Does Dave Ramsey invest in bonds?

Contents

- 1 Does Dave Ramsey invest in bonds?

- 2 Are bonds safe if the market crashes?

- 3 Why are bond prices falling?

- 4 What is the future of bonds?

- 5 Which is better EE or I bonds?

When it comes to investing, top bond funds shouldn’t be your wealth building strategy. The rate of return is generally lower than the stock market. … This is what usually happens with bonds – they fall in value when interest rates rise, which causes you to lose money. Dave doesn’t invest in bonds.

What investments does Dave Ramsey recommend? What Dave Ramsey Does (and Doesn’t) Invest In

- Mutual Funds. …

- Exchange traded funds. …

- Unique stocks. …

- Certificates of Deposit (CDs) …

- titles. …

- Fixed Annuities. …

- Variable Annuities (VAs)…

- Real Estate Investment Funds (REITs)

Is bond investing a good idea?

An I bond is a US government savings bond that carries a fixed interest rate plus an additional inflation adjuster, so you get an inflation-adjusted real rate of return. In a world of inflation concerns and few inflation-adjusted investments, Title I is a great place to look for savers.

Are bonds a safe investment now?

Risk: Savings bonds are backed by the US government, so they are considered as safe as an investment. However, keep in mind that bond interest payments will fall if and when inflation stabilizes.

Are bonds safe if the market crashes?

Buying Bonds During a Market Crash Government bonds are generally considered the safest investment, yet they are decidedly unattractive and often offer meager returns compared to stocks and even other bonds.

Are I bonds a good investment 2020?

Best Investment for Like other government-issued debt, Series I bonds are attractive to risk-averse investors who don’t want to take any risk of default. These bonds are also a good choice for investors who want to protect their investment against inflation.

Why investing in bonds is a bad idea?

Interest Rate Risk Just as prices can rise in an economy, interest rates can also rise. As a result, Treasury bonds are exposed to interest rate risk. If interest rates are rising in an economy, the existing T-bond and its fixed interest rate may underperform newly issued bonds, which would pay a higher interest rate.

Are bonds safe if the market crashes?

Buying Bonds During a Market Crash Government bonds are generally considered the safest investment, yet they are decidedly unattractive and often offer meager returns compared to stocks and even other bonds.

Are bonds a good investment now?

Owning bonds today is still relevant because they provide stable income and protect portfolios when risky assets fall. If you depend on your portfolio for spending, the bond portion should protect your level of spending. And you can sell bonds and take advantage of lower prices on risky assets.

What are the disadvantages of investing in bonds?

Securities are subject to risks such as interest rate risk, prepayment risk, credit risk, reinvestment risk and liquidity risk.

Does Dave Ramsey consider bonds to be a good long term investment?

So are bonds a good investment? We do not recommend betting your retirement on bonds. It’s best to invest your money in a mix of growth stock mutual funds.

Does Dave Ramsey recommend bond funds?

Dave doesn’t invest in bonds. Ever. And he doesn’t encourage anyone to do it either. He invests in good-growing stock mutual funds, and that’s what you should be doing too.

What 4 types of investments does Dave Ramsey recommend?

That’s why we recommend distributing your investments evenly across four types of mutual funds: growth and income, growth, aggressive growth, and international.

Are bonds a good long-term investment?

All other things being equal, a bond with a longer maturity will generally pay a higher interest rate than a bond with a shorter term. … Bonds with maturities of one to 10 years are sufficient for most long-term investors. They yield more than short-term bonds and are less volatile than long-term issues.

Are bonds safe if the market crashes?

Buying Bonds During a Market Crash Government bonds are generally considered the safest investment, yet they are decidedly unattractive and often offer meager returns compared to stocks and even other bonds.

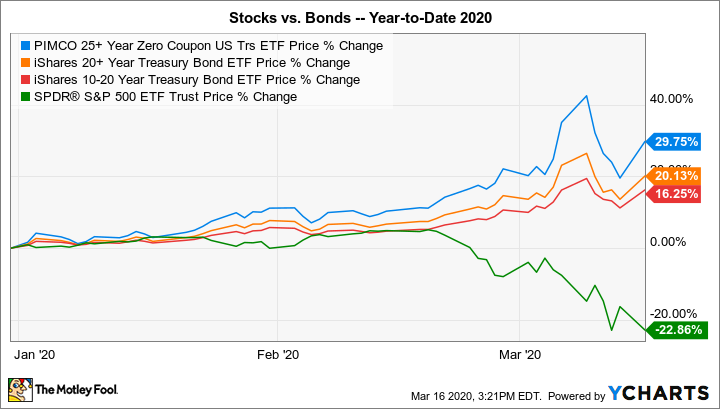

Do bond funds fare well in a recession? Bonds can do well in a recession because they become more in demand than stocks. There is more risk involved in owning a company through stocks than in lending money through a bond.

What happens to bonds when the stock market goes down?

Bonds affect the stock market because when bonds fall, stock prices tend to rise. The opposite also happens: when bond prices rise, stock prices tend to fall. Bonds compete with stocks for investors’ dollars because bonds are often considered safer than stocks. However, bonds generally offer lower returns.

Do bonds increase when stocks fall?

Equity selling is being led by bond markets, which have fallen this year as inflation could erode how much money investors make in their businesses. When bond prices fall, their yields increase.

Can you lose money in a bond?

Bonds are often touted as less risky than stocks – and most of the time they are – but that doesn’t mean you can’t lose money owning bonds. Bond prices fall when interest rates rise, when the issuer experiences a negative credit event, or when market liquidity dries up.

Are bonds safe in a stock market crash?

Buying Bonds During a Market Crash The markets are also a chance for investors to consider an area that novice investors might miss out on: bond investing. Government bonds are generally considered the safest investment, although they are decidedly unattractive and often offer meager returns compared to stocks and even other bonds.

Are bonds a safe investment right now?

Risk: Savings bonds are backed by the US government, so they are considered as safe as an investment. However, keep in mind that bond interest payments will fall if and when inflation stabilizes.

Are I bonds a good investment 2020?

Best Investment for Like other government-issued debt, Series I bonds are attractive to risk-averse investors who don’t want to take any risk of default. These bonds are also a good choice for investors who want to protect their investment against inflation.

Are bonds a good investment for 2021?

Are bonds a good investment in 2021? In 2021, interest rates paid on bonds were very low because the Federal Reserve cut interest rates in response to the 2020 economic crisis and the resulting recession.

Are bonds a good investment right now?

Owning bonds today is still relevant because they provide stable income and protect portfolios when risky assets fall. If you depend on your portfolio for spending, the bond portion should protect your level of spending. And you can sell bonds and take advantage of lower prices on risky assets.

What is the safest investment if the stock market crashes?

Get collateral If you’re a short-term investor, bank CDs and Treasury bills are a good bet. If you are investing for a longer period of time, fixed or indexed annuities or even indexed universal life insurance products can provide better returns than Treasury bonds.

Are bonds a good investment when stock market crashes?

Federal Bond Funds Funds made up of US Treasury bonds lead the pack as they are considered one of the safest. Investors do not face credit risk because the government’s ability to collect taxes and print money eliminates default risk and provides principal protection.

Why are bond prices falling?

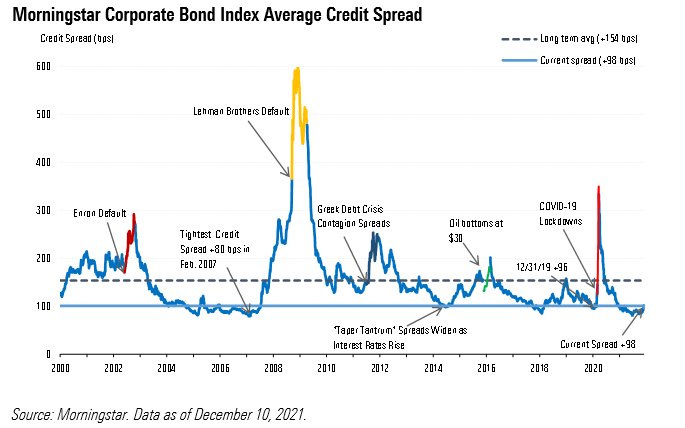

Bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates rise, bond prices fall in value.

Why are bonds falling in value? Bond prices fall when interest rates rise, when the issuer experiences a negative credit event, or when market liquidity dries up. Inflation can also erode bond returns, as well as tax or regulatory changes.

What happens when bond price falls?

In general, bond prices rise as interest rates fall. And bond prices fall as interest rates rise. It is important to note that the par value of a bond (the amount you will receive at maturity) will never change, regardless of secondary market prices.

Why are bond prices falling?

Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, increasing demand and the price of the bond. On the other hand, if interest rates rise, investors will no longer prefer the lowest fixed interest rate paid for a bond, resulting in a fall in its price.

What are bond prices doing today?

| SYMBOL | HARVEST | CHANGE |

|---|---|---|

| USA 3 years | 1.54 | 0.124 |

| USA 5 years | 1,773 | 0.112 |

| USA 7 years | 1,892 | 0.1 |

| USA 10 years | 1,916 | 0.089 |

Why are bonds falling with stocks?

During periods of economic expansion, bond prices and the stock market move in opposite directions because they are competing for capital. Selling on the stock market leads to higher bond prices and lower yields as money enters the bond market.

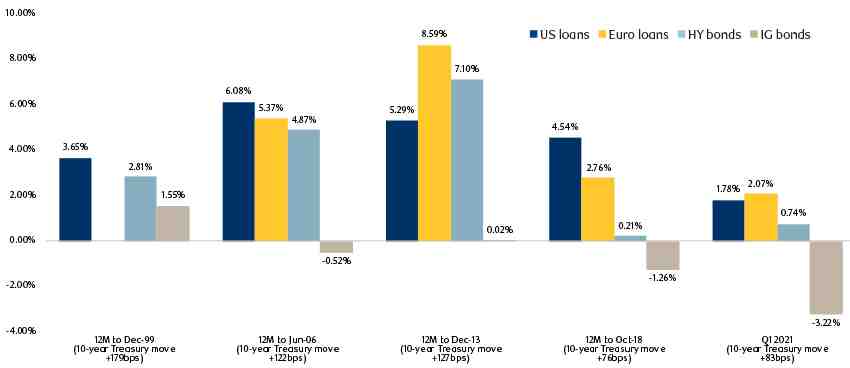

What is the future of bonds?

The Federal Reserve, focused on taming inflation, is expected to raise overnight rates to 1% during 2022 and then above 2% by the end of next year. Strategists polled by Bloomberg News predict higher Treasury yields through the end of 2022, with the 10-year yield hitting 2.04% and 30-year bonds rising to 2.45%.

What will titles do in 2022? The Federal Reserve is likely to start raising interest rates in 2022, potentially boosting bond yields and lowering bond prices. Fed actions are likely to have modest impacts on most bond portfolios, but the precise extent and timing of rate hikes is uncertain.

Are bonds a good investment 2022?

If you know that interest rates are rising, buying bonds after rates have increased would be beneficial. You avoid the -5.2% loss and buy a bond that yields 2.8%. The Fed is signaling 3-4 interest rate hikes in 2022 to as low as 1%.

Will bonds go up in 2022?

The metric measures the difference between the rates on five-year Treasury bills and Treasury Inflation Protected Securities, or TIPS. That number is somewhat close to the Federal Reserve’s own forecast of 2.6% for 2022 and 2.3% for next year.

Are bonds a good investment for the future?

Funds that invest in government debt instruments are considered among the safest investments because the bonds are guaranteed by the full faith and credit of the US government. If interest rates rise, the prices of existing bonds fall; and if interest rates fall, the prices of existing bonds rise.

Are bonds a safe investment right now?

Risk: Savings bonds are backed by the US government, so they are considered as safe as an investment. However, keep in mind that bond interest payments will fall if and when inflation stabilizes.

Will bonds go up in 2022?

The metric measures the difference between the rates on five-year Treasury bills and Treasury Inflation Protected Securities, or TIPS. That number is somewhat close to the Federal Reserve’s own forecast of 2.6% for 2022 and 2.3% for next year.

Are bonds a good investment for the future?

Funds that invest in government debt instruments are considered among the safest investments because the bonds are guaranteed by the full faith and credit of the US government. If interest rates rise, the prices of existing bonds fall; and if interest rates fall, the prices of existing bonds rise.

Will bond funds rise with interest rates?

In general, bond funds tend to do well when interest rates fall because bonds already in the fund’s portfolio are likely to carry higher coupon rates than newly issued bonds and therefore increase in value. … Bonds that are very close to maturity, within a year, for example, are much less likely to lose or gain in value.

When should I invest in bond funds?

The best time to use the bond ladder is when interest rates are low and starting to rise. When interest rates are going up, mutual fund prices are often going down. Therefore, the investor can start buying bonds gradually as rates rise to “lock in” yields and minimize the price risk of bond mutual funds.

Are bonds a good investment for the future?

Funds that invest in government debt instruments are considered among the safest investments because the bonds are guaranteed by the full faith and credit of the US government. If interest rates rise, the prices of existing bonds fall; and if interest rates fall, the prices of existing bonds rise.

Can you lose money in a bond?

Bonds are often touted as less risky than stocks – and most of the time they are – but that doesn’t mean you can’t lose money owning bonds. Bond prices fall when interest rates rise, when the issuer experiences a negative credit event, or when market liquidity dries up.

Are bonds a good investment anymore?

Savings bonds are not the best investment, even for college. The rate of return is set by the US government and market conditions, and it can take up to 20 years for bonds to fully mature to double their original value. … Bonds are generally not worth their par value until 20 years after issuance.

Are bonds a good investment in 2020?

Treasury bonds can be a good investment for anyone looking for security and a fixed interest rate that is paid semi-annually until the bond matures. Bonds are an important part of an investment portfolio’s asset allocation, as the steady return of bonds helps offset the volatility of stock prices.

Which is better EE or I bonds?

According to the Treasury Department, if an I bond is used to pay for qualifying educational expenses in the same way as EE bonds, related interest can be excluded from income. Since the advent of Series I bonds, interest rates and inflation rates have generally favored them over EE bonds.

Are Bonds a Good Investment 2021? An I bond is a US government savings bond that carries a fixed interest rate plus an additional inflation adjuster, so you get an inflation-adjusted real rate of return. In a world of inflation concerns and few inflation-adjusted investments, Title I is a great place to look for savers.

Can I convert EE bonds to I bonds?

What titles can I exchange? You may convert Series E, EE and I paper securities in which you are the sole owner, a co-owner or the owner with a beneficiary. You can also convert paper bonds purchased as gifts to someone else or bonds you obtained through inheritance or other change of ownership.

What is the difference between Series EE and I bonds?

EE Bond and I Bond Differences The interest rate on EE bonds is fixed over the life of the bond, while I bonds offer adjusted rates to protect against inflation. EE bonds offer a guaranteed return that doubles your investment if held for 20 years. There is no guaranteed return on I bonds.

Can I exchange EE bonds for I bonds?

Can EE or E bonds be exchanged for I bonds? No, but you can discount EE or E bonds and use the proceeds to buy I bonds. Interest earned on EE or E bonds must be reported on your federal income tax return for the year it was discounted.

Are I bonds still available?

You can buy I bonds at this rate until April 2022. … Series I savings bonds are a low-risk savings product. During their lifetime, they earn interest and are protected from inflation.

Are I savings bonds a good investment?

I bonds are a good cash investment because they are guaranteed and have deferred and inflation-corrected interest. … Bonds accrue interest, and you can cash them in during retirement to make sure you have safe, secure investments available. Interest is a combination of a fixed rate and an inflation rate.

How much should I invest in Series I bonds?

| Quick Information on Series I Savings Bonds | |

|---|---|

| Minimum purchase of securities I | $25 through Treasury Direct $50 through federal income tax return |

| Maximum purchase of securities I per calendar year | $10,000 through Treasury Direct $5,000 through federal income tax refund |

| Where to buy | TreasuryDirect.gov IRS Form 8888 |

Are I bonds a good investment 2020?

Best Investment for Like other government-issued debt, Series I bonds are attractive to risk-averse investors who don’t want to take any risk of default. These bonds are also a good choice for investors who want to protect their investment against inflation.

Which is better Series EE or I bonds?

If you want to cash out after a few years, a Series I title usually promises a better return. Series EE bonds carry a lower interest rate until maturity.

What is the current rate for I and EE bonds?

Starting today, Series EE premium bonds issued from November 2021 to April 2022 will earn a fixed annual fee of 0.10%. Series I premium bonds will have a compound rate of 7.12%, with a portion indexed to inflation every six months. The fixed rate for EE bonds applies to a bond’s original 20-year maturity.

What is the difference between Series I and EE savings bonds?

EE Bond and I Bond Differences The interest rate on EE bonds is fixed for the life of the bond, while I bonds offer rates that are adjusted to protect against inflation. EE bonds offer a guaranteed return that doubles your investment if held for 20 years. There is no guaranteed return on I bonds.