What is convertible debt in a startup?

Contents

- 1 What is convertible debt in a startup?

- 2 How do you account for debt to equity swap?

- 3 Are equity shares convertible?

- 4 What are the two types of convertible security?

- 5 Are convertible notes good for stocks?

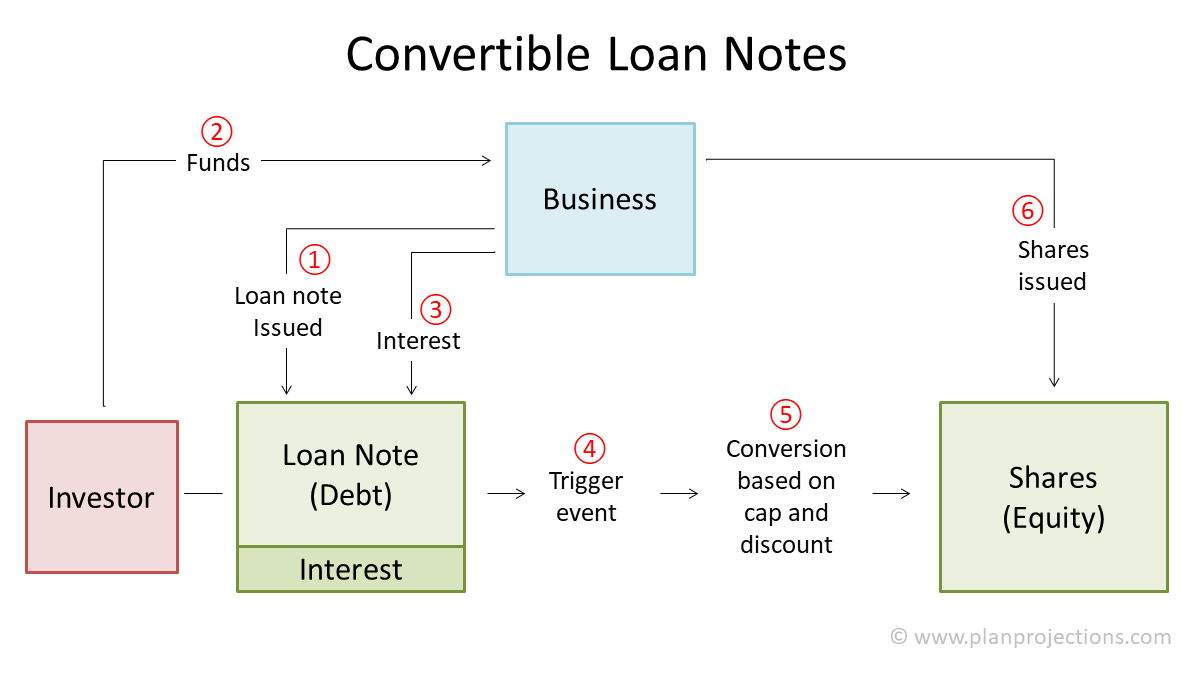

What is convertible debt? Convertible debt (sometimes referred to as a convertible bond) is an investment opportunity used by early-stage investors, such as venture capitalists and angel investors, to provide money to a start-up while postponing the valuation of the start-up.

What is considered a convertible debt? In the case of a convertible debt, the company borrows money from the lender if both parties enter into an agreement with the intention (from the outset) to repay all (or part) of the loan, converting it into a number of shares at some point. the future.

Is a convertible loan debt or equity?

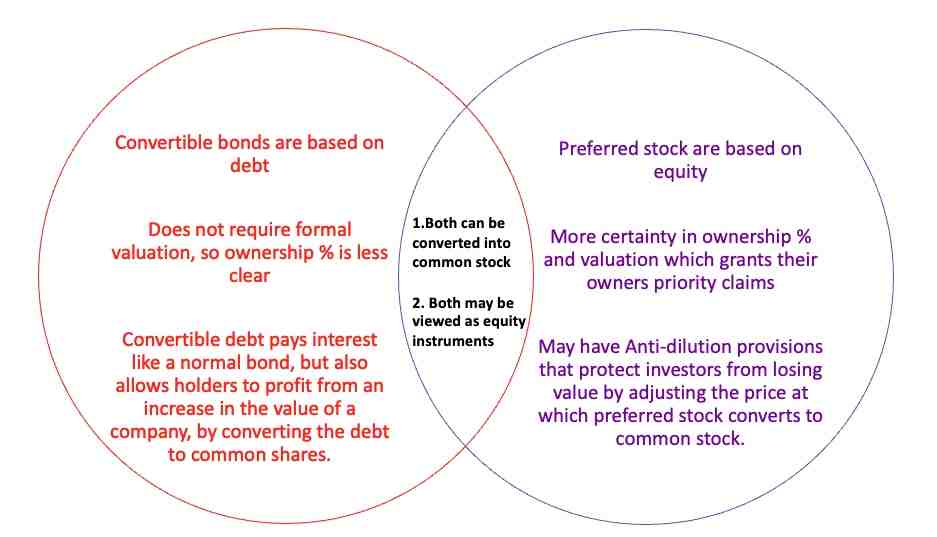

Is a convertible bond a debt or a share? Convertible bonds are initially structured as debt investments, but have a provision that allows the principal, together with accrued interest, to be converted into equity investments at a later date. This means that they are essentially a hybrid of debt and equity.

Are convertible loans debt?

A convertible loan letter is a type of debt instrument, ie a document that reflects a loan granted to a company. The bond is “issued” by the borrower and held by lenders (or investors). Convertible loan bonds differ from ordinary bonds in that they are convertible into the company’s shares (equity).

Is convertible a debt equity?

A convertible bond is a short-term debt that eventually becomes shares. Convertible bonds act as loans and are usually issued in connection with future financial rounds.

Is convertible note a debt?

A convertible bond is a debt instrument that is often used by British or early stage investors who want to finance an early stage start-up that has not been explicitly valued. After more information is available to determine a reasonable value for the entity, convertible bond investors will be able to convert the bond into equity.

Why do startups use convertible notes?

Convertible bonds allow start-ups to focus on growing their business before they have to repay their debts. This is especially important for technology companies that have to spend a lot of time finishing their product. Convertible bonds are a quick and easy way for start-ups to raise money.

Why do companies use convertible notes?

Companies issue convertible bonds to lower the debt coupon rate and delay dilution. The conversion factor of a bond determines how many shares the investor will receive for it. Companies may force the conversion of bonds if the share price is higher than when the bond is redeemed.

What is the main advantage of a convertible note?

The main advantage of convertible banknotes is their relatively simple structure. Startup funding rounds can quickly become complicated and take a lot of time and money. Financing convertible bonds tends to be faster, easier and cheaper than financing paid bonds.

Why convertible notes are better than safe?

The most important difference is that SAFE banknotes have a specific conversion method, while convertible banknotes offer different conversion conditions. SAFE bonds will be converted into preference shares to be issued by the company in the next round of price financing.

How does a convertible debt work?

A convertible debt is an investor’s loan or debt that is settled in the company’s equity or shares. … If a company borrows money from investors and intends to later convert it into shares or property in the company, it is a convertible debt.

How does convertible debt work for startups?

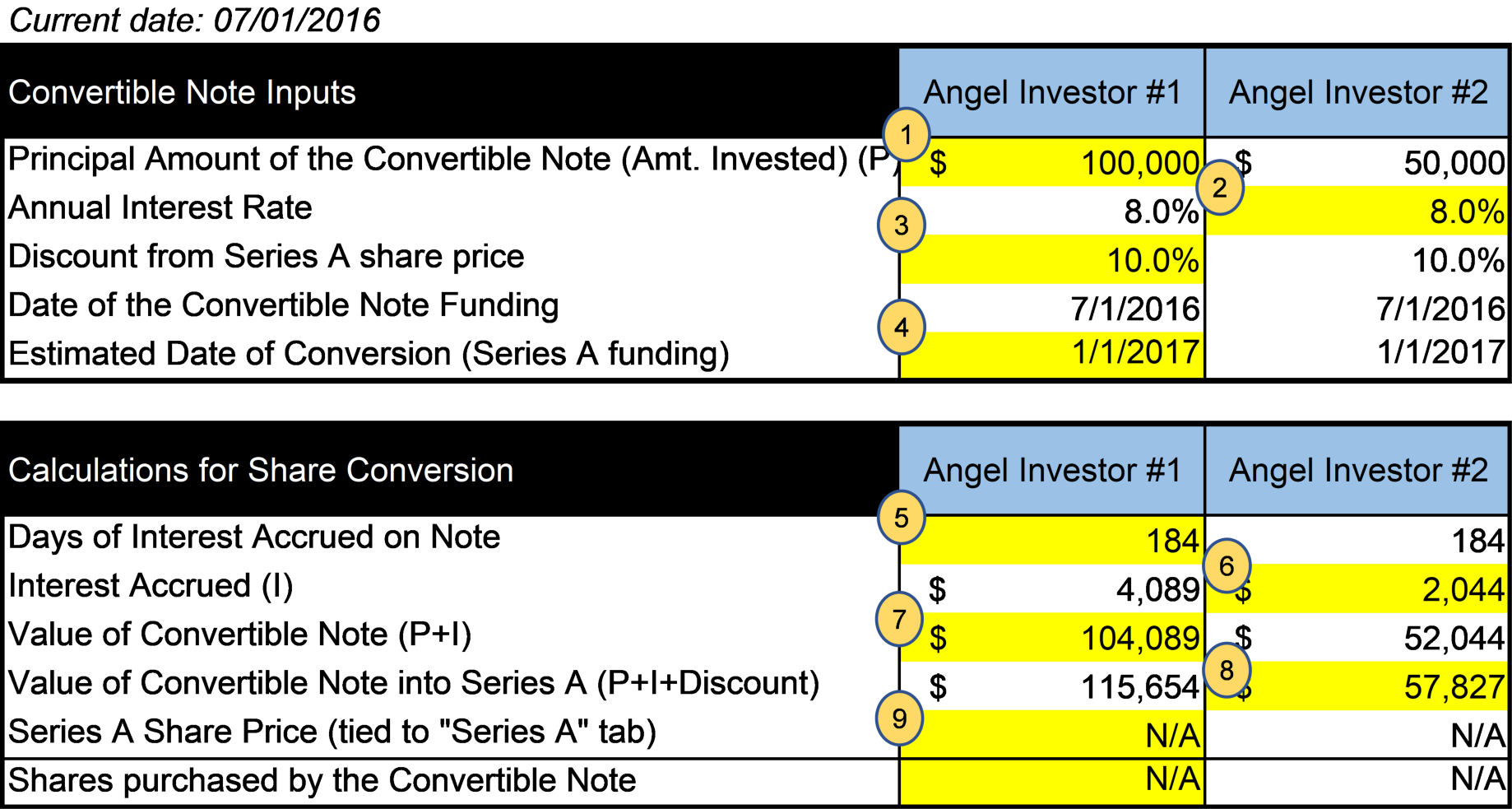

Basically, a convertible debt is a loan – the investor gives you your start-up money to build a business. … Instead, when the time comes – in a later round of financing – you convert the original amount of the loan into shares (shares) in your new company.

What does convertible debt usually convert to?

A convertible bond is a company’s fixed-income debt security that provides interest payments but can be converted into a predetermined number of ordinary shares or stocks. Conversion from a bond to a share may occur at certain times during the life of the bond and is usually at the discretion of the bondholder.

How is convertible debt calculated?

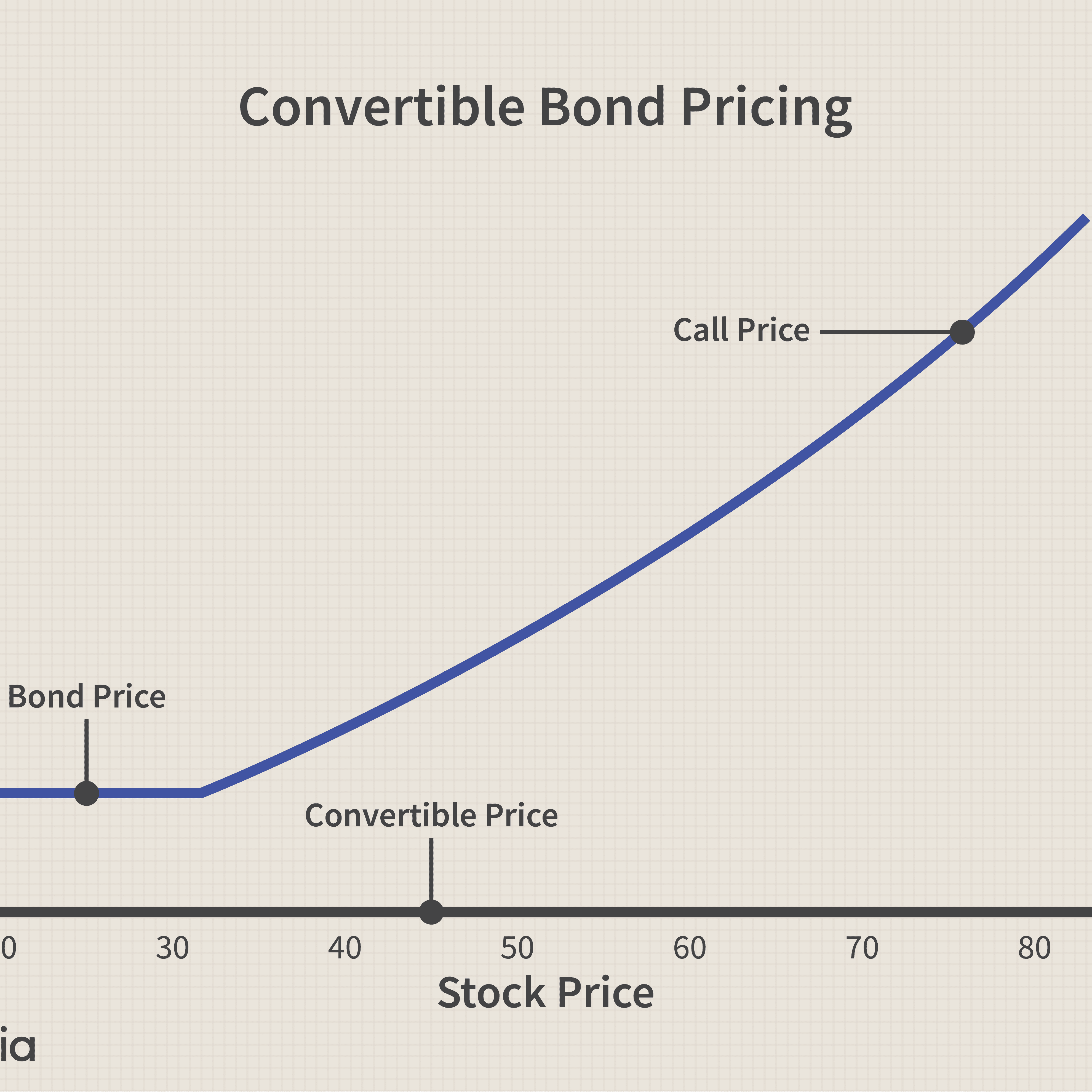

Convertible debt is a hybrid debt product that has a built-in option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the nominal value of the convertible security by the conversion price of the share.

How do you account for debt to equity swap?

Accounting for a debt-to-equity swap The conversion of the entire $ 10 million loan into shares at the date of the transaction will allow the company to debit the entire $ 10 million books. The stock account is then credited with a new share issue – in this example, $ 1 million, or 10%.

Who benefits from debt swaps? Instead of cash, you can also pay something equivalent to the value of cash. In the case of debt-to-equity swaps, loans in favor of shares are written off. In these transactions, the lender usually receives less than the nominal value of the debt but more than the amortized market value. Consequently, both sides are better.

What is a combination of debt and equity financing that has the right to convert to an equity interest?

Debt / equity swaps involve the exchange of shares for debt in order to restructure a company’s capital position.

What is a debt-to-equity conversion?

A debt / equity swap is a refinancing transaction in which the holder of a debt obtains a share position in order to clear the debt. An exchange is usually made to help a company in difficulty continue to operate. The logic of this is that an insolvent company will not be able to pay its debts or improve its capital position.

Which type of debt can be converted to equity?

Convertible debt works in the same way as normal lending, with one major exception. In the case of a convertible debt, the debt eventually becomes equity for the issuer after certain conditions are met. An early stage company may use convertible debt to raise money.

What are the two types of equity financing?

There are two methods of financing equity: private equity investments for investors and a public offering of shares. Equity financing is different from debt financing: the former involves borrowing money and the latter the sale of a company’s share of equity.

What happens when debt is converted to equity?

A debt / equity swap is a refinancing transaction in which the holder of a debt obtains a share position in order to clear the debt. An exchange is usually made to help a company in difficulty continue to operate. The logic of this is that an insolvent company will not be able to pay its debts or improve its capital position.

What does conversion of debt mean?

1.1 Commercial Debt Conversion Box 1.1 Debt Conversion. A debt swap involves the voluntary exchange of a debt between a creditor and a debtor for cash, another asset, or a new liability that has different repayment terms.

Does raising debt increase equity value?

If you are a shareholder, debt increases in value, but only to a certain extent, it decreases in value sharply. The main reason for using debt is that it is cheaper than shares. Thus, the value of a share increases if cheaper capital is put to work just as profitably.

Is a refinancing deal in which debt holder gets an equity position in exchange for cancelation of debt?

In a debt / equity swap agreement, the lender receives equity shares, such as company shares, in exchange for writing off the company’s debt.

What does debt swap meaning?

Debt swaps refer to the exchange of debt in the form of a loan or, more commonly, to securities other than shares for a new debt agreement (ie a debt-to-debt swap) or a debt-to-equity swap (ie a debt-to-equity swap).

What is a debt for equity exchange?

Debt-for-equity swaps mean that a creditor converts a company’s debt into that company’s equity. The effect of the exchange is to issue equity to the creditor to satisfy the debt so that the debt is written off, released or extinguished.

How do you account for debt to equity swap?

Accounting for a debt-to-equity swap The conversion of the entire $ 10 million loan into shares at the date of the transaction will allow the company to debit the entire $ 10 million books. The simple stock account is then credited with a new share issue – in this example, $ 1 million, or 10%.

The Company issues convertible securities that allow holders to convert their securities into ordinary shares at a discount to the market price prevailing at the time of conversion. This means that the lower the share price, the more shares the company has to issue upon conversion.

Is share capital a convertible debt? Is a convertible bond a debt or a share? Convertible bonds are initially structured as debt investments, but have a provision that allows the principal, together with accrued interest, to be converted into equity investments at a later date. This means that they are essentially a hybrid of debt and equity.

Shares are not convertible. Preference shares will be redeemed on maturity. The company may repurchase its shares. Only in special cases do preference shares have voting rights.

Under the 2013 Rules of the Indian Securities and Exchange Commission (Issuance and Listing of Non-Convertible Redeemable Preference Shares), a non-convertible redeemable preference share means a preference share that is redeemable under the Companies Act 1956 and does not include a preference …

What are convertible preference shares? These shares are the company’s fixed income securities that the investor can choose to convert a certain number of the company’s ordinary shares after a specified period of time or on a specified date.

What are convertible equities?

“What is a convertible share?” is a common issue among start-ups in need of additional financing and among companies at risk of insolvency. In particular, a convertible share, also called a convertible security, is a debt that does not need to be repaid when it matures.

What are examples of convertible securities?

The types of securities exchanged are as follows:

- Convertible bond.

- Reverse convertible bond.

- Convertible preference share.

- Asset-linked bond: Although an asset-warranted bond is a type of convertible security, it is not an ordinary warrant. …

- Asset Note.

- Bond with asset order.

Are convertible notes good for stocks?

Convertible banknotes are good for quick closing of the Seed Round. These are great for outsourcing your first investors, especially if you’re having a hard time pricing your business. … If you need money to reach an A-series that attracts a certain leading investor at a fair price, a convertible bond can help.

What are convertibles in stock market?

A “convertible security” is a security – usually a bond or a preference share – that can be converted into another security – usually a company’s ordinary shares. In most cases, the owner of the convertible decides whether and when to rebuild.

What are convertible preference shares? These shares are the company’s fixed income securities that the investor can choose to convert a certain number of the company’s ordinary shares after a specified period of time or on a specified date.

What companies offer convertibles?

| Symbol | Grade | Name |

|---|---|---|

| CWB | C | SPDR Barclays Convertible Securities ETF |

| CGO | C | Calamos Global Total Return Fund |

| OPY | C | Oppenheimer Holdings, Inc. Class A (DE) |

| FCVT | C | First Trust SSI Strategic Convertible Securities ETF |

Which stock is convertible?

A “convertible security” is a security – usually a bond or a preference share – that can be converted into another security – usually a company’s ordinary shares. In most cases, the owner of the convertible decides whether and when to rebuild.

What are examples of convertible securities?

The types of securities exchanged are as follows:

- Convertible bond.

- Reverse convertible bond.

- Convertible preference share.

- Asset-linked bond: Although an asset-warranted bond is a type of convertible security, it is not an ordinary warrant. …

- Asset Note.

- Bond with asset order.

What are the two types of convertible security?

A convertible security is an investment that can be changed from its original form to another form. The most common types of convertible securities are convertible bonds and convertible preference shares that can be converted into ordinary shares.

What are convertible securities? A “convertible security” is a security – usually a bond or a preference share – that can be converted into another security – usually a company’s ordinary shares. … In other cases, the enterprise has the right to determine when the translation will occur. Usually, companies issue convertible securities to raise money.

What do you mean by convertibles why company issue convertibles?

The Company may issue convertible bonds to avoid a negative mood. Bondholders can then convert into shares if the company is doing well. The issuance of convertible bonds can also help provide investors with some collateral in the event of insolvency.

Why would a company offer convertible senior notes?

Why do companies offer convertible bonds? Convertible bonds and convertible bonds are a popular way for companies to borrow money at a lower interest rate than other types of debt. When bondholders redeem their bonds for the company’s shares, they reduce the company’s debt.

What do you mean by convertibles?

Convertible shares are securities, usually bonds or preference shares, that can be converted into ordinary shares. Convertible bonds are most often associated with convertible bonds, which allow bondholders to convert their creditor position into that of an shareholder at an agreed price.

Why do companies issue convertibles?

Companies issue convertible bonds to lower the debt coupon rate and delay dilution. The conversion factor of a bond determines how many shares the investor will receive for it. Companies may force the conversion of bonds if the share price is higher than when the bond is redeemed.

What do you mean by convertibles?

Convertible shares are securities, usually bonds or preference shares, that can be converted into ordinary shares. Convertible bonds are most often associated with convertible bonds, which allow bondholders to convert their creditor position into that of an shareholder at an agreed price.

What is the meaning of convertible bond?

A convertible bond is a company’s fixed-income debt security that provides interest payments but can be converted into a predetermined number of ordinary shares or stocks. Conversion from a bond to a share may occur at certain times during the life of the bond and is usually at the discretion of the bondholder.

What are convertibles in stock market?

A “convertible security” is a security – usually a bond or a preference share – that can be converted into another security – usually a company’s ordinary shares. In most cases, the owner of the convertible decides whether and when to rebuild.

What is convertible feature?

A convertible bond entitles its holder to “convert” or exchange the nominal amount of the bond for a specified proportion of the issuer’s ordinary shares over a specified period. As bonds, they have the characteristics of certain fixed-income securities. Their conversion function also gives them the characteristics of equity securities.

Are convertible notes good for stocks?

Convertible banknotes are good for quick closing of the Seed Round. These are great for outsourcing your first investors, especially if you’re having a hard time pricing your business. … If you need money to reach an A-series that attracts a certain leading investor at a fair price, a convertible bond can help.

Is a convertible bond good for investors? Convertible bonds can be a great option for the right company and the right investor. A high-risk, high-reward model can offer start-ups the opportunity to raise start-up money before they have the resources to fund Series A.

How does convertible debt affect stock price?

As a general rule, the stronger a company is, the lower the preferred yield compared to its bond yield. … By this logic, a convertible bond allows an issuer to sell ordinary shares indirectly at a price higher than the current price.

Do convertible bonds increase stock price?

As the name implies, a convertible bond gives its holder the option to convert or exchange it for a pre-determined number of shares in the issuing company. … Because convertibles can be converted into stocks and thus benefit from rising share prices, companies are offering lower returns on convertibles.

Do convertible notes dilute stock?

The shares that convertible bondholders receive upon conversion of the bonds are in the form of newly issued securities that may be detrimental to previous investors. In the absence of protection, convertible bonds almost always dilute the percentage of ownership of current shareholders.

Why are convertible bonds attractive to investors?

Convertible bonds are attractive because when the share price falls, the fixed income component of the convertible bond (ie the value of the investment) acts as a reference level through which the convertible bond does not fall.

The shares that convertible bondholders receive upon conversion of the bonds are in the form of newly issued securities that may be detrimental to previous investors. In the absence of protection, convertible bonds almost always dilute the percentage of ownership of current shareholders.

Is convertible debt dilutive?

Dilution securities are not originally ordinary shares. … Some examples of dilutive securities include convertible preference shares, convertible debt instruments, warrants and stock options.

What happens when convertible notes convert?

As a general rule, convertible bonds are converted into shares (“conversion shares”) in a qualifying equity financing round (this term should be defined in the bond and usually means a minimum size of preferred financing round) below two different rounds of financing. share prices: (1) share price using the conversion limit (…

What are convertible notes in stocks?

A convertible bond is a debt instrument that is often used by British or early stage investors who want to finance an early stage start-up that has not been explicitly valued. … So that instead of a return on the principal plus interest, the investor would receive equity in the company.

Why are convertible notes good for investors?

Convertible bonds allow issuers to postpone valuation negotiations until the next funding round. … The discount rate of the convertible bond allows investors to convert their loan amount with accrued interest into shares at a lower price compared to investors in the next round.

Can you lose money on a convertible note?

When a startup fails, the company usually runs out of money. The holder of a convertible bond may not receive anything or, at best, will only receive pennies on the dollar. You may also be able to pay for your losses.