How can I buy a 10 year Treasury note?

Contents

- 1 How can I buy a 10 year Treasury note?

- 2 How do I invest in 30 year Treasury?

- 3 Is it a good time to buy Treasury bills?

- 4 How much is a $50 savings bond?

- 5 How do I buy US Treasury bonds?

The US Treasury Department sells 10-year T-notes and notes with shorter maturities, as well as Treasury bills and bonds, directly through the TreasuryDirect website through competitive or non-competitive bids, with a minimum purchase of $ 100 and in increments of $ 100. They can also be purchased indirectly through a bank or broker.

What is today’s 10-year treasury rate?

How do I buy a 10 year Treasury bond?

You can buy banknotes from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell notes in Legacy Treasury Direct, which we are phasing out.) You can keep a note until it expires, or sell it before it expires.

Can you purchase a Treasury bond without a broker?

Direct from the US Government: The federal government has created a program on the Treasury Direct website that allows investors to purchase government bonds directly without having to pay a fee to a broker or other intermediary.

How do I buy US Treasury bonds?

You can buy short-term government bonds on TreasuryDirect, the US government’s portal for buying US government bonds. Short-term treasury bills can also be bought and sold at a bank or through a broker. If you do not keep your government bonds until maturity, the only way to sell them is through a bank or broker.

How do I buy Treasury bonds online?

TreasuryDirect – Purchase electronic savings bonds from the US Treasury Department via an online account. It is convenient and safe. Open an account with as little as $ 25 at www.treasurydirect.gov.

Can you purchase Treasury bonds without a broker?

Direct from the US Government: The federal government has created a program on the Treasury Direct website that allows investors to purchase government bonds directly without having to pay a fee to a broker or other intermediary.

How do I invest in US Treasury bonds?

You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell bonds in Legacy Treasury Direct, which we are phasing out.) You can keep a bond until it expires, or sell it before it expires.

How do I purchase a Treasury note?

You can buy government bonds directly from the US Treasury Department or through a bank, broker or dealer.

- Buy directly from the US Treasury Department. …

- Place a bid in TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Buy through a bank, broker or dealer.

Can an individual buy Treasury bills?

Government Treasury bills can be obtained by individuals with a discount on the face value of the security and redeemed at their face value, allowing investors to pocket the difference. For example, a 91-day Treasury bill with a face value of Rs. 120 can be purchased at a reduced price of Rs.

How much does a Treasury note cost?

Treasury bills or treasury bills are typically issued at a discount from the parible amount (also called face value). For example, if you buy a $ 1,000 banknote at a price per $ 100 at $ 99.986111, you pay $ 999.86 ($ 1,000 x. 99986111 = $ 999.86111). * When the bill expires, you will be paid its face value, $ 1,000.

Can you buy Treasury bills at a bank?

You can buy bills from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell bills of exchange in Legacy Treasury Direct, which we are phasing out.) You can keep a bill of exchange until it expires or sell it before it expires.

How do I invest in 30 year Treasury?

Government bonds pay a fixed interest rate every six months until they expire. They are issued for a term of 20 years or 30 years. You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker.

How do I buy US government bonds? You can buy banknotes from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell notes in Legacy Treasury Direct, which we are phasing out.) You can keep a note until it expires, or sell it before it expires.

How much does a 30 year Treasury bond cost?

What do government bonds pay? Imagine that a 30-year-old US government bond pays around a coupon rate of 1.25 percent. This means that the bond will pay $ 12.50 per year for every $ 1,000 in face value (par value) that you own. The half-yearly coupon payments are half, or $ 6.25 per. $ 1,000.

What is the return on a 30 year bond?

The US 30-year bond yield is expected to trade at 2.28 percent by the end of this quarter, according to Trading Economics ‘global macro models and analysts’ expectations.

How do I buy a 30 year US Treasury bond?

They are issued for a term of 20 years or 30 years. You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell Legacy Treasury Direct bonds, which we are phasing out.)

How much does a US Treasury bond cost?

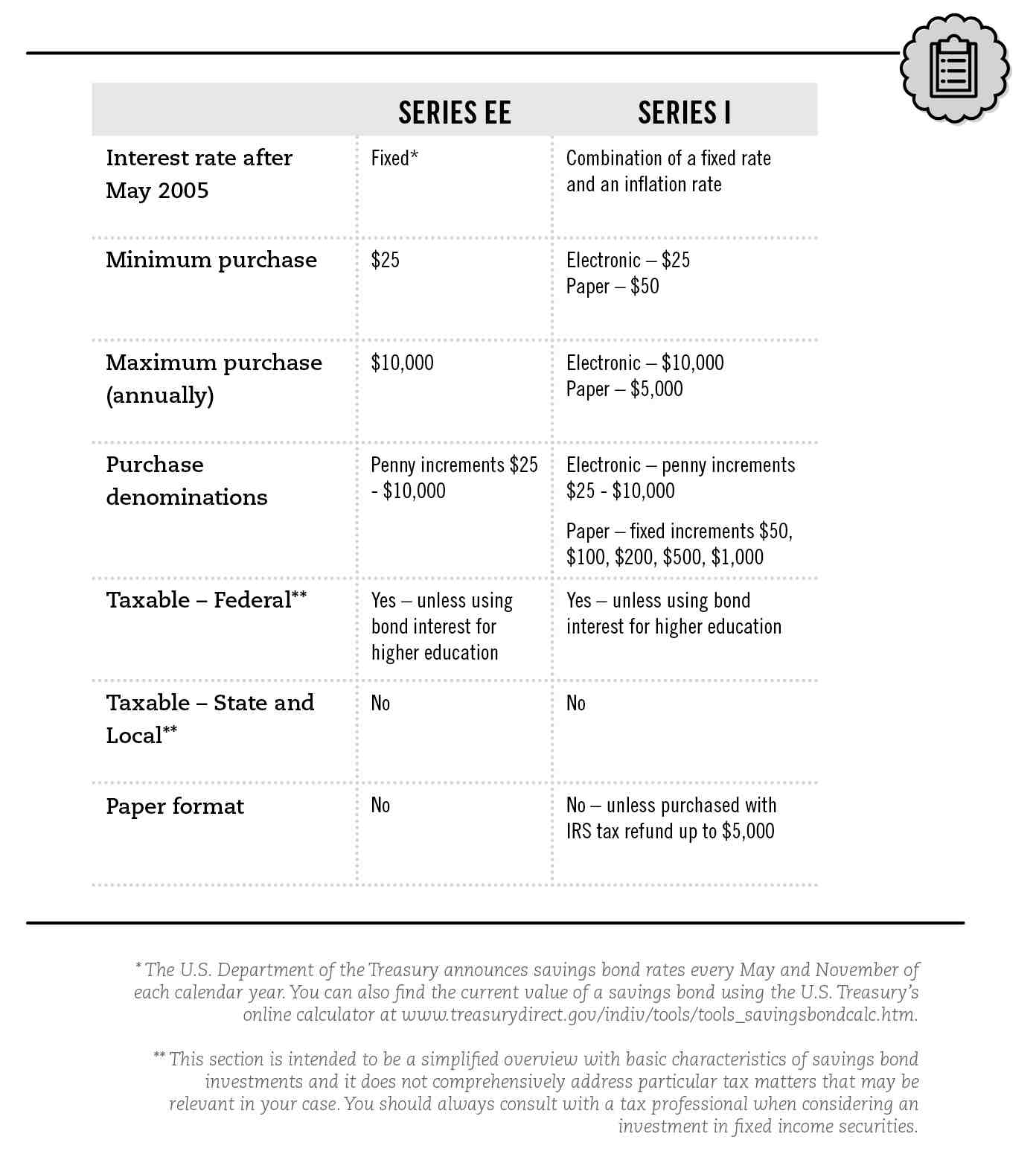

You pay the face value. For example, an EE bond of $ 50 costs $ 50. EE bonds come in any amount to penny for $ 25 or more. For example, you could buy a $ 50.23 bond.

How do I buy US Treasury bonds?

You can buy short-term government bonds on TreasuryDirect, the US government’s portal for buying US government bonds. Short-term treasury bills can also be bought and sold at a bank or through a broker. If you do not keep your government bonds until maturity, the only way to sell them is through a bank or broker.

How much does a $100 savings bond cost?

You can purchase EE savings bonds through banks and other financial institutions or through the TreasuryDirect website of the US Treasury Department. The bonds, which are now issued in electronic form, are sold at half face value; For example, you pay $ 50 for a $ 100 bond.

How do I invest in US Treasury bonds?

You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell bonds in Legacy Treasury Direct, which we are phasing out.) You can keep a bond until it expires, or sell it before it expires.

How do I buy Treasury bonds online?

TreasuryDirect – Purchase electronic savings bonds from the US Treasury Department via an online account. It is convenient and safe. Open an account with as little as $ 25 at www.treasurydirect.gov.

How do I invest in Treasury?

Government Treasury bills can be obtained by individuals with a discount on the face value of the security and redeemed at their face value, allowing investors to pocket the difference. For example, a 91-day Treasury bill with a face value of Rs. 120 can be purchased at a reduced price of Rs. 118.40.

How do you invest in Treasuries?

You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell bonds in Legacy Treasury Direct, which we are phasing out.) You can keep a bond until it expires, or sell it before it expires.

How do I buy Treasury bonds?

You can buy government bonds directly from the US Treasury Department or through a bank, broker or dealer.

- Buy directly from the US Treasury Department. …

- Place a bid in TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Buy through a bank, broker or dealer.

What is the minimum amount to invest in Treasury?

Treasury Certificates Treasury bills are available for a minimum amount of Rs. 25,000 and in multiples of Rs. 25,000. Treasury bills are issued at a discount and redeemed at par.

Is it a good time to buy Treasury bills?

Treasury bills are one of the safest investments, but their returns are low compared to most other investments. When deciding whether treasury bills fit well into a pension portfolio, alternative costs and risk must be considered. In general, Treasury bills may be appropriate for investors approaching or retiring.

Can You Lose Money on Treasury Certificates? Government bonds are considered risk-free assets, which means that there is no risk of the investor losing their principal. In other words, investors holding the bond until maturity are guaranteed their principal or initial investment.

How much interest can you earn from a treasury bill?

Rates currently range from 0.09% to 0.17% for Treasury bills ranging from four weeks to 52 weeks. “T-bills do not pay periodic interest, instead earn the implied interest by being sold at a discount to face value,” Michelson said.

Do Treasury bills earn interest?

The T-bill pays no coupon – interest payments – until its expiration. Treasury bills can hamper the cash flow for investors who demand a stable income. Treasury bills have interest rate risk, so their interest rates may become less attractive in an environment of rising interest rates.

How much can you make with Treasury bills?

For example, a 52-week, $ 100,000 Treasury bill with a 1.5 percent exchange rate would cost $ 98,500. The current rate of Treasury bills slightly underestimates the return earned as the amount invested is less than the face value. In the example, an investor would earn $ 1,500 on a $ 98,500 investment, which is a dividend of 1.523 percent.

Is it a good time to invest in Treasuries?

Treasuries can be a great investment for investors looking for a low-risk savings and a constant stream of income. But their low returns also make them unlikely to outperform other investments, such as mutual funds and exchange-traded funds.

Are I bonds a good investment 2021?

An I-bond is a US Government Savings bond that has a fixed interest rate, plus an additional inflation adjustment, so you get an inflation-adjusted real return. In a world of inflation concerns and few inflation-adjusted investments, the I-bond is a good place to look for savers.

Can you lose money on Treasuries?

Can You Lose Money By Investing In Bonds? Yes, you can lose money when you sell a bond before its expiration date, as the sale price may be lower than the purchase price.

Are long term Treasuries a good investment now?

As you might expect for a safe investment, yields on long-term government bonds are modest in today’s low-yield environment. Yet they are not insignificant. … Today, some popular long-term government bond funds have a return of 2.6% or higher. What’s more, interest rates on government bonds are exempt from state and local income tax.

How much is a $50 savings bond?

For example, an EE bond of $ 50 costs $ 50. EE bonds come in any amount to penny for $ 25 or more. For example, you could buy a $ 50.23 bond.

How much is a 1986 $ 50 savings bond worth today? How much money are we talking about? A $ 50 Series EE savings bond, representing George Washington and issued in January 1986, was worth $ 113.06 in December.

How long does it take for a $50 savings bond to mature?

Otherwise, you can keep savings bonds until they expire in full, which is usually 30 years. These days, you can only buy electronic bonds, but you can still redeem paper bonds.

Can a $50 savings bond be worth more than $50?

Paper EE bonds were issued from July 1980 to December 2011 in denominations of $ 50 to $ 10,000. All paper EE bonds will be worth more than their face value if held to full maturity after 30 years. … Any EE bond purchased before 1983 had fully matured in 2012 and has ceased to bear interest.

What is the final maturity of a $50 savings bond?

“The bonds expire after 20 years, after which the US Treasury Department guarantees that investors have doubled their money.” Although savings bonds have a low return, there are few investments that guarantee to double your money â € ”even if you have to wait 20 years.

How do I buy US Treasury bonds?

You can buy short-term government bonds on TreasuryDirect, the US government’s portal for buying US government bonds. Short-term treasury bills can also be bought and sold at a bank or through a broker. If you do not keep your government bonds until maturity, the only way to sell them is through a bank or broker.

How much does a $ 100 savings bond cost? You can purchase EE savings bonds through banks and other financial institutions or through the TreasuryDirect website of the US Treasury Department. The bonds, which are now issued in electronic form, are sold at half face value; For example, you pay $ 50 for a $ 100 bond.

How do I invest in US Treasury bonds?

You can buy government bonds from us at TreasuryDirect. You can also buy them through a bank or broker. (We no longer sell bonds in Legacy Treasury Direct, which we are phasing out.) You can keep a bond until it expires, or sell it before it expires.

Is it safe to buy U.S. Treasury bonds?

US Treasury bonds are issued by the federal government and are considered to be among the safest investments you can make because all government bonds are backed by the “full faith and credit” of the US government.

Can you purchase Treasury bonds without a broker?

Direct from the US Government: The federal government has created a program on the Treasury Direct website that allows investors to purchase government bonds directly without having to pay a fee to a broker or other intermediary.

How do I buy Treasury bonds online?

TreasuryDirect – Purchase electronic savings bonds from the US Treasury Department via an online account. It is convenient and safe. Open an account with as little as $ 25 at www.treasurydirect.gov.

How can I buy US bonds online?

Place a bid in TreasuryDirect Log in to your account and click on the BuyDirect® tab. Follow the instructions to enter the security you want, the purchase amount and other requested information. You can also create reinvestments by using the proceeds of one maturing bond to buy another bond.

Can you purchase a Treasury bond without a broker?

Direct from the US Government: The federal government has created a program on the Treasury Direct website that allows investors to purchase government bonds directly without having to pay a fee to a broker or other intermediary.

Can you purchase Treasury bonds without a broker?

Direct from the US Government: The federal government has created a program on the Treasury Direct website that allows investors to purchase government bonds directly without having to pay a fee to a broker or other intermediary.

How do I buy Treasury bonds directly?

You can buy government bonds directly from the US Treasury Department or through a bank, broker or dealer.

- Buy directly from the US Treasury Department. …

- Place a bid in TreasuryDirect. …

- Payments and receipts in TreasuryDirect. …

- Buy through a bank, broker or dealer.

Can you buy government bonds directly?

Government bonds can be purchased directly from the government TreasuryDirect website or through a broker or bank. Government bonds are valued by income-seeking investors because they are low-risk and highly liquid; however, they do not pay the highest interest rates.

How do I buy my own bonds?

You can buy government bonds as US government bonds through a broker or directly through Treasury Direct. As mentioned above, government bonds are issued in increments of $ 100. Investors can buy newly issued government bonds through auctions several times a year by submitting a competitive or non-competitive bid.