What is difference between a mortgage and a note?

Contents

- 1 What is difference between a mortgage and a note?

- 2 Do banks make money selling mortgages?

- 3 How do I get a mortgage note?

- 4 What is the difference between a note and a loan?

- 5 Can you buy bank notes?

The difference between a promissory note & amp; a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage, whereas a mortgage is a mortgage-backed mortgage.

What is a note on a property? In real estate, Note is the legal document that binds the borrower to repay a mortgage. This agreement will include important loan specifications, such as loan amount, interest rate, due dates, late collection and the terms of the mortgage.

Can you be on the note but not the mortgage?

In case of default on the payment of the note, the lender can forcibly auction the home and sell it. The mortgage deed or trust deed must be signed by all the property rights to the property. … But if you have not signed the mortgage, it is because you are not a co-owner of the home.

Can you be on the note and not the mortgage?

Lenders require co-signatories to sign the note, but not the deed, upon closing. Borrowers can remove themselves from the deed and waive the right of ownership, but remain on the banknote and responsible for the repayment of the loan. In both cases, your credit is involved in case of default.

Can a borrower be on the note but not on title?

The whole definition of a “mortgage” requires that a borrower has ownership because a mortgage refers to a promissory note or promissory note attached to real estate as collateral. If the borrower is not in ownership, the property cannot be tied to the promissory note. Buyers can have ownership without being on the loan.

What is the difference between the mortgage and the note?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage, whereas a mortgage is a mortgage-backed mortgage.

Who holds the mortgage and promissory note?

The lender holds the promissory note while the loan is outstanding. Once the loan is paid off, the note is marked as “fully paid” and returned to the borrower.

Who signs the promissory note and mortgage?

The promissory note is usually only signed by the maker, as the holder does not commit under the note. Even in the case of a loan, the transfer of funds is separate from the banknote itself. It is important to note that a promissory note is not a substitute for a formal contract.

Who holds the mortgage?

When you take out a mortgage, there is someone (usually a financial institution) who “holds” that mortgage. That is, they are the lender and you have to pay them back. Today, it is not always obvious who has your mortgage, as it may have been sold to someone else, just as a government bond may be sold.

Who holds the original promissory note?

The buyer of the note becomes what is called a “holder” because they hold your note as the owner of it. A proprietor has a special right to pick up from you immediately if you do not pay. However, only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

Do banks make money selling mortgages?

Why Banks Sell Mortgages Banks make money on your mortgage by charging interest payments. … When banks sell loans, they really sell the service rights to them. This frees up credit lines and allows lenders to give money out to other borrowers (and monetize the fees for setting up a mortgage).

Why do banks sell your mortgage? Lenders typically sell loans for two reasons. The first is to free up capital, which can be used to provide loans to other borrowers. The second is to generate cash by selling the loan to another bank while retaining the right to service the loan.

How do banks make profit on mortgages?

Often people apply for a mortgage loan at the same institution where they have already opened a bank account because of their knowledge of the bank. Interest rates and fees on the mortgage loan are likely to be more than the interest rates paid to a savings account customer, resulting in a net profit for the bank.

How much do banks make when they sell your mortgage?

They typically earn a commission of around 1% -2% of the loan value that the borrower or lender can pay. When you take out a larger loan, your mortgage broker makes more money. A mortgage broker’s total compensation can be paid in various ways, including cash or a supplement to the loan balance.

How do banks make money from mortgages?

Mortgage banks can make money in a variety of ways, including set-up fees, spread spreads, discount points, closing costs, mortgage-backed securities and loan services. … Lenders can also get money to service the loans they package and sell through MBS.

Do banks make a lot of money on mortgages?

Whether it’s the interest rates you pay on your mortgage or the interest rates they earn by lending the money you’ve saved with them, banks make huge amounts of money on seemingly small percentage margins.

Can you make money selling mortgages?

Mortgage banks can make money in a variety of ways, including set-up fees, spread spreads, discount points, closing costs, mortgage-backed securities and loan services. … Pledged securities allow lenders to make money on packing and selling loans.

Is owning a mortgage company profitable?

Mortgage brokers can have a high profit margin. Smaller companies generally have a higher margin than larger ones, due to the fact that smaller companies have lower fixed costs and running costs. Margins can range from 10% up to 50% or more, depending on the size of the operation.

How much do mortgage agents make?

There are mortgage brokers who earn well over the annual salaries of doctors and lawyers. On average, however, mortgage brokers earn about $ 100,000 a year.

How much can you make selling mortgage?

Mortgage brokers average $ 92,262 a year in the United States, but this figure can vary based on factors such as experience level and geographic location.

How much do banks make selling mortgages?

They typically earn a commission of around 1% -2% of the loan value that the borrower or lender can pay. When you take out a larger loan, your mortgage broker makes more money. A mortgage broker’s total compensation can be paid in various ways, including cash or a supplement to the loan balance.

How much profit do banks make on mortgages?

Independent mortgage lenders and mortgage lenders reported a profit of $ 1,675 on each second-quarter loan. This is up from a profit of only $ 285 per. loans in the first quarter and the highest profit since the third quarter of 2016, when the profit hit $ 1,773 per. loan.

Is it common for banks to sell mortgages?

It is very common for mortgages to be sold and it is not a cause for alarm. You should receive notification by mail both before and after the sale takes place.

How much commission do mortgage lenders make?

On average, mortgage lenders charge a commission of 2.25% for each loan, but according to federal rules, they can not charge more than 3% of the loan amount.

How do I get a mortgage note?

The mortgage deed is part of your closing papers and you will receive a copy upon closing. If you lose your closing papers or they are destroyed, you can get a copy of your mortgage deed by searching the county’s archives or contacting the deed book.

What is a note on a mortgage loan? A mortgage deed is the document you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it does not.

What else is a mortgage note called?

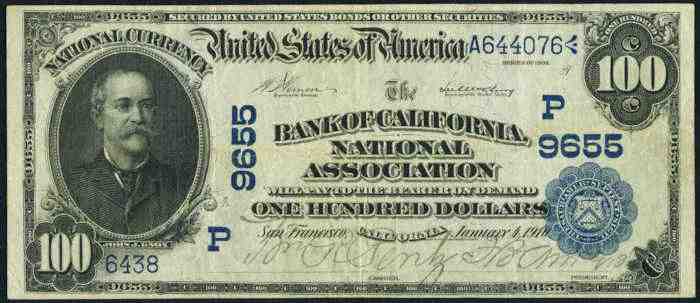

Promissory notes, also known as mortgage deeds, are written agreements in which one party promises to pay another party a certain amount at a later date. Banks and borrowers typically accept these notes during the mortgage lending process.

Is a mortgage note the same as a Deed?

It’s called the note. Here’s what you need to know about all three: Deed: This is the document that proves ownership of a property. … Mortgage: This is the document that gives the lender a security right in the property until the Banknote is paid in full.

Is a mortgage note the same as closing disclosure?

Learn about our editorial standards and how we make money. When you take out a mortgage on a home, there are several important documents to register and make it official. These are documents that you sign during closing, also called closing documents, and one of these documents is the mortgage deed.

What is the difference between a mortgage note and a deed of trust?

The memorandum is signed by the persons who agree to pay the debt (the persons who are to pay the mortgage). The deed and the Letter of Trust are signed by those who are to own the property being mortgaged. The note itself has virtually nothing to do with the property. …

How much does a mortgage note cost?

How much do people usually invest in mortgage deeds? Most mortgage loan investments range from $ 20,000 to $ 50,000 per month. Costs will vary based on several factors, including banknote age, payment history, loan-to-value ratio and more.

Do banks sell mortgage notes?

Banks create and sell mortgage notes as part of their business model. They earn their money by lending and receiving interest. The more they lend, the more they earn.

What is the note on a mortgage?

A mortgage is a form of contract. … A mortgage deed is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it does not.

How do you buy notes?

You can buy government bonds directly from the US Treasury Department or through a bank, broker or dealer.

- Buy directly from the US Treasury Department. …

- Place a bid in TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Buy through a bank, broker or dealer.

What is the difference between a note and a loan?

A promissory note is a simple document that is not as complex as a loan agreement and that can be shorter and less detailed. … Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and the lender must sign the agreement.

Why is a loan called a banknote? A loan certificate is a form of debt agreement that describes the legal obligations of the lender and the borrower. A loan slip is a legally binding agreement that includes all loan terms, such as payment schedule, due date, principal, interest and any prepayment fines.

Is a loan a note?

A loan certificate is a type of financial instrument; it is a contract for a loan that specifies when the loan is to be repaid and usually also the interest to be repaid.

What is a note purchase loan?

See, a banknote purchase means the buyer is buying a lender’s promissory note instead of the actual property. The foreclosure process can be costly in time and money for financial institutions. When a loan does not perform poorly, these institutions are often willing to sell them at a discount.

Is a loan the same as a note?

A loan agreement serves a similar purpose as a promissory note. Like a promissory note, it is a contractual agreement between a lender that agrees to lend money to a borrower. However, a loan agreement is much more detailed than a promissory note.

What is the difference between a note and a term loan?

The interest rate can be fixed or variable; Interest rates on debt securities are generally fixed. Forward loans are usually repaid over a period of one to five years.

What’s the difference between loan and notes?

In general, promissory notes are used for more informal matters than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

Is a term loan A note?

A loan slip is a legally binding agreement that includes all loan terms, such as payment schedule, due date, principal, interest and any prepayment fines.

What are the 3 types of term loan?

There are three main classifications of maturity loans: short-term loans, medium-term loans and long-term loans.

Can you buy bank notes?

As I mentioned early on, banks sell banknotes all the time, and buying banknotes is a widely used practice. Since investors can expect to buy a banknote at a discount, this is equivalent to buying the property directly FOR LESS, and then not being responsible for managing the property.

How much does a mortgage deed cost? How much do people usually invest in mortgage deeds? Most mortgage loan investments range from $ 20,000 to $ 50,000 per month. Costs will vary based on several factors, including banknote age, payment history, loan-to-value ratio and more.

Do banks sell mortgage notes?

Banks create and sell mortgage notes as part of their business model. They earn their money by lending and receiving interest. The more they lend, the more they earn.

Can I buy mortgages from a bank?

It is an ideal way to invest in real estate without a wealth of time and effort. Banks will typically be your most reliable source because they usually seek to empty inventory. However, make sure you know how to buy a mortgage deed from the bank before contacting an institution willing to sell.

How do you buy notes?

You can buy government bonds directly from the US Treasury Department or through a bank, broker or dealer.

- Buy directly from the US Treasury Department. …

- Place a bid in TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Buy through a bank, broker or dealer.

Is buying notes a good idea?

Liquidity and Profit Perhaps the most attractive thing about investing in real estate is the potential for high returns without the hassle of owning real estate. After all, lenders simply charge interest payments. They do not have to manage properties and tenants or pay property taxes.

How does buying a note work?

When you buy a banknote and a mortgage, you are buying the debt to be paid on the banknote, secured by the asset described in the mortgage. You do not buy the property – you buy the debt and secured interest in the property. Basically, a banknote buyer steps into the bank’s shoes.

What happens when you buy a bank note?

When you buy a banknote, you become the banker. Buy a note of performance and you can expect timely payment from a creditworthy borrower. You get some of your money out plus a little bit of interest and it’s all secured by the real estate, making it an attractive way to invest in making notes.

What happens when you buy a note?

When you buy a banknote and a mortgage, you are buying the debt to be paid on the banknote, secured by the asset described in the mortgage. You do not buy the property – you buy the debt and secured interest in the property. Basically, a banknote buyer steps into the bank’s shoes.

How do mortgage notes work?

A mortgage deed is simply a promissory note used exclusively in real estate transactions. … Once the borrower has signed the required documentation and submitted the note, the lender keeps the paper until the borrower makes the final repayment of the loan.