What does a mortgage note include?

Contents

- 1 What does a mortgage note include?

- 2 What does it mean to execute a note and mortgage on a property?

- 3 How do you value a mortgage note?

- 4 Can a house be under two names?

- 5 What are my rights if my name is not on a deed?

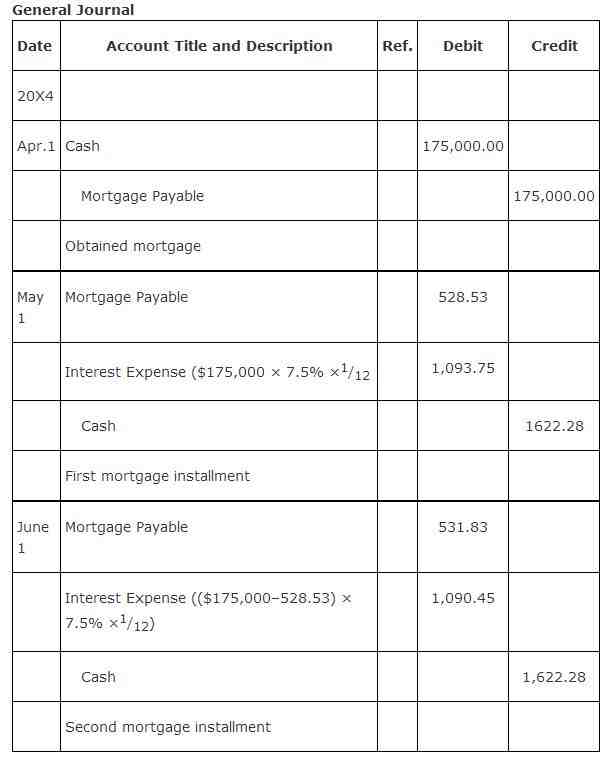

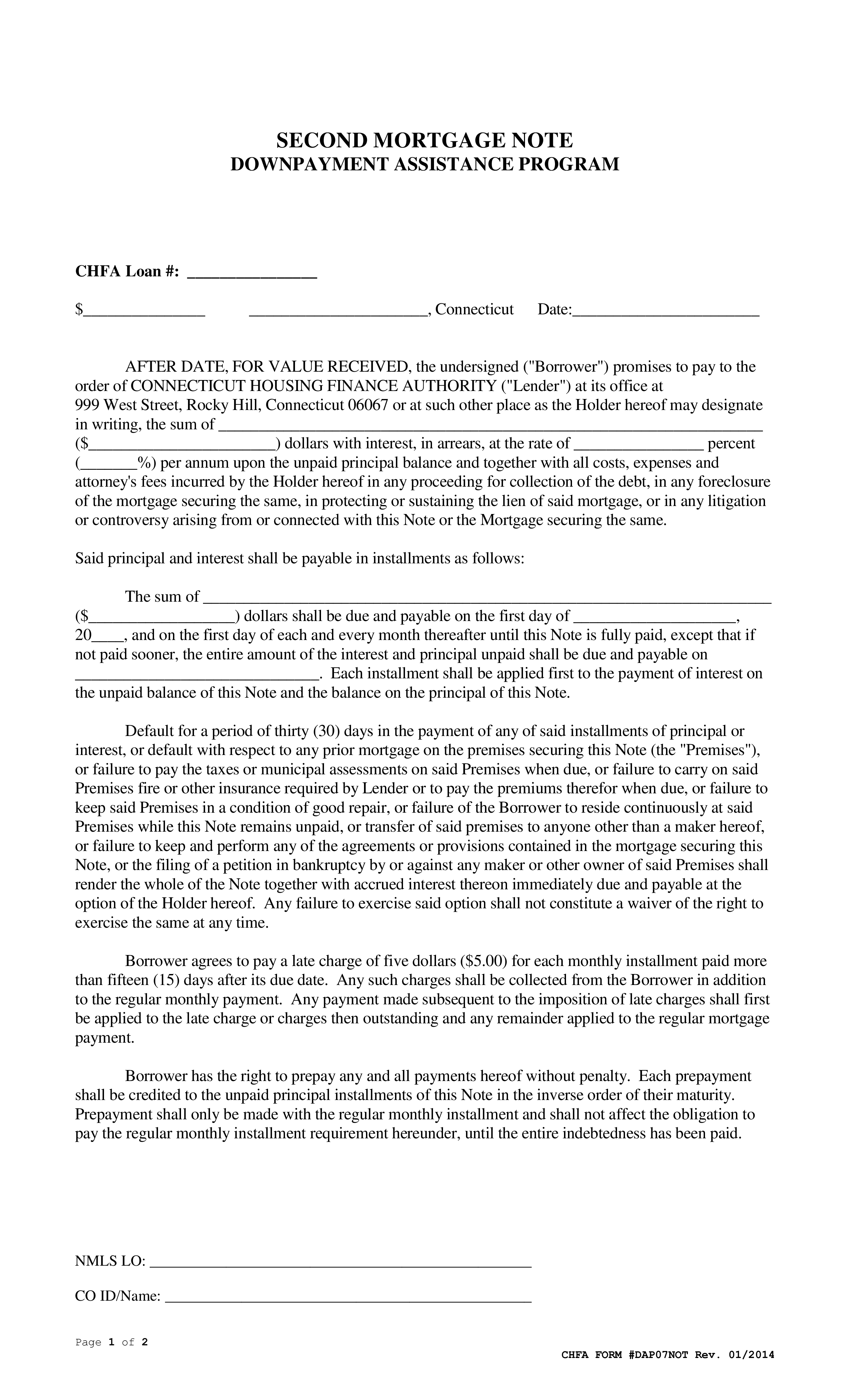

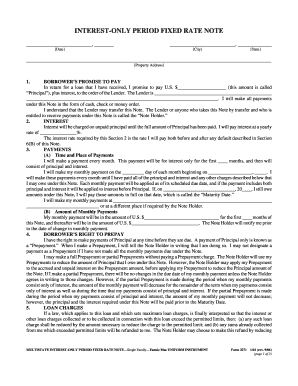

The note will provide you with details about your loan, including the amount you owe, the interest rate on the mortgage, the dates you have to pay, the length of the repayment, and where you have to pay.

What is the difference between a bond and a mortgage? The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is a written contract that contains details of a mortgage loan, while a mortgage is a loan secured by real estate.

What is a 1st mortgage note?

The first mortgage is the primary lien on the property. As the primary loan with which the real estate is paid, the loan has priority over all other liens or receivables on the real estate in case of non-payment. The first mortgage is not a mortgage on the borrower’s first apartment; it is the original mortgage taken on any property.

How do you explain a mortgage note?

In essence, a mortgage promissory note is a contract that promises that the borrower will repay the money borrowed from the lender. The mortgage record also explains how the loan is to be repaid, including details on the amount of the monthly payment and the length of the repayment.

What is the first mortgage note?

The note first states the amount of the mortgage loan. Since the buyer makes an advance payment on the property, this will probably not be the actual price of the property. The mortgage record then sets the interest rate on the loan or how much the buyer will pay to the seller in addition to the principal.

How do I get my first mortgage note?

The mortgage record is part of your closing documents and you will receive a copy upon completion. If you lose your final documents or are destroyed, you can obtain a copy of the mortgage by searching the district records or contacting the register of documents.

How do I get my mortgage note?

The mortgage record is part of your closing documents and you will receive a copy upon completion. If you lose your final documents or are destroyed, you can obtain a copy of the mortgage by searching the district records or contacting the register of documents.

Who holds the note to my mortgage?

The owner of the mortgage, also called the mortgage holder or bondholder, is the entity that owns your loan. … The owner of the mortgage is the only person who has the right to recover the debt or foreclosure on the property if the borrower does not pay the mortgage loans.

What is a current mortgage note?

A mortgage is a type of contract. … A mortgage record is a document you sign at the end of the closure of your home. It must accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if not.

How do I find the original mortgage note?

The ownership company may provide a copy of the deed and other documents of the loan. Find the records of the district record. Debentures are usually recorded as authentic instruments and are available soon after closing. The trustee keeps the original document until the loan is repaid.

What does it mean to execute a note and mortgage on a property?

Execution of a mortgage This is a legal document that gives your lender the right to take your property without your permission if you do not pay the loan. When you execute it, which is the legal term that means & quot; sign, & quot; you officially hand over this right to your lender.

Who executes the duty and the mortgage? The memorandum and mortgage are documents that are usually part of a larger package of loan documents. Borrowers enforce both the debt value and the mortgage to ensure the lender’s interest in the loan. Although banknotes and mortgages are crucial to the loan package, they each have a different purpose.

What is a note on a property?

In the case of real estate, the note is a legal document that obliges the borrower to repay the mortgage loan. This agreement will contain important loan specifications such as loan amount, interest rate, maturity, default costs and mortgage terms.

What is the difference between a note and a loan?

A promissory note is a simple document that is not as complex as a loan agreement and can be shorter and less detailed. … Unlike a promissory note, a loan agreement imposes obligations on both parties, so both the borrower and the lender must sign the agreement.

What’s the difference between a note and a Deed?

Document: This is a document proving the ownership of the property. … The document is recorded in court and the original is returned to the buyer a few weeks later. Note: this is the “debt owed” between the lender and the borrower. So whoever is the borrower on the notice is personally responsible for repaying the debt to the lender.

What is execution of mortgage?

When the mortgagee personally undertakes to pay the pledged money by enforcing and signing the mortgage deed. In the deed, he agrees that the mortgagee is entitled in the event of his default on the property. The latter can sell the property to recover his money.

What is loan execution?

Execution of the loan. Entry of customers into the loan.

How is mortgage executed?

The most common forms of mortgages When a mortgage debtor personally undertakes to pay mortgage money by enforcing and signing a mortgage deed. In the deed, he agrees that the mortgagee is entitled in the event of his default on the property.

What is best execution in mortgage?

Mortgage Loan A: The best performance is to sell the loan to Retained and keep servicing. Mortgage Loan B: The best economic and monetary execution is to maintain servicing.

How do you value a mortgage note?

In determining the price of a mortgage bill, one of the many calculations used by investors is “present value”; the flow of payments to be purchased based on their required & quot; return & quot; for this type / quality mortgage. Example: original banknote amount $ 100,000, 6,000% interest rate, 30 years, payments $ 599.55 per month.

How to sell a property? How to Sell Your Private Mortgage Record |

- The decision to sell.

- Choice between full or partial sale.

- Choosing a company to buy banknotes.

- Getting your offer.

- Real estate appraisal process.

- Completion of sale, acquisition of money.

How does selling a note work?

A mortgage bill is usually sold to the buyer when the seller no longer wants to wait for payments and immediately needs a lump sum of cash. In this case, the current owner of the mortgage bill would sell the bill of exchange, thereby waiving the obligations of the borrower.

What does it mean to sell a note?

Selling a banknote is a decision that is not always the right one for everyone, but it can be extremely beneficial or profitable for many people with banknotes. When selling a banknote, the seller receives a lump sum of cash in exchange for payments for the duration of the banknote.

What does it mean to sell a note in real estate?

Sale of mortgage bills. Mortgage bills or promissory notes are financial instruments that define the terms of a loan for the purchase of real estate. People who have a mortgage record for a home, business or property can sell it for a lump sum of cash to a buyer in the secondary mortgage notes industry.

What happens when you sell a note?

Mortgage bills can be sold in two different ways: selling the entire bill or selling part of the payment. Both result in your exchange of money from long-term lump sum payments, but the biggest difference is how big that lump sum is. … Most banknote holders who sell choose this option.

How do you value a note?

When it comes to valuing a security, the key factors that affect the value are the interest rate and the depreciation plan of the record. A bond with an interest rate below the market rate would be sold at a discount depending on the situation, just as bonds are traded on the public market.

Can a house be under two names?

Real ownership Both names can be at the address of the apartment without being mortgaged. … In case you opt for two names on the address and only one on the mortgage, they are both owners. The person who signed the mortgage, however, is the one who is obligated to repay the loan.

Can a mortgage be on behalf of two people? Usually, ownership is determined by looking at the names on the deed, so one person can technically get a mortgage when two people look like the owners. However, if you have two names on the address with one on the mortgage, you may be liable if the mortgagee stops paying and risks foreclosure.

Can you put two names on a house if not married?

To get the same protection as a traditionally recognized marriage, unmarried couples buying a house together must write down their default values. This is commonly known as a “coexistence agreement” and should include rules on how the property will be divided if the worst happens.

Can I put my girlfriend on the deed to my house?

You can add your fiancé to the property of the house with a statement of resignation. … When you add the name of the client to the house document, you hand over the ownership share in your property. It can also have tax consequences for your gifts.

Can two names be on a mortgage if not married?

Unmarried couples will apply for a mortgage as individuals. This means that a partner with a stronger financial and credit score may want to buy a home to get better mortgage terms and interest rates. … Some lenders may allow both parties to apply for a mortgage together.

Can a house be registered in two names?

a) Land may be registered in more than one name. In the event that it is registered in your name and also in the name of your wife, you will be considered the owner of the property because the funds to purchase the property came from you.

Should House be in joint names?

First, if you are a couple and want to move in together, it usually makes sense to have both names on the property list as a joint owner. Another popular reason is if you can’t afford to buy the property yourself, but want to get on the real estate ladder, so buy the property with friends.

How do you create a property in joint names?

To add a co-owner, the bank would have to enter into a new housing loan agreement, which must be registered after payment of the due stamp duty and registration costs. The bank would also insist that the co-owner become a co-borrower in a valid housing loan.

How many names can be on a property?

Yes, it is really possible. Normally, lenders allow a maximum of two names in a mortgage agreement. This is most common in the case of married couples. However, if you are single and want the other person to share the mortgage liability and future ownership of the home, you can provide the name of the co-signatory.

Can two people own a house?

Yes. Many lenders allow two families to pool their income to buy a house together. … Lenders can also claim that both families have equal property rights in the house. Matters such as the use of property, costs and property are best agreed in advance with the help of lawyers.

Joint tenants mean that both owners own the entire property and have equal rights to the property. … Owners decide what shares they both have when buying a property. They can choose to own 50% each, or they can decide that one person should have a larger share than the other.

Can a house be in 2 people’s names?

In California, you can own a property with two or more people. Your title deed lists all the names of the various owners and their property rights.

What are my rights if my name is not on a deed?

In single-name cases (as opposed to situations where the names of both owners are on the deed), the starting point is that the “non-owner” (the party whose name is not on the deed) has no rights to the property. They must therefore find out what is legally called “beneficial interest”.

What happens if your spouse dies and you are not on the charter? If you are not on the deed and your husband passes, the house should go through the estate. … You can avoid everything by concluding a new joint deed and a deed of survivorship deed, or by making a transfer to a death statement so that after his death the house would pass to you.

Does my partner have rights to my property?

It is generally accepted that when your partner moves into your home, the ownership of your property, savings and investment is not affected. If you owned something before your partner moved in, it continues to be solely your property.

Does a deed mean you own the house?

A house deed is a legal document that transfers ownership of a property from the seller to the buyer. In short, this ensures that the house you just bought is legally yours.

What does it mean if you are on the deed of a house?

The person whose name appears on the deed has title to the property. It does not matter whether the property was transferred by purchase, inheritance or gift. It is a document that transfers ownership. The title deed has a legal description of the property, including the property or boundary lines.

Who owns a house deed or mortgage?

If your name is on the deed but not on the mortgage, it means that you own the apartment but are not responsible for the mortgage loan and the resulting payments. However, if you do not pay the payments, the lender can still seize the home, even though only one spouse is listed on the mortgage.

Do house deeds show ownership?

In essence, the documents are a trace of documents proving the ownership of the property. This may include sales contracts, mortgages, leases, transfer documents and wills.

Is my wife entitled to half my house if it’s in my name?

Your spouse is not entitled to half of the house just because he paid on a mortgage basis. Your spouse is entitled to a refund of half of the principal paid during the marriage (ie from the date of marriage to the date of divorce).

How long do you have to stay married to get half of everything?

California Community Property Act: “10 Year Rule” In California, a marriage that lasts less than 10 years will have a fixed length of maintenance, which is usually half the length of the marriage. If the marriage lasted 10 years or more, then there is no set time limit for the spouse’s maintenance.

What happens if you are married & The House is not in your name?

Real estate owned before the wedding remains a separate property. … If your name is not in the title of your home for these reasons, you would not be the owner of the home; nor would they be liable for repayment of the loan or any other lien on the property, even if this would result in foreclosure.

Can my wife take half of my house?

Legally, your ex can’t force you out of the family home to sell it. Changing locks and other such activities are unacceptable, as both have the legal right to remain in possession until a decision is made. … No single party in a divorce is entitled to 50% of all property, including the family home.