What does it mean to sell a note?

Contents

- 1 What does it mean to sell a note?

- 2 How do banks make money on structured notes?

- 3 Are notes the same as bonds?

- 4 What is investing in real estate notes?

- 5 How do Treasury notes work?

Selling a note is not a good decision for everyone, but it can be very useful or profitable for many people with notes. When a ticket is sold, the seller receives a certain amount of money in exchange for the life of the ticket.

What does it mean to sell a real estate ticket? Selling mortgage mortgages. Mortgage bills, or debtor letters, are financial instruments that define the terms of a loan used to purchase a property. People with a mortgage letter for a home, business, or property can sell it for a sum of money to a buyer in the secondary mortgage industry.

Why do banks sell notes?

Why do banks sell banknotes? Banks sell banknotes to recapitalize as a regular part of their business. Many banks create loans (mortgages) with the intention of selling these loans to the secondary market.

Why do banks sell mortgage notes?

Banks create and sell mortgage sites as part of their business model. They make money by borrowing and receiving interest. The more they give, the more they earn. There are guidelines for finding out how much money a bank needs to borrow; this number is called the reserve ratio.

Is buying notes a good idea?

Ordinary Monthly Income When you buy a ticket, you become a banker. Buy a performance note, and you can expect a credit borrower to pay on time. You’ll get a fraction of your money and a little interest, and all that real estate is secured is invested, making it an attractive way to make notes.

How do mortgage notes make money?

Note buyers can take advantage of the purchase of loans, as they will receive interest on these loans, and can buy them at a discount from the lender. Note Buyers can work with lenders who pay their loans and receive monthly checks without having to check with the borrower.

How much does it cost to sell a mortgage note?

First-position notes that do not meet the above requirements typically sell for between $ 0.70 and $ 0.85 for every $ 1 of the remaining principal due. If you want to offer financing to a seller, consider the many factors that determine the value of your mortgage. Make sure your buyer complies with the end of the agreement.

How do I sell my private mortgage note?

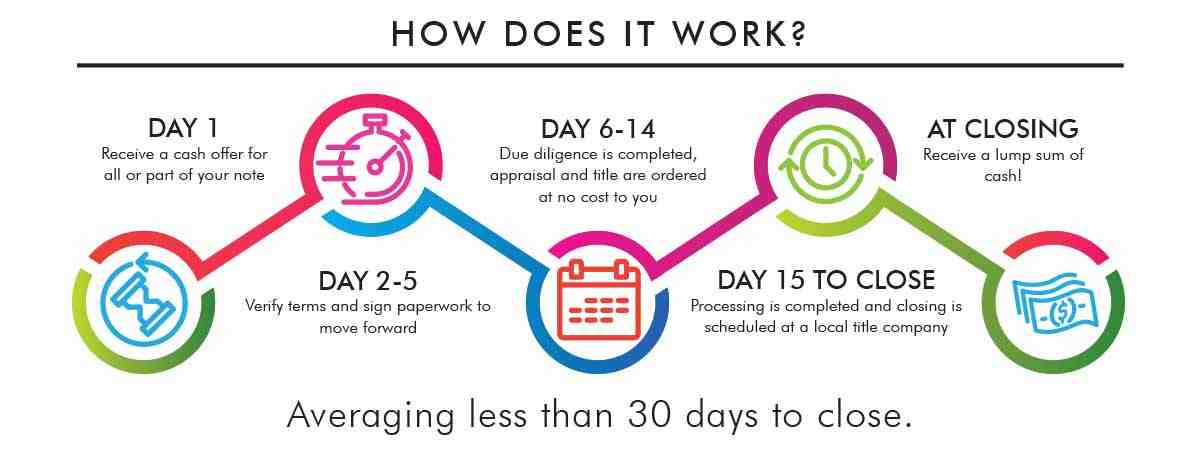

How to sell your private mortgage note

- Deciding to sell.

- Choosing a full or partial sale.

- Select a note buying company.

- Get your budget.

- Property Valuation Process.

- Closing the sale, getting your money.

What does it mean to sell your mortgage note?

Selling a Mortgage Note A mortgage note is usually sold to the buyer when the seller does not want to wait for payments and immediately needs a certain amount of money. In that case, the current owner of the mortgage attorney would sell that letter card, waiving the obligations of the borrower.

Can I sell a mortgage note?

Private mortgage holders sell their banknotes for a variety of reasons, most of which are related to raising money to manage their immediate needs. You can sell your mortgage letter for other financial purposes, such as: Getting a certain amount of money. Debt settlement.

What is a note sale?

Definition of Sales Notes: A memorandum issued by a broker to a buyer or seller of goods that indicates that the specified goods have been sold on behalf of a seller appointed by the broker to a designated buyer.

What is a note sale in real estate?

Selling a note means that the financial institution can avoid additional costs, and investors can buy a profitable or unprofitable mortgage, often at a discounted rate. … Millennium Properties is often required to sell commercial real estate notes.

What is a mortgage note sale?

A mortgage letter is usually sold to the buyer when the seller does not want to wait for payments and immediately needs a certain amount of money. In that case, the current owner of the mortgage attorney would sell that letter card, waiving the obligations of the borrower.

What is difference between a mortgage and a note?

The difference between an insurance letter and a mortgage. The main difference between an insurance letter and a mortgage is that it is a written agreement that includes the details of the mortgage loan, the mortgage is a secured loan with real estate.

How do banks make money on structured notes?

Structured banknotes are usually sold by brokers and receive an average of about 2% commission from the issuing bank. Although investors do not pay these fees directly, they are included in the principal value as a trademark or embedded fee.

How do issuers get structured banknotes? Structured banknotes are not direct investments, but derivatives. This means that they follow the value of another product. The return on a structured note depends on the issuer’s return of the underlying bond and the payment of the premium on the related asset.

How do banks hedge structured notes?

Banks pay a fee in advance to create and issue structured banknotes, which is part of the transaction cost. … That’s why banks cover their risk, often in the foreign exchange markets (like vanilla options) for their structured banknote book.

How do you hedge a structured note?

Structured Bond Hedging Hedging is typically comprised of two different but very similar swaps, which in turn result in the obligation to make a payment to a third party not affiliated with the issuer in accordance with the associated notes.

Why do banks sell structured notes?

The value of the derivative is derived from an underlying asset or group of assets, also known as a reference. Investment banks argue that structured banknotes offer asset diversification, the ability to profit from stock market performance, and downside protection.

How do structure Notes work?

A structured note is a debt guarantee issued by a financial institution. Its return is based on capital indices, single capital, a basket of shares, interest rates, commodities or foreign currencies. The performance of a structured note is related to the performance of an underlying asset, asset group, or index.

Why do banks offer structured notes?

What are the benefits of structured notes? Investment banks advertise that structured banknotes allow for the diversification of specific investment products and types of securities in addition to providing an overall diversification of assets.

Why do banks issue structured products?

Benefits. Structured products provide access and the ability to capture improved returns and / or capital gains, based on a market perspective on how an underlying financial instrument that represents a traditional asset class will work. Structured products can be used to change the risk and return profile.

What is the purpose of a structured note?

A structured note is a debt obligation and also includes an embedded derivative component that adjusts the risk return profile of the security. The performance of a structured note will monitor the underlying debt obligation and the derivative embedded in it.

What are the pros and cons of structured notes?

The advantages of a structured note include higher potential returns than CDs, upside market share, limited downside exposure, and personalized note parameters to suit your risk level. Some structured notes may have a “buffer”, which describes the protection below.

Why do banks sell structured products?

Structured products offer investors the opportunity to reap the benefits associated with the performance of an index or securities basket. Profitability rates vary and are generally paid on time, along with the nominal amount of the investment, depending on the credit risk of the issuer.

How do banks make money on structured products?

Banks pay a fee in advance to create and issue structured banknotes, which is part of the transaction cost. And that’s where the banks want to make their money. … Structured banknotes want to issue cheap debt, earn a fair share of creating a personalized investment and see the customer happy with the result.

Why do banks sell structured notes?

The value of the derivative is derived from an underlying asset or group of assets, also known as a reference. Investment banks argue that structured banknotes offer asset diversification, the ability to profit from stock market performance, and downside protection.

What is the benefit of structured products?

Other advantages depend on the type of product structured, as each is different. These advantages may include: major protection, low volatility, tax efficiency, higher returns (leverage) than those provided by underlying assets, or positive returns in low-yield environments.

Are notes the same as bonds?

A bond is a debt issued to the public, which buys bonds. One note is the debt arrangement between the county and a financial institution.

Are the bonds banknotes? Notes are similar to bonds, but usually have an earlier maturity date than other debt securities, such as bonds. For example, a banknote may pay an interest rate of 2% per annum and be due in one year or less. A bond can offer a higher interest rate and will be available in a few years.

What is the difference between bonds and notes payable?

Bonds and notes payable are both types of loans. Bonds are treated as securities and can usually be bought and sold, just like stocks and other securities. The notes to be paid are like traditional loans and are not always considered as legal tender, subject to specific conditions.

What are the similarities and differences between bonds and notes?

The terms “vouchers” and “notes” are used interchangeably (and there is no legal difference between the terms), although notes are issued continuously or intermittently for a shorter period (less than three years) and bonds issued in a large discrete offer. with longer maturity.

What are the similarities and differences between bonds payables and notes payables?

For accounting purposes, a note payable and a bond payable are similar. That is, they are both: 1) written promises to pay interest and repay the principal amount or maturity amount at specified future dates, 2) both are expressed as liabilities, and 3) interest is accrued as current liabilities.

Is loan note same as bond?

Bonds are fixed installments and a pre-determined number of bonds are available, while in the loan notes you decide how small or large your slice will be. In fact, you can still choose the exact amount of money you want to invest, so you won’t see much difference between a Bond and a Loan Note.

Are loans and bonds the same?

The main difference between Bonds and Loans is that the bonds are debt instruments issued by companies that raise highly negotiable funds in the market, which means that a person with a bond can sell them in the market without waiting for their maturity. The loan is an agreement between the two parties, where …

What is investing in real estate notes?

Note investing is the process of buying debt and its security tool. When you invest in a mortgage loan, you become a lender, which is why you start charging the borrower. … Usually, those who invest in banknotes do so by buying these banknotes at a discounted rate.

What does the note mean in real estate? A real estate note is just an IOU secured by the property. In a regular real estate transaction, a buyer makes a payment, obtains a loan, and signs a note promising the lender to pay a certain amount each month until the loan plus interest is paid.

What does it mean to buy notes?

By investing in notes, you are buying a debt secured by an asset, a promise to repay, and (in general) the right to execute and repay your investment if the borrower fails to meet its obligations or makes payments. You are not the owner of the physical property.

How does a note investment work?

Investors typically buy non-performing notes from other lenders at a discount. Lenders and investors sell their non-performing notes for quick payment and avoid lengthy and costly execution procedures.

How do you buy notes?

You can purchase treasury notes directly from the U.S. Treasury or through a bank, broker, or dealer.

- Purchase directly from the US Treasury. …

- Submit your offer to TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Purchase through a Bank, Broker or Dealer.

What is buying and selling notes?

The purchase and sale of real estate involves the transfer of not only the debt, but also the pledges that come with it, and it is advisable to record this assignment in the real estate registers where the security property is located.

How do real estate notes make money?

Real estate investors make money by investing in banknotes by buying mortgage notes from unsecured lenders. Basically, they buy debt. As a result, the investor can collect mortgage payments and interest just like banks can.

How do mortgage notes make money?

Banks create and sell mortgage sites as part of their business model. They make money by borrowing and receiving interest. The more they give, the more they earn. There are guidelines for finding out how much money a bank needs to borrow; this number is called the reserve ratio.

How does a note investment work?

Investors typically buy non-performing notes from other lenders at a discount. Lenders and investors sell their non-performing notes for quick payment and avoid lengthy and costly execution procedures.

How do mortgage notes make money?

Note buyers can take advantage of the purchase of loans, as they will receive interest on these loans, and can buy them at a discount from the lender. Note Buyers can work with lenders who pay their loans and receive monthly checks without having to check with the borrower.

How does a note investment work?

Investors typically buy non-performing notes from other lenders at a discount. Lenders and investors sell their non-performing notes for quick payment and avoid lengthy and costly execution procedures.

Can you make money investing in notes?

Investing in mortgage notes is a great way to manage your passive income. Finding the right business, buying a note, or buying and serving a note is an easy way to make a monthly income without having to turn to your home or tenant.

How do mortgage notes work?

A mortgage letter is just a place of debt used only in real estate transactions. … After signing and issuing the required documentation to the borrower, the lender holds the paper until the borrower makes the final repayment of the loan.

How do Treasury notes work?

Treasury bills and bonds are securities that pay a fixed interest rate every six months until the securities expire, which means that the Treasury pays the face value. … A FRN is a security that has an interest payment that can change over time. As interest rates rise, interest payments on securities will increase.

How do Treasury bills pay interest? Treasury bills are securities of interest with a fixed maturity of less than one year and a maximum of 10 years from the date of issue. … Treasury bills pay interest in a semester. When a note arrives, the investor receives a face value.

How do Treasury bills pay?

Treasury bills are sold at a discount on face value. … The U.S. Government, through the Department of the Treasury, promises to pay the investor the full face value of the T-letter when the deadline expires. At maturity, the government will pay the investor $ 10,000 and earn $ 500.

How do you make money on Treasury bills?

Each invoice has a specific due date, which is when you return the money. Then the government pays you the full price of the bill (in this case $ 10,000) and you earn $ 400 with your investment. The amount you earn is considered interest, or the payment made on your money loan.

How does a Treasury bill work?

Treasury bills (or T-letters) are short-term securities that are issued within one year or less of the date of issue. T-letters are purchased at or below the face value of their nominal value (foam), and when they expire, the Treasury pays their face value.

Do Treasury bills pay monthly?

Treasury bonds pay a fixed interest rate for one semester. This interest is exempt from state and local taxes. But it is subject to federal income tax, according to TreasuryDirect. Treasury bills are government bonds with a term of 30 years.

Do Treasury notes pay interest at maturity?

Treasury bills, sometimes called T-Notes, earn a fixed interest rate every six months until maturity.

Do Treasury bills pay interest at maturity?

T-Bill does not pay coupons – interest payments – until its due date. T-let can hinder cash flow for investors who need a steady income. T-let’s are at an interest rate risk, so their rate may not be as attractive as the rate hike might be.

Do Treasury notes pay interest?

Treasury bills are securities of interest with a fixed maturity of less than one year and a maximum of 10 years from the date of issue. Treasury bills pay semester interest. … When a note arrives, the investor receives the face value.

How often do Treasuries pay interest?

For example, Treasury letters or T-letters are short-term bonds with maturities ranging from a few days to 52 weeks. Treasury bills or T-notes are very similar to Treasury bills in that they pay a fixed interest rate every six months until its maturity.

Why would you buy a Treasury note?

Treasury bonds can be a good investment for those looking for a security and a fixed interest rate, and up to the maturity of the bond, which is paid every six months. .

What are Treasury notes used for?

The Treasury bill is a U.S. government debt security with a fixed interest rate and a maturity of two to 10 years. Treasury bills are available through a competitive bid in which the investor determines the return, or non-competitive bids in which the investor specifies the return.

Which is better Treasury bills or notes?

T-notes have a maturity of two to 10 years, with two-year interest payments, but lower yields. Letters have the shortest term: four weeks to one year. These investments are regularly auctioned off on the U.S. Treasury website.

Can you lose money on Treasury bills?

Treasury bonds are considered risk-free assets, meaning there is no risk of the investor losing their principal. In other words, investors who hold the bond until maturity are guaranteed their main investment or initial investment.