What is a convertible note term sheet?

Contents

- 1 What is a convertible note term sheet?

- 2 What is convertible debt offering?

- 3 Can you lose money on a convertible note?

- 4 Can a convertible loan be repaid?

- 5 Are convertible notes included in net debt?

The table of conditions for convertible bonds is a concise overview of the key conditions for the basic financing of convertible debt. As you get closer to potential investors, the list of terms will be a critical part of your set of start-up financing tools, along with a summary and investor presentation.

What is a convertible note template? A convertible banknote is a type of financial document that allows companies to exchange equity or other intangible assets for a typically short-term loan. A convertible bill of exchange, like a bill of exchange, offers something like capital in exchange for payment.

What is a convertible note for dummies?

Convertible banknotes allow investors to change debt into equity when certain events occur. Investors and founders use them in companies at an early stage, because the legal costs and complexity are lower than using other types of financing. … Convertible banknotes play an important role in basic financing.

How does a convertible debt work?

Convertible debt is a loan or debt obligation from an investor that is paid with equity or company shares. … When a company borrows money from an investor and plans to later convert it into equity or ownership in the company, it is convertible debt.

What is a convertible note example?

A convertible banknote is a form of short-term debt, which is usually issued to the company’s investors in exchange for shares later. For example, it could be debt that automatically converts into preferred stock shares after the round of financing closes.

How do you explain a convertible note?

A convertible banknote is a form of short-term debt that is converted into equity, usually in connection with a future round of financing; in fact, the investor would lend money to the startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company.

What is convertible debt offering?

A convertible banknote is a debt instrument that is convertible into shares of the issuer or another entity. They offer investors protection against the downsides of a debt instrument and the potential to increase capital investment, but in return usually offer lower interest rates than direct debt instruments.

How does convertible debt work? Convertible debt is a loan or debt obligation from an investor that is paid with equity or company shares. … When a company borrows money from an investor and plans to later convert it into equity or ownership in the company, it is convertible debt.

Why do companies issue convertible debt?

Companies issue convertible bonds to lower the coupon rate on debt and delay dilution. The conversion rate of a bond determines how many shares the investor will receive for it. Companies can force the conversion of bonds if the share price is higher than if the bond is redeemed.

Why do companies issue convertible bonds?

Companies with low credit ratings and high growth potential often issue convertible bonds. For financing purposes, bonds offer more flexibility than ordinary bonds. They may be more attractive to investors because convertible bonds offer growth potential through future capital price appreciation.

What are the advantages and disadvantages of convertibles to issuers?

Advantages and disadvantages of convertible vehicles Lower borrowing costs with a fixed interest rate. Concluding long-term borrowing with a low fixed interest rate. Postponement of dilution of votes. Increasing the overall level of indebtedness.

Why is convertible debt good?

The benefits of the Company’s convertible bonds reduce interest costs due to lower interest rates. Companies avoid problems with stock dilution. Investors enjoy a guaranteed income. The disadvantages are limited because the investor can recoup his original investment when the bond matures.

What is a convertible debt deal?

In convertible debt, a company borrows money from a lender where both parties enter into an agreement with the intention (from the outset) of repaying all (or part) of the loan by converting it into a number of its ordinary shares at some point in the future.

Why is convertible debt good?

The benefits of the Company’s convertible bonds reduce interest costs due to lower interest rates. Companies avoid problems with stock dilution. Investors enjoy a guaranteed income. The disadvantages are limited because the investor can recoup his original investment when the bond matures.

What is a convertible debt investment?

A convertible bond is a corporate debt security with a fixed income that yields interest repayments, but can be converted into a predetermined number of ordinary shares or equity shares. A conversion from a bond to a share can be made at certain times during the life of the bond and is usually at the discretion of the bondholder.

Why is convertible debt good?

The benefits of the Company’s convertible bonds reduce interest costs due to lower interest rates. Companies avoid problems with stock dilution. Investors enjoy a guaranteed income. The disadvantages are limited because the investor can recoup his original investment when the bond matures.

When would you use a convertible debt?

Companies typically take on convertible debts when they believe their shares will increase in value. This allows them to reduce the dilution of capital (renunciation of too much ownership). For example, if a company wants to raise $ 1 million and its shares are worth $ 20 today, it would have to sell $ 50,000 to reach its goal.

Why are convertible bonds attractive to investors?

Convertible bonds are attractive because as a stock falls in price, the fixed income component of a convertible bond (i.e., its investment value) acts as a support level through which the convertible bond will not fall.

What is the advantage of convertible debt?

Benefits of Debt Financing in Convertible Bonds No matter how profitable a company is, convertible bond owners receive only fixed, limited income until conversion. This is an advantage for the company because most of the operating income is available to ordinary shareholders.

Can you lose money on a convertible note?

When a startup fails, the company usually runs out of money. The owner of the convertible banknote may not get anything, or at best he can only get pennies on the dollar. You may also be able to write off your loss.

What happens to convertible banknotes? A convertible banknote is a form of short-term debt that is converted into equity, usually in connection with a future round of financing; in fact, the investor would lend money to the startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company.

Are convertible notes a good investment?

Convertible banknotes are good for quickly closing a Seed round. They are great for getting a purchase from your first investor, especially when you find it difficult to set a price for your company. … If you need money to get to A series that will attract a solid leading investor at a fair price, a convertible banknote can help.

Do investors prefer convertible notes?

Some investors do not like convertible banknotes Although there are advantages in their use, convertible banknotes have disadvantages that both investors and entrepreneurs should keep in mind. … Some investors prefer to wait until the price round, even though they admit they will most likely pay a higher price.

Are convertible bonds a good investment now?

Convertible companies offer greater potential for appreciation than ordinary corporate bonds and an investor can make a conversion to benefit from an increase in stock prices. In a fixed income portfolio, convertible products can increase returns through exposure to rising equity prices and reduce the impact of rising interest rates.

What are the risks of convertible notes?

The main disadvantages of convertible banknote supply are the dilution of capital and the short-term impact on the stock price and, if the stock price fails to rise above the conversion price, the potential refinancing risk.

Can you lose money on convertible bonds?

While convertible bonds have a higher appreciation potential than corporate bonds, they may be more prone to losses if the issuer fails to pay (or fails to pay interest and principal on time).

Are convertible bonds a good investment now?

Convertible companies offer greater potential for appreciation than ordinary corporate bonds and an investor can make a conversion to benefit from an increase in stock prices. In a fixed income portfolio, convertible products can increase returns through exposure to rising equity prices and reduce the impact of rising interest rates.

Are convertible bonds a good investment 2021?

The average interest rate coupon on convertible debt in 2021 is 1.41%, which is the lowest record. On average, this year’s issuers will have to convert bonds into shares only if their share price rises by 39%, usually over a five-year period, the highest so-called conversion premium since 2003, according to Dealogic.

Are convertible bond funds risky?

One is that financing with convertible securities carries the risk of distributing not only EPS of ordinary shares of the company, but also control of the company. … For a corporation, convertible bonds carry a significantly higher risk of bankruptcy than preferred or ordinary shares.

Is a convertible note secured?

A convertible banknote is a security instrument, usually used by an angel or an initial investor, in the form of a short-term loan, either secured or unsecured, to provide start-up capital for a business.

Is a convertible loan a security?

A convertible bill is a debt security that is converted into equity when certain conversion events occur. A convertible loan has certain significant advantages over investing in capital: … Faster, cheaper process.

Can a convertible loan be repaid?

A convertible loan must be repaid like any loan, but the critical part lies in the repayment terms: “how” and / or “when”. In most cases, debt repayment is done by converting the value of the loan and interest into the company’s equity instead of repaying the cash.

Can you repay the convertible loan? Not until the convertible debt is outstanding, then Yes after it is converted into equity. No repayment until the sale of the company.

What happens when convertible debt matures?

Most convertible bills, like other forms of debt, are expected to mature on the maturity date, usually 18 to 24 months. Occasionally, convertible banknotes will allow them to be automatically converted into equity at maturity or converted into equity at the option of the lender.

Do you pay interest on convertible debt?

Because convertible loans are partly debt and partly equity, investors earn interest on the total loan amount over the life of the loan. In most cases, interest is added to the principal each month and is not paid each month.

What happens when convertible bond matures?

The bond has a maturity of 10 years and a convertible ratio of 100 shares for each convertible bond. If the bond is held to maturity, the investor will be paid $ 1,000 in principal plus $ 40 in interest for that year.

How does convertible debt affect balance sheet?

When convertible bonds are issued and sold, the business will take cash, which will increase assets. On the other side of the balance sheet, liabilities will increase by the same amount, because a convertible bond is a liability.

Can you pay back convertible note?

Convertible banknotes are like any other form of debt – you will have to repay the principal plus interest. In an ideal world, a startup would never return a convertible banknote in cash. However, if the maturity date comes before the A-Series financing, investors may decide to claim their money back.

Is a convertible note a warrant?

Warrant for convertible banknotes is a good way to encourage investors, because it gives them the right to later buy a certain amount of company shares.

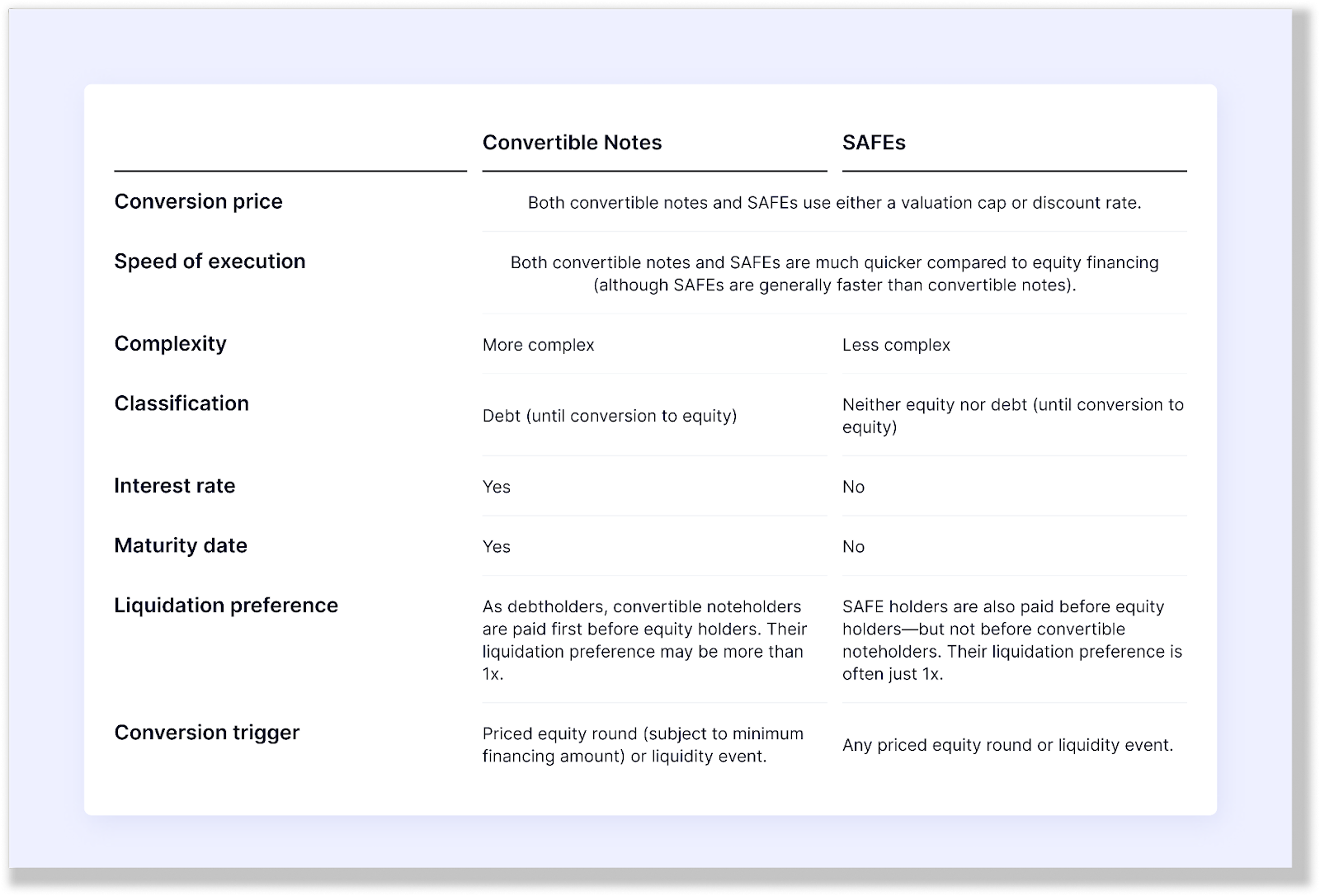

Is a convertible note considered debt?

A convertible banknote is a debt instrument often used by angels or start-up investors who want to finance an early-stage startup that is not explicitly valued. Once more information becomes available to determine reasonable value for the company, investors in convertible banknotes can convert the banknotes into equity.

Are convertible notes considered debt?

A convertible share is a bond, preference share or other financial instrument that a shareholder can convert into ordinary shares. Convertible securities are not classified as debt or equity; instead, they are considered a hybrid of two categories, possessing cash flow characteristics of both bonds and stocks.

Do convertible notes count as debt?

Is a convertible banknote debt or equity? Convertible banknotes were originally structured as debt investments, but have a provision that allows principal plus accrued interest to be later converted into equity investments. This means that they are essentially a hybrid of debt and capital.

Is a convertible note considered equity?

A convertible banknote is a short-term debt that eventually turns into equity. Convertible banknotes function as loans and are usually issued in connection with future rounds of financing.

Are convertible notes included in net debt?

Any in-the-money (BMI) convertible debt is treated as if it were converted into equity and is not considered debt. … In practice, non-controlling interest, preferential capital that cannot be converted into ordinary shares and capital leasing are sometimes linked to the calculation of net debt.

Is convertible debt included in the debt-to-equity ratio? The issuance of convertible bonds delays the dilution of shareholders because there is no impact on equity until the conversion option is exercised and now previous shareholders have fewer “cars”. … The conversion is usually conducted by the bondholder unless the conversion is initiated by the items specified in the contract.

What’s included in net debt?

Net debt is calculated by adding up all short-term and long-term liabilities of the company and deducting its working capital. This figure reflects the company’s ability to meet all its liabilities at the same time using only those assets that are easily liquidated.

What does net debt include?

Net debt shows how much cash would remain if all debts were repaid and whether the company has enough liquidity to meet its debt obligations. Net debt is calculated by deducting the company’s total cash and cash equivalents from its total short-term and long-term debt.

Are accruals included in net debt?

It is always shown as a liability in the company’s balance sheet. Operating liabilities such as trade payables, deferred revenue and accrued liabilities are excluded from the calculation of net debt.

Are payables included in net debt?

Net debt = Short-term debt Long-term debt – cash. they never involve obligations.

Is convertible debt considered debt?

A convertible share is a bond, preference share or other financial instrument that a shareholder can convert into ordinary shares. Convertible securities are not classified as debt or equity; instead, they are considered a hybrid of two categories, possessing cash flow characteristics of both bonds and stocks.

Is a convertible note considered debt?

A convertible banknote is a debt instrument often used by angels or start-up investors who want to finance an early-stage startup that is not explicitly valued. Once more information becomes available to determine reasonable value for the company, investors in convertible banknotes can convert the banknotes into equity.

Are convertible loans debt?

A convertible loan is a type of debt ‘instrument’, ie a document that represents a loan given to a company. The promissory note is ‘issued’ by the borrower and held by the lenders (or investors). Convertible loans differ from ordinary debt because they are convertible into company shares (its capital).

Are convertible bonds considered debt?

A convertible bond is a corporate debt security with a fixed income that yields interest repayments, but can be converted into a predetermined number of ordinary shares or equity shares. A conversion from a bond to a share can be made at certain times during the life of the bond and is usually at the discretion of the bondholder.

What is not included in net debt?

It is always shown as a liability in the company’s balance sheet. Operating liabilities such as trade payables, deferred revenue and accrued liabilities are excluded from the calculation of net debt.

Are payables included in net debt?

Net debt = Short-term debt Long-term debt – cash. they never involve obligations.

What is not included in total debt?

It should be noted that the measure of total debt does not include short-term liabilities such as trade payables and long-term liabilities such as capital leasing and pension plan liabilities.

What does net debt include?

Net debt shows how much cash would remain if all debts were repaid and whether the company has enough liquidity to meet its debt obligations. Net debt is calculated by deducting the company’s total cash and cash equivalents from its total short-term and long-term debt.