What is the disadvantage of treasury bill?

Contents

- 1 What is the disadvantage of treasury bill?

- 2 What happens when a Treasury bill matures?

- 3 How do Treasury notes work?

- 4 Can you lose money on Treasury bills?

One of the major advantages of the T-Bill is also one of its major drawbacks. You must always convert them into new investments as they grow rapidly. This means that if you have a T-Bill paying good interest rates and dividends, you will end up re-investing and earning less money.

What are the benefits of Treasury bonds? The value of the treasury pays a fixed amount of interest, which can provide a stable income structure. As a result, bonds can provide investors with confidence that can help reduce potential losses from other investments in their portfolio, such as equities.

What are the merits of treasury bill?

There is no risk involved – it is sponsored by the RBI and supported by the Government of India. It is a short-term loan; so the maturity period does not exceed one year and is very secure; so there is no risk in it. Investing in a Treasury Account ensures the full security of your money.

What are the merits and demerits of Treasury bills?

| Profits | Prisoners |

|---|---|

| Sipili tsoho kasada | Take the risk of profits |

| State and local income taxes are not levied on interest rates | Give low results |

| It can be easily bought or sold in the secondary market | Leading up to maturity, it does not pay any coupon fees |

What is the main attraction of Treasury bills?

Because the basic characteristics of T-Bills are that they guarantee a high return, they usually act as a secure portion of the investment file.

What is a Treasury bill?

Fiscal funds are short-term government programs with a maturity of a few days to 52 weeks. Bills are sold at a discount from their face value.

What is Treasury bills advantages and disadvantages?

Compared to other stock market investment tools, T-biloons offer easier results as they receive government-sponsored loans. T-bills do not have a zero-coupon bond, i.e. no interest is paid to investors. However, they are offered at a cheaper rate and are redeemed at a lower cost.

What is a Treasury bill?

Fiscal funds are short-term government programs with a maturity of a few days to 52 weeks. Bills are sold at a discount from their face value.

What are advantages of Treasury bills?

The risk of default is zero since T-sponsors are guaranteed by the US government. T-shirts offer a minimum investment requirement of $ 100. Profit income is excluded from state and local income tax but under federal income tax. Investors can buy and sell T bonds with ease in the secondary stock market.

What happens when a Treasury bill matures?

When the bill grows, you are paid exactly the same amount. If the cost is higher than the purchase price, the difference is your interest. You can buy bills from us at TreasuryDirect. You can also buy them through a bank or dealer.

What is the significance of the Great Depression? Treasury bills are for a year or less, and they do not pay interest before the end of the maturity period. They are sold at auction at a discount from the actual billing price. They are offered with puberty of 28 days (one month), 91 days (3 months), 182 days (6 months), and 364 days (one year).

Can you sell a Treasury bill before maturity?

You can hold Treasury bills until they grow or sell before they grow. To sell the account you hold in TreasuryDirect or Legacy Treasury Direct, first transfer the account to a bank, broker, or dealer, and then ask the bank, broker, or dealer to sell the account to you.

What is the minimum maturity of Treasury bill?

Treasury bills, or T-bills, have an average maturity period of 364 days. Thus, they are classified as currency trading instruments (currency pairs deal with currencies with maturity of less than one year). Currently, bills are offered in three maturities – 91-day, 182-day and 364-day.

Can Treasury bill be liquidated before maturity?

Yes, you can sell T-Bills before maturity. Of course, the price you pay depends on the profit margin.

Can Treasury bills be sold?

Treasury bills, or T-bills, are sold in terms that range from a few days to 52 weeks. rarely, they are sold at reasonable prices. When the bill grows, you are paid exactly the same amount.

What happens when Treasury bonds mature?

When the Treasury Agreement â € “means it reaches puberty and ends â €“ the investor is paid the full value of the T-bond. This means that if the shareholder holds a $ 10,000 balance sheet, he or she will receive a $ 10,000 maximum back, and have an interest in the investment.

Do you have to redeem EE bonds when they mature?

(Hunting updated monthly.) Note: While you must take action to issue any certificates you may have, the funds you hold in your TreasuryDirect are automatically earned and no longer profitable. on the day they grew up. To see the security status in TreasuryDirect, go to your TreasuryDirect account.

Is there a penalty for not cashing in matured EE savings bonds?

As a final consideration, you will be subject to tax liability on your evidence when they grow up whether you redeem your evidence or not. Make sure you include any previously reported profits on your tax return during the maturity year. If not, you could face legal action for tax evasion.

Do treasury bonds pay interest after maturity?

EE certificates are profitable until they are 30 years old or until you pay them, whoever comes first. You can give them after 1 year. But if you spend them before 5 years, you lose the profit for the last 3 months. (For example, if you spend EE money after 18 months, you get the first 15 months of profit.)

How do Treasury notes work?

Treasury records and bonds are plans to pay a fixed interest rate every six months until security is matured, which is when the Treasury pays the correct amount. The difference between them is their height until puberty. The treasury records have grown over a year, but not more than 10 years from the date of their publication.

Can you make a loss on the Treasury note? Can You Lose Money To Invest In Bonds? Yes, you may lose money when selling a joint before the due date since the selling price may be lower than the purchase price.

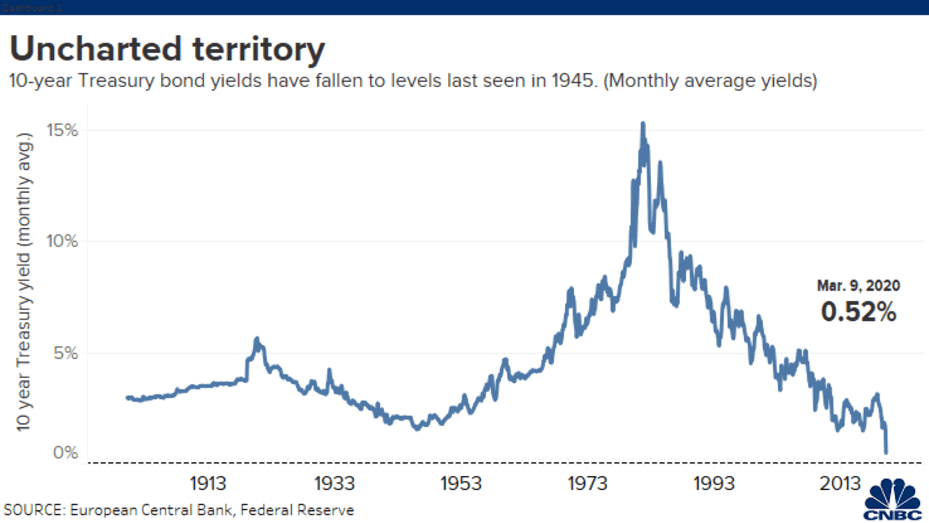

What is 10-year Treasury note?

The 10-year Treasury record is a credit requirement provided by the US government with a 10-year maturity at the initial issuance. The 10-year Treasury report pays interest on a fixed rate once every six months and pays the face value to the holder of puberty.

What is the 10 year treasury rate today?

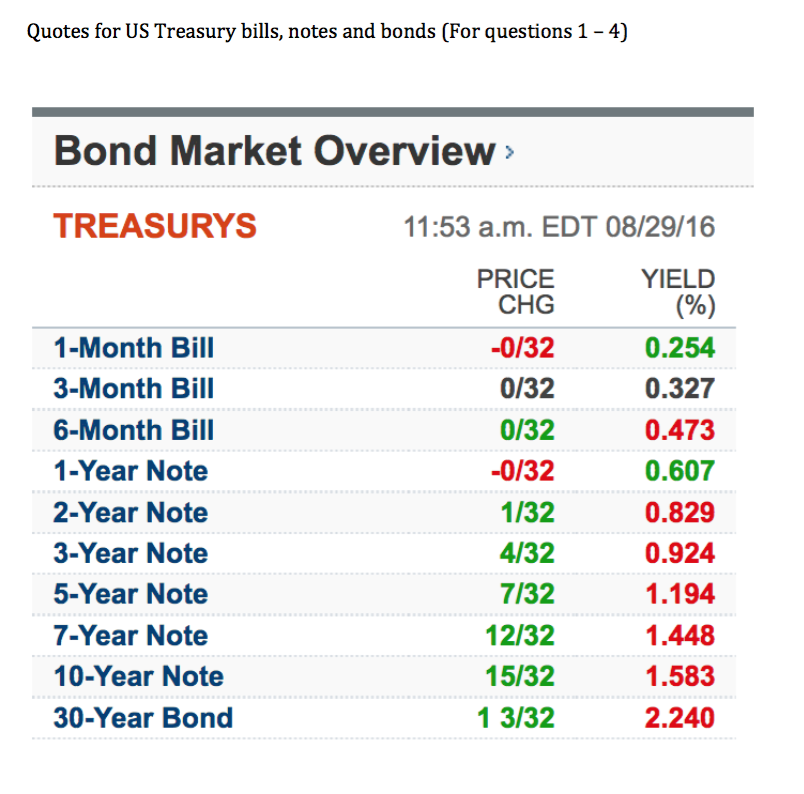

| Sun by Range | 1.9300 – 1.9300 |

|---|---|

| Length of Week 52 | 1.1280 – 1.9360 |

| Average volume | 0 |

Why would you buy a Treasury note?

Treasury bonds can be a good investment for those looking for security with a fixed annual interest rate until puberty. … Corporate terms pay higher yields than Treasury since corporate bonds have unrealistic risks, while stocks have a guarantee if they are held to growth.

How do Treasury notes work?

Treasury records and bonds are plans to pay a fixed interest rate every six months until security is matured, which is when the Treasury pays the correct amount. … FRN is a security interest-bearing payment that can change over time. As interest rates increase, security costs will increase.

How do Treasury bills work?

Treasury bills are calculated on the basis of the original value and the buyer receives the actual value after maturity. For example, a budget of Rs 100 can be spent on Rs 95, but the buyer is paid Rs 100 on maturity. The return on fiscal stimulus depends on the financial situation in the economy.

How much interest can you earn from a treasury bill?

Prices currently rise from 0.09% to 0.17% for T-payments which have grown from four weeks to 52 weeks. actually by selling them at a discount to face the price, â Miche Michelson said.

Can you lose money on Treasury bills?

Securities are considered risky assets, meaning there is no risk that the investor will lose their capital. In other words, investors who hold bonds until growth are guaranteed a large or first investment.

How do you make money from Treasury bills?

Treasury is also a type of investment that is highly liquid. This means that they are easy to trade. They can be sold in the secondary market and easily converted into cash. If you sell the bill in the secondary market, sell it to someone instead of waiting for it to grow.

How do Treasury notes pay interest?

The treasury records are water-bearing plans that have a limited maturity of not more than 1 year and not more than 10 years from the date of issue. … Treasury data pays interest over half a year. When the notes mature, the investor receives a face value.

How often is interest paid on Treasury bills?

For example, Treasury bills or T-bills are short-term payments that range from a few days to 52 weeks. Treasury notes or T-bills are very similar to Treasury bills because they pay a fixed interest rate every six months until they grew up.

How does the Treasury pay interest?

The fiscal consolidation pays a fixed amount of interest over half a year. This profit is exempt from state and local taxes. But it is subject to federal income tax, according to TreasuryDirect. The budget is a government budget that has a 30-year term.

Do Treasury bills pay interest?

T-Bill does not pay the duesâ € zai which leads to maturity. T-shirts can prevent cash flow for investors who need a steady income. T-shirts have a risk of interest rates, so, their value may be less attractive in the case of inflation.

Can you lose money on Treasury bills?

Securities are considered risky assets, meaning there is no risk that the investor will lose their capital. In other words, investors who hold bonds until growth are guaranteed a large or first investment.

What is the risk of Treasury bills? So, the risk of investing in T-bonds is a right risk. That is, the investor is likely to get a good return somewhere, and only time will tell. The risk lies in three areas: inflation, profit risk, and opportunity prices.

Is it safe to invest in treasury bills?

T-money is one of the safest investments, but their return is relatively small compared to many other investments. When deciding if T-support documents are appropriate for the retirement file, the cost of opportunity and risk need to be considered. In general, T-shirts may be suitable for investors who are near or in retirement.

Why do people still invest in treasury bills?

The biggest benefit of trusting US Treasures is security. No investor carries a strong guarantee that interest and capital will be repaid on time. Because these funds can be quoted, many people invest in them to save and improve their capital and have an improved income system.

Are Treasury bills a safe investment?

T-sponsorship is considered a safe and conservative investment since it was backed by the US government. T-Bills are usually administered until puberty. However, some holders may want to withdraw money before maturity and realize their short-term profit margins by reselling their shares in the secondary market.

Are Treasury bonds a safe investment?

The Treasuries are funded by the federal government and are considered the safest investment you can make, because all treasuries have the “absolute trust and value” of the US government.

Are Treasury bills less risky?

Most often, either the current Treasury bills, or the T-bill, a tally or a long-term government loan amount are used as a risk factor. T-shirts are considered almost safe because they have the full support of the US government.

Are Treasury bills the safest investment?

The Treasuries are funded by the federal government and are considered the safest investment you can make, because all treasuries have the “absolute trust and value” of the US government.

Why are Treasury bills risk-free?

Debt obligations made by the US Treasury Department (bonds, notes, especially Treasury bills) are considered safe because of the “full trust and dignity” of the US government. Because they are safe, the return on safe assets is close to the current profit margin.

Are treasury bills low-risk?

Treasury bills are sold in groups of $ 1,000. However, some can reach an average of $ 5 million in non-competitive offers. These documents are considered to be low risk and safe investment.

Can bonds lose money?

Bonds are often regarded as less risky than stocks – and in most cases, they are – but that does not mean you can not lose the money to own bonds. Stock prices plummet when interest rates rise, when a issuer faces a negative credit score, or when market capitalization dries up.

Do bonds lose money in a recession?

First, witnesses, especially government witnesses, are considered trustworthy assets (U.S. evidence is considered a “safe gift”) with minimal risk. … The downside is that their “safe assets” that completely fall out of favor during the recession and may swing wildly in value in the short term.

Is money in bonds safe?

As NS&I is owned by the Government, savings are as healthy as ever, but these days almost all UK reserves are protected. With Premium Bonds there is no risk to your capital â € “so the money you put in is generally unhealthy â € kawai just’s just ‘interested’ in gambling.

Are bonds still a good investment?

Ownership of bonds today is still relevant because they provide a steady income and protect files when risky assets fall. If you rely on your file to spend, the joint venture should protect your spending level. Also, you can sell bonds and use lower prices in risky assets.