Does closing disclosure mean clear to close?

Contents

- 1 Does closing disclosure mean clear to close?

- 2 Why is there a 3 day waiting period after closing disclosure?

- 3 What happens after the initial disclosure?

- 4 What is the difference between a loan estimate and closing disclosure?

- 5 Can you close the same day you get clear to close?

Receiving a termination request means that you are clear that you are closing, but the terms are not completely synonymous. Technically, it is clear to you that you are closing at the moment the insurer signs the loan, and it can take between 24 and 72 hours for you to receive your closing application.

How long does it take to close after disclosure is closed? How long does it take to close after emptying? Most buyers don’t have to wait long to meet at the closing desk when they’re done. With this in mind, you should have at least a 3-day buffer between the day you receive your closing request and the day you close it.

Is clear to close the same as closing disclosure?

If your loan manager calls and says your loan is about to be terminated (CTC), it means that the insurer has approved all the documents needed for the proprietary company to plan the closure and start preparing the closure application. … However, this is not a guarantee that your loan will be closed.

What comes first closing disclosure or clear to close?

You can close three days after receiving your closing request. The lender is required to submit a foreclosure application at least three business days before the scheduled foreclosure. This will give you time to identify any discrepancies in the loan terms or details compared to what is included in the loan appraisal.

What does it mean to be cleared to close?

“Incomplete” simply means that you have met the requirements and conditions for closing a mortgage. At this stage, your lender has completely reviewed your documents and made sure you meet your expectations regarding the type and amount of mortgage you are applying for.

How many days before closing do you get clear to close?

Approved until closing (3 days) Completion of all closing is the last step before the final loan documents are prepared and sent to you for signing and notarization. Your lender will prepare a final foreclosure statement detailing all loan terms, costs and other details and submit it to you for review.

Does a closing disclosure mean loan is approved?

The 3-day foreclosure statement rule now gives you plenty of time to review the final terms of your loan before signing the foreclosure documents. … This means that the validation, assessment, insurance and calculation of all third party fees will be completed before the closure application is issued.

Does closing disclosure mean underwriting is complete?

You will receive a foreclosure application after selecting a lender and starting the mortgage securing process. It contains the same information as in the loan appraisal, but in its final form. This means that it includes the locked costs of your loan and the specific amount you will have to pay when you close it.

What happens after loan closing disclosure?

What happens after closing? Three business days after you receive your closing request, you’ll use a cashier’s check or bank transfer to send the billing company the money you’ll need to bring to your closing table, such as a deposit and closing costs.

Is closing Disclosure final approval?

The final report is a final statement of the interest rate and fees on your loan, the cost of closing the mortgage, the monthly payment on the mortgage, and all payments and financial charges. The form is issued at least three days before the mortgage documents are signed.

Can loan be denied after closing disclosure?

Can the loan be refused after closing? You will not normally be denied a loan after you have finished. However, if there are major changes to your credit report (such as a new car or credit card), you can discard your entire loan.

Can a lender cancel a loan after closing?

Yes. For certain types of mortgages, you can change your mind after signing the mortgage foreclosure documents. You have the right to cancel, also known as the right to cancel, most non-cash mortgages.

Can you be denied after closing disclosure?

Although rare, a mortgage can be refused after the borrower has signed the closing papers. For example, in some states, a bank can finance a loan after the borrower closes. … During this time, borrowers have the right to repay the loan, so the bank can immediately delay the issuance of money.

Why is there a 3 day waiting period after closing disclosure?

The purpose of the three-day waiting period after receiving your final application is to give you enough time to review the document and identify and resolve any issues found.

Do you have to wait 3 days after closing the release? According to the final rule of the Consumer Financial Protection Bureau, the creditor must send the final report to the consumer at least three working days before the date of the transaction.

How long after final disclosure can you close?

The 3-day foreclosure statement rule now gives you plenty of time to review the final terms of your loan before signing the foreclosure documents. Due to the 3-day rule, the sequence of events leading to a closure application should be relatively predictable.

What happens after final closing disclosure?

What happens after closing? Three business days after you receive your closing request, you’ll use a cashier’s check or bank transfer to send the billing company the money you’ll need to bring to your closing table, such as a deposit and closing costs.

Do you have to close 3 days after closing disclosure?

Your lender is required to send you a foreclosure notice, which you must receive at least three business days before the foreclosure. … Only sign your closing documents after you have carefully reviewed all the terms in the closing application and compared them with your loan rating.

Does closing disclosure mean loan is approved?

The 3-day foreclosure statement rule now gives you plenty of time to review the final terms of your loan before signing the foreclosure documents. … This means that the validation, assessment, insurance and calculation of all third party fees will be completed before the closure application is issued.

What triggers a new 3-day waiting period for closing disclosure?

Three changes may trigger an amended closing statement and a new three-day waiting period: a change in the annual percentage rate of charge (APR) for your loan. … loan product exchange; for example, switching to a fixed rate mortgage.

What would trigger the 3-day waiting period resulting in a delay in closing?

Some changes trigger a new 3-day wait. These are: a change that makes the cost of credit inaccurate; a change in the loan product that causes the disclosed information to become inaccurate; or.

What requires a new 3-day waiting period for closing disclosure?

12 CFR § 1026.19 (f) (2) (i). If the annual percentage rate of charge for an overestimated credit is inaccurate under Regulation Z, the creditor must ensure that the consumer receives the adjusted closure application at least three business days before the end of the loan (ie an inaccurate annual percentage rate of charge triggers a new three business day waiting period).

What requires a new 3-day review?

Only three changes require a new three-day review. A prepayment penalty is added, which makes refinancing or selling expensive. The main product of the loan changes, for example, the transition from a fixed interest rate to an adjustable interest rate or an interest-only loan.

What happens after the initial disclosure?

Once the lender has received a signed foreclosure statement from all borrowers, they can begin preparing the loan documents. Once the loan documents have been prepared, they are delivered to the escrow company. Signing.

What happens after the initial disclosure of the loan? Three business days after you receive your closing request, you’ll use a cashier’s check or bank transfer to send the billing company the money you’ll need to bring to your closing table, such as a deposit and closing costs. You will also sign the loan closing papers.

Does receiving initial disclosure mean Im approved?

By signing the initial disclosure, you do not agree to the terms, especially if the interest rate has not yet been locked. All your signature is doing at the moment is authorizing the lender to start working on the loan file.

What happens after initial disclosures are signed?

After signing the foreclosure statement, it is not permitted to change the lender’s or broker’s fees, transfer taxes or other fees that you were not allowed to purchase. Don’t let anyone put pressure on you to rush to the final statement. You have every right to breathe and to read and re-read the documents.

Does initial disclosure mean loan is approved?

Preliminary disclosures are preliminary disclosures that must be confirmed and signed in order to proceed with a loan application. … Preliminary disclosures let you know what to expect in terms of costs, monthly payments, and loan structure.

Does a loan disclosure mean loan is approved?

The 3-day foreclosure statement rule now gives you plenty of time to review the final terms of your loan before signing the foreclosure documents. … This means that the validation, assessment, insurance and calculation of all third party fees will be completed before the closure application is issued.

How long does it take to close after initial disclosures?

The creditor must ensure that the consumer receives the initial closure application no later than three working days before execution. 12 CFR § 1026.19 (f) (1) (ii) (A).

What happens after the initial closing disclosure?

What happens after closing? Three business days after you receive your closing request, you’ll use a cashier’s check or bank transfer to send the billing company the money you’ll need to bring to your closing table, such as a deposit and closing costs.

How many days after initial disclosure can you close?

The creditor must ensure that the consumer receives the initial closure application no later than three working days before execution.

What happens after initial disclosures are signed?

After signing the foreclosure statement, it is not permitted to change the lender’s or broker’s fees, transfer taxes or other fees that you were not allowed to purchase. Don’t let anyone put pressure on you to rush to the final statement. You have every right to breathe and to read and re-read the documents.

What is the difference between a loan estimate and closing disclosure?

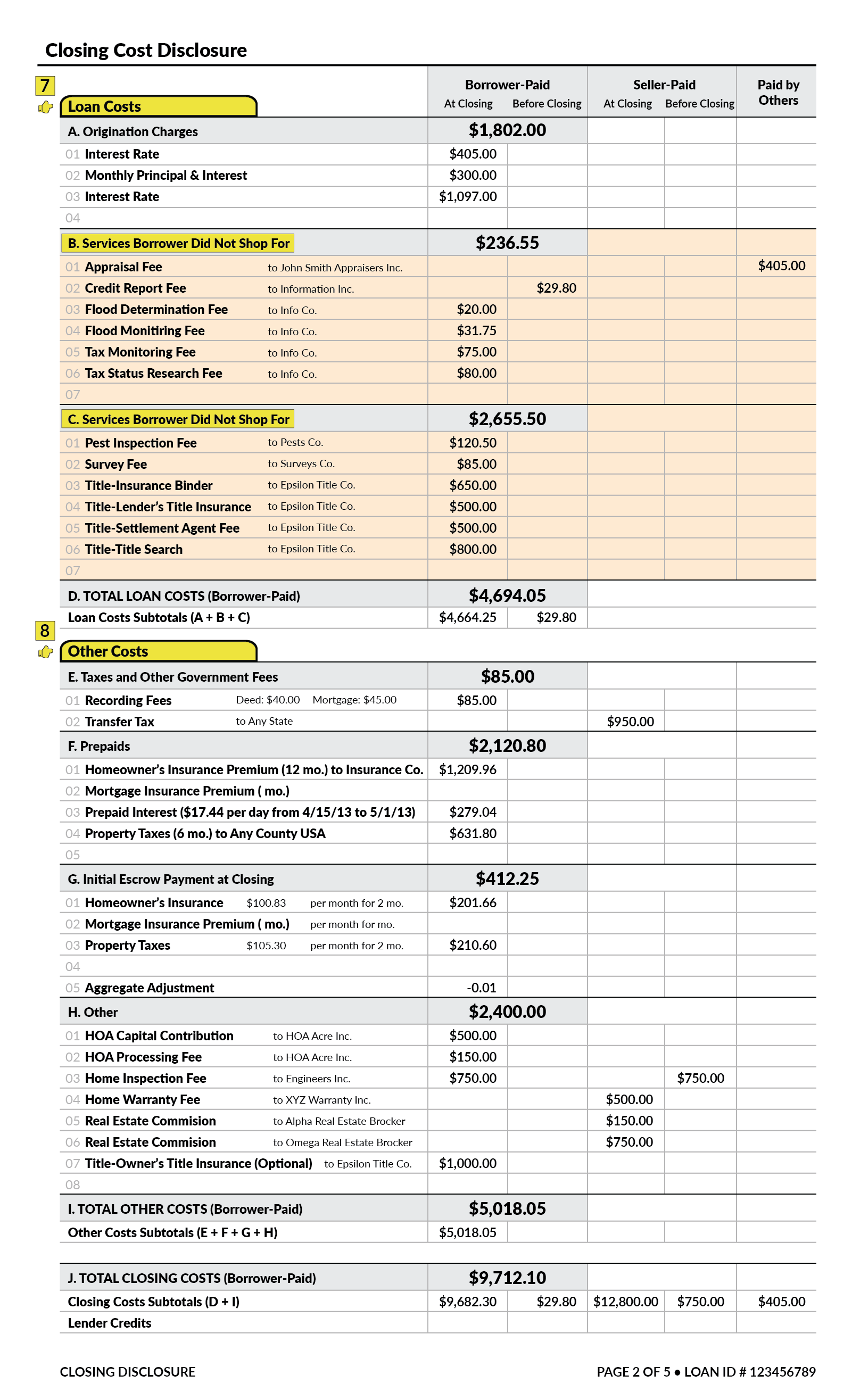

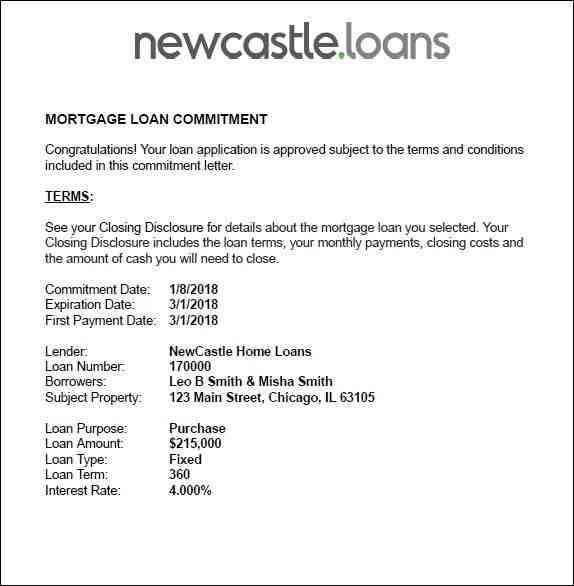

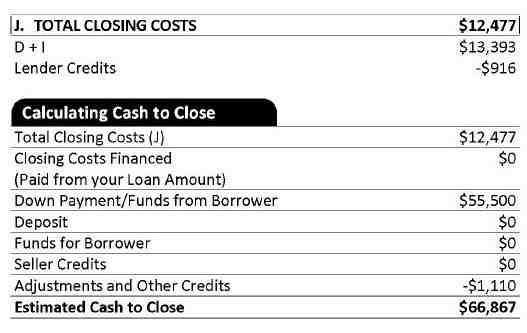

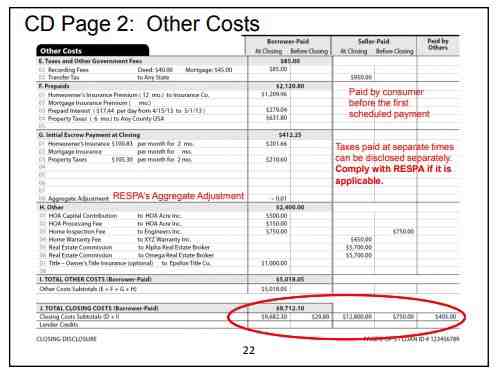

If the loan estimate gives you an estimate of your closing costs and monthly payments, the closing information will include the final numbers of your mortgage cost. The purpose is to let you know exactly how much you will pay each month for the loan.

Can the loan forecast and closing report be issued on the same day? Q: Can an amended loan appraisal and closing report be issued on the same day? No. The revised loan estimate must be issued one day before the closing announcement.

Is the loan estimate the same as closing disclosure?

You will receive a foreclosure application after selecting a lender and starting the mortgage securing process. It contains the same information as in the loan appraisal, but in its final form. This means that it includes the locked costs of your loan and the specific amount you will have to pay when you close it.

Can loan estimate and closing disclosure be issued same day?

The creditor will not be able to publish the final credit assessment and the closing report on the same day, so he will have to wait until Saturday, 15 August 2015 (one working day after the revised credit assessment) to send the final report to the consumer.

Can a loan estimate be issued after a closing disclosure?

The loan estimate must be submitted to the consumer no later than within three working days after the submission of the loan application. … The final report must be submitted to the consumers three working days before the termination of the loan agreement.

Should the loan estimate match the closing disclosure?

In general, the terms and closing costs listed in your foreclosure statement should exactly match the terms and conditions and closing costs listed in the loan appraisal you received after you submitted your application. In fact, there are some items on the CD that cannot be changed by law. However, some closing costs may increase before closing.

Does closing disclosure mean loan is approved?

The 3-day foreclosure statement rule now gives you plenty of time to review the final terms of your loan before signing the foreclosure documents. … This means that the validation, assessment, insurance and calculation of all third party fees will be completed before the closure application is issued.

Does closing disclosure mean final approval?

The final report is a final statement of the interest rate and fees on your loan, the cost of closing the mortgage, the monthly payment on the mortgage, and all payments and financial charges. The form is issued at least three days before the mortgage documents are signed.

Can loan be denied after closing disclosure?

Can the loan be refused after closing? You will not normally be denied a loan after you have finished. However, if there are major changes to your credit report (such as a new car or credit card), you can discard your entire loan.

What comes after closing disclosure?

What happens after closing? Three business days after you receive your closing request, you’ll use a cashier’s check or bank transfer to send the billing company the money you’ll need to bring to your closing table, such as a deposit and closing costs.

What is a loan estimate disclosure?

The loan appraisal is a three-page form that you will receive after you apply for a mortgage. A loan appraisal will give you important details about the loan you are applying for. … The form will give you important information, including the estimated interest rate, monthly payment and total closing costs of the loan.

What would be included in a loan estimate disclosure?

This will give you the actual cost of your chosen mortgage, including:

- Loan amount.

- Interest.

- Monthly payment.

- Closure costs.

- Estimated taxes, insurance and other expenses.

- Transaction summaries.

- Learn more about your loan.

Can you close the same day you get clear to close?

You have the right to go through the property for the last time before closing. This is usually done on the same day you close. At the last pass, you make sure that the home is in good condition and that the sellers have repaired all the things you have agreed on in advance.

Is closing the same as closing disclosure? If your loan manager calls and says your loan is about to be terminated (CTC), it means that the insurer has approved all the documents needed for the proprietary company to plan the closure and start preparing the closure application. … However, this is not a guarantee that your loan will be closed.

What happens after a clear to close?

After obtaining permission to close, your lender will double-check your credit and employment to make sure there are no significant changes since you applied for the loan. … If you took out another loan to cover costs or your credit was hit, your lender may mark your loan application.

What comes after Clear to Close?

Once you have been given permission to terminate, the lender will prepare your documents. Next, you review and sign them, and the lender transfers the money to a company in your name (or a lawyer in some states).

How long does it take for underwriter to clear to close?

Closing: at least 3 days Once the insurer has determined that your loan is eligible for approval, you will be allowed to close. You will receive a closing notification at this time.

Do they pull credit after clear to close?

While this is rare, the short answer is yes. After your loan closes, your lender will update your credit and check your status again.

Can a loan be denied after closing?

Can a mortgage be refused after foreclosure? Although rare, a mortgage can be refused after the borrower has signed the closing papers. For example, in some states, a bank can finance a loan after the borrower closes. … This may also happen during the refinancing closure, as borrowers have a three-day right of withdrawal.

How soon before closing is credit checked?

Lenders typically check borrowers’ financial information in the last week before the loan’s due date, including preparing a credit report and re-checking the job. You don’t want to experience hiccups before getting a new set of shiny keys.

What comes after Clear to Close?

Once you have been given permission to terminate, the lender will prepare your documents. Next, you review and sign them, and the lender transfers the money to a company in your name (or a lawyer in some states).