Is a SAFE note debt or equity?

Contents

- 1 Is a SAFE note debt or equity?

- 2 What can I invest in safely?

- 3 Can a SAFE note be repaid?

- 4 How do you account for debt to equity swap?

- 5 Are SAFEs considered debt or equity?

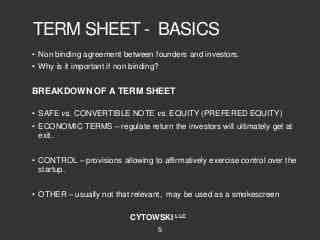

SAFE banknotes are not long; are convertible equity. Loan or due date not included.

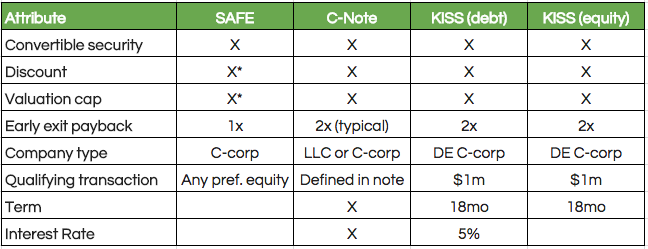

Is SAFE equity? SAFE banknotes are a type of convertible security, while convertible bills are a form of debt that can be converted into equity once certain milestones are met. As a result, convertible bonds usually have a maturity and interest rate.

Is SAFE note a debt?

The iSAFE banknote is a convertible security that is not in debt and therefore does not charge interest. As the Companies Act 2013 classifies all share capital as either equity or preference, iSAFE bonds issued in India are classified as preference shares and entitle the holders to a nominal dividend.

Is a SAFE convertible debt?

The convertible banknote is long and the SAFE is a non-debt convertible security. Consequently, the convertible banknote includes the interest rate and the maturity rate, while SAFE does not. … Both SAFE and convertible banknotes may have value constraints, discounts and most-favored-nation countries.

Is a SAFE a debt instrument?

In practice, SAFE allows a start-up and an investor to achieve the same general objective as a convertible record, even though SAFE is not a debt instrument. SAFE is a contract that can be applied between a company and an investor. Investors invest money in a company using SAFE.

What is a SAFE note?

SAFEs (or simple arrangements for future equity) are documents often used by start-ups to help raise seed capital. In essence, the SAFE banknote acts as a legally binding promise to allow the investor to purchase a certain number of shares at an agreed price at some point in the future.

Is SAFE an equity financing?

The Simple Future Equity Agreement (SAFE) is a common equity financing document used by start-ups and investors in start-up financing operations. SAFE created the Y Combinator, a famous technology accelerator located in Silicon Valley, California.

What is a SAFE financing?

A simple future equity agreement (SAFE) is a financing agreement that a start-up company can use to raise capital in its seed financing rounds. Some consider the instrument to be a more alternative alternative to convertible notes.

Is a SAFE an equity security?

For those who don’t know, SAFE is a contract by which an investor provides an investment in a company that is converted into a preferred equity security when AND IF the preferred equity is issued with a qualifying capital raise. … This is a really risky bet for an investor, especially a small investor.

Is a SAFE agreement a loan?

SAFE is a cash investment now in exchange for a contract that gives the investor the right to convert the investment into future equity. SAFE is not a loan: there is no interest rate, no payments and no maturity date.

Is a SAFE a debt instrument?

In practice, SAFE allows a start-up and an investor to achieve the same general objective as a convertible record, even though SAFE is not a debt instrument. SAFE is a contract that can be applied between a company and an investor. Investors invest money in a company using SAFE.

Is a SAFE convertible debt?

The convertible banknote is long and the SAFE is a non-debt convertible security. Consequently, the convertible banknote includes the interest rate and the maturity rate, while SAFE does not. … Both SAFE and convertible banknotes may have value constraints, discounts and most-favored-nation countries.

Is a SAFE note a debt instrument?

Because SAFE records are not debt instruments, there is no maturity or end date. The end date can force the conversion into equity and provide the right to the conversion of equity beyond the valuation ceiling. With SAFE notes, investors can wait indefinitely for maturity, even when the company is making a profit.

Are SAFEs debt or equity?

In 2013, Y Combinator created SAFE notes to simplify the process. SAFE banknotes are not long; are convertible equity. Loan or due date not included.

What can I invest in safely?

The best safe investments in 2022

- High Yield Savings Accounts. High-yield savings accounts are almost the safest type of account for your money. …

- Certificates of deposit. …

- Gold. …

- US Treasury Bonds. …

- Savings bonds of series I. …

- Corporate bonds. …

- Real estate. …

- Preference shares.

What is the safest thing to invest in? U.S. treasury bills, bills, and bonds, also known as treasuries, are considered the safest investments in the world and are supported by the government. 4 Brokers sell these investments in $ 100 increments, or you can purchase them yourself from TreasuryDirect.

Can a SAFE note be repaid?

However, since the real purpose of the SAFE banknote is not to repay but to acquire equity, investors can agree to this arrangement. Lower returns: The absence of interest on a short-term investment is not a big deal. However, if you have an investment for more than a year, this could make a big difference.

Is the SAFE note long? The iSAFE banknote is a convertible security that is not in debt and therefore does not charge interest. As the Companies Act 2013 classifies all share capital as either equity or preference, iSAFE bonds issued in India are classified as preference shares and entitle the holders to a nominal dividend.

Are SAFEs legally binding?

This SAFE constitutes a valid and binding obligation of the investor, enforceable under its terms, unless limited by bankruptcy, insolvency or other general laws relating to or affecting the exercise of creditors’ rights in general and the general principles of equity.

Are SAFEs liabilities or equity?

Most SAFEs should be classified as a liability, probably a long-term liability. … SAFE provides the company with an obligation to deliver a variable number of shares based on a future round of unknown price (discounted) or valuation ceilings.

Is a SAFE a warrant?

Unlike the SAFE convertible banknote, it is not a loan; is more than a task. In particular, there is no interest paid and no due date, so SAFE is not subject to regulations that debt can be in many jurisdictions.

Is a SAFE considered a security?

Some issuers are offering a new type of security as part of some of the crowdfunding offerings they have named SAFE. Abbreviation for Simple Agreement for Future Equity. These securities are risky and very different from traditional ordinary shares.

How does a SAFE note work?

SAFE notes work by allowing you to postpone the valuation of your business to a later date. … Once progress is made, you find another investor who gives your company a so-called cash valuation. With this data, you can then calculate the company’s new price per share.

How are SAFE Notes calculated?

The discount for convertible banknotes or SAFE is calculated by dividing the valuation ceiling by the traditional valuation of equity financing and then subtracting this value from 1 (meaning no discount). In this case, this would be mathematically represented as $ 2 million / $ 4 million = 0.5 and 1 â € “0.5 = 0.5.

What happens if a SAFE never converts?

If the company never decides to rise again, SAFE will continue forever without conversion. Like most convertible shares, SAFE gives investors the right to receive a certain number of shares in the next round of financing at a certain price. … Another obligation for investors is that no refund is required.

How do you account for debt to equity swap?

Accounting for debt-to-equity swap Conversion of the entire $ 10 million loan into equity at the date of the transaction allows the company to debit the books for as much as $ 10 million. The Common Equity Account is then credited to the new equity issue – in this case $ 1 million or 10%.

What happens when debt is converted into equity? Debt / equity swap is a refinancing transaction in which the debt holder obtains an ownership position in exchange for a debt write-off. The replacement is usually done to help companies in difficulty continue to operate. The logic of this is that an insolvent company cannot pay its debts or improve its ownership position.

Who benefits from debt for equity swaps?

Instead of cash, it is also possible to pay some equivalent value of cash. In the event of debt-to-equity swap, loans are extinguished in favor of equity. In these transactions, the lender typically receives less than the face value of the debt but more than the amortized market value. So both sides are better.

How do you account for debt to equity swap?

Accounting for debt-to-equity swap Conversion of the entire $ 10 million loan into equity at the date of the transaction allows the company to debit the books for as much as $ 10 million. The Common Equity Account is then credited to the new equity issue – in this case USD 1 million or 10%.

What is a combination of debt and equity financing that has the right to convert to an equity interest?

Debt / equity swaps include swaps equity swaps to restructure a company’s equity position.

Who utilizes equity swaps?

Debt / equity swaps refer to a type of financial restructuring in which an entity offers its lender an equity interest in exchange for its debt interest in the entity. Debt and equity swaps are usually made in response to a company falling into severe financial distress.

What is a combination of debt and equity financing that has the right to convert to an equity interest?

Debt / equity swaps include swaps equity swaps to restructure a company’s equity position.

Which type of debt can be converted to equity?

Convertible debt works similarly to a regular loan, with one major exception. In the case of convertible debt, the debt will eventually change into equity for the issuer once certain conditions are met. In its earliest stages, a company may use convertible debt for fundraising purposes.

What is the combination of debt and equity financing?

A mixture of debt and equity is a combination of debt and equity used to finance corporate assets. That. is defined as the amount of permanent short – term debt, preference shares and ordinary equity capital used for. to finance the company. The debt capital mix is sometimes used as a synonym for capital structure.

What are the two types of equity financing?

There are two methods of equity financing: private placement of shares with investors and public offering of shares. Equity financing is different from debt financing: the former involves borrowing money and the latter involves selling part of the equity in the company.

Is a refinancing deal in which debt holder gets an equity position in exchange for cancelation of debt?

When exchanging debt / equity, the lender receives an equity stake, such as shares in the company, in exchange for writing off the company’s debt to it.

What is a debt for equity exchange?

Debt-to-equity swapping involves the creditor converting debt owed by an enterprise into equity of that enterprise. The effect of the swap is to issue equity to the creditor to repay the debt so that the debt is repaid, released or extinguished.

What does debt swap meaning?

Debt swaps refer to the swap of debt in the form of a loan or, more typically, securities other than shares, for a new debt contract (ie debt and debt swap) or debt swap for equity (ie debt and equity swap) .

How do you account for debt to equity swap?

Accounting for debt-to-equity swap Conversion of the entire $ 10 million loan into equity at the date of the transaction allows the company to debit the books for as much as $ 10 million. The Common Equity Account is then credited to the new equity issue – in this case USD 1 million or 10%.

Are SAFEs considered debt or equity?

SAFE agreements are neither debt nor equity. Instead, they are contractual rights to future equity. These rights are in exchange for early capital investments invested in start-ups. The SAFE agreements allow investors to convert investments into equity during the pricing round at some future point.

Is SAFE a debt instrument? In practice, SAFE allows a start-up and an investor to achieve the same general objective as a convertible record, even though SAFE is not a debt instrument. SAFE is a contract that can be applied between a company and an investor. Investors invest money in a company using SAFE.

Is a SAFE considered equity?

SAFEs do not represent the current ownership interest in the company in which you are investing. … SAFE is an agreement to provide you with a future equity interest based on the amount you have invested if – and only if – a triggering event occurs, such as an additional round of financing or the sale of a business.

Are SAFEs considered securities?

SAFEs are considered securities such as shares and convertible banknotes and are thus regulated by the SEC in accordance with the Securities Act of 1933 and the Stock Exchange Act of 1934.

Are SAFEs equity for tax purposes?

Depending on the terms of the SAFE and the facts and circumstances relevant to its issuance, the SAFE should be treated as either equity or a variable prepaid futures contract in terms of U.S. federal income tax.

Is a SAFE note a liability or equity?

Although the SAFE agreements are not long in the traditional sense and it can be argued that they are recorded as equity; in practice, we see that SAFE agreements are recorded as long-term debt.

Is SAFE an equity financing?

The Simple Future Equity Agreement (SAFE) is a common equity financing document used by start-ups and investors in start-up financing operations. SAFE created the Y Combinator, a famous technology accelerator located in Silicon Valley, California.

What is a SAFE financing?

A simple future equity agreement (SAFE) is a financing agreement that a start-up company can use to raise capital in its seed financing rounds. Some consider the instrument to be a more alternative alternative to convertible notes.

Is a SAFE agreement a loan?

SAFE is a cash investment now in exchange for a contract that gives the investor the right to convert the investment into future equity. SAFE is not a loan: there is no interest rate, no payments and no maturity date.

Are SAFEs debt or equity?

In 2013, Y Combinator created SAFE notes to simplify the process. SAFE banknotes are not long; are convertible equity. Loan or due date not included.