Historically, the basic rule is that refinancing is a good idea if you reduce your interest rate by at least 2%. However, many lenders say that 1% savings is enough incentive to refinance.

In what range do the closing costs on a home loan typically fall?

Contents

- 1 In what range do the closing costs on a home loan typically fall?

- 2 Is it worth refinancing to save $300 a month?

- 3 Are points deductible?

- 4 How much is 25 points on a mortgage?

- 5 How much is 2 points on a loan?

Closing costs typically range from 3% to 6% of the purchase price of the home. 1 So if you buy a home for $ 200,000, your closing costs can range from $ 6,000 to $ 12,000. Closing rates vary depending on your situation, type of loan, and mortgage lender, so it’s important to pay close attention to those fees.

How much does it usually cost to close a home? Closing costs can be around 3% of the house price – 6%. This means that if you take out a $ 200,000 mortgage, you can expect the closing costs to be around $ 6,000 – $ 12,000. Closing costs do not include your payment.

What costs are due at closing?

What are the closing costs? Closing costs include the amount of property, insurance, and mortgage payments that your lender incurs while processing your loan, such as home valuation and title insurance costs. Lenders are required by law to provide a loan calculation within 3 business days of receiving your application.

What is included in closing costs?

Closing costs are the cost of real estate that buyers and sellers typically incur to complete a real estate transaction. These costs may include loan creation fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed registration fees, and credit report expenses.

What are typical closing costs?

Generally, you want to budget between 3% and 4% of the purchase price of a resale home to cover closing costs. So in a home that costs $ 200,000, your closing costs can range from $ 6,000 to $ 8,000.

What monies are due at closing?

Closing costs are expenses related to making a loan and closing the purchase, says Ailion. â € œThey include attorneys’ fees, title fees, surveys, transfer fees and transfer taxes. They also include loan creation fees, appraisal fees, document preparation fees and title insurance, â € he says.

Is it worth refinancing to save $300 a month?

Refinancing your mortgage should generally save you money over the life of your loan. … DiBugnara explains: “Say you save $ 300 a month after refinancing, but your closing costs were $ 6,000 in total. Here, you would get your costs back in 20 months.

Is it worth refinancing to save $ 200 a month? Generally, refinancing is worth it if you stay home long enough to reach the time limit when your savings exceed the closing costs you paid to refinance your loan. For example, suppose you save $ 200 a month by refinancing, and your closing costs will be around $ 4,000.

How do I know if my refinance is worth it?

When does refinancing make sense?

- Mortgage rates are down. …

- Your credit has improved. …

- You want a shorter term loan. …

- The value of your home has increased. …

- You want to convert from an adjustable rate to a fixed rate. …

- You are subject to a prepayment penalty. …

- You will move soon. …

- You already have a home loan.

Do you end up paying more when you refinance?

Refinancing your mortgage can be a good idea or a bad idea, depending on your motivation and goals, as well as your financial terms. .

Is it worth refinancing for .75 percent?

If you are saving money and have no plans to move soon – or if it helps you meet another financial goal, then all the signs indicate “yes”. they are usually told that it makes sense to lower the mortgage interest rate by at least 0.75%.

Is it worth refinancing to save $400 a month?

Refinancing may be worth it though. This homeowner would save $ 400 a month by refinancing. This extra money can lead to a significant reduction in monthly bills and living expenses. … However, refinancing in a new 30-year term would mean that this person would pay an additional $ 25,000 over the life of the loan.

How much can you save monthly by refinancing?

If you were able to refinance at a 3.75% interest rate on a 20-year mortgage, your monthly payment would drop to $ 1,897, saving you about $ 130 a month.

Is it worth refinancing to save $300 a month?

Refinancing your mortgage should generally save you money over the life of your loan. … DiBugnar explains: â € œSay you end up saving $ 300 a month after refinancing, but your closing costs were $ 6,000 in total. Here, you would get your costs back in 20 months.

Are points deductible?

Points are interest paid in advance and may be deductible as a mortgage interest on your home, if the deductions are on the A sheet (Form 1040), if you provide for the deductions. … It is allowed to remove points in a rare manner during the term of the loan or in the year in which it was repaid.

Can you deduct points if you do not specify? Tip: Even if you don’t specify deductions, you can deduct up to $ 300 in your 2020 tax return (which you will file in 2021). You can apply for an “over the line” deduction in Appendix 1. In the 2021 tax year, that amount rises to $ 600 for married couples filed together.

Can you deduct points on a second home?

You can deduct mortgage interest and points on your first and second home, as well as the mortgage insurance premiums you pay. The mortgage lender will send you a copy of Form 1098, informing you of the annual mortgage interest.

What mortgage points are tax deductible?

The home mortgage industry uses two types of points, origin points and discount points. Origin points are usually the income of the loan maker, and discount points are a type of prepaid interest and are often fully deductible.

Are closing costs and points tax deductible?

Can you deduct these closing costs from your income taxes? For the most part, the answer is “no”. The only costs of closing a mortgage that you can claim on your home purchase statement are the points you pay to reduce the interest rate and the actual rate. you can pay property taxes in advance.

Can you write off points on an investment property?

According to the IRS, points, closing costs and mortgage interest paid on a secured investment property loan are tax deductible. … If you sell the property and pay off the loan, you can deduct the remaining fees and points in the year the home is sold.

Are origination points tax deductible?

The points of origin are the fees paid for evaluating, processing, and approving mortgage loans. The more discount points you pay, the lower the interest rate on your mortgage. One point is usually equal to 1% of the mortgage amount. Unlike other mortgage payments, points of origin are not tax deductible.

Are loan points tax deductible?

Mortgage points are considered a specific deduction and are claimed in Appendix A of Form 1040. … Typically, the lender will send you a Form 1098 showing how much you have paid in mortgage points and mortgage interest. Transfer this amount to line 10 of Annex A to Model 1040.

Are refinance origination fees tax deductible?

Origin Fees The IRS classifies mortgage origination fees as points. You can remove your loan origination fees even if the seller pays you. These are the fees that lenders charge to secure and process your mortgage.

What part of closing costs are tax deductible?

Usually, the only closing costs that are tax deductible are mortgage interest – points of purchase – or real estate taxes. There are no other closing costs. These are: Fees for abstracts.

What points are deductible on a mortgage?

The home mortgage industry uses two types of points, origin points and discount points. Origin points are usually the income of the loan maker, and discount points are a type of prepaid interest and are often fully deductible.

Are closing costs and points tax deductible?

Can you deduct these closing costs from your income taxes? For the most part, the answer is “no”. The only costs of closing a mortgage that you can claim on your home purchase statement are the points you pay to reduce the interest rate and the actual rate. you can pay property taxes in advance.

Which items are considered deductible points?

Points can also be called loan creation fees, maximum loan expenses, loan discount or discount points. Points are interest paid in advance and may be deductible as a mortgage interest on your home, if the deductions are on the A sheet (Form 1040), if you provide for the deductions.

Is mortgage interest 100% deductible?

Many non-households have very simple tax situations, so information on tax bases is required. … This deduction stipulates that up to 100 percent of the interest you pay on your mortgage is deductible from your gross income before your tax liability is calculated, along with any other deductions you are entitled to.

How much is 25 points on a mortgage?

It is a 25 percentage point reduction in interest rate and costs $ 1,000.

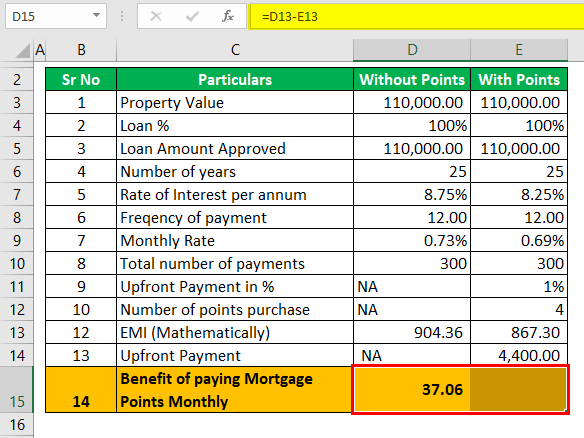

How are discount points calculated? Points are calculated in terms of the loan amount. Each point is a percentage of the loan amount. For example, a point on a $ 100,000 loan would be a percentage of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How much is 3 points on a mortgage?

Points are a prepayment that lenders are part of the price of a mortgage. The points are expressed as a percentage of the loan amount, and 3 points are 3%. In a $ 100,000 loan, 3 points means paying $ 3,000 in cash.

How much does 2 points cost on a mortgage?

What is the value of the points? A mortgage is usually worth 1% of your total loan (for example, $ 2,000 on a $ 200,000 mortgage). So if you buy two points – for $ 4,000, you’ll need to write a $ 4,000 check when the mortgage closes.

What does 3 points mean in real estate?

Are there different types of points? Points are usually referred to as something plus one. For example, a 10% interest rate with three more points: one point is the fee for creating a loan that pays the cost of processing the mortgage; three points are discount points.

How much is a point on a mortgage worth?

Mortgage points are the installments that the borrower pays to a mortgage lender to reduce the interest rate on the loan. It is sometimes referred to as “buying down”. Each point purchased by the borrower is worth 1 percent of the mortgage amount. So a $ 300,000 mortgage would be worth $ 3,000.

How much does 1 point cost on a mortgage?

A mortgage point (sometimes called a discount point) is a fee that you pay to lower the interest rate on the purchase or refinancing of your home. One discount point is worth 1% of your home loan amount. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

How much is 1 point on a mortgage?

One mortgage point is 1 percent of your total loan amount; for example, on a $ 100,000 loan, one point would be $ 1,000.

How much does 1 point lower your interest rate?

Each point typically drops the rate by 0.25 percent, so one point would lower the mortgage rate by 3.75 percent to 4 percent over the life of the loan.

How much is 2 points on a loan?

Each point is a percentage of the loan amount. For example, a point on a $ 100,000 loan would be a percentage of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How do I calculate points on a mortgage?

The mortgage rate is equal to 1 percent of your total loan amount. For example, in a $ 100,000 loan, one point would be $ 1,000. Learn more about what mortgage points are and determine if buying “points” is a good option for you.

How much is 2 points on a loan?

Each point is a percentage of the loan amount. For example, a point on a $ 100,000 loan would be a percentage of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How much is .25 points on a mortgage?

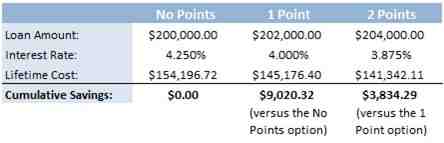

Here’s a sample of the interest rate savings on a 200,000 loan on a 30-year fixed rate mortgage. Each point counts. It is a 25 percentage point reduction in interest rate and costs $ 1,000.

How much is 2 points on a loan?

Each point is a percentage of the loan amount. For example, a point on a $ 100,000 loan would be a percentage of the loan amount, or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

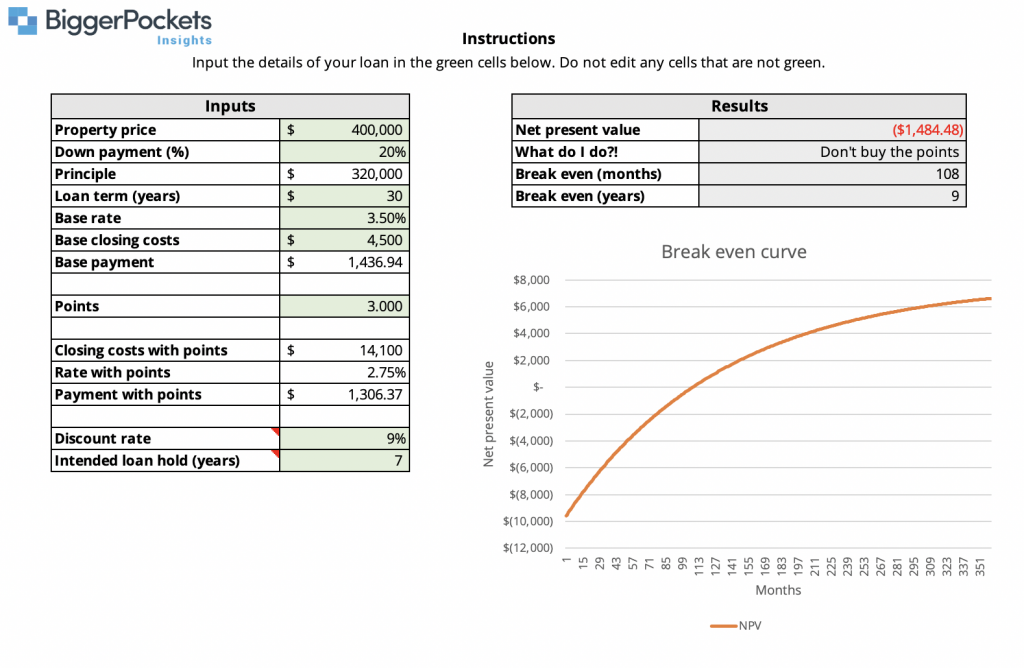

How Much Money Does a Mortgage Make? By buying $ 4,000 two points in advance, the borrower’s interest rate was reduced to 3.5 percent, with a monthly payment of $ 56 and $ 20,680 in interest savings over the life of the loan. (However, to save a total of $ 20,680, the borrower would have to live in the home for the full term of the loan, which is 30 years).

How much is 3 points on a mortgage?

Points are a prepayment that lenders are part of the price of a mortgage. The points are expressed as a percentage of the loan amount, and 3 points are 3%. In a $ 100,000 loan, 3 points means paying $ 3,000 in cash.

What does 3 points mean in real estate?

Are there different types of points? Points are usually referred to as something plus one. For example, a 10% interest rate with three more points: one point is the fee for creating a loan that pays the cost of processing the mortgage; three points are discount points.

How do I calculate my mortgage points?

One point is 1% or $ 1,000 of loan value. To calculate this amount, multiply $ 1% by $ 100,000. To make that payment, you need to earn more than $ 1,000. Points are not always in round numbers, and your lender may offer several options.

How much is a point on a mortgage worth?

Mortgage points are the installments that the borrower pays to a mortgage lender to reduce the interest rate on the loan. It is sometimes referred to as “buying down”. Each point purchased by the borrower is worth 1 percent of the mortgage amount. So a $ 300,000 mortgage would be worth $ 3,000.

How do you calculate loan points?

The mortgage rate is equal to 1 percent of your total loan amount. For example, in a $ 100,000 loan, one point would be $ 1,000. Learn more about what mortgage points are and determine if buying “points” is a good option for you.

How much is 1 point worth in a mortgage?

A mortgage point (sometimes called a discount point) is a fee that you pay to lower the interest rate on the purchase or refinancing of your home. One discount point is worth 1% of your home loan amount. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

How much is 1.5 points on a mortgage?

Mortgage Creation Points The creation point typically costs 1 percent of the total mortgage. So if a lender charges 1.5 origin points on a $ 250,000 mortgage, the borrower will have to pay $ 4,125.

What does 3 points on a loan mean?

If a bank announces a prime mortgage rate plus two points, this means that the interest rate on the loan is 2% plus the primary loan rate. … Each point is equal to 1% of the loan amount. If a bank offers a $ 200,000 mortgage with a three-point origination fee, the loan has a $ 6,000 origination fee.

How much does 1 point cost on a mortgage?

A mortgage point (sometimes called a discount point) is a fee that you pay to lower the interest rate on the purchase or refinancing of your home. One discount point is worth 1% of your home loan amount. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

How much does 1 point lower your interest rate?

Each point typically drops the rate by 0.25 percent, so one point would lower the mortgage rate by 3.75 percent to 4 percent over the life of the loan.

How much is 1 point on a mortgage?

One mortgage point is 1 percent of your total loan amount; for example, on a $ 100,000 loan, one point would be $ 1,000.