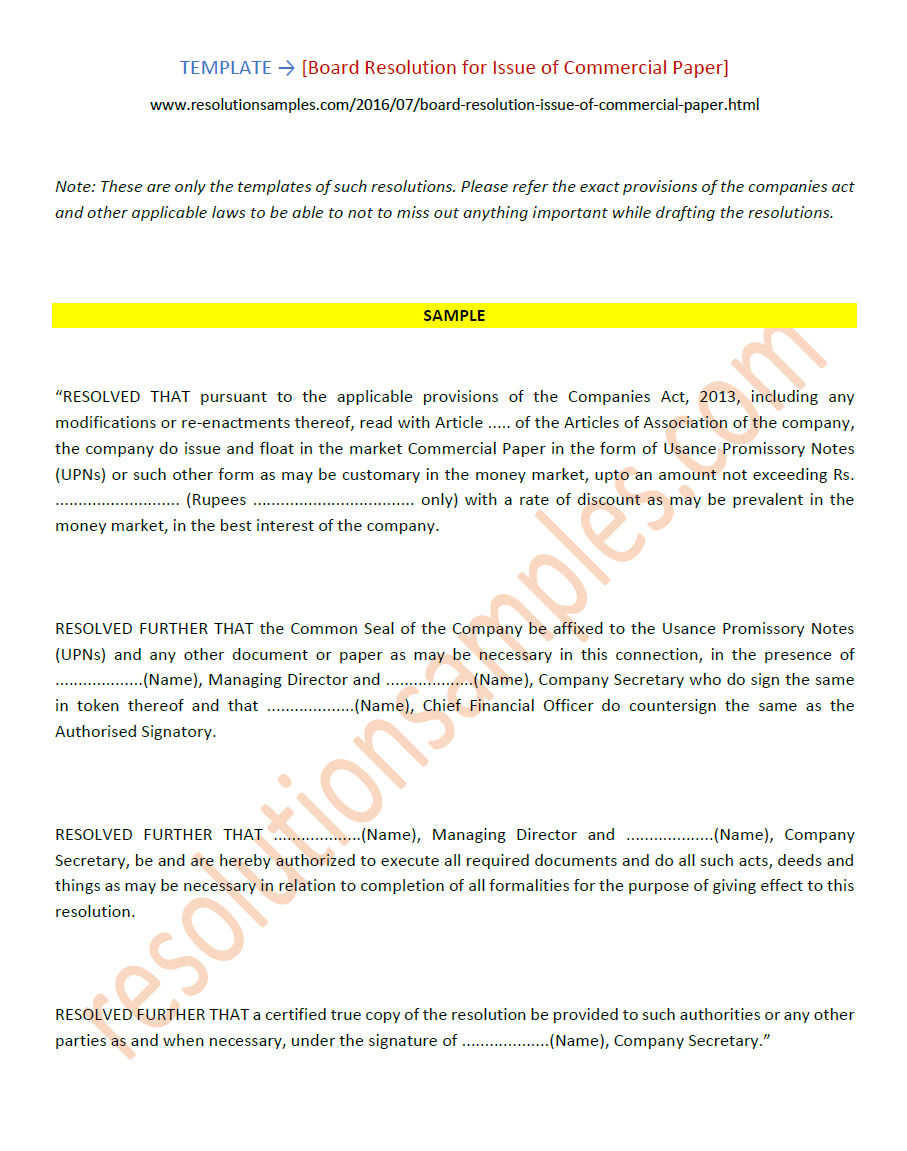

The company issues these notes to finance all aspects of its business, from launching new products to paying off more expensive debts. In return for a loan, the company agrees to pay investors a fixed return within a certain period of time. Even a valid promissory note is not risk-free.

What is the difference between notes and loans?

Contents

- 1 What is the difference between notes and loans?

- 2 Are structured products high risk?

- 3 What happens when a convertible note matures?

- 4 Is it good for a company to have no debt?

- 5 What is a senior secure note?

In general, promissory notes work for relationships that are more informal than loan agreements. Promissory notes can work for friends and family loans, or short -term, small loans. Loan agreements, on the other hand, work for everything from vehicles to mortgages to new business ventures.

What is the difference between a note and a mortgage? Differences Between Promissory Notes & Mortgages. The main difference between a promissory note and a mortgage is that a promissory note is a written agreement that contains the details of the mortgage loan, whereas a mortgage is a loan secured by real estate.

Does note mean loan?

A record is a legal document that represents a loan made from an issuer to a creditor or investor. The record requires payback of the principal amount of the loan, as well as any predetermined interest payments. The U.S. government issues Treasury Notes (T-notes) to raise money to pay for infrastructure.

What does it mean when a lender calls a note?

In terms of intermediate loans, as well as mortgages, there is usually a language in the record that allows a lender to call the record if the lender deems herself unsafe. This usually occurs when borrowers are highly leveraged and the value of its leveraged assets falls significantly.

Does note mean money?

What’s the note? A note, also known as a promissory note, is a legal debt instrument where one party makes a promise in writing to pay a certain amount of money to another party under certain circumstances.

Is a note the same as a loan?

A loan record is a type of promissory agreement that outlines the legal obligations of the lender and the borrower. A loan record is a legally valid agreement that includes all the terms of the loan, such as payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

Why is a loan called a note?

A loan record is a type of promissory agreement that outlines the legal obligations of the lender and the borrower. A loan record is a legally valid agreement that includes all the terms of the loan, such as payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

Is a note considered a loan?

Notes A note is a debt guarantee that requires the repayment of a loan, at a pre -determined interest rate, within a specified period of time. Notes are the same as bonds but usually have an earlier maturity date than other debt securities, such as bonds.

What does it mean when a lender calls a note?

In terms of intermediate loans, as well as mortgages, there is usually a language in the record that allows a lender to call the record if the lender deems herself unsafe. This usually occurs when borrowers are highly leveraged and the value of its leveraged assets falls significantly.

Does a promissory note mean you got the loan?

Promissory notes legally bind the borrower and lender in an agreement where the borrower is responsible for repaying the loan or debt. … Only the borrower signs the promissory note, whereas the borrower either the borrower signs the loan agreement. The signed document means that the borrower agrees to repay the loan.

Does promissory note mean approved?

A promissory note does not necessarily mean you have been approved. … Some lenders may choose to request more documentation after the promissory note is signed, or they may refuse funds due to suspicion of fraud. Promissory notes do not make lenders obligated to fund.

How long does it take to get funded after signing promissory note?

In most cases, these fees occur within 2 to 3 working days after you sign your promissory note. To avoid delays, check the Status Details of your application to ensure your bank information is complete. Problems with your bank information will slow down funds. Bank Information Required: There is a problem financing your loan.

Is a promissory note a loan?

A Promissory Note is essentially an unconditional written promise to repay a loan or other debt, on a date that is fixed or can be determined. Although it can be legally enforced, promissory notes are less formal than loan agreements and are suitable for smaller amounts of money.

Are structured products high risk?

Structured products are hybrid investments that consist of bonds and options. They offer the potential for a higher return on investment compared to standard deposits. Structured products are low risk investments with the possibility of receiving capital protection up to 100%.

Do structured products carry credit risk? Comparison with direct investment You should consider the following differences between direct investment before considering an investment in a structured product: â € “Structured products bear the credit risk of the investment issuer.

What is the risk of structured products?

There are three major risks attached to structured products, according to Nick Johal, director at Dura Capital. This is credit risk, market risk and inflation risk. In terms of credit risk, Mr Johal describes this as â € œthe security that supports your investment plan will be issued by a financial institution, usually a bank.

What is the benefit of structured products?

Other benefits depend on the type of structured product, as each is different. These benefits can include, principal protection, low volatility, tax efficiency, returns that are greater than those provided by the underlying asset (leverage), or positive yields in a low yield environment.

What are the disadvantages of investing in a structured product?

Weaknesses of structured products can include: Credit risk â € “Structured products are debts that are not guaranteed by investment banks. Lack of liquidity â € “structured products are primarily traded on counters and publishers are not required to make offers.

What is a risk involved with investing in structured products?

Among the risks inherent in investing in structured products are liquidity risk, market risk and counterparty risk. … Investing involves risk. You can lose (part of) your deposit.

What are the 4 main risks of investing?

4 Real Risks of Investing (and What to Do About Them)

- Corporate risk. Company -specific risk seems to be the most common threat to investors who buy individual shares. …

- Volatility and market risk. …

- Opportunity cost. …

- Liquidity risk.

Are structured investments risky?

Structured notes can offer increased or decreased upside potential, decreased risk, and general volatility. For example, a structured note can consist of fairly stable bonds coupled with out-of-the-money call options on risky stocks. Such combinations limit losses, while creating the potential for huge gains.

What are the disadvantages of investing in a structured product?

Weaknesses of structured products can include: Credit risk â € “Structured products are debts that are not guaranteed by investment banks. Lack of liquidity â € “structured products are primarily traded on counters and publishers are not required to make offers.

Are structured products covered by FSCS?

A Structured Deposit Plan is a capital -protected product and has protection of up to £ 85,000 by the Financial Services Compensation Scheme (FSCS).

What is a structured product FCA?

Most structured products are fixed -term investments. … The amount you earn, or receive back, depends on the performance of a specific market (such as the FTSE 100) or a specific asset (such as shares in an individual company).

Are structured products considered fixed income?

Structured investments can vary in scope and complexity, often depending on investor risk tolerance. SIP usually involves exposure to fixed income and derivatives markets. … This type of product is a combination of a CD fixed income long -term call option on the Nasdaq 100 index.

Are structured products FDIC insured?

No, structured records and principal protection are not insured to the FDIC.

What happens when a convertible note matures?

Most notes that can be changed, such as other forms of debt, provide that they are paid on the maturity date, usually 18 to 24 months. Occasionally, convertible notes will provide that at maturity they automatically convert into equity, or convert into equity at the lender’s option.

What happens when a convertible note changes? In general, notes that can be converted into shares (“Conversion Shares”) in a qualified equity financing round (this term should be defined in the notes and usually means a preferred financing round of minimum size) are two different ones. price per share: (1) price per share using a conversion cap (…

Do you have to pay back a convertible note?

Notes that can be changed are the same as any other form of debt – you have to pay back the principal plus interest. In an ideal world, a startup would never pay back a cash convertible note. However, if the maturity date hits before a Series A financing, investors can choose to get their money back.

Is a convertible note a debt?

Convertible notes are short -term debt that is eventually converted into equity. Convertible notes operate as a loan and are typically issued in conjunction with the next round of financing.

Can you lose money on a convertible note?

If a startup fails, the company typically has run out of money. The holder of a convertible note can get nothing, or at best can only receive pennies on the dollar. You may also be able to write off your loss.

Can a convertible loan be repaid?

Convertible loans need to be repaid as per loan, but the important part is in terms of payment: â how and / or when. In most cases, debt reimbursement is done by converting the value of the loan and interest into company equity rather than returning the cash back.

What happens when notes mature?

When the notes payable reach maturity, all obligations must be repaid, or the lender will declare a default. If you cannot pay all obligations by maturity, you should make an alternative agreement with your lender.

Are convertible notes good?

Notes that can be changed nicely to quickly close the Seedling round. It’s good to buy from your first investor, especially when you’re having a hard time buying your company. … If you need cash to get you into Series A that will attract solid lead investors at a fair price, convertible notes can help.

How do convertible notes affect stock price?

As a general rule, the stronger the company, the lower the preferred yield relative to its bond yield. … By this logic, convertible bonds allow issuers to sell shares indirectly at a price higher than the current price.

Are senior notes a good investment?

Senior notes are bonds that must be paid before many other debts if the issuer declares bankruptcy. That makes senior records more secure than other bonds. That greater level of security means investors receive slightly lower interest rates.

What happens to convertible debt on maturity?

A convertible note is a debt instrument that includes terms such as maturity date, interest rate, etc., but it will be converted into equity if a future round of equity is raised. Conversion usually takes place at a discount to the price per share of the next round.

Can you repay convertible debt?

In other words, a convertible note is a loan to start an early stage from an investor who hopes to be repaid when the note is paid. But, instead of being paid back in principal with interestâ € ”as would be the case with a typical loanâ €” investors can be repaid in equity in your company.

What happens to convertible debt in an acquisition?

What will happen to the record that can be changed if the company acquires or merges with another company? … Most convertible notes call for notes to be converted into shares in the company at a pre-set price just before the acquisition / merger, often at the same price as the note stamp.

Is it good for a company to have no debt?

However, for companies that do not have debt is good news. … If Company A and Company B are allocating more capital for debt repayment, then they are allocating less capital for capital expenditure, or CapEx. This, in turn, will make them less competitive and increase market share for Company C, which does not have debt to leverage.

Why is it better for a company to have debt? In general, too much debt is a bad thing for the company and its shareholders because it hinders the company’s ability to create a cash surplus. Furthermore, high debt levels can negatively affect general stockholders, who are last in line to claim payback from a company that goes bankrupt.

Why would a company go debt free?

Small firms without debt with little access to the credit market look to raise equity while paying higher dividends. Large debt -free firms, generating more cash flow for their investment needs, often pay off their debts while paying higher dividends.

Why do companies go debt free?

The advantages of US debt free firms are they are debt free companies that can provide winning returns. Debt is only a short -term fix for the financial crisis. Debt has a higher long -term cost. Debt -free corporations pay higher dividends and have higher equity returns.

What does it mean when a company has no debt?

In general, companies manage their funding requirements through equity or debt or internally generated cash. … However, often many companies proudly claim that they are debt-free companies which means either they have zero debt or a small amount of debt.

Is it good for a business to have no debt?

The advantage of all this is that business owners who operate without business debt have a greater degree of financial freedom and flexibility, and a lower level of risk in the face of economic downturn and business downturn.

Is Zero debt good for a company?

Debt -free businesses are not affected by a slowing economy or rising interest rates. They can run businesses even if the economy slows. … Debt has a higher long -term cost. Debt -free corporations pay higher dividends and have higher equity returns.

What happens when a company is debt free?

What happens to the cash and debt that is in the business that he owns? Cash free, debt free by the simplest definition means that when a buyer purchases a company and its assets, it is on the basis that the seller will pay all debts and withdraw any excess cash before completing the transaction.

What is a senior secure note?

Senior Secure Record means the secured or unsecured record or other debt of the Company issued after the Closing Date, and the Debt is described accordingly; if (a) the terms do not provide for a scheduled payment, mandatory redemption or sinking fund obligation before the Latest Maturity Date …

What does it mean when a company offers senior notes? Senior note bidding refers to the sale of senior note by a company that wants to raise money from investors. Usually, the announcement of the senior note offer is accompanied by legal disclosure of the amount sought by the company, and what the company is going to do with the money.

Are senior secured notes first lien?

Senior debt is often secured by collateral where the lender has placed a lien first. Usually this covers all corporate assets and often works for revolving credit lines. It is debt that has priority to pay back in liquidation.

What is the difference between senior secured and first lien?

First Lien Debt means the Initial First Lien Debt and the Additional First Lien Debt. Senior Guaranteed Party means the Guaranteed Credit Agreement and the Additional Senior Debt Party.

What is senior secured first lien?

First Lien Senior Secured Loan means a Bank Loan (i) that is not (and by no means cannot be) subject to the right to pay on obligations other than those obligated to such loan, (ii) which is secured by a valid first priority. perfected security interest or lien to or under the obligor’s special security guarantee …

Are first lien notes secured?

The position of the lien is a priority of the note being paid, especially if there is a default. First position mortgage notes are the safest because they will be paid first.