Can you have a mortgage without a note?

Contents

- 1 Can you have a mortgage without a note?

- 2 Can you be on a mortgage but not the note?

- 3 What rights do I have if my name is not on the mortgage?

- 4 Is a mortgage note a security?

- 5 Who signs promissory note?

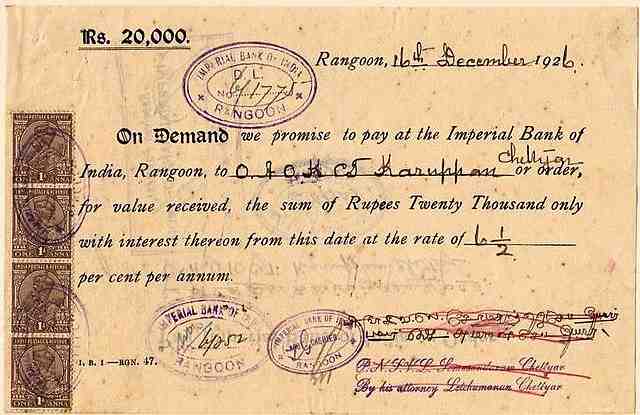

When you take out a mortgage, or any other type of loan, the law requires you to sign a document indicating your consent to repay the money. A promissory note is a binding legal document, enforceable in court. … If the banknote is lost, then the loan owner could have a problem.

What is the difference between a bill and a mortgage? The difference between a promissory note and a mortgage. The main difference between a bill of exchange and a mortgage is that a promissory note is a written contract that contains the details of a mortgage loan, while a mortgage is a loan secured by real estate.

Do you need an original promissory note?

Accordingly, there is no requirement that the original bill of exchange be required to conduct a bankruptcy sale in California, as the beneficiary may be bound by the missing bill of exchange.

Is a copy of a promissory note enforceable?

The original copy of a valid debenture is usually kept by the lender. The Borrower shall keep a copy of the signed document. If the borrower does not repay the loan, the lender may initiate appropriate legal proceedings.

What is required for a valid promissory note?

In order for a promissory note to be valid and legally binding, it must contain certain information. “The promissory note should include details including the amount of the loan, the repayment plan and whether it is insured or uninsured,” Wheeler says.

What if original promissory note is lost?

A promissory note, to put it simply, is the recognition of a debt. … Even if the debenture is lost, the legal obligation to repay the loan remains. The lender has the right to ‘re-establish’ the note legally until it has sold or transferred the note to another party.

Does a mortgage require a note?

The debenture is the borrower’s promise to repay the loan; The mortgage puts the title on the house as collateral for the loan. When you take out a home loan, the lender will likely require you to sign both a promissory note and a mortgage.

Who holds mortgage and note?

The owner of the mortgage, more accurately referred to as the “banknote owner” or simply the “holder”, is the owner of your loan. The holder has the right to enforce the loan agreement.

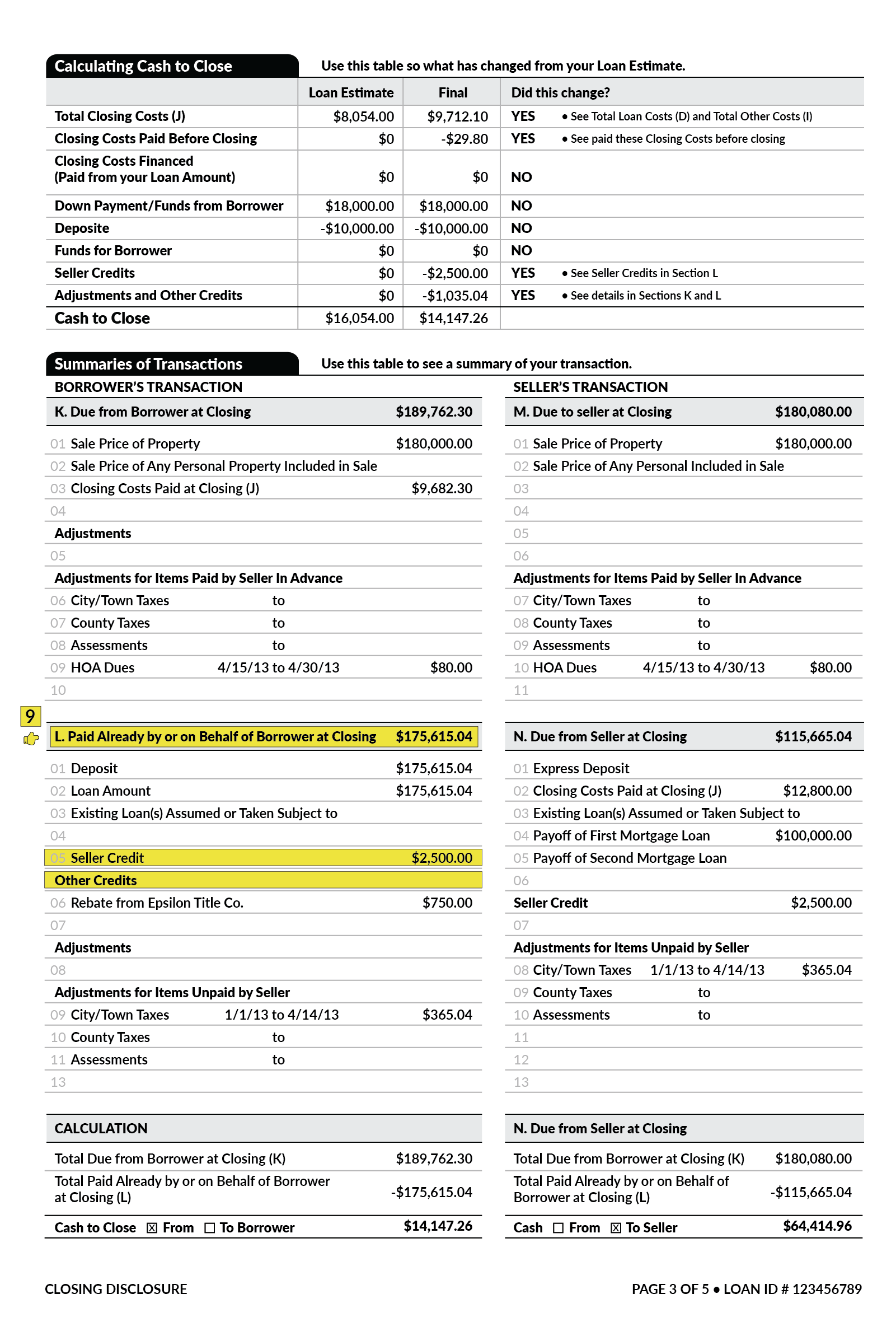

What does a mortgage note include?

The note will provide you with details regarding your loan, including the amount you owe, the mortgage interest rate, the dates when payments need to be made, the length of the repayment time, and the place of payment to be sent.

How do I get a mortgage note?

The mortgage is part of your final paperwork and you will receive a copy at closing. If you lose your final papers or they are destroyed, you can get a copy of your mortgage by searching the district records or contacting the Deed Registry.

Can you be on a mortgage but not the note?

In case of delay in payment of the banknote, the lender can foreclose on the house and sell it. A mortgage or trust agreement must be signed by all property owners. If you and your spouse own your home together, you had to sign a mortgage, even if you didn’t sign the note.

Can someone be on the title and not on the mortgage? It is possible to be named in the title deed of the house, without being mortgaged. However, this implies risks of ownership because the right of ownership is not free from liens and possible other encumbrances. Free and clear means that no one else has the right to a title above the owner.

Can you be on the mortgage but not the loan?

If your name is on the mortgage, but not in the document, it means that you are not the owner of the house. Instead, you are simply a co-signer of the mortgage. Since your name is on the mortgage, you are required to pay the loan repayments as well as the individual who owns the home.

Can someone be on the title but not the loan?

The full definition of “mortgage” requires that the borrower has a right of ownership because the mortgage refers to a debt instrument or debenture that is tied to the property as collateral. If the borrower is not owned, the property cannot be tied to the debenture. Customers can be owned without being on loan.

Can a borrower be on a loan but not on title?

The full definition of “mortgage” requires that the borrower has a right of ownership because the mortgage refers to a debt instrument or debenture that is tied to the property as collateral. If the borrower is not owned, the property cannot be tied to the debenture. Customers can be owned without being on loan.

Can you be on the loan but not the title?

If the borrower is on a loan, he or she must also have title. … If the borrower is not owned, the property cannot be tied to the debenture. Customers can be owned without being on loan. We call such customers ‘only with the right of ownership’, which means that they will have only the property and not the loan.

Can spouse be on mortgage but not title?

You can put your spouse on the title without putting on a mortgage; this would mean that they share ownership of the house, but are not legally responsible for paying the mortgage.

What rights do I have if my name is not on the mortgage?

Real estate that was owned before marriage remains a separate property. … If your name is not in the title of your home for these reasons, you would not own a home; nor would you be liable for the repayment of the loan or any other lien on the property, even if it resulted in foreclosure.

What if only your spouse is mortgaged or titled? You cannot give a mortgage unless you are on the title. So if only your spouse is mortgaged, you are not necessarily on the title, automatically or otherwise. However, you can be on the title, but not on loan as you will see below.

What if spouse is not on mortgage?

The title has little to do with the mortgage. … You can put your spouse on the title without mortgaging him; this would mean that they share ownership of the house, but are not legally responsible for paying the mortgage.

What happens if my husband dies and I’m not on the mortgage?

Your wife’s property can be held liable to the lender, and if you don’t pay the monthly mortgage repayments, the lender can take the house away, sell it, and use the proceeds of the sale to repay the loan. After her death, as a joint tenant, you became the sole owner of the house and were able to move on to the sale of the house.

What happens if my wife is not on the mortgage?

What will happen if I die and my wife is not mortgaged? In that case, the property of the deceased will be responsible for the mortgage. The legacy will have to pay a monthly payment or risk foreclosure. Generally, the bank will work with the surviving spouse to refinance the home in his or her name.

What happens if only one spouse is on mortgage?

Leaving your spouse out of a mortgage can also affect your debt-to-income ratio (DTI). … If one spouse applies for a mortgage on their own and they have large debts, it may be more difficult for them to meet the lender’s DTI requirements. Or they can qualify, but for a smaller loan amount than expected.

What happens if I died and my wife is not on the mortgage?

If there is no co-owner on your mortgage, the assets in your deposit can be used to pay the outstanding amount of your mortgage. If there are not enough assets in your property to cover the remaining amount, your surviving spouse can take over the mortgage payment.

What happens if my name is not on the mortgage?

If your name is on the document, but not on the mortgage, it means that you are the owner of the house, but you are not responsible for the mortgage loan and payments from it. However, if you do not make the payment, the lender can still make foreclosures on the house, despite the fact that only one spouse is listed on the mortgage.

Do all owners of a house have to be on the mortgage?

Not all property owners need to be mortgaged. So, if you are an unmarried person, but the property owners want to introduce you to the document, this can be achieved very easily. To do this, you only need to fill out an act of waiver.

Do both owners names need to be on a mortgage?

Only the owner applying for a mortgage loan must be listed in the mortgage documents. Both owners will, however, be in the list of the house, which serves as proof of ownership.

Is a mortgage note a security?

Hard money loans are loan instruments in which the lender offers funds to the borrower in exchange for a debenture secured by the debtor’s assets, usually real estate. All bills of exchange were found to be ICA securities.

Is a banknote a security? A promissory note is a debt security that obliges to repay the loan, at a predetermined interest rate, within a certain period of time. Notes are similar to bonds, but usually have an earlier maturity date than other debt securities, such as bonds.

Is a mortgage a security?

A mortgage is a legal instrument used to create a security interest in a property held by a lender as collateral for a debt, usually a loan of money. A mortgage in itself is not a debt, it is a guarantee of the lender for the debt.

Is a mortgage a type of security?

One of the most common examples of security interest is a mortgage: a person borrows money from a bank to buy a house and gives a mortgage over the house so that the bank can sell the house if it does not repay the loan. and apply the proceeds to the outstanding loan.

Is a mortgage a security instrument?

A mortgage is not a loan and it is not something that the lender gives you. It is a security instrument that you give to the lender, a document that protects the interests of the lender in your property.

What is the difference between a security and a mortgage?

A mortgage essentially secures the rights of the lender and places a lien on the title of the property. The lien is removed after all loan payments have been completed. … Under the guarantee agreement, the lender is automatically able to seize or sell the property when the borrower defaults.

Who signs promissory note?

Only the borrower signs the promissory note, while both the lender and the borrower sign the loan agreement. A signed document means that the borrower agrees to repay the loan.

WHO issues the bill? The bank can issue a promissory note, but also an individual, a company or a company – anyone who borrows money. A promissory note is not a contract, but you will probably need to sign it before you take out a mortgage.

Does the maker sign the promissory note?

The promissory note is usually signed only by the issuer as the holder does not commit under the bill of exchange. Even in the case of a loan, the transfer of funds is separate from the banknote itself. It is important to note that a promissory note is not a substitute for a formal contract.

What does the maker of a promissory note do?

A promissory note is a debt instrument that contains a written promise from one party (issuer or issuer of a bill of exchange) that it will pay a certain amount of money to the other party (the recipient of the bill of exchange), either on demand or on a specific date in the future. … In fact, promissory notes can allow anyone to be a lender.

Does the maker of a promissory note issue the note?

They are called note makers because they have physically entered into a contract. The note maker essentially issues the IOU or note to another person or company promising to return the money with interest. The recipient of the banknote or the lender agrees to lend the money to the maker and signs the banknote.

Do promissory notes need signing?

A promissory note is a written promise of payment within a specified period of time. This type of document implements the borrower’s promise to return it to the lender within a certain period of time, and both parties must sign the document.