Most homebuyers start their home hunt in anticipation of negotiating with sellers, but there is another question that many never stop: “Can you negotiate a mortgage rate with lenders?” The answer is yes – buyers are they can negotiate better mortgage interest rates and other commissions with banks and mortgage lenders.

Can I use my own appraisal for a refinance?

Contents

- 1 Can I use my own appraisal for a refinance?

- 2 What fees can be rolled into a mortgage?

- 3 Do banks require their own appraisers?

- 4 What will fail an appraisal?

- 5 What is the advantage of paying points on a mortgage?

Who pays the house appraisal? … A low rating can also prevent refinancing. However, don’t think that you could get a high rating at home by hiring your own appraiser. You can hire your own appraiser, but mortgage lenders will also order your own appraisals of the property you have or want to buy.

Can a borrower choose their appraiser? Can I choose my appraiser? Neither borrowers nor lenders can choose a special appraiser due to the very strict regulations introduced after the 2008 mortgage breakdown. Every mortgage lender is required by law to order any appraisal through an appraisal management company (AMC).

Can you pay for your own appraisal?

The appraisal of the apartment can be ordered independently by the owner of the apartment or the future buyer, or it can be ordered by the lender or a third party. If you need an appraisal, it’s important to learn when you can and can’t hire an independent housing appraiser. The bonus is: See how the assessment differs from the inspection.

Do I have to use the bank’s appraisal?

When you buy a home with cash, no lender is involved, so an estimate is not required. However, you may still want to get an appraisal to ensure you don’t pay more than the property is worth. In that case, you would hire an appraiser and pay a fee.

How can I do my own appraisal?

You can do a basic appraisal by entering information about your home on a real estate site such as the one offered by Realtor.com, Zillow, Redfin and other major online real estate companies. You may only need to enter your address on these sites and the estimated value of your home will appear immediately.

Do lenders use their own appraisers?

Only the lender or a third party explicitly authorized by the lender (including, but not limited to, appraisal companies, AMCs and correspondent lenders) may pay appraisal services directly to the appraiser. Lenders may charge an appraisal fee to an intermediary or borrower.

Do you need another appraisal for refinance?

Most lenders require you to receive a valuation or other form of property valuation before refinancing to ensure that they do not lend you too much money for your property. You may not need an appraisal to refinance your loan if you have an FHA, VA, or USDA loan.

Can you reuse an appraisal for a refinance?

One of the biggest costs of refinancing is valuation. Did you know that you can re-use a borrower rating with both Fannie and Freddie?

What type of appraisal is needed for a refinance?

Lenders can be happy with the rating while driving or just an external one for many future homeowners. The Federal Housing Authority (FHA) and the Veterans Administration (VA) only allow external evaluations for most refinancing.

How can I refinance without an appraisal?

To be eligible for FHA or USDA refinancing without an appraisal, you will already need to have this type of mortgage and be up to date with your payments. With a VA loan, this can be done with a refinancing loan with a reduction in interest rates that replaces an existing VA-secured mortgage with another VA-secured mortgage under the new conditions.

Do you have to use the lender’s appraiser?

Although a mortgage company must use an appraisal done by an appraiser hired by a management company, no law prohibits hiring your own appraiser if you have the money to do so.

Do I have to use the bank’s appraisal?

When you buy a home with cash, no lender is involved, so an estimate is not required. However, you may still want to get an appraisal to ensure you don’t pay more than the property is worth. In that case, you would hire an appraiser and pay a fee.

Can I use my own appraiser?

You can hire your own appraiser, but mortgage lenders will also order your own appraisals of the property you have or want to buy. And it is this assessment commissioned by the lender that is important in real estate transactions.

Do lenders have their own appraisers?

According to regulations set by the Federal Housing Authority, Fannie Mae and Freddie Mac, lenders also cannot be associated with appraisers. Many lenders choose to ask an appraiser from a valuation management company that has a list of licensed appraisers.

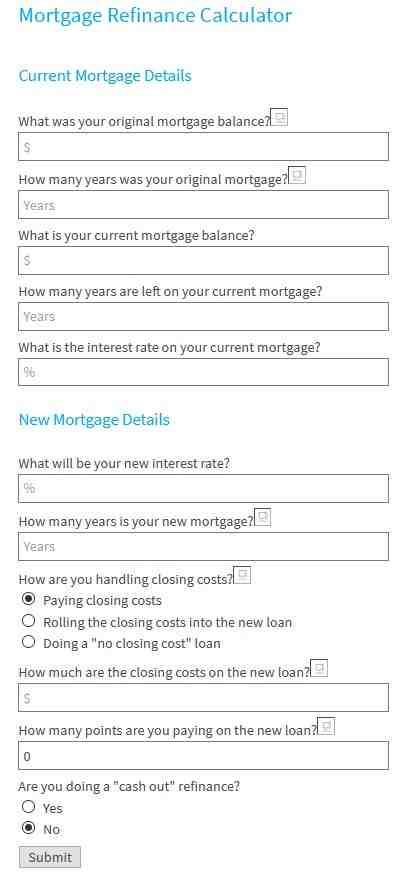

What fees can be rolled into a mortgage?

Many borrowers include certain commissions in their mortgages to avoid high costs in advance. The types of fees that may be included include loan fees, such as loan approval fees; state fees such as registration fees, administrative costs and certain taxes; and attorney’s fees.

Can you mortgage the cost of foreclosure? Simply put, you can include foreclosure costs in your mortgage, but not all lenders allow you to do so, and the rules may vary depending on the type of mortgage you receive. If you decide to include your closing costs in the mortgage, you will have to pay interest on those costs for the duration of the loan.

Can you roll lawyer fees into mortgage?

Calculate the final cost of the customer. These costs include, but are not limited to: taxes on the transfer of land or real estate, attorney’s fees and inspection fees. In most cases, they have to be paid in advance and cannot be included in your mortgage.

Can you roll some closing costs into mortgage?

Most lenders will allow you to include foreclosure costs in your mortgage when refinancing. In general, it is not a question of which lender can allow you to transfer the closing costs into a mortgage. It is more about the type of loan you receive – purchase or refinancing.

What fees can be included in mortgage?

Their cost usually includes: one or two starting points – “lender fees”, corresponding to 1% to 2% of the loan amount and usually include loan fees of $ 750 to $ 1,200) $ 1,000 or more in loan fees for things , such as inspection, evaluation, review and title work.

Can you get closing cost included in mortgage?

If you are refinancing an existing home loan, it is often possible to include closing costs in the loan amount. As long as the inclusion of costs in your mortgage does not affect the debt-to-income ratio (DTI) or loan-to-value (LTV) ratio too much, you should be able to do so.

What other fees are included in mortgage?

Common fees are labeled origin fees, registration fees, insurance fees, processing fees, administrative fees, etc. Points. Points are the cost you pay to the lender in advance. Points are part of the cost of borrowing money and are calculated as a percentage of the loan amount.

Are taxes and fees included in mortgage?

Most likely, your taxes will be included in your monthly mortgage payments. While this can increase your payments, it will allow you to avoid paying a thousand dollars (or more) in one session. And with the help of a lender, you can make sure your property tax payments are made in full and on time.

Do banks require their own appraisers?

Neither borrowers nor lenders can choose a special appraiser due to the very strict regulations introduced after the 2008 mortgage breakdown. Every mortgage lender is required by law to order any appraisal through an appraisal management company (AMC).

How do banks assign appraisers? How do lenders choose appraisers? These banks set up an impartial committee of members outside their mortgage lending department to choose which AMC to work with. AMC manages the valuation process and employs a team of appraisers to conduct these appraisals.

Do banks use their own appraisers?

Many mortgage banks (such as JVM) maintain their own internal group of manually selected appraisers who are not only qualified but local in the area and are therefore more familiar with the many nuances of the particular market in which they are valued.

Do lenders use their own appraisers?

Only the lender or a third party explicitly authorized by the lender (including, but not limited to, appraisal companies, AMCs and correspondent lenders) may pay appraisal services directly to the appraiser. Lenders may charge an appraisal fee to an intermediary or borrower.

Do banks and appraisers work together?

We work for the bank, not for you… But while domestic inspectors, real estate agents and contractors technically work for the consumer, the appraiser’s work is owned by the bank. In some cases, homeowners and buyers are negatively affected by ratings they never see in person.

Do banks and appraisers work together?

We work for the bank, not for you… But while domestic inspectors, real estate agents and contractors technically work for the consumer, the appraiser’s work is owned by the bank. In some cases, homeowners and buyers are negatively affected by ratings they never see in person.

Do lenders use their own appraisers?

Only the lender or a third party explicitly authorized by the lender (including, but not limited to, appraisal companies, AMCs and correspondent lenders) may pay appraisal services directly to the appraiser. Lenders may charge an appraisal fee to an intermediary or borrower.

Do lenders and appraisers work together?

Assessors must be a neutral party. According to regulations set by the Federal Housing Authority, Fannie Mae and Freddie Mac, lenders also cannot be associated with appraisers. … They must comply with all state and federal regulations, including uniform standards of professional assessment practice.

Do banks always require an appraisal?

Ordinary mortgage lenders will almost always require an appraisal, whether legally required or not, because it can protect them from loss if the borrower fails to meet its obligations.

Will a bank give you a mortgage without an appraisal?

An unsecured mortgage is a home loan that does not require an appraisal. Most lenders offer unrated mortgages for refinancing purposes, while others can offer them for a first loan. … Unsecured loans are offered by a number of government agencies, including the Federal Housing Administration.

Can you skip the appraisal?

Appraisal waivers or “Property Surveillance (PIW) waivers” allow borrowers and lenders to completely skip the California home appraisal process when buying a home. However, there are very strict criteria that must be met before a PIW can be approved.

How can you avoid an appraisal?

According to the government, not all real estate transactions require valuations. In general, you can skip the estimate if the loan amount is $ 250,000 or less AND the transaction involves “certain renewals, refinancing or other transactions involving an existing credit extension”.

What will fail an appraisal?

The estimated value is lower than the selling price. Sales prices of recent real estate sales in the area and possible local sales price trends. Average time of real estate sold in the area and condition of buyers and sellers. General condition of the home and possible improvements to the home since the last date of purchase.

Does cleanliness affect the assessment of the home? Unless the amount of clutter begins to affect the structural condition of the home, it will not affect the estimate. The cleanliness of the home also does not affect the value. It is not uncommon for an appraiser to step into a crowded, untidy home.

What can mess up a home appraisal?

If you are ready to evaluate your home, you need to address any significant issues that could affect the value of your home, such as damaged floors, outdated appliances, and broken windows. A messy home should not affect your valuation, but signs of neglect can affect how much lenders are willing to allow you to borrow.

What can cause an appraisal to fail?

Inadequate electrical systems are one of the most common reasons why a home will not pass a VA bank assessment. In a bank valuation, the valuer will check that the heating and cooling systems are working.

What can ruin a home appraisal?

Things that can hurt the assessment at home. A cluttered yard, poor color, overgrown grass, and generally neglected aesthetics can damage the evaluation of your home. Defective appliances and outdated systems. By systems we mean plumbing, heating and cooling and electrical systems.

What lowers a home appraisal?

The location reduces the appraisal value of the home the most. This is due to the fact that most homes are rated in 20 percent of similar homes in the area.

What will cause an appraisal to fail?

Inadequate electrical systems are one of the most common reasons why a home will not pass a VA bank assessment. In a bank valuation, the valuer will check that the heating and cooling systems are working.

What can negatively affect a home appraisal?

What negatively affects the assessment of housing? One of the big things that can negatively impact is the age and condition of home systems (HVAC, plumbing) and appliances. If the local market declines, it will also damage the estimated value of your home.

Why would an appraisal be denied?

The most common reason for rejecting an assessment is unsupported adjustments. Even minor adjustments can greatly affect the value of a home. This means that appraisers must be careful to keep track of all important details when tracking adjustments.

What hurts an appraisal?

Things that can hurt the assessment at home. A cluttered yard, poor color, overgrown grass, and generally neglected aesthetics can damage the evaluation of your home. Defective appliances and outdated systems. By systems we mean plumbing, heating and cooling and electrical systems.

What needs to be fixed before an appraisal?

Appraisers will point to growing problems with plumbing, electricity and HVAC (heating, ventilation and air conditioning). All systems must be in working order or you may need to repair them before the bank can provide the buyer’s loan.

Should I touch up paint before an appraisal?

Break the brush Walls, ceilings, cabinets and other painted surfaces can benefit from repairs. Here’s something about painting before evaluation: Be conservative. … Even if they don’t lower the overall value, expressively painted walls could mean more time in the market.

What should I fix before an appraisal?

Here are four things you need to fix before your appraiser comes to visit:

- Take care of the little things. While it may not seem like much, caring for small items can make a big difference. …

- Address safety concerns. …

- Updating your home. …

- Add some extras.

What will fail a home appraisal?

General condition of the home and possible improvements to the home since the last date of purchase. Number of bedrooms and bathrooms compared to other properties in the neighborhood and amenities such as fireplaces, decks, bonus rooms, garages and landscaping. Restrictions on plot and neighborhood size.

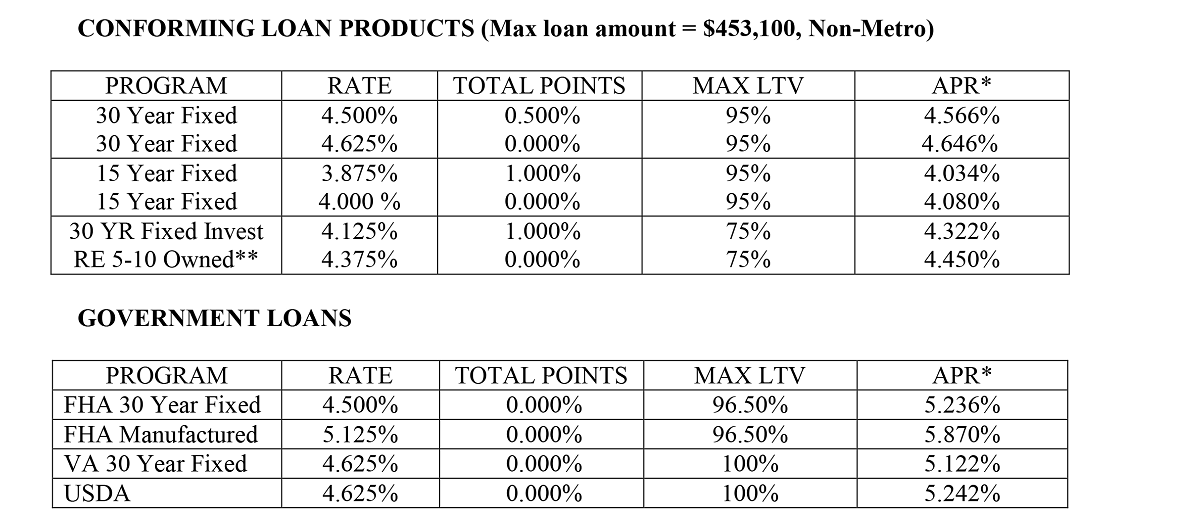

What is the advantage of paying points on a mortgage?

The biggest advantage of buying points is that you get a lower interest rate on a mortgage loan, regardless of your credit rating. Lower interest rates can save you money on both monthly mortgage payments and total interest payments over the life of the loan.

What are the benefits of paying discount points? Paying discount points reduces the interest rate and thus the monthly payments. Your monthly savings depend on the interest rate, the amount of the loan, and the term of the loan (for example, a 30-year or 15-year loan).

How much does 1 point lower your interest rate?

Each point typically lowers the interest rate by 0.25 percent, so one point would lower the mortgage rate by 4 percent to 3.75 percent over the life of the loan.

Is it worth it to refinance for 1% point?

Is it worth refinancing by 1 percent? Refinancing to save 1 percent is often worth it. One percentage point is a significant drop in interest rates and should generate significant monthly savings in most cases. For example, lowering the interest rate by 1 percent – from 3.75% to 2.75% – could save $ 250 a month on a $ 250,000 loan.

How much does a 1% lower interest rate save?

The monthly payments on this loan would be approximately $ 1,347. In this case, a 1% interest rate difference could save you (or cost) $ 173 per month or $ 62,252 for the duration of your loan.

How many points does it take to lower your interest rate?

Usually one point lowers your interest rate by about a quarter of a percent.

Does it make sense to buy down points on a mortgage?

If you have some money in your reserves and can afford it, buying mortgage points may be worth the investment. In general, buying a mortgage point is most beneficial if you plan to stay in your home longer and can afford to pay the mortgage point.

What is the benefit of paying discount points as part of the closing costs?

What is the advantage of paying discounts as part of the final cost? Usually, points lower the mortgage rate. The more points the buyer pays in advance, the lower the interest rate.

Can you buy down points on an existing mortgage?

Can you negotiate mortgage points? Yes you can. Lenders can add discount points to your loan offer to make their interest rate look lower – even if you haven’t requested the purchase of discount points.

Why would you buy down points on a mortgage?

Buying mortgage points is a way to pay in advance to lower the total cost of your loan. It makes the most sense if you plan to stay home for longer. The amount you save each month is likely to be worth the upfront cost.

What is the benefit of paying discount points as part of the closing costs?

What is the advantage of paying discounts as part of the final cost? Usually, points lower the mortgage rate. The more points the buyer pays in advance, the lower the interest rate.

Are points part of closing costs?

No, they are not the same thing, but lenders often use language to describe the same costs. The point is 1% of the loan value. This is the cost you pay to receive a lower interest rate on the loan.

Do discount points lower the cost of a home loan?

If you can afford to buy discount points in addition to the down payment and closing costs, you will lower your monthly mortgage payments and can save a lot of money. The key is to stay home long enough to pay the interest paid in advance.