Why do banks sell notes?

Contents

- 1 Why do banks sell notes?

- 2 What is a first mortgage note?

- 3 How much does a mortgage note cost?

- 4 What document itemizes the closing costs?

- 5 How do banks make money on structured notes?

Why Do Banks Sell Notes? Banks sell notes as a regular part of their business to recapitalize. Many banks originate loans (mortgages) with the intention of selling those loans in the secondary market.

Is buying notes a good idea? Liquidity and Profits Perhaps the most attractive thing about investing in real estate notes is the potential for great returns without any hassle of real estate. After all, loans simply collect interest payments. They do not need to manage property and tenants, or pay property taxes.

Can you buy bank notes?

As I said before, banks sell notes all the time, and buying bank notes is a widely used practice. Since investors can expect to purchase a bank note at a discount, it’s like buying the property directly FOR MENU, and not having to be responsible for managing the property.

How much does a mortgage note cost?

How Much Do People Usually Invest in Mortgage Notes? Most mortgage note investments range from $ 20,000 to $ 50,000 per note. The cost will vary based on several factors, including the age of the note, the payment history, the loan-to-value ratio, and more.

What happens when you buy a bank note?

When you buy a note, you become the banker. Purchase a note of completion, and you can expect payment on time from a credit lender. You’ll find a little bit of your money plus a little bit of interest, and everything is secured by that real estate, making it an attractive way to invest in performing notes.

How do you buy notes?

You can buy Treasury notes directly from the United States Treasury or through a bank, broker, or dealer.

- Buy directly from the United States Treasury. …

- Submit an offer in TreasuryDirect. …

- Payments and Receipts in TreasuryDirect. …

- Buy through a Bank, Broker, or Dealer.

Why do banks sell mortgage notes?

Banks create and sell mortgage notes as part of their business model. They make their own money by borrowing and receiving interest. The sooner they do, the more they do. There are guidelines for how much money a bank has to keep in reserve to lend – this amount is called the reserve ratio.

How do mortgage notes make money?

Note buyers can profit from the purchase of loans as they receive interest on these loans, and can buy with a discount from the loans. Note buyers can work with lenders who serve their loans to them and receive monthly checks without having to check with the loan.

Why do people sell mortgage notes?

Private mortgage holders sell their notes for a variety of reasons, most of which have to do with money to address immediate needs. You can sell your mortgage note for other financial purposes, such as: … Investing money in alternative investment vehicles. Paying medical bills.

Why do banks sell your mortgage?

Lenders typically sell loans for two reasons. The first is to free up capital that can be used to make loans on other loans. The other is to generate money by selling the loan to another bank, while retaining the right to service the loan.

How do mortgage notes make money?

Note buyers can profit from the purchase of loans as they receive interest on these loans, and can buy with a discount from the loans. Note buyers can work with lenders who serve their loans to them and receive monthly checks without having to check with the loan.

How do mortgage notes work?

A mortgage note is just a pledge note used only in real estate transactions. … Once the lender has signed the required documentation and provided the note, the lender holds the card until the lender makes the final repayment of the loan.

How do real estate notes make money?

Real estate investors earn money by investing in notes by purchasing mortgage notes from lenders who no longer want them. Essentially, they buy the debt. As a result, the investor is able to collect mortgage payments and interest as well as banks.

Can you make money investing in notes?

Investing in notes can be a profitable promotion in most scenarios, but in almost all cases, the larger the discount you negotiate when you buy, the more likely you are to earn more money on the investment.

What is a first mortgage note?

The first note lists the amount of the mortgage loan. Due to the buyer placing a down payment on the property, this will probably not be the actual price of the property. The mortgage note then identifies the interest rate of the loan, or how much above the principal loan that the buyer will pay the seller.

What does the mortgage note include? The note will give you details about your loan, including the amount you owe, the interest rate on the mortgage loan, the dates when payments will be made, the length of time for repayment, and the location. the payments are to be. to be sent.

How do I get my first mortgage note?

The mortgage note is part of your closing documents and you will receive a copy at the end. If your lost documents are lost or destroyed, you may obtain a copy of your mortgage note by searching the account records or by contacting the deed register.

Where can I find my promissory note?

You can obtain a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on “Completed Master Promissory Notes” under the menu bar heading that says “My Loan Documents.” Completed Master Promissory Notes appear, and you can download them directly.

Can I get my mortgage note online?

Mortgage notes can be purchased through mortgage note brokers (you can find hundreds online).

Who holds the note to my mortgage?

The homeowner of the mortgage, also referred to as the mortgagee or note holder, is the entity that owns your loan. … The mortgage owner is the only party who has the right to collect the debt or foreclose on the property if a lender fails to make its mortgage payments.

What is a 1st mortgage note?

A first mortgage is a primary lien on a property. As a primary issue paying for the property, the issue takes precedence over all other liens or claims on a property in the event of a defect. A first mortgage is not the mortgage on the first home of the loan; it is the original mortgage taken on any property.

What is the difference between a note and a mortgage?

The difference between a promissory note and a mortgage. The main difference between a pledge and a mortgage is that a pledge is the written agreement that contains the details of the mortgage issue, while a mortgage is a loan that is secured by real estate.

How do you explain a mortgage note?

Essentially, a mortgage note is an agreement that promises that the money borrowed from a lender will be repaid by the lender. The mortgage note also explains how the loan should be repaid, including details on the amount of the monthly payment and the length of the repayment period.

What is the difference between a note and a mortgage?

The difference between a promissory note and a mortgage. The main difference between a pledge and a mortgage is that a pledge is the written agreement that contains the details of the mortgage issue, while a mortgage is a loan that is secured by real estate.

Can you be on the note but not the mortgage?

In case of failure to pay the bill, the lender may foreclose on the home and sell it. The mortgage or deed of trust must be signed by all who hold the title to the property. … But if you have not signed the mortgage, it is because you are not the co-owner of the house.

Who signs the mortgage and the note?

Who signs a mortgage note? Because the mortgage note states the amount of the debt, the interest rate and obliges the borrower personally to repay it, the lender signs the mortgage note.

Does a mortgage note commit you to paying your loan?

Mortgage notes are given to the security lenders during the loan process, as without the note, the borrowers will not be legally obliged to repay the loan. Once the note has been signed by both parties, it is legally binding and gives the lender the ability to take legal action if the lender makes the loan.

How much does a mortgage note cost?

How Much Do People Usually Invest in Mortgage Notes? Most mortgage note investments range from $ 20,000 to $ 50,000 per note. The cost will vary based on several factors, including the age of the note, the payment history, the loan-to-value ratio, and more.

How to buy notes? You can buy Treasury notes directly from the United States Treasury or through a bank, broker, or dealer.

- Buy directly from the United States Treasury. …

- Submit an offer in TreasuryDirect. …

- Payments and Receipts in TreasuryDirect. …

- Buy through a Bank, Broker, or Dealer.

What is the note on a mortgage?

A mortgage is a type of contract. … A mortgage note is the document you sign at the end of your locked home. It should accurately reflect all the terms of the agreement between the lender and the lender or be corrected immediately if it is not.

How do I get my mortgage note?

The mortgage note is part of your closing documents and you will receive a copy at the end. If your lost documents are lost or destroyed, you may obtain a copy of your mortgage note by searching the account records or by contacting the deed register.

How does a mortgage note work?

Essentially, a mortgage note is an agreement that promises that the money borrowed from a lender will be repaid by the lender. The mortgage note also explains how the loan should be repaid, including details on the amount of the monthly payment and the length of the repayment period.

What is the note on a property?

In real estate, the Note is the legal document that wins the loan to repay a mortgage loan. This agreement contains an important specification of the loan, such as the amount of the loan, the interest rate, the due dates, the late costs and the terms of the mortgage.

How do I get a mortgage note?

The mortgage note is part of your closing documents and you will receive a copy at the end. If your lost documents are lost or destroyed, you may obtain a copy of your mortgage note by searching the account records or by contacting the deed register.

What is a note on a mortgage?

A mortgage note is the document you sign at the end of the closing of your home. It should accurately reflect all the terms of the agreement between the lender and the lender or be corrected immediately if it is not.

What else is a mortgage note called?

Promissory Notes, also known as mortgage notes, are written agreements in which one party promises to pay the other party a certain amount of money at a later date in time. Banks and lenders generally agree to these notes during the mortgage process.

Do banks sell mortgage notes?

Banks create and sell mortgage notes as part of their business model. They make their own money by borrowing and receiving interest. The sooner they do, the more they do.

Can I buy mortgages from a bank?

It is an ideal way to invest in real estate without a ton of time and effort. Banks are typically your most reliable source because they usually try to drain your inventory. Make sure you know how to buy a mortgage note from the bank, however, before approaching an institution willing to sell.

Can you buy bank notes?

As I said before, banks sell notes all the time, and buying bank notes is a widely used practice. Since investors can expect to purchase a bank note at a discount, it’s like buying the property directly FOR MENU, and not having to be responsible for managing the property.

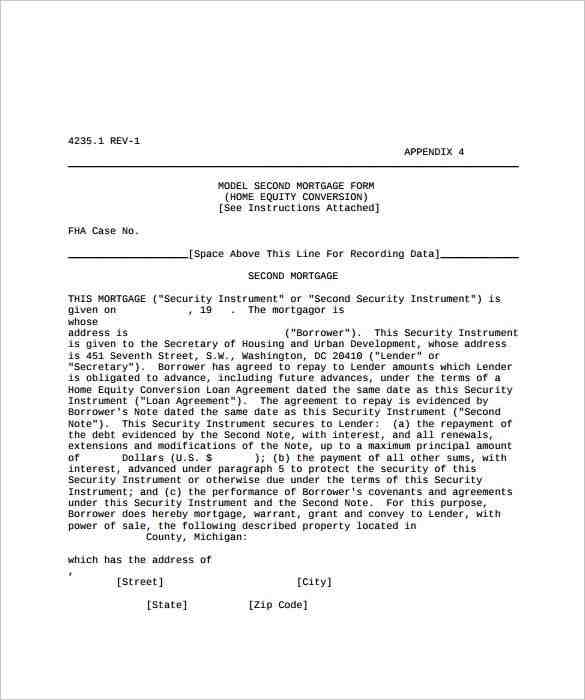

What document itemizes the closing costs?

A Closing Disclosure is a five page form that provides the final details on the mortgage loan you have chosen. It includes the terms of the loan, your expected monthly payments, and how much you will pay in fees and other costs to obtain your mortgage (closing cost).

Which of these documents details the closing costs and explains the terms of your assessment of the loan affidavit of the disclosure act? The HUD or Settlement Statement details all closing costs; on pages 1 and 2 the items appearing on this statement include real estate commissions, loan fees, points, payments and escrow amounts.

What itemizes the closing costs?

Closing costs are the costs above and beyond the price of the property that buyers and sellers are generally incurred to complete a real estate transaction. These costs may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, fees, deed registration fees, and credit report charges.

What are included in closing costs for buyer?

Closing costs refer to the charges and fees that are paid when a home purchase is finalized. … Typically, the buyer’s costs include mortgage insurance, homeowner’s insurance, appraisal fees and property tax, while the seller covers property transfer fees and he pays a commission to his real estate agent.

How are closing costs calculated?

To calculate your closing costs, most lenders recommend estimating your closing rates to be between one percent and five percent of your home purchase price. If you buy your home for $ 300,000, you can estimate your total foreclosure costs to be between $ 3,000 and $ 15,000.

What is the closing disclosure?

Closing Disclosure is a five-page form that describes, in detail, the critical aspects of your mortgage issue, including the purchase price, loan rates, interest rate, estimated real estate rates, and insurance. , closing costs and other expenses. …

What happens after closing disclosure is sent?

What happens after the lock disclosure? Three business days after receiving your lock disclosure, you must use a cashier’s check or bank transfer to send the settlement company any money you need to bring to the lock table, such as your payment and the costs of closures.

Does a closing disclosure mean clear to close?

Receiving a key disclosure means that you are clear of a key, but the terms are not just synonymous. Technically speaking, you are clear about closing the moment the lender signs the loan, and it can take between 24-72 hours from then to receive your closing disclosure.

How many days before closing Do you receive the closing disclosure?

By law, you must receive your Closing Disclosure at least three business days prior to your closing. Please read your Disclosure Closing carefully. It tells you how much you will pay for your loan.

Where can I find my closing disclosure?

Your agent should receive a copy of the Closing Disclosure form from the provider. They can help you check for accuracy. Take some time to review, double check and ask questions about the information you have received.

On which page of the closing disclosure would you find the final costs?

Page 2 of the Closing Disclosure is the Details of Closing Costs, which is also divided into two sub-headings – Borrowing Costs and Other Costs.

Are closing disclosures public?

Since this document contains personal, non-public financial information associated with your loan, your lender and title company must not share this document with anyone, including your own real estate agent, without your permission.

Who provides the closing disclosure?

Your lender is required by federal law to give you standardized Closing Disclosure at least 3 days before closing. It should be similar to the Loan Estimate. The law requires you to receive the Loan Estimate 3 days after you submit a loan application.

How do banks make money on structured notes?

Structured notes are typically sold by brokers, who receive commissions averaging about 2% from the issuing bank. While investors do not pay these fees directly, they are integrated into the principal value as a market or an integrated fee.

What are the benefits of taking structured notes? The flexibility of structured notes allows them to provide a wide variety of potential payments that are hard to find elsewhere. Structured notes can offer increased or decreased potential upside, downside risk, and overall volatility.

How do banks hedge structured notes?

Banks are paid an upfront fee to create and issue structured notes, this is part of the transaction cost. … As such, banks cover their risk, often in the stock markets (such as vanilla options) for their structured ledger.

Why do banks sell structured notes?

The value of the derivative is derived from an underlying asset or group of assets, also known as a benchmark. Investment banks claim that structured notes offer asset diversification, the ability to profit from the performance of the stock market, and the protection of disadvantages.

How do structure Notes work?

A structured note is a debt security issued by financial institutions. Its return is based on the equity index, a single equity, a basket of stocks, interest rates, commodities, or foreign currencies. The performance of a structured note is related to the performance of an underlying asset, group of assets, or index.

How do you hedge a structured note?

Structured Bond Hedging In general, hedging consists of two distinct but very similar swaps, which together have the effect of transferring to a third party not affiliated with the issuer the obligation to make payments equal to those to be made. below the related notes.

Why do banks sell structured products?

Structured products offer investors the potential to earn returns linked to the performance of an index or basket of securities. Return rates vary and are generally paid at maturity, along with the nominal amount of the investment, subject to the issuer’s credit risk.

Why do banks issue structured products?

Benefits. Structured Products provide access and the ability to capture potential returns and / or capital gains based on a market view of how an underlying financial instrument is envisaged that represents a traditional asset class. Structured products can be used to change the risk and return profile.

What is the benefit of structured products?

The other benefits depend on the type of structured product, as each is different. Those advantages may include key protection, low volatility, fiscal efficiency, higher returns than the underlying asset provides (leverage), or positive returns in low-yield environments.

Why do banks sell structured notes?

The value of the derivative is derived from an underlying asset or group of assets, also known as a benchmark. Investment banks claim that structured notes offer asset diversification, the ability to profit from the performance of the stock market, and the protection of disadvantages.

Why do banks offer structured notes?

What are the advantages of structured notes? Investment banks advertise that structured notes allow them to diversify specific investment products and types of securities in addition to providing a general diversification of assets.

What is the purpose of a structured note?

A structured note is a debt obligation that also contains an embedded derivative component that adds to the security risk-return profile. The return on a structured note will outline the underlying debt obligation and the derivative embedded in it.

Why do banks issue structured products?

Benefits. Structured Products provide access and the ability to capture potential returns and / or capital gains based on a market view of how an underlying financial instrument is envisaged that represents a traditional asset class. Structured products can be used to change the risk and return profile.

What are the pros and cons of structured notes?

The benefits of a structured note include higher potential returns than CDs, upside market share while also limiting downside exposure, and custom note settings to suit your level of risk. Some structured notes may have a “buffer”, which describes the protection against the disadvantage.