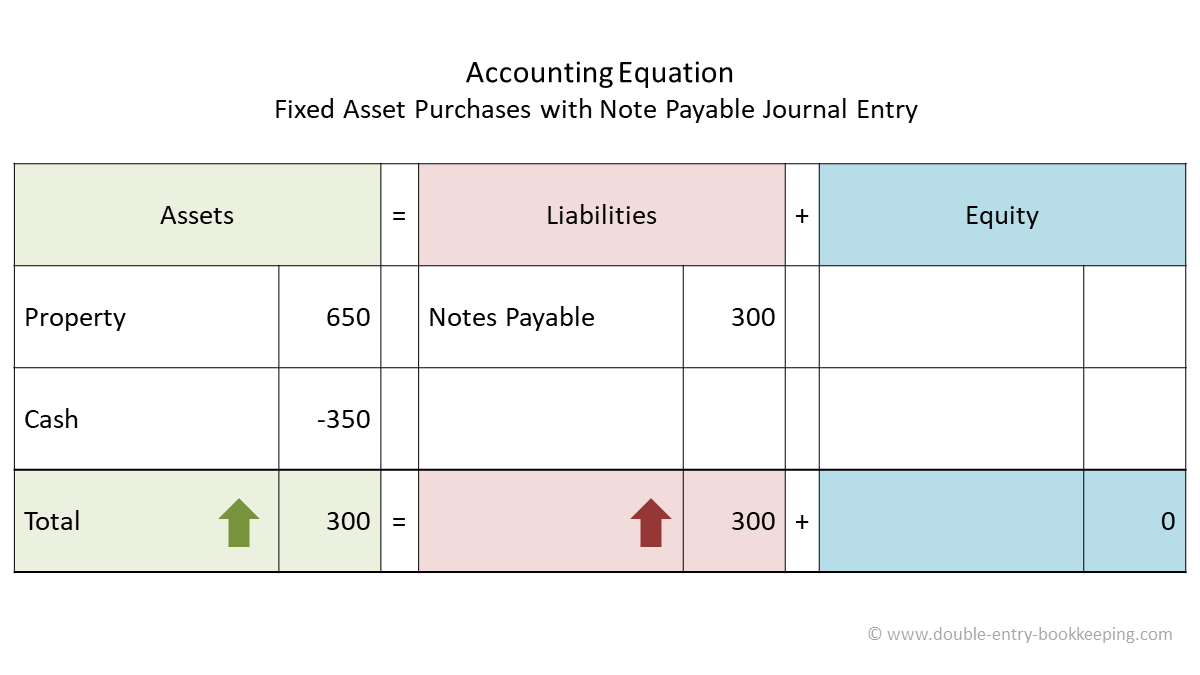

What examples of texts can be provided? What examples of texts can be provided? Buying a building, getting a car for a company, or borrowing from a bank is all examples of documents that can be provided. Submissions may be submitted for short-term liability (lt; 1 year) or long-term liability (1 year) depending on the loan deadline.

What is a note on a loan?

A loan notice is a type of collateral that defines the legal obligations of creditors and debtors. A loan notice is a legal agreement that includes all loan terms, such as payment schedule, expected date, total amount, interest rate, and any repayment penalty.

What is the difference between a note and a loan?

A guarantee notice is a simple document that is not as complicated as a loan agreement, and may be shorter and more detailed. … Unlike a guarantee letter, a loan agreement imposes obligations on both parties, which is why both the lender and the lender must sign the agreement.

What is the difference between a note and a mortgage?

The difference between a letter of promise and a loan. The main difference between a mortgage and a mortgage is that the mortgage is a written agreement that contains the details of a mortgage loan, while a mortgage is a mortgage loan.

What is the note number on a loan?

To find your credit card number, look at the top corner of your loan account in your most recent loan statement. … The last two digits of those five are the credit number.

What are notes payable used for?

A paid diary is a liability account written as part of the company’s general handbook. This is where lenders make written promises to lenders. Instead, the lender will write a written guarantee of the same on his available account.

Why do companies issue notes payable?

Risk Reduction. If the long-term bond payment has a fixed interest rate, the payment can be planned and settled. The time limit for repaying these types of loans is longer and does not depend on existing assets. This reduces the risk of debt consolidation, and increases the debt capacity and financial stability of the company …

What is difference between notes payable and accounts payable?

The difference between prepaid notes and noteworthy accounts is written agreements that are usually made out of debt consolidation and given to credit unions and financial institutions. Accounts payable are generally suppliers of services and supplies.

Where does note payable go?

Payment accounts are always available on current loan balances, along with other short-term loans such as credit card payments. However, notes on the balance sheet can be obtained from current loans or long-term loans, depending on whether the balance is expected within one year.

What is a note in money?

What is writing? A deed, also known as a deed of promise, is a legal debt instrument where one party makes a written promise to pay a certain amount of money to another party in accordance with certain conditions.

What is a note in currency?

The bank statement is given to the carrier upon request, and the amount to be displayed is on the face of the letter. Bank notes are considered legal tender; along with coins, they contain forms that carry all the modern currency. A bank letter is called a “bill” or “note.”

Why is money called a note?

The word “bank note” comes from bank notes (“nota di banco”) and dates from the 14th century; it first recognized the right of the holder of the document to collect the precious metal (usually gold or silver) deposited in a bank (through a monetary account).

Is a dollar a note?

| US Dollars | |

|---|---|

| Frequent used | $ 1, $ 5, $ 10, $ 20, $ 50, $ 100 |

| Rarely used | $ 2 (still in print); $ 500, $ 1,000, $ 5,000, $ 10,000 (canceled, pending bill) |

| Coins |

What is the first item in presenting the notes?

2. What is the first item that presents accounting records? registered office.

What is the third item that presents texts? The third thing that texts can tell users is how the company values, or lowers, the value of a property over a period of time.

What is the order of presenting the notes to financial statements?

Financial reports are collected in a particular way because the data in one statement submits to the next statement. Test proceeds are the first step in the process, followed by modified probation, income statement, balance sheet and landlord equity statement.

What is usually presented first in the notes to the financial statements?

The first set of accounting statements is usually a summary of the company’s key accounting policies on the use of estimates, revenue identification, goods, assets and equipment, goodwill and other intangible assets, fair value measurements, termination work, translation of foreign currency,. ..

What are the 4 financial statements in order?

There are four major accounts. They are: (1) balance sheet; (2) income accounts; (3) Cash flow statements; and (4) statements of shareholder equality.

What is the order of accounting statements?

The list of each account owned by the company is usually displayed in the order in which the accounts appear in their accounts. This means that the accounts of assets, assets, liabilities, and equity shareholders are first on the list, followed by the accounts in the income statement â € dakh income and expenses.

What is the first item in presenting the notes to financial statements?

The first set of accounting statements is usually a summary of the company’s key accounting policies on the use of estimates, revenue identification, goods, assets and equipment, goodwill and other intangible assets, fair value measurements, termination work, translation of foreign currency,. ..

What is the order to prepare for the financial statements?

Financial reports are prepared as follows:

- Income Report

- Declared Income Declaration â € “also known as the Ownership Equality Statement.

- Balance Sheet.

- Cash Declaration

What is the first item on an income statement?

Revenue or Sales: This is the first part of the revenue report, and gives you a summary of the total sales made by the company. Income can be divided into two types: active and non-active.

Is Notes Payable an asset?

While Notes Payable is a responsibility, Notes Receivable is an asset. Portable documents record the value of a business affidavit and, as a result, are registered as assets.

Where are the notes on the balance sheet? Payment accounts are always available on current loan balances, along with other short-term loans such as credit card payments. However, notes on the balance sheet can be obtained from current loans or long-term loans, depending on whether the balance is expected within one year.

Is notes payable a current asset?

Existing debts are usually resolved using existing assets, which are assets used within one year. Examples of current loans include repayment accounts, short-term loans, dividends, and disbursements as well as income tax liabilities.

Is Notes payable an asset or equity?

The notes that can be provided are the account holders in the organization’s general book. It is a written promise to pay a certain amount of money within a certain period of time.

What accounts are current assets?

Current assets include cash, cash equivalents, available accounts, stock options, foreclosure bonds, prepaid loans, and other liquid assets. Existing assets are important for businesses because they can be used to finance the day-to-day operations of the business and to pay for ongoing operating expenses.

Is Notes payable current or noncurrent?

Notes to be paid are classified as current debts when the amount is due within one year of the balance sheet.

What is note payable?

The securities are long-term loans that describe the companyâ lacagta TMs debt to its investorsâ € ”Banks and other financial institutions as well as other financial sources such as friends and family. It is a long time because it is paid for more than 12 months, although usually within five years.

What is difference between note payable and account payable?

Payment loans are written agreements that are usually made and issued by creditors and are provided to credit unions and financial institutions. Accounts payable are generally suppliers of services and supplies.

Is notes payable a debit or credit?

When the loan is repaid, the company registers the receipts as payment, and calculates the cash accounts, which are registered as liability on the balance sheet.

Is notes payable an asset or equity?

The notes that can be provided are the account holders in the organization’s general book. It is a written promise to pay a certain amount of money within a certain period of time.

Is notes payable debt or equity?

“Memory to be paid” is proof of debt. Payment notes can provide the necessary capital for a business, but, like other loans and obligations, liability undermines the totality of business equity. Businesses use the balance sheet to pay off current or long-term debt.

What is notes payable in balance sheet?

The securities are long-term loans that describe the companyâ lacagta TMs debt to its investorsâ € ”Banks and other financial institutions as well as other financial sources such as friends and family. .

Is notes payable an equity?

Paper is a loan and therefore cannot be used equitably. However, you can use it as a guarantee for the text.